You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 7, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, DECEMBER 14TH, 2022

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-142.29 |

33,966.35 |

-0.42% |

|

Volume |

1,060,206,668 |

-11% |

|

Volume |

5,480,252,900 |

-10% |

|

NASDAQ |

-85.93 |

11,170.89 |

-0.76% |

|

Advancers |

1,209 |

41% |

|

Advancers |

1,890 |

41% |

|

S&P 500 |

-24.33 |

3,995.32 |

-0.61% |

|

Decliners |

1,714 |

59% |

|

Decliners |

2,664 |

58% |

|

Russell 2000 |

-11.91 |

1,820.45 |

-0.65% |

|

52 Wk Highs |

46 |

|

|

52 Wk Highs |

103 |

|

|

S&P 600 |

-9.72 |

1,193.59 |

-0.81% |

|

52 Wk Lows |

92 |

|

|

52 Wk Lows |

249 |

|

|

|

Indices Reversed Early Gains to Close Lower After Fed Rate Hike

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Dow shed 142 points, while the Nasdaq Composite fell 0.8%. The S&P 500 declined 0.6%, with 10 sectors ending in negative territory. Volume totals were lighter than the prior session on the NYSE and on the Nasdaq exchange. Breadth was negative as decliners led advancers by almost a 3-2 margin on the NYSE and on the Nasdaq exchange. There were 20 high-ranked companies from the Leaders List that hit new 52-week highs and were listed on the BreakOuts Page, versus the total of 40 on the prior session. New 52-week lows totals expanded and solidly outnumbered shrinking new 52-week highs on the NYSE and on the Nasdaq exchange. The market is in an uptrend (M criteria). Healthy leadership (new 52-week highs totals) must continue for the rally be productive, but new highs totals have recently contracted. Only stocks meeting all key-criteria of the fact-based investment system should be considered as buy candidates.

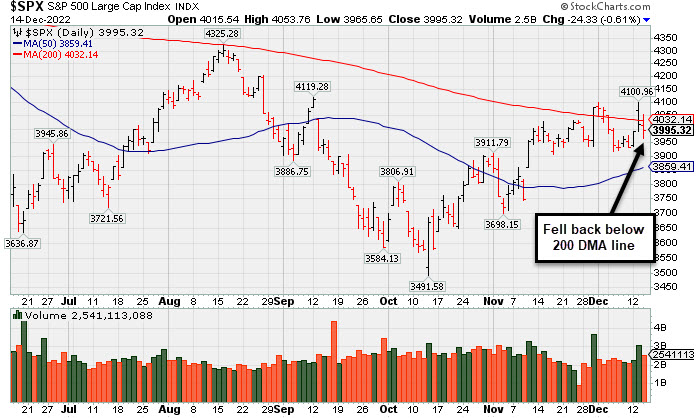

Chart courtesy of www.stockcharts.com PICTURED: The S&P 500 Index fell back below its 200-day moving average (DMA) line after rallying above it on the prior session. Subsequent gains and a rebound back above the 200 DMA could help to signal that the benchmark index is in healthier shape.

U.S. equities finished lower Wednesday in volatile trading as investors digested the latest Federal Reserve (Fed) monetary policy decision. The central bank has unanimously decided to raise rates by a widely expected 50 basis points (0.50%) to bring the benchmark rate to 4.25%-4.5%. The median forecasts for future rate hikes has been raised to 5.1% in 2023 and 4.1% in 2024. The statement following release reiterated the need for ongoing interest rate hikes to curb inflation. In his post-meeting press conference, Fed Chairman Jerome Powell adopted a more hawkish tone, saying the labor market remains “extremely tight” and the central bank “will stay the course until the job is done.”

On the data front, import prices fell 0.6% month-over-month in November, while export prices fell by a less-than-expected 0.3%. Elsewhere, MBA mortgage applications climbed 3.2% in the week ended December 9. Treasuries were little changed following the rate hike announcement, with the yield on the benchmark 10-year note down three basis points (0.03%) to 3.48%, while the 30-year bond yield dipped one basis point (0.01%) to 3.53%. The yield on the two-year note, which is more sensitive to changes in Fed policy, declined one basis point (0.01%) to 4.22%. In commodities, West Texas Intermediate (WTI) crude climbed 2.7% to $77.42/barrel amid reports of an uptick in 2023 crude demand. The Organization of Petroleum Exporting Countries (OPEC) and International Energy Agency (IEA) both reported more upbeat demand forecasts for the upcoming year.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Biotech Index Edged Higher on Mostly Negative Session

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX -1.69%) and Broker/Dealer Index ($XBD -1.64%) lost ground and created a drag on the major indices while the Retail Index ($RLX -0.34%) suffered a smaller loss. The Semiconductor Index($SOX -1.57%) outpaced the Networking Index ($NWX -0.51%) to the downside while the Biotech Index ($BTK +0.55%) eked out a small gain. Commodity-linked groups had a slightly negative bias as the Gold & Silver Index ($XAU -0.65%), Oil Services Index ($OSX -0.64%), and Integrated Oil Index ($XOI -0.65%) unanimously edged lower.

PICTURED: The Oil Services Index ($OSX -0.64%) nearly tested its 200-day moving average (DMA) line then rebounded above its 50 DMA line.

| Oil Services |

$OSX |

80.49 |

-0.52 |

-0.64% |

+52.67% |

| Integrated Oil |

$XOI |

1,739.14 |

-11.32 |

-0.65% |

+47.61% |

| Semiconductor |

$SOX |

2,777.27 |

-44.26 |

-1.57% |

-29.62% |

| Networking |

$NWX |

824.23 |

-4.19 |

-0.51% |

-15.12% |

| Broker/Dealer |

$XBD |

459.75 |

-7.65 |

-1.64% |

-5.57% |

| Retail |

$RLX |

2,905.66 |

-9.86 |

-0.34% |

-31.25% |

| Gold & Silver |

$XAU |

122.02 |

-0.80 |

-0.65% |

-7.87% |

| Bank |

$BKX |

100.32 |

-1.73 |

-1.69% |

-24.12% |

| Biotech |

$BTK |

5,420.50 |

+29.45 |

+0.55% |

-1.77% |

|

|

|

|

Sterling Infrastructure Forming Orderly Base Pattern

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Sterling Infrastructure (STRL -$0.04 or -0.13% to $31.89) was highlighted in yellow with pivot point cited based on its 11/08/22 high plus 10 cents in the earlier mid-day report (read here). It has been consolidating for about 5 weeks in a tight range near its all-time high with volume totals cooling. It faces very little resistance due to overhead supply. Subsequent gains above the pivot point backed by at least +40% above average volume are needed to trigger a proper technical buy signal.

STRL hails from the Building - Heavy Construction industry group which is ranked 61st on the 197 Industry Groups list (L criteria). It has a 96 Earnings Per Share Rating. It reported Sep '22 quarterly earnings +35% on +20% sales revenues versus the year ago period, its 5th quarterly comparison at or above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady since FY '17.

The company has a small supply of only 30.3 million shares outstanding. That can lead to greater price volatility in the event of institutional buying or selling. The number of top rated funds owning its shares only rose from 337 in Dec '21 to 340 in Sep '22. However, its current Up/Down volume ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ESQ

-

NASDAQ

ESQ

-

NASDAQ

Esquire Financial Hldgs

Finance-Commercial Loans

|

$41.68

|

-0.14

-0.33% |

$41.98

|

29,673

109.90% of 50 DAV

50 DAV is 27,000

|

$48.13

-13.40%

|

10/18/2022

|

$40.02

|

PP = $39.95

|

|

MB = $41.95

|

Most Recent Note - 12/12/2022 6:09:28 PM

G - Managed a positive reversal today after early weakness below its 50 DMA line, testing prior highs and its 50 DMA line ($42.43) defining important near-term support to watch.

>>> FEATURED STOCK ARTICLE : Pulled Back Following "Negative Reversal" at All-Time High - 11/25/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CMC

-

NYSE

CMC

-

NYSE

Commercial Metals Co

METALS and MINING - Steel and Iron

|

$48.85

|

+0.05

0.10% |

$49.35

|

1,243,107

125.06% of 50 DAV

50 DAV is 994,000

|

$50.83

-3.90%

|

10/14/2022

|

$41.61

|

PP = $44.45

|

|

MB = $46.67

|

Most Recent Note - 12/13/2022 6:52:27 PM

G - Posted a 2nd consecutive gain today but ended near the session low. Remains perched near its 52-week high after breaking a streak of 9 consecutive weekly gains. Fundamentals remain strong. Prior highs define initial support to watch above its 50 DMA line ($45.38).

>>> FEATURED STOCK ARTICLE : Wedging Higher With Recent Gains Lacking Great Volume - 12/2/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

VRTX

-

NASDAQ

VRTX

-

NASDAQ

Vertex Pharmaceuticals

Medical-Biomed/Biotech

|

$312.09

|

+5.00

1.63% |

$314.80

|

1,402,447

95.34% of 50 DAV

50 DAV is 1,471,000

|

$324.75

-3.90%

|

10/24/2022

|

$308.47

|

PP = $306.05

|

|

MB = $321.35

|

Most Recent Note - 12/13/2022 6:47:26 PM

Y - Pulled back today with above average volume after wedging to new highs with light volume, testing support near its 50 DMA line ($307.36) and prior pivot point. Recently reported Sep '22 quarterly earnings +14% on +18% sales revenues versus the year ago period, below the +25% minimum earnings guideline raising fundamental concerns (C criteria). See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Testing Support Near 50-Day Moving Average Line and Prior Pivot - 12/13/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

GPK

-

NYSE

GPK

-

NYSE

Graphic Packaging Hldg

CONSUMER NON-DURABLES - Packaging and Containers

|

$22.31

|

+0.12

0.54% |

$22.65

|

2,655,803

90.18% of 50 DAV

50 DAV is 2,945,100

|

$24.07

-7.31%

|

10/25/2022

|

$22.75

|

PP = $24.17

|

|

MB = $25.38

|

Most Recent Note - 12/13/2022 6:54:02 PM

Y - Posted a 2nd consecutive gain today but ended near the session low, consolidating just above its 50 DMA line ($22.04). More damaging losses would raise concerns and trigger a technical sell signal. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Consolidating Above 50-Day Moving Average Still Perched Near High - 11/17/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CBZ

-

NYSE

CBZ

-

NYSE

C B I Z Inc

Comml Svcs-Consulting

|

$49.97

|

-0.54

-1.07% |

$51.02

|

232,631

89.13% of 50 DAV

50 DAV is 261,000

|

$51.67

-3.29%

|

10/26/2022

|

$47.83

|

PP = $48.57

|

|

MB = $51.00

|

Most Recent Note - 12/12/2022 6:41:39 PM

Y - Posted a 3rd consecutive small gain today with +22% above average volume, hovering near its 52-week high. Its 50 DMA line ($47.45) and recent low define important near-term support. It has formed an orderly new 6-week flat base but a new pivot point is not cited because it has made little headway from the prior base and remains below the "max buy" level. Recently reported Sep '22 quarterly earnings +24% on +28% sales revenues versus the year ago period.

>>> FEATURED STOCK ARTICLE : Gapped Up and Rebounded Above Pivot Point - 11/18/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ENPH

-

NASDAQ

ENPH

-

NASDAQ

Enphase Energy Inc

Energy-Solar

|

$332.80

|

+6.81

2.09% |

$338.10

|

2,745,484

69.68% of 50 DAV

50 DAV is 3,940,000

|

$339.92

-2.09%

|

10/26/2022

|

$301.55

|

PP = $324.94

|

|

MB = $341.19

|

Most Recent Note - 12/14/2022 6:18:38 PM

Most Recent Note - 12/14/2022 6:18:38 PM

Y - Posted a 3rd consecutive gain with below average volume while wedging above its pivot point. Stalled after hitting a new all-time high on 12/02/22 with a volume-driven gain above its pivot point. Faces no resistance due to overhead supply. Its 50 DMA line ($290) defines near-term support to watch on pullbacks. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Perched Near High Still Awaiting Technical Breakout - 11/21/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

HRMY

-

NASDAQ

HRMY

-

NASDAQ

Harmony Biosciences Holdings

Medical-Biomed/Biotech

|

$58.65

|

-0.64

-1.08% |

$60.00

|

334,327

71.00% of 50 DAV

50 DAV is 470,900

|

$62.09

-5.54%

|

11/1/2022

|

$55.31

|

PP = $57.23

|

|

MB = $60.09

|

Most Recent Note - 12/13/2022 7:00:05 PM

Y - Still hovering below its "max buy" level with below average volume totals. Its 50 DMA line ($54.92) and 11/17/22 low ($53.06) define important near-term support to watch.

>>> FEATURED STOCK ARTICLE : Harmony Still Hovering Near All-Time High - 11/28/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CLH

-

NYSE

CLH

-

NYSE

Clean Harbors Inc

Pollution Control

|

$118.76

|

-1.44

-1.20% |

$120.62

|

281,710

69.39% of 50 DAV

50 DAV is 406,000

|

$125.41

-5.30%

|

11/2/2022

|

$121.59

|

PP = $124.59

|

|

MB = $130.82

|

Most Recent Note - 12/13/2022 6:49:47 PM

Y - Posted a gain today with average volume. Still consolidating back below its pivot point yet remaining above its 50 DMA line ($117) and recent low ($114.86 on 11/29/22) which define important near-term support to watch. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Volume-Driven Losses Undercut 50-Day Moving Average - 11/29/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NPO

-

NYSE

NPO

-

NYSE

Enpro Industries Inc

Machinery-Gen Industrial

|

$107.94

|

-3.53

-3.17% |

$111.29

|

97,089

97.09% of 50 DAV

50 DAV is 100,000

|

$127.67

-15.45%

|

11/4/2022

|

$119.06

|

PP = $117.73

|

|

MB = $123.62

|

Most Recent Note - 12/14/2022 6:20:38 PM

Most Recent Note - 12/14/2022 6:20:38 PM

G - It violated its 50 DMA line ($108.63) with today's loss on average volume triggering a technical sell signal and its color code is changed to green. A prompt rebound above the 50 DMA line is needed for its outlook to improve. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Consolidating Near Old Highs Following Recent Breakout - 12/1/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

DGII

-

NASDAQ

DGII

-

NASDAQ

Digi International Inc

COMPUTER HARDWARE - Networking and Communication Dev

|

$39.57

|

-0.96

-2.37% |

$40.93

|

235,176

62.38% of 50 DAV

50 DAV is 377,000

|

$43.68

-9.41%

|

11/10/2022

|

$41.82

|

PP = $40.96

|

|

MB = $43.01

|

Most Recent Note - 12/14/2022 6:16:52 PM

Most Recent Note - 12/14/2022 6:16:52 PM

Y - Suffered a loss today with lighter than average volume, slumping near its 50 DMA line ($38.83) and prior lows defining important near-term support to watch. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Sputtering After Recently Wedging to New Highs - 12/6/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

GFF

-

NYSE

GFF

-

NYSE

Griffon Corporation

MATERIALS and CONSTRUCTION - General Building Materials

|

$35.99

|

-0.34

-0.94% |

$36.54

|

292,017

79.57% of 50 DAV

50 DAV is 367,000

|

$37.69

-4.51%

|

11/10/2022

|

$34.13

|

PP = $35.02

|

|

MB = $36.77

|

Most Recent Note - 12/13/2022 12:42:54 PM

Y - Hit a new 52-week high today with a 2nd consecutive volume-driven gain. Recently consolidating near prior highs in the $34 area which define initial support to watch above its 50 DMA line ($32.99). Reported Sep '22 quarterly earnings +230% on +24% sales revenues versus the year ago period.

>>> FEATURED STOCK ARTICLE : No Meaningful Progress After Breakout 3 Weeks Ago - 12/7/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ANET

-

NYSE

ANET

-

NYSE

Arista Networks Inc

Computer-Networking

|

$130.99

|

-2.03

-1.53% |

$135.29

|

2,148,486

88.63% of 50 DAV

50 DAV is 2,424,000

|

$148.57

-11.83%

|

11/14/2022

|

$132.05

|

PP = $133.70

|

|

MB = $140.39

|

Most Recent Note - 12/12/2022 6:56:11 PM

Y - Posted a gain today with below average volume. Its 50-day moving average (DMA) line ($123) defines near-term support to watch. Subsequent gains and a close above the pivot point must be backed by at least +40% above average volume to trigger a proper technical buy signal. Faces some resistance due to overhead supply up to the $148 level. Fundamentals are strong.

>>> FEATURED STOCK ARTICLE : Sputtered Back Below Prior High Hurting Outlook - 12/9/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CPRX

-

NASDAQ

CPRX

-

NASDAQ

Catalyst Pharma Inc

Medical-Biomed/Biotech

|

$17.71

|

-0.09

-0.51% |

$18.38

|

2,342,871

105.96% of 50 DAV

50 DAV is 2,211,000

|

$18.39

-3.70%

|

11/22/2022

|

$17.38

|

PP = $16.66

|

|

MB = $17.49

|

Most Recent Note - 12/12/2022 6:51:14 PM

Y - Posted a big volume-driven gain today approaching its "max buy" level. Recently consolidating near the prior high and well above its 50 DMA line ($14.70).

>>> FEATURED STOCK ARTICLE : Breakout From Cup-With-Handle With 90% Above Average Volume - 11/22/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

TITN

-

NASDAQ

TITN

-

NASDAQ

Titan Machinery Inc

SPECIALTY RETAIL

|

$40.94

|

+0.80

1.99% |

$41.15

|

307,599

163.62% of 50 DAV

50 DAV is 188,000

|

$44.35

-7.69%

|

11/30/2022

|

$40.10

|

PP = $38.68

|

|

MB = $40.61

|

Most Recent Note - 12/12/2022 6:48:53 PM

Y - Consolidating in an orderly fashion above the prior high in the $38 area which defines initial support to watch. Fundamentals remain strong after reporting Oct '22 quarterly earnings +91% on +47% sales revenues.

>>> FEATURED STOCK ARTICLE : Gap Up and Big Volume-Driven Breakout Gain - 11/30/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

MYE

-

NYSE

MYE

-

NYSE

Myers Industries Inc

Containers/Packaging

|

$23.30

|

-0.47

-1.98% |

$23.91

|

191,306

150.63% of 50 DAV

50 DAV is 127,000

|

$25.55

-8.81%

|

12/8/2022

|

$23.94

|

PP = $25.65

|

|

MB = $26.93

|

Most Recent Note - 12/13/2022 6:56:07 PM

Y - Posted a gain today with above average volume but ended near the session low. Highlighted in yellow with pivot point cited based on its 6/06/22 high plus 10 cents in the 12/08/22 mid-day report. It is -6.9% off its 52-week high. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. The Sep '22 quarter showed +78% earnings on +14% sales revenues versus the year ago period. The past 4 quarterly comparisons were above the +25% minimum guideline (C criteria), however, its sales revenues growth rate has shown deceleration in sequential comparisons +45%, +29%, +24%, to +14%. Annual earnings (A criteria) history had a slight downturn in FY '19 but growth has been otherwise strong and steady.

>>> FEATURED STOCK ARTICLE : Myers Industries on Track for 9th Straight Weekly Gain - 12/8/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

BOX

-

NYSE

BOX

-

NYSE

Box Inc Cl A

Computer Sftwr-Database

|

$31.69

|

+0.41

1.31% |

$32.00

|

2,126,408

194.90% of 50 DAV

50 DAV is 1,091,000

|

$33.04

-4.09%

|

12/12/2022

|

$29.83

|

PP = $29.57

|

|

MB = $31.05

|

Most Recent Note - 12/13/2022 12:20:23 PM

Y - Gapped up for a 2nd consecutive session and it is trading near its "max buy" level. Color code was changed to yellow with pivot point cited based on its 11/01/22 high plus 10 cents in the prior mid-day report while noted - "It formed an orderly base and recently found support near its 50 and 200 DMA lines. Faces some additional resistance due to overhead supply up to the $33 level. Quarterly and annual earnings increases have been strong and steady." See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Volume Heavy Behind Breakout for Box Inc - 12/12/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

STRL

-

NASDAQ

STRL

-

NASDAQ

Sterling Infrastructure

MATERIALS and; CONSTRUCTION - Heavy Construction

|

$31.89

|

-0.04

-0.13% |

$32.49

|

232,722

130.01% of 50 DAV

50 DAV is 179,000

|

$33.62

-5.15%

|

12/14/2022

|

$32.41

|

PP = $33.72

|

|

MB = $35.41

|

Most Recent Note - 12/14/2022 6:15:20 PM

Most Recent Note - 12/14/2022 6:15:20 PM

Y - Highlighted in yellow with pivot point cited based on its 11/08/22 high plus 10 cents in the earlier mid-day report. Consolidating for about 5 weeks in a tight range near its all-time high with volume totals cooling. Faces very little resistance due to overhead supply. Subsequent gains above the pivot point backed by at least +40% above average volume are needed to trigger a proper technical buy signal. Reported Sep '22 quarterly earnings +35% on +20% sales revenues versus the year ago period, its 5th quarterly comparison at or above the +25% minimum earnings guideline (C criteria). After years of losses it has shown improving annual earnings (A criteria) since FY '17. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Sterling Infrastructure Forming Orderly Base Pattern - 12/14/2022 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|