You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Thursday, March 20, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, JANUARY 31ST, 2018

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+72.50 |

26,149.39 |

+0.28% |

|

Volume |

1,125,656,830 |

+23% |

|

Volume |

2,412,684,550 |

+11% |

|

NASDAQ |

+9.00 |

7,411.48 |

+0.12% |

|

Advancers |

1,564 |

53% |

|

Advancers |

695 |

31% |

|

S&P 500 |

+1.38 |

2,823.81 |

+0.05% |

|

Decliners |

1,391 |

47% |

|

Decliners |

1,578 |

69% |

|

Russell 2000 |

-7.83 |

1,574.98 |

-0.49% |

|

52 Wk Highs |

91 |

|

|

52 Wk Highs |

100 |

|

|

S&P 600 |

-5.22 |

959.39 |

-0.54% |

|

52 Wk Lows |

109 |

|

|

52 Wk Lows |

63 |

|

|

|

Indices Erased Much of the Session's Early Gain

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

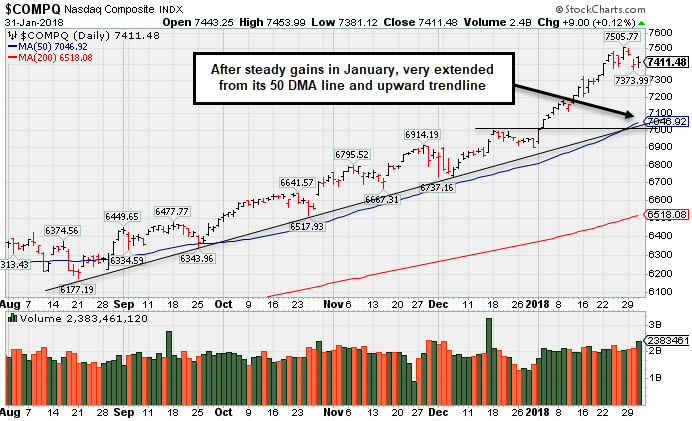

For January, the Dow added 5.8%, the best finish to a month since March 2016. The S&P 500 climbed 5.7% and the Nasdaq was up 7.4%. Stocks finished higher Wednesday. The Dow advanced 74 points to 26150 while the S&P 500 added 1 point to 2824. The Nasdaq Composite gained 9 points to 7411. Volume totals reported were higher than the prior session totals on the NYSE and on the Nasdaq exchange. Advancers narrowly led decliners on the NYSE, but decliners led advancers by more than a 2-1 margin on the Nasdaq exchange. New 52-week highs totals abruptly contracted and were outnumbered by new 52-week lows on both the NYSE and the Nasdaq exchange. There were 35 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, versus the total of 13 on the prior session. The Featured Stocks Page provides the latest analysis on noteworthy high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The Nasdaq Composite Index is extended from its 50-day moving average (DMA) line and upward trendline, pulling back from its record high after making steady progress in January. The major averages (M criteria) are in a confirmed uptrend. Investors should only consider stocks meeting all key criteria of the fact-based investment system as they trigger technical buy signals.

U.S. equities pared earlier gains following the FOMC’s unanimous decision to leave interest rates unchanged. In Janet Yellen’s final appearance as Fed Chair, policymakers reiterated “further gradual” rate hikes amid expectations for higher inflation this year. On the data front, private payrolls increased by 234,000 in January, well above expectations for an 185,000 gain. Another release showed the pace of Midwest manufacturing activity expanded at a slower rate in January. Pending home sales grew 0.5% in December, in line with projections.

Technology and Industrials contributed the most to today’s advance. Health Care was a notable laggard with Eli Lilly (LLY -5.39%) despite quarterly results topping analyst projections. In other earnings news, Boeing (BA +4.93%) and Electronic Arts (EA +6.96%) rose as both posted profits that exceeded consensus estimates.

Treasuries finished mixed on the session. The 10-year note yield jumped to 2.75% after the Fed meeting, but finished unchanged at 2.72%. In commodities, NYMEX WTI crude advanced 0.6% to $64.91/barrel, reversing earlier losses. COMEX gold gained 0.7% to $1349.60/ounce. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Semiconductor, Financials, and Gold & Silver Index Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

On Wednesday the Retail Index ($RLX -0.29%) edged lower while the Bank Index ($BKX +0.15%) and the Broker/Dealer Index ($XBD +0.36%) both edged higher. The Biotechnology Index ($BTK -1.85%) fell while the Networking Index ($NWX -0.01%) finished flat and the Semiconductor Index ($SOX +0.82%) rose. Commodity-linked groups were mixed as the Gold & Silver Index ($XAU +1.27%) and Integrated Oil Index ($XOI +0.57%) rose while the Oil Services Index ($OSX -1.04%) ended lower. Charts courtesy wwwstockcharts.com

PICTURED: The Oil Services Index ($OSX -1.04%) ended lower for a third consecutive session, undercutting its prior low.

| Oil Services |

$OSX |

155.20 |

-1.63 |

-1.04% |

+3.78% |

| Integrated Oil |

$XOI |

1,406.23 |

+7.97 |

+0.57% |

+5.29% |

| Semiconductor |

$SOX |

1,361.50 |

+11.06 |

+0.82% |

+8.65% |

| Networking |

$NWX |

512.18 |

-0.06 |

-0.01% |

+4.41% |

| Broker/Dealer |

$XBD |

278.51 |

+0.99 |

+0.36% |

+5.00% |

| Retail |

$RLX |

2,000.70 |

-5.86 |

-0.29% |

+15.40% |

| Gold & Silver |

$XAU |

87.66 |

+1.10 |

+1.27% |

+2.80% |

| Bank |

$BKX |

115.30 |

+0.18 |

+0.16% |

+8.05% |

| Biotech |

$BTK |

4,771.68 |

-90.00 |

-1.85% |

+13.01% |

|

|

|

|

Consolidating After Getting Extended From its Prior High

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Arista Networks Inc (ANET +$0.59 or +0.21% to $275.82) rebounded promptly after a sharp pullback at the open on Tuesday briefly undercut its "max buy" level. Prior highs in the $245 area define initial support to watch above its 50-day moving average (DMA) line ($243.57).

Fundamentals remain very strong, as ANET reported earnings +95% on +51% sales revenues for the Sep '17 quarter. It has shown strong and steady increases in quarterly sales revenues while earnings have routinely been well above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) growth has been strong, however, its history is limited since its $43 IPO in June of 2014.

ANET traded up as much as +203.5% since first highlighted at $93.80 in yellow with pivot point cited based on its 2015 high plus 10 cents in the 11/21/16 mid-day report (read here). It rebounded and rallied to new highs since last shown in this FSU section on 12/06/17 with an annotated graph under the headline, "Encountering Distributional Pressure After Wedging Near Prior High."

The number of top-rated funds owning its shares rose from 360 in Dec '15 to 724 in Dec '17, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.2 is an unbiased indication its shares have been under accumulation over the past 50 days. The high-ranked Computer - Networking firm has a Timeliness Rating of A and a Sponsorship Rating of B. Its small supply of 45.3 million shares (S criteria) in the public float may contribute to greater volatility in the event of institutional buying or selling.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

THO

-

NYSE

Thor Industries Inc

AUTOMOTIVE - Recreational Vehicles

|

$136.66

|

-3.26

-2.33% |

$141.08

|

865,701

125.65% of 50 DAV

50 DAV is 689,000

|

$161.48

-15.37%

|

12/19/2017

|

$153.92

|

PP = $156.96

|

|

MB = $164.81

|

Most Recent Note - 1/31/2018 6:59:42 PM

Most Recent Note - 1/31/2018 6:59:42 PM

G - Slumped further below its 50 DMA line today after damaging volume-driven losses triggering a technical sell signal. Only a prompt rebound above the 50 DMA line ($149.92) would help its outlook improve.

>>> FEATURED STOCK ARTICLE : Damaging Losses Hurt Companies That Make Recreational Vehicles - 1/26/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ROG

-

NYSE

Rogers Corp

CONSUMER NON-DURABLES - Rubber and Plastics

|

$164.78

|

-2.80

-1.67% |

$170.00

|

80,162

51.39% of 50 DAV

50 DAV is 156,000

|

$184.00

-10.45%

|

12/29/2017

|

$162.92

|

PP = $168.17

|

|

MB = $176.58

|

Most Recent Note - 1/30/2018 7:12:24 PM

Y - Recently stalled and it is quietly consolidating above its 50 DMA line ($163.44) which defines important near-term support to watch. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Stalled After Recent Technical Breakout - 1/30/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

TPL

-

NYSE

Texas Pacific Land Trust

FINANCIAL SERVICES - Diversified Investments

|

$537.05

|

-2.51

-0.47% |

$559.50

|

20,995

131.22% of 50 DAV

50 DAV is 16,000

|

$569.99

-5.78%

|

12/21/2017

|

$419.50

|

PP = $435.09

|

|

MB = $456.84

|

Most Recent Note - 1/29/2018 6:34:52 PM

G - Finished at the session high with today's gain backed by above average volume. Consolidating after getting very extended from the previously noted base. Prior highs in the $434 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Considerable Gains in First 2-3 Weeks After Recent Breakout - 1/23/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

YY

-

NASDAQ

YY Inc

INTERNET - Internet Service Providers

|

$132.96

|

+0.39

0.29% |

$135.92

|

703,231

53.80% of 50 DAV

50 DAV is 1,307,000

|

$142.97

-7.00%

|

12/29/2017

|

$113.06

|

PP = $123.58

|

|

MB = $129.76

|

Most Recent Note - 1/30/2018 7:16:53 PM

G - Finished near its session high after a gap down deep early losses today tested prior highs in the $123 area. Its 50 DMA line ($118.96) defines the next support to watch on pullbacks. This China-based Internet - Content firm's fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Touched a New High But Ended Below New Pivot Point Cited - 1/4/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

HTHT

-

NASDAQ

China Lodging Group Ads

LEISURE - Lodging

|

$149.49

|

-1.07

-0.71% |

$153.90

|

317,861

44.77% of 50 DAV

50 DAV is 710,000

|

$166.19

-10.05%

|

12/22/2017

|

$138.07

|

PP = $142.90

|

|

MB = $150.05

|

Most Recent Note - 1/29/2018 12:42:56 PM

G - Abruptly dipped and briefly undercut its 50 DMA line ($135.49) then promptly rebounded from early lows. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Found Support Above Prior High After Latest Breakout - 1/24/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

PETS

-

NASDAQ

Petmed Express Inc

RETAIL - Drug Stores

|

$45.20

|

-1.52

-3.25% |

$47.96

|

616,423

88.44% of 50 DAV

50 DAV is 697,000

|

$57.80

-21.80%

|

1/19/2018

|

$53.59

|

PP = $51.00

|

|

MB = $53.55

|

Most Recent Note - 1/31/2018 7:07:52 PM

Most Recent Note - 1/31/2018 7:07:52 PM

G - Fell to a close just below its 50 DMA line ($45.40) today, slumping further after a "negative reversal" on 1/22/18 following earnings news. Color code is changed to green. Only a prompt rebound above the 50 DMA line would help its outlook improve. Reported earnings +83% on +14% sales revenues, continuing its strong earnings track record.

>>> FEATURED STOCK ARTICLE : Strong Finish Ahead of Earnings News Next Week - 1/19/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PATK

-

NASDAQ

Patrick Industries Inc

Bldg-Mobile/Mfg and RV

|

$64.05

|

-2.80

-4.19% |

$67.75

|

318,916

176.29% of 50 DAV

50 DAV is 180,900

|

$72.35

-11.47%

|

10/26/2017

|

$90.90

|

PP = $87.90

|

|

MB = $92.30

|

Most Recent Note - 1/31/2018 6:57:50 PM

Most Recent Note - 1/31/2018 6:57:50 PM

G - Slumped further below its 50 DMA line ($66.62) with today's considerable volume-driven loss raising concerns and triggering a technical sell signal. Its Relative Strength Rating has slumped to 74, below the 80+ minimum guideline for buy candidates.

>>> FEATURED STOCK ARTICLE : Pulled Back From Record High With Higher Volume - 1/10/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ESNT

-

NYSE

Essent Group Ltd

Finance-MrtgandRel Svc

|

$46.52

|

-0.68

-1.44% |

$47.65

|

557,616

80.70% of 50 DAV

50 DAV is 691,000

|

$50.08

-7.11%

|

10/9/2017

|

$39.75

|

PP = $41.54

|

|

MB = $43.62

|

Most Recent Note - 1/29/2018 6:20:55 PM

G - Its 50 DMA line ($45.87) and recent lows in the $43.00 area define important support to watch..Its Relative Strength rating has slumped to 79, but it is still only -5.3% off its high.

>>> FEATURED STOCK ARTICLE : Perched Near High After Brief Consolidation Below 50 DMA Line - 1/9/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

FIVE

-

NASDAQ

Five Below Inc

Retail-DiscountandVariety

|

$64.93

|

-0.45

-0.69% |

$67.26

|

1,024,906

86.64% of 50 DAV

50 DAV is 1,183,000

|

$73.55

-11.72%

|

1/2/2018

|

$69.16

|

PP = $68.99

|

|

MB = $72.44

|

Most Recent Note - 1/26/2018 3:59:36 PM

Y - Consolidating in a tight range in recent weeks with volume totals cooling. Its 50 DMA line ($65.22) and recent low ($64.73 on 1/10/18) define important near term support where violations may trigger technical sell signals. Fundamentals remain very strong.

>>> FEATURED STOCK ARTICLE : Consolidating After Negating Breakout From Advanced Base - 1/17/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

MDXG

-

NASDAQ

MiMedx Group Inc

Medical-Products

|

$16.75

|

-0.95

-5.37% |

$17.88

|

2,142,699

113.25% of 50 DAV

50 DAV is 1,892,000

|

$18.25

-8.22%

|

1/29/2018

|

$17.43

|

PP = $17.57

|

|

MB = $18.45

|

Most Recent Note - 1/31/2018 7:01:58 PM

Most Recent Note - 1/31/2018 7:01:58 PM

Y - Pulled back today for a 2nd loss on near average volume. Prior gains backed by above average volume triggered a technical buy signal. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Hit a New High With it 6th Consecutive Gain - 1/29/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ANET

-

NYSE

Arista Networks Inc

TELECOMMUNICATIONS - Communication Equipment

|

$275.82

|

+0.59

0.21% |

$277.00

|

933,655

118.48% of 50 DAV

50 DAV is 788,000

|

$284.76

-3.14%

|

1/8/2018

|

$248.88

|

PP = $245.75

|

|

MB = $258.04

|

Most Recent Note - 1/30/2018 12:46:31 PM

G - Rebounded promptly after a sharp pullback at the open briefly undercut its "max buy" level. Prior highs in the $245 area define initial support to watch above its 50 DMA line ($242.70).

>>> FEATURED STOCK ARTICLE : Consolidating After Getting Extended From its Prior High - 1/31/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PAYC

-

NYSE

Paycom Software Inc

COMPUTER SOFTWARE and SERVICES - Application Software

|

$91.64

|

+0.24

0.26% |

$93.20

|

528,560

90.82% of 50 DAV

50 DAV is 582,000

|

$93.61

-2.10%

|

1/12/2018

|

$87.93

|

PP = $86.20

|

|

MB = $90.51

|

Most Recent Note - 1/31/2018 6:54:32 PM

Most Recent Note - 1/31/2018 6:54:32 PM

G - Stubbornly holding its ground perched near its all-time high, extended from any sound base. Prior highs near $86 and its 50 DMA line ($83.90) define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Finished Strong With Big Gain on +118% Above Average Volume - 1/12/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

GRUB

-

NYSE

Grubhub Inc

COMPUTER SOFTWARE and SERVICES - Technical and System Software

|

$72.25

|

-0.47

-0.65% |

$74.05

|

1,305,145

102.61% of 50 DAV

50 DAV is 1,272,000

|

$77.99

-7.35%

|

6/21/2017

|

$47.33

|

PP = $46.94

|

|

MB = $49.29

|

Most Recent Note - 1/29/2018 12:38:46 PM

G - Hit another new all-time high today. Big volume-driven gain on Friday cleared a short flat base during which it found prompt support near its 50 DMA line. The 2 latest quarterly comparisons were below the +25% minimum earnings guideline, so fundamental concerns were raised and noted before.

>>> FEATURED STOCK ARTICLE : Prompt Rebound Above 50-Day Moving Average Helped Outlook - 1/11/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

IBP

-

NYSE

Installed Building Prod

DIVERSIFIED SERVICES - Business/Management Services

|

$71.95

|

-1.95

-2.64% |

$75.75

|

221,991

124.02% of 50 DAV

50 DAV is 179,000

|

$79.40

-9.38%

|

12/26/2017

|

$75.00

|

PP = $79.50

|

|

MB = $83.48

|

Most Recent Note - 1/31/2018 6:52:43 PM

Most Recent Note - 1/31/2018 6:52:43 PM

G - Ended near the session low with a loss on higher volume, closing below its 50 DMA line ($73.93) raising concerns and its color code is changed to green. Prior low ($68.30 on 12/13/17) defines the next important support level where a violation may trigger more worrisome technical sell signal. A rebound above the 50 DMA line is needed for its outlook to improve. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal.

>>> FEATURED STOCK ARTICLE : Quietly Consolidating Near 50-Day Moving Average Line - 1/25/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

OLLI

-

NASDAQ

Ollie's Bargain Outlet

Retail-DiscountandVariety

|

$55.55

|

-0.20

-0.36% |

$56.70

|

519,350

83.77% of 50 DAV

50 DAV is 620,000

|

$58.50

-5.04%

|

11/21/2017

|

$46.78

|

PP = $47.00

|

|

MB = $49.35

|

Most Recent Note - 1/30/2018 7:07:37 PM

G - Pulled back from its all-time high after getting very extended from any sound base. Its 50 DMA line ($51.61) and recent low ($50.15 on 1/04/18) define important near-term support above prior highs in the $46 area. Fundamentals remain very strong.

>>> FEATURED STOCK ARTICLE : Bargain Outlet Looked Expensive Before +114% Rally in 18 Months - 1/18/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

WB

-

NASDAQ

Weibo Corp Cl A Ads

INTERNET - Content

|

$129.57

|

+0.98

0.76% |

$131.91

|

1,260,248

75.15% of 50 DAV

50 DAV is 1,677,000

|

$136.19

-4.86%

|

1/16/2018

|

$126.33

|

PP = $122.21

|

|

MB = $128.32

|

Most Recent Note - 1/29/2018 1:13:54 PM

G - Perched near its all-time high today after wedging higher with recent gains lacking great volume conviction. Prior highs in the $123 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Close in Session's Lower Third a Sign of Distributional Pressure - 1/16/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

HLI

-

NYSE

Houlihan Lokey Inc Cl A

Finance-Invest Bnk/Bkrs

|

$47.70

|

-2.17

-4.35% |

$50.04

|

347,466

181.92% of 50 DAV

50 DAV is 191,000

|

$52.81

-9.68%

|

1/3/2018

|

$45.88

|

PP = $47.09

|

|

MB = $49.44

|

Most Recent Note - 1/31/2018 7:04:40 PM

Most Recent Note - 1/31/2018 7:04:40 PM

G - Reported earnings +21% on +5% sales revenues for the Dec '17 quarter, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. Pulled back for a 2nd consecutive loss following a "negative reversal" after hitting a new all-time high. Extended from any sound base, its 50 DMA line ($46.63) defines near-term support to watch on pullbacks. On 10/26/17 it completed a Secondary Offering.

>>> FEATURED STOCK ARTICLE : Tight Weekly Closes Formed Advanced Base Pattern - 1/3/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ICHR

-

NASDAQ

Ichor Holdings Ltd

ELECTRONICS - Semiconductor Equipment

|

$31.92

|

-0.30

-0.93% |

$33.58

|

989,937

75.97% of 50 DAV

50 DAV is 1,303,000

|

$35.51

-10.11%

|

1/22/2018

|

$34.00

|

PP = $35.61

|

|

MB = $37.39

|

Most Recent Note - 1/26/2018 10:46:37 AM

Y - Perched within striking distance of its 52-week high. New pivot point cited was based on its 10/20/17 high plus 10 cents in the 1/22/18 mid-day report (read here). Very little overhead supply remains. Subsequent gains above the pivot point backed by at least +40% above average volume are still needed to trigger a technical buy signal.

>>> FEATURED STOCK ARTICLE : Found Support at 200 Day Average and Rebounded Near Prior High - 1/22/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|