You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, March 24, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - THURSDAY, OCTOBER 11TH, 2018

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-545.91 |

25,052.83 |

-2.13% |

|

Volume |

1,168,025,040 |

+9% |

|

Volume |

3,136,245,100 |

+2% |

|

NASDAQ |

-92.99 |

7,329.06 |

-1.25% |

|

Advancers |

640 |

21% |

|

Advancers |

840 |

27% |

|

S&P 500 |

-57.31 |

2,728.37 |

-2.06% |

|

Decliners |

2,386 |

79% |

|

Decliners |

2,247 |

73% |

|

Russell 2000 |

-30.03 |

1,545.38 |

-1.91% |

|

52 Wk Highs |

9 |

|

|

52 Wk Highs |

13 |

|

|

S&P 600 |

-20.56 |

967.23 |

-2.08% |

|

52 Wk Lows |

526 |

|

|

52 Wk Lows |

401 |

|

|

|

Major Averages Dive Into a Deeper Correction

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

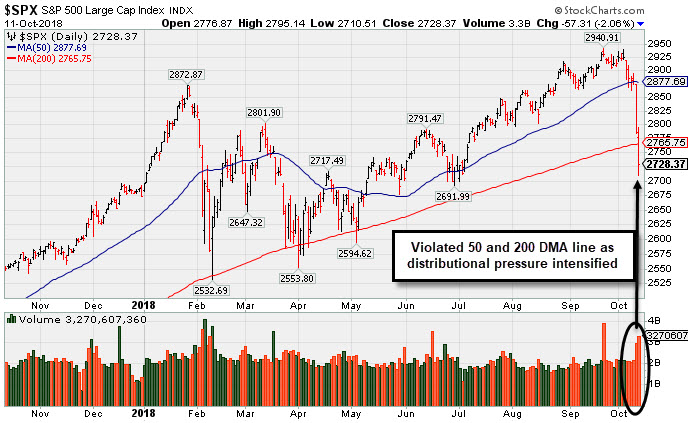

Stocks finished decisively lower on Thursday. The Dow fell 545 points to 25052. The S&P 500 fell for a sixth straight day, down 57 points to 2728. The Nasdaq Composite dropped 92 points to 7329. Volume totals reported were higher on the NYSE and on the Nasdaq exchange versus the prior session, a clear indication of even heavier distributional pressure or selling from the institutional crowd. Decliners led advancers by almost a 4-1 margin on the NYSE and nearly 3-1 on the Nasdaq exchange. There were 0 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, versus the total of 9 on the prior session - down considerably from 38 last Friday, clear proof that market leadership has evaporated. New 52-week lows totals swelled and solidly outnumbered shrinking new 52-week highs on both the NYSE and Nasdaq. The major indices (M criteria) have shown action indicative of a market in correction while leadership has quickly evaporated. During market corrections investors should have a bias toward selling stocks on a case by case basis as technical sell signals occur, raising cash levels while reducing market exposure. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The benchmark S&P 500 Index abruptly violated its 200-day moving average (DMA) line with a big volume-driven loss. Losses on higher volume have been indicative of worrisome distributional pressure.

The major averages extended losses as investors remained cautious following Wednesday’s sharp decline. The Nasdaq slipped into correction territory as the recent sell-off in Tech stocks caused the index to drop over 10% from its record level in August. Treasuries rose during the session as investors shifted funds into perceived “safe-haven” assets. The yield on the 30-year bond, which traded as high as 3.25% on Tuesday, fell an additional five basis points to 3.14%. On the data front, an update on inflation showed core CPI (ex-food and energy) advanced 2.2% year-over-year in September, below projections of a 2.3% gain.

Energy shares provided a stiff market headwind as WTI crude retreated 3.2% to $70.80/barrel after a report revealed a surprise build-up in U.S. crude supplies last week. Financials also underperformed ahead of the “unofficial” start to earnings season with several large-cap banks releasing third quarter results before Friday’s open. In other corporate news, Walgreens Boots Alliance (WBA -2.0%) after the company fell short of analyst revenue projections. Delta Air Lines (DAL +3.6%) rose after topping analyst estimates on the top and bottom line.

In commodities, COMEX gold added 2.7% to $1,220.80/ounce amid a weaker dollar. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Retail, Tech and Energy Groups Sank

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX -2.77%), Broker/Dealer Index ($XBD -2.48%), and the Retail Index ($RLX -1.76%) were unanimously lower on Thursday, creating a drag on the major averages. The tech sector also had a negative bias as the Networking Index ($NWX -2.04%), Biotech Index ($BTK -1.42%), and the Semiconductor Index ($SOX -1.03%) each sank. The Oil Services Index ($OSX -2.38%) and the Integrated Oil Index ($XOI -2.90%) both suffered large losses. The Gold & Silver Index ($XAU +6.80%) posted a big gain making it a clear standout for the second consecutive session.

Charts courtesy of www.stockcharts.com

PICTURED: The Oil Services Index ($OSX -2.38%) has abruptly slumped below its 50-day and 200-day moving average (DMA) lines.

| Oil Services |

$OSX |

142.46 |

-3.48 |

-2.38% |

-4.74% |

| Integrated Oil |

$XOI |

1,483.95 |

-44.31 |

-2.90% |

+11.11% |

| Semiconductor |

$SOX |

1,229.36 |

-12.74 |

-1.03% |

-1.89% |

| Networking |

$NWX |

501.79 |

-10.46 |

-2.04% |

+2.30% |

| Broker/Dealer |

$XBD |

258.39 |

-6.56 |

-2.48% |

-2.58% |

| Retail |

$RLX |

2,177.18 |

-39.00 |

-1.76% |

+25.57% |

| Gold & Silver |

$XAU |

69.97 |

+4.46 |

+6.81% |

-17.94% |

| Bank |

$BKX |

101.31 |

-2.88 |

-2.76% |

-5.06% |

| Biotech |

$BTK |

4,816.38 |

-69.44 |

-1.42% |

+14.07% |

|

|

|

|

Weak Action Amid Broader Market Declines

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

S V B Financial Group (SIVB -$8.25 or -2.74% to $292.89) slumped near its 200-day moving average (DMA) line ($287) earlier today before rebounding. It suffered a big volume-driven loss on the prior session. A rebound above the 50 DMA line ($319.83) is needed for its outlook to improve

Fundamentals remain strong. It reported financial results for the quarter ended June 30, 2018 and earnings rose +91% on +40% sales revenues versus the year ago period, marking its 6th consecutive comparison above the +25% minimum guideline (C criteria) of the fact-based investment system's guidelines. It has a great annual earnings history (A criteria).

SIVB last appeared in this FSU section on 8/27/18 with an annotated graph under the headline, "Bank Posted Quiet Gain for a Best-Ever Close". It was highlighted in yellow with pivot point cited based on its 1/24/18 high plus 10 cents in the 3/12/18 mid-day report (read here).

The number of top-rated funds owning its shares rose from 761 in Mar '17 to 1,366 in Jun '18, a reassuring sign concerning the I criteria. Its current Up/Down Volume ratio of 0.7 is an unbiased indication its shares have been under slight accumulation over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of B. There are only 53.2 million shares outstanding (S criteria) which can contribute to greater price volatility in the event of institutional buying or selling. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

OSBC

-

NASDAQ

Old Second Bancorp Inc

BANKING - Regional - Midwest Banks

|

$14.70

|

-0.31

-2.07% |

$15.03

|

107,754

114.63% of 50 DAV

50 DAV is 94,000

|

$16.30

-9.82%

|

9/24/2018

|

$15.38

|

PP = $16.40

|

|

MB = $17.22

|

Most Recent Note - 10/10/2018 1:33:01 PM

G - Color code is changed to green while sputtering below its 50 DMA line ($15.34). Prior lows and its 200 DMA line define additional near-term support. Its Relative Strength Rating is 74, below the 80+ minimum guideline for buy candidates. Met stubborn resistance after hitting a new high on 7/26/18 with a big volume-driven gain. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Bank Recently Sputtering Below its 50-Day Moving Average - 10/10/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

SIVB

-

NASDAQ

S V B Financial Group

BANKING - Regional - Pacific Banks

|

$292.89

|

-8.25

-2.74% |

$302.88

|

866,462

228.62% of 50 DAV

50 DAV is 379,000

|

$333.74

-12.24%

|

8/6/2018

|

$314.77

|

PP = $329.75

|

|

MB = $346.24

|

Most Recent Note - 10/11/2018 6:15:36 PM

Most Recent Note - 10/11/2018 6:15:36 PM

G - Slumped near its 200 DMA ($287) today with another volume-driven loss. Suffered a big volume-driven loss on the prior session. A rebound above the 50 DMA line ($320) is needed for its outlook to improve. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Weak Action Amid Broader Market Declines - 10/11/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

GMED

-

NYSE

Globus Medical Inc Cl A

CHEMICALS - Specialty Chemicals

|

$50.41

|

-0.27

-0.53% |

$51.36

|

1,116,906

181.91% of 50 DAV

50 DAV is 614,000

|

$57.55

-12.41%

|

9/26/2018

|

$56.11

|

PP = $57.65

|

|

MB = $60.53

|

Most Recent Note - 10/9/2018 5:13:38 PM

G - Color code is changed to green after a slump. Halted its slide at its 200 DMA line, however a rebound above the 50 DMA line is needed for its outlook to improve. Subsequent gains above the pivot point backed by more than +40% above average volume are needed to trigger a proper technical buy signal.

>>> FEATURED STOCK ARTICLE : Rallying Near Pivot Point With Volume-Driven Gains - 9/26/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ZBRA

-

NASDAQ

Zebra Tech Corp Cl A

COMPUTER HARDWARE - Computer Peripherals

|

$151.00

|

+1.42

0.95% |

$153.50

|

490,224

125.38% of 50 DAV

50 DAV is 391,000

|

$179.47

-15.86%

|

8/7/2018

|

$164.26

|

PP = $161.82

|

|

MB = $169.91

|

Most Recent Note - 10/10/2018 12:28:51 PM

G - With today's 5th consecutive loss it is slumping further below its 50 DMA line ($166) and prior high ($161) after noted losses triggered technical sell signals. Only a prompt rebound above the 50 DMA line would help its outlook improve.

>>> FEATURED STOCK ARTICLE : Hovering Near All-Time High With Strong Fundamentals - 9/24/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

TSC

-

NASDAQ

TriState Capital Hld Inc

CONSUMER NON-DURABLES - Personal Products

|

$26.99

|

-0.77

-2.77% |

$27.90

|

479,804

239.90% of 50 DAV

50 DAV is 200,000

|

$30.10

-10.33%

|

9/11/2018

|

$29.75

|

PP = $30.20

|

|

MB = $31.71

|

Most Recent Note - 10/10/2018 1:31:32 PM

G - A rebound above the 50 DMA line ($28.87) still is needed for its outlook to improve. Found support near prior highs in the $27 area. Faces near-term resistance due to overhead supply up to the $30 level.

>>> FEATURED STOCK ARTICLE : TriState Bank Perched Near All-Time High - 9/11/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

CME

-

NASDAQ

C M E Group Inc

DIVERSIFIED SERVICES - Business/Management Services

|

$176.03

|

-4.22

-2.34% |

$180.57

|

3,357,889

254.19% of 50 DAV

50 DAV is 1,321,000

|

$182.97

-3.79%

|

10/4/2018

|

$179.29

|

PP = $177.45

|

|

MB = $186.32

|

Most Recent Note - 10/10/2018 5:53:05 PM

Y - Stubbornly holding its ground despite broad market weakness (M criteria). Prior highs in the $177 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : CME Group Blasted to New Record High - 10/4/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

FLT

-

NYSE

Fleetcor Technologies

DIVERSIFIED SERVICES - Business/Management Services

|

$200.60

|

-4.68

-2.28% |

$207.88

|

703,583

135.46% of 50 DAV

50 DAV is 519,400

|

$230.24

-12.87%

|

9/12/2018

|

$221.01

|

PP = $226.02

|

|

MB = $237.32

|

Most Recent Note - 10/9/2018 5:10:08 PM

G - Sputtering below its 50 DMA line ($218) after 4 consecutive losses and its color code is changed to green. A rebound above the 50 DMA line is needed for its outlook to improve. Subsequent volume-driven gains above the pivot point are needed to trigger a new (or add-on) technical buy signal.

>>> FEATURED STOCK ARTICLE : Perched Within Close Striking Distance of New Pivot Point - 9/20/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

MA

-

NYSE

Mastercard Inc Cl A

Finance-CrdtCard/PmtPr

|

$194.51

|

-2.18

-1.11% |

$199.73

|

9,166,828

285.30% of 50 DAV

50 DAV is 3,213,000

|

$225.35

-13.69%

|

7/11/2018

|

$203.84

|

PP = $204.10

|

|

MB = $214.31

|

Most Recent Note - 10/11/2018 12:38:55 PM

Most Recent Note - 10/11/2018 12:38:55 PM

G - Slumped near its 200 DMA line ($189) earlier today then managed a positive reversal. Volume-driven losses this week triggered technical sell signals. Only a prompt rebound above the 50 DMA line ($211) would help its outlook improve.

>>> FEATURED STOCK ARTICLE : Hovering Near High, Extended From Any Sound Base - 9/27/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

V

-

NYSE

Visa Inc Cl A

Finance-CrdtCard/PmtPr

|

$133.73

|

-1.79

-1.32% |

$137.24

|

15,555,059

210.15% of 50 DAV

50 DAV is 7,402,000

|

$151.56

-11.76%

|

4/26/2018

|

$126.68

|

PP = $126.98

|

|

MB = $133.33

|

Most Recent Note - 10/11/2018 1:03:18 PM

Most Recent Note - 10/11/2018 1:03:18 PM

G - Sputtering above its 200 DMA line ($131) which defines the next important support after losses violating its 50 DMA line and recent low ($142.55 on 9/05/18) triggered technical sell signals. A rebound above the 50 DMA line ($144) is needed for its outlook to improve.

>>> FEATURED STOCK ARTICLE : Visa Near Record but Endured Distributional Pressure - 9/13/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ENV

-

NYSE

Envestnet Inc

FINANCIAL SERVICES - Diversified Investments

|

$55.85

|

-2.24

-3.86% |

$58.04

|

480,078

192.80% of 50 DAV

50 DAV is 249,000

|

$64.80

-13.81%

|

6/15/2018

|

$57.85

|

PP = $60.37

|

|

MB = $63.39

|

Most Recent Note - 10/11/2018 12:25:42 PM

Most Recent Note - 10/11/2018 12:25:42 PM

G - Testing its 200 DMA line ($57.05) with today's 5th consecutive loss. More damaging losses would raise greater concerns. A rebound above its 50 DMA line ($61.13) is needed for its outlook to improve. Its Relative Strength Rating is 80, right at the 80+ minimum guideline for buy candidates. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Found Recent Support at 50-Day Moving Average - 9/21/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

TPL

-

NYSE

Texas Pacific Land Trust

Real Estate Dvlpmt/Ops

|

$785.00

|

-19.89

-2.47% |

$821.39

|

28,049

215.76% of 50 DAV

50 DAV is 13,000

|

$877.97

-10.59%

|

9/14/2018

|

$820.45

|

PP = $874.10

|

|

MB = $917.81

|

Most Recent Note - 10/11/2018 1:00:24 PM

Most Recent Note - 10/11/2018 1:00:24 PM

G - Sputtering today, on track for a 6th consecutive loss marked by higher volume after violating its 50 DMA line and prior low ($818) on the prior session triggering technical sell signals. A rebound above the 50 DMA line ($828) is needed for its outlook to improve. The prior low ($760 on 8/15/18) defines the next important near-term support to watch.

>>> FEATURED STOCK ARTICLE : Best Ever Close After a Solid Gain on Higher Volume - 9/4/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ABMD

-

NASDAQ

Abiomed Inc

HEALTH SERVICES - Medical Instruments and Supplies

|

$367.54

|

-9.35

-2.48% |

$383.88

|

815,425

140.11% of 50 DAV

50 DAV is 582,000

|

$459.75

-20.06%

|

9/25/2018

|

$441.96

|

PP = $451.03

|

|

MB = $473.58

|

Most Recent Note - 10/10/2018 5:36:51 PM

G - Color code is changed to green after slumping below its 50 DMA line ($391) with higher volume behind today's 8th consecutive loss. Only a prompt rebound above the 50 DMA line would help its outlook improve.

>>> FEATURED STOCK ARTICLE : Quick Rebound Near Prior High - 9/25/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

DPZ

-

NYSE

Dominos Pizza Inc

Retail-Restaurants

|

$270.88

|

-4.04

-1.47% |

$278.06

|

679,280

135.86% of 50 DAV

50 DAV is 500,000

|

$305.34

-11.29%

|

8/13/2018

|

$288.60

|

PP = $293.91

|

|

MB = $308.61

|

Most Recent Note - 10/10/2018 1:30:01 PM

G - Color code is changed to green while sputtering below its 50 DMA line ($287) raising concerns. The recent low ($273.63 on 9/17/18) defines important near-term support to watch.

>>> FEATURED STOCK ARTICLE : Pulling Back After Wedging Gains for Highs Lacked Great Volume - 9/5/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

FIVE

-

NASDAQ

Five Below Inc

Retail-DiscountandVariety

|

$112.76

|

-2.28

-1.98% |

$117.06

|

1,146,819

123.18% of 50 DAV

50 DAV is 931,000

|

$136.13

-17.17%

|

7/6/2018

|

$98.90

|

PP = $104.09

|

|

MB = $109.29

|

Most Recent Note - 10/10/2018 5:56:26 PM

G - Violated its 50 DMA line ($117) with today's volume-driven loss triggering a technical sell signal. The prior high ($109.09 on 7/19/18) defines the next important support level to watch.

>>> FEATURED STOCK ARTICLE : Retreating After +138% Rally in Under 12 Months - 10/2/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NVEE

-

NASDAQ

N V 5 Global Inc

Comml Svcs-Consulting

|

$82.22

|

-0.66

-0.80% |

$83.76

|

95,030

106.78% of 50 DAV

50 DAV is 89,000

|

$92.75

-11.35%

|

6/15/2018

|

$7,070.00

|

PP = $72.00

|

|

MB = $75.60

|

Most Recent Note - 10/8/2018 6:55:02 PM

G - Still sputtering below its 50 DMA line ($86.32). A rebound above the 50 DMA line is needed for its outlook to improve. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Recently Slumped Below 50-Day Moving Average Line - 10/8/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

PANW

-

NYSE

Palo Alto Networks

Computer Sftwr-Security

|

$203.17

|

+0.79

0.39% |

$206.31

|

1,697,989

138.95% of 50 DAV

50 DAV is 1,222,000

|

$239.50

-15.17%

|

6/12/2018

|

$206.55

|

PP = $214.69

|

|

MB = $225.42

|

Most Recent Note - 10/10/2018 6:06:23 PM

G - After noted technical sell signals it slumped even further below its 50 DMA line ($221) and below the prior high ($219.38 on 7/13/18) with heavier volume behind today's 12th consecutive loss. A rebound above the 50 DMA line is needed for its outlook to improve.

>>> FEATURED STOCK ARTICLE : Perched Near All-Time High With Volume Totals Cooling - 9/17/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

HQY

-

NASDAQ

Healthequity Inc

COMPUTER SOFTWARE and SERVICES - Healthcare Information Service

|

$82.83

|

-1.93

-2.28% |

$85.87

|

685,238

91.49% of 50 DAV

50 DAV is 749,000

|

$99.99

-17.16%

|

8/13/2018

|

$82.39

|

PP = $83.44

|

|

MB = $87.61

|

Most Recent Note - 10/8/2018 6:48:54 PM

G - Quietly slumped below its 50 DMA line ($89.05) today raising concerns. More damaging losses would raise greater concerns. Prior highs in the $82-83 area define the next important support to watch.

>>> FEATURED STOCK ARTICLE : Very Extended From Any Sound Base After Streak of Gains - 9/10/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

OLLI

-

NASDAQ

Ollie's Bargain Outlet

Retail-DiscountandVariety

|

$85.03

|

-2.33

-2.67% |

$87.96

|

849,368

129.48% of 50 DAV

50 DAV is 656,000

|

$97.61

-12.89%

|

7/12/2018

|

$74.43

|

PP = $77.60

|

|

MB = $81.48

|

Most Recent Note - 10/8/2018 12:49:02 PM

G - Very extended from any sound base. Its 50 DMA line ($83.59) defines near-term support above prior highs in the $77 area. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Encountered Distributional Pressure After a Great Rally - 10/9/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|