Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com?

Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com

Charts courtesy www.stockcharts.com

It has earned an Earnings Per Share Rating of 99, putting it in the top 1% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has a B- Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 232 in Dec '14 to 343 in Dec'16, a reassuring sign concerning the I criteria. Its small supply of only 17.1 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

Stamps.Com Inc (STMP -$10.82 or -10.13% to $95.98) suffered a damaging volume-driven loss today and triggered a technical sell signal. It violated its 50-day moving average (DMA) line which was previously noted as important near-term support to watch. Its latest consolidation was too brief to be considered a sound base. Its last appearance in this FSU section with an annotated graph was on 12/28/15 under the headline, "Consolidation Was Brief Following Prior Breakaway Gap".

STMP was highlighted in yellow with pivot point cited based on its 8/19/15 high plus 10 cents in the 11/06/15 mid-day report (read here). Nearly 8 times average volume was behind its considerable "breakaway gap". Breakaway gaps are one noted exception where chasing a stock more than +5% above prior highs is permitted under the fact-based investment system guidelines, but risk increases the further above prior highs one makes any purchases.

Bullish action came after it reported earnings +61% on +37% sales revenues for the Sep '15 quarter, well above the +25% minimum guideline (C criteria), continuing its strong earnings history matching the fact-based investment system's winning models. Earnings rose +44%, +76%, and 61% in the Mar, Jun, and Sep '15 quarters, respectively, versus the year ago periods. Sales revenues rose +32%, +41%, and +37% during that same span.

It has earned an Earnings Per Share Rating of 99, putting it in the top 1% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A+ Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 232 in Dec '14 to 319 in Sep '15, a reassuring sign concerning the I criteria. Its small supply of only 16.6 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

Stamps.Com Inc (STMP -$0.69 or -0.61% to $111.92 ) is perched near its 52-week high after volume-driven gains. Its 50-day moving average (DMA) line ($94.39) and recent lows define near-term support to watch. Disciplined investors avoid chasing extended stocks. Its latest consolidation was too brief to be considered a sound base, yet it stubbornly held its ground and showed bullish action since last appearing in this FSU section with an annotated graph on 12/11/15 under the headline, "Perched Near 52-Week High After More Bullish Action".

STMP was highlighted in yellow with pivot point cited based on its 8/19/15 high plus 10 cents in the 11/06/15 mid-day report (read here). Nearly 8 times average volume was behind its considerable "breakaway gap". Breakaway gaps are one noted exception where chasing a stock more than +5% above prior highs is permitted under the fact-based investment system guidelines, but risk increases the further above prior highs one makes any purchases.

Bullish action came after it reported earnings +61% on +37% sales revenues for the Sep '15 quarter, well above the +25% minimum guideline (C criteria), continuing its strong earnings history matching the fact-based investment system's winning models. Earnings rose +44%, +76%, and 61% in the Mar, Jun, and Sep '15 quarters, respectively, versus the year ago periods. Sales revenues rose +32%, +41%, and +37% during that same span.

It has earned an Earnings Per Share Rating of 99, putting it in the top 1% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A+ Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 232 in Dec '14 to 316 in Sep '15, a reassuring sign concerning the I criteria. Its small supply of only 16.6 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

Stamps.Com Inc (STMP +$0.77 or +0.75% to $104.04) is still consolidating in a very tight range near its 52-week high. Prior highs in the $88 area define important near-term support to watch. Disciplined investors avoid chasing extended stocks. It has been consolidating since last shown in this FSU section with an annotated graph on 11/23/15 under the headline, "Volume-Driven Gain For Second Best Close". It was highlighted in yellow with pivot point cited based on its 8/19/15 high plus 10 cents in the 11/06/15 mid-day report (read here). Nearly 8 times average volume was behind its considerable "breakaway gap". Breakaway gaps are one noted exception where chasing a stock more than +5% above prior highs is permitted under the fact-based investment system guidelines, but risk increases the further above prior highs one makes any purchases.

Bullish action came after it reported earnings +61% on +37% sales revenues for the Sep '15 quarter, well above the +25% minimum guideline (C criteria), continuing its strong earnings history matching the fact-based investment system's winning models. Earnings rose +44%, +76%, and 61% in the Mar, Jun, and Sep '15 quarters, respectively, versus the year ago periods. Sales revenues rose +32%, +41%, and +37% during that same span.

It has earned an Earnings Per Share Rating of 99, putting it in the top 1% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A+ Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 232 in Dec '14 to 312 in Sep '15, a reassuring sign concerning the I criteria. Its small supply of only 16.5 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

Stamps.Com Inc (STMP +$3.14 or +3.18% to $101.85) rose today with above average volume for its best close since its big "breakaway gap" on 10/28/15. Disciplined investors avoid chasing extended stocks. It has been consolidating since last shown in this FSU section with an annotated graph on 11/06/15 under the headline, "Big Breakaway Gap With Heavy Volume Following Earnings News". It was highlighted in yellow with pivot point cited based on its 8/19/15 high plus 10 cents in the earlier mid-day report (read here).

Nearly 8 times average volume was behind its considerable "breakaway gap". Breakaway gaps are one noted exception where chasing a stock more than +5% above prior highs is permitted under the fact-based investment system guidelines, but risk increases the further above prior highs one makes any purchases.

Bullish action came after it reported earnings +61% on +37% sales revenues for the Sep '15 quarter, well above the +25% minimum guideline (C criteria), continuing its strong earnings history matching the fact-based investment system's winning models. Earnings rose +44%, +76%, and 61% in the Mar, Jun, and Sep '15 quarters, respectively, versus the year ago periods. Sales revenues rose +32%, +41%, and +37% during that same span.

It has earned an Earnings Per Share Rating of 99, putting it in the top 1% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A+ Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 232 in Dec '14 to 309 in Sep '15, a reassuring sign concerning the I criteria. Its small supply of only 16.5 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

Stamps.Com Inc (STMP +$28.95 or +38.10% to $104.93) was highlighted in yellow with pivot point cited based on its 8/19/15 high plus 10 cents (read here). It hit a new 52-week high with nearly 8 times average volume behind today's considerable "breakaway gap". Breakaway gaps are one noted exception where chasing a stock more than +5% above prior highs is permitted under the fact-based investment system guidelines, but risk increases the further above prior highs one makes any purchases.

Bullish action came after it reported earnings +61% on +37% sales revenues for the Sep '15 quarter, well above the +25% minimum guideline (C criteria), continuing its strong earnings history matching the fact-based investment system's winning models. Earnings rose +44%, +76%, and 61% in the Mar, Jun, and Sep '15 quarters, respectively, versus the year ago periods. Sales revenues rose +32%, +41%, and +37% during that same span.

STMP has managed a choppy ascent following a deep consolidation after last shown in this FSU section with an annotated graph on 12/02/13 under the headline, " Upward Trendline and 50-Day Average Define Important Near-Term Support".

It has earned an Earnings Per Share Rating of 99, putting it in the top 1% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A+ Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 232 in Dec '14 to 303 in Sep '15, a reassuring sign concerning the I criteria. Its small supply of only 16.5 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

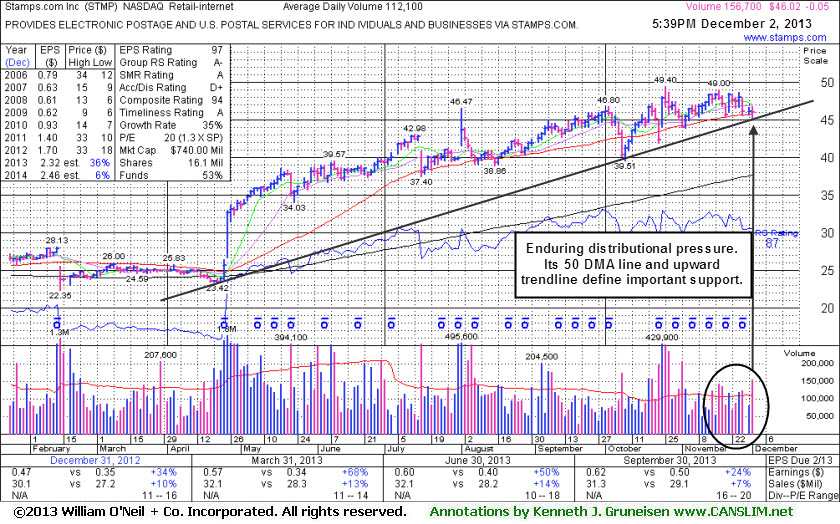

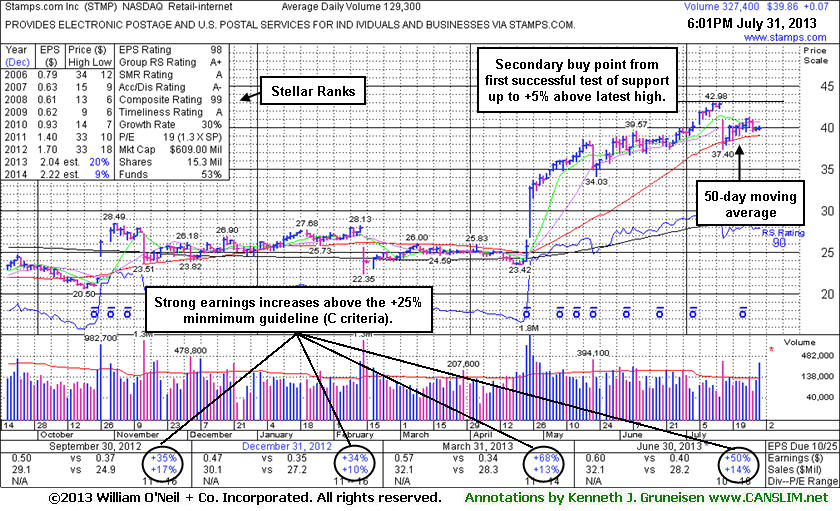

Stamps.Com Inc (STMP -$0.05 or -0.11% to $46.02) is still finding support near its 50-day moving average (DMA) line which recently acted as support. An upward trendline also comes into play as a technical support level. More damaging losses below those levels would raise greater concerns and trigger worrisome technical sell signals.

Earnings were +24% on +7% sales revenues for the Sep '13 quarter, just below the +25% minimum earnings guideline (C criteria). STMP has been resilient was last shown in this FSU section with an annotated graph on 10/31/13 under the headline, "Fundamental Flaw May Prompt Disciplined Investors to Look Elsewhere", consolidating near prior highs in the $46 area. Disciplined investors might watch for continued technical strength and better earnings results in the next quarter, meanwhile looking to take action sooner on any fresh buy candidates without flaws.

It has earned an Earnings Per Share Rating of 97, putting it in the top 3% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A- Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 194 in Dec '12 to 231 in Sep '13, a reassuring sign concerning the I criteria. Its small supply of only 15.6 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

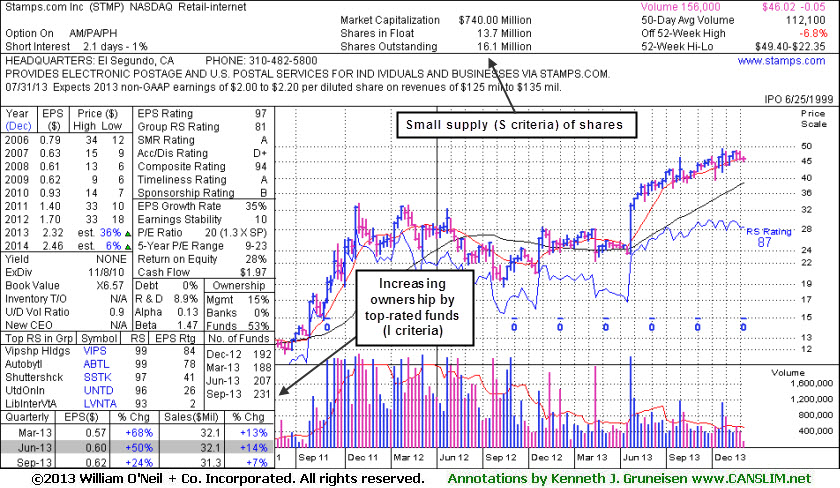

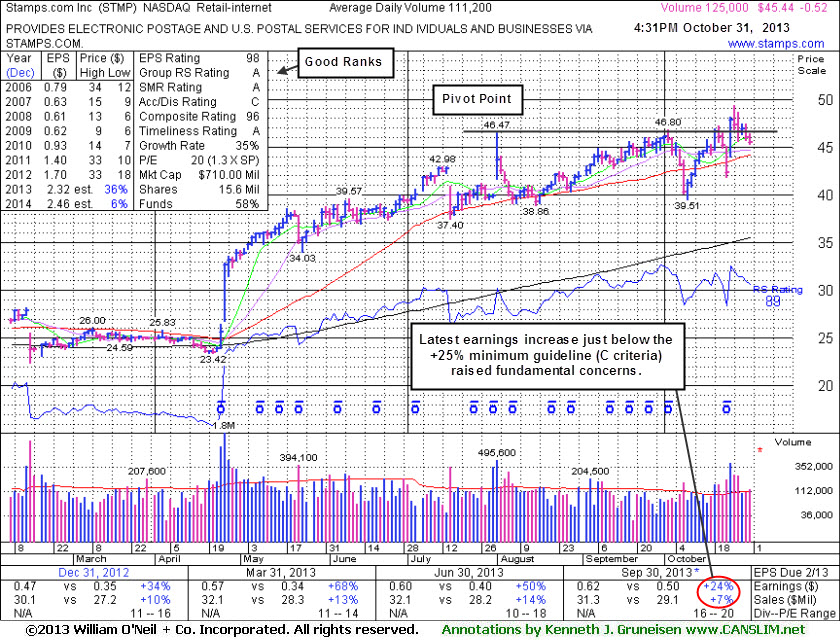

STMP was last shown in this FSU section with an annotated graph on 9/24/13 under the headline, "Forming New Set-Up After 50-Day Average Acted as Support". It has earned an Earnings Per Share Rating of 98, putting it in the top 2% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 194 in Dec '12 to 227 in Sep '13, a reassuring sign concerning the I criteria. Its small supply of only 15.6 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

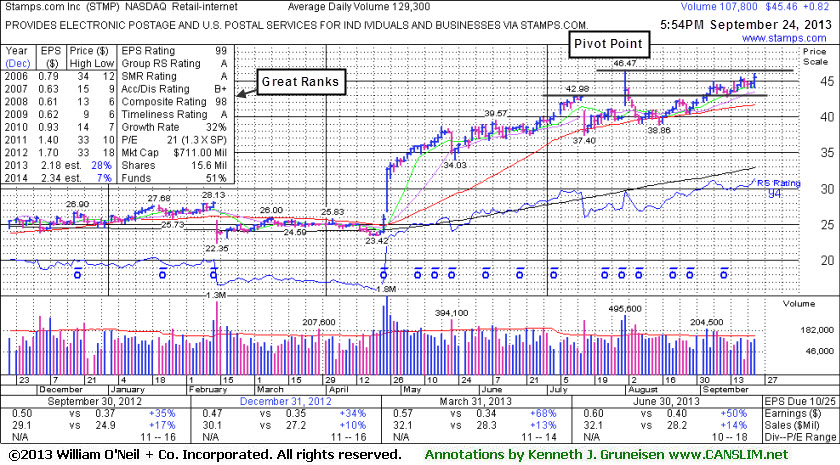

After clearing multi-year resistance in the $33 area it subsequently made steady progress. It reported earnings +50% on +14% sales for the quarter ended June 30, 2013 versus the year ago period, continuing its strong earnings track record. It has earned an Earnings Per Share Rating of 99, putting it in the top 1% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 194 in Dec '12 to 207 in Jun '13, a reassuring sign concerning the I criteria. Its small supply of only 15.6 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

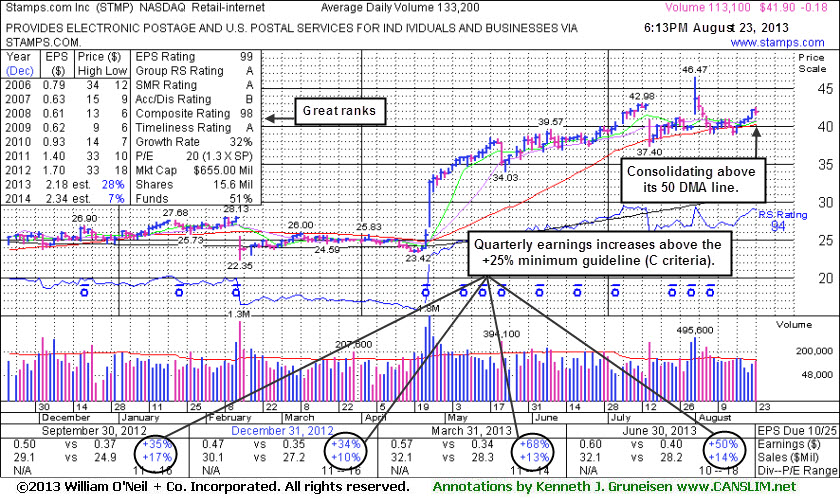

Stamps.Com Inc (STMP -$0.18 or +0.18% to $41.90) has recently been consolidating above its 50-day moving average (DMA) line. It was last shown in this FSU section with an annotated graph on 7/31/13 under the headline, "Following Test of Support Secondary Buy Point Exists". It stalled following a considerable volume-driven gap up gain on 8/01/13. Keep in mind that the broader market direction (M criteria) weighs heavily into the mix as historic studies showed that 3 out of 4 stocks typically move in the same direction of the major averages. For as long as the current market correction continues, odds are not favorable for most stocks making meaningful headway.

Pay close attention to stocks that hold up well during corrections and watch for those that are the first ones breaking into new high ground upon any new confirmed rally. Meanwhile, if holding onto current gains, investors should stand ready to reduce exposure before too much damage starts to mount. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price, but sometimes weak technical action may hint that it is a smart time to sell even before losses reach that important maximum loss threshold.

After clearing multi-year resistance in the $33 area it subsequently made steady progress. STMP had not formed a sound new base, however it was highlighted in yellow in the 7/31/13 mid-day report (read here) as it was noted - "A valid secondary buy point exists following its successful test of support up to +5% above its prior high. Reported earnings +68% on +13% sales revenues for the quarter ended March 31, 2013 versus the year ago period, marking a 3rd consecutive quarter above the +25% minimum guideline (C criteria). Due to report earnings after the close, and volume and volatility often increase near earnings news. "

After the close it reported earnings +50% on +14% sales for the quarter ended June 30, 2013 versus the year ago period, continuing its strong earnings track record. It has earned an Earnings Per Share Rating of 99, putting it in the top 1% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 194 in Dec '12 to 204 in Jun '13, a reassuring sign concerning the I criteria. Its small supply of only 15.6 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

In the Certification they teach that stocks can be bought from their first test of the 10-week moving average (WMA) line up to as much as +5% above the latest high following an earlier technical breakout. The approach offers investors a "secondary buy point" if they missed an opportunity to accumulate shares at an earlier breakout, or if they wish to make add-on purchases and "force feed" their winning positions. The 10 WMA line closely corresponds with the 50-day moving average (DMA) line shown on the graph below. Obviously any damaging pullback may prompt investors to limit their losses at the -7% threshold from their purchase price, as always.

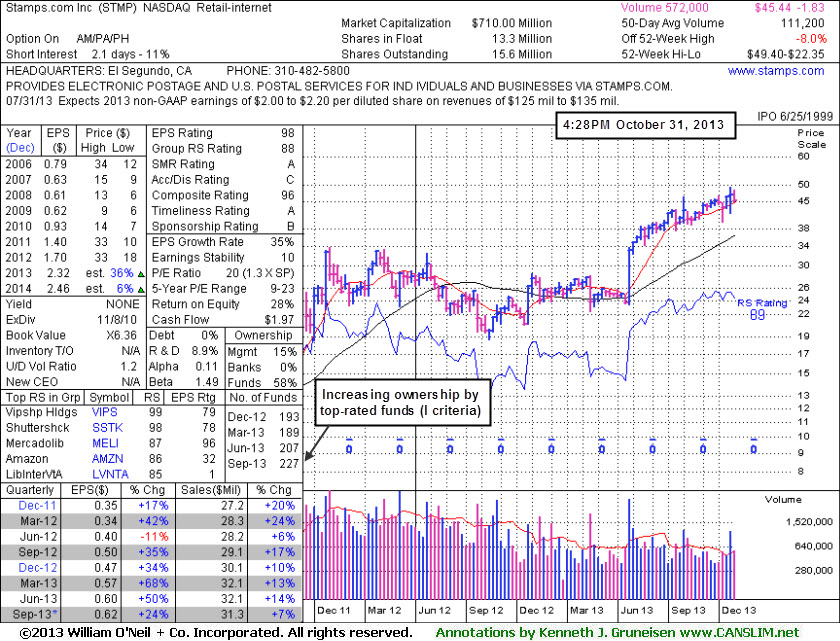

Stamps.Com Inc (STMP +$0.07 or +0.18% to $39.86) found prompt support at its 50-day moving average (DMA) line when it was hit with distributional pressure since last noted in the 6/25/13 mid-day report. Disciplined investors may watch for it to possibly form a proper base of sufficient length and be noted in the weeks ahead. The graph below shows its powerful breakout in late April. After clearing multi-year resistance in the $33 area it subsequently made steady progress by mostly wedging higher with gains lacking great volume conviction. That lack of great volume conviction in recent month helps explain why it failed to meet the screening criteria to show up in the daily mid-day report which is produced via a screening of the high-ranked Leaders List since the 6/25/13 mid-day report had noted - "It has not formed a sound base yet made gradual progress above multi-year highs in the $33 area since last noted in the 4/29/13 mid-day report - "Patient and disciplined investors may watch for a new base or secondary buy point to possibly develop and be noted in the weeks ahead. Reported earnings +68% on +13% sales revenues for the quarter ended March 31, 2013 versus the year ago period, marking a 3rd consecutive quarter above the +25% minimum guideline (C criteria). It survived but failed to impress since dropped from the Featured Stocks list on 2/14/12 based on the fundamental and technical concerns."

STMP had not formed a sound new base, however it was highlighted in yellow in today's mid-day report (read here) as it was noted - "A valid secondary buy point exists following its successful test of support up to +5% above its prior high. Reported earnings +68% on +13% sales revenues for the quarter ended March 31, 2013 versus the year ago period, marking a 3rd consecutive quarter above the +25% minimum guideline (C criteria). Due to report earnings after the close, and volume and volatility often increase near earnings news. "

After the close it reported earnings +50% on +14% sales for the quarter ended June 30, 2013 versus the year ago period, continuing its strong earnings track record. It has earned an Earnings Per Share Rating of 98, putting it in the top 2% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A+ Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 194 in Dec '12 to 199 in Jun '13, a reassuring sign concerning the I criteria. Its small supply of only 15.3 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Stamps.Com Inc (STMP +$0.68 or +2.15% to $32.33) tallied a volume-driven gain today. It was featured in yellow in the earlier mid-day report while perched within close striking distance of its 52-week high after a 14-week cup-with-handle shaped base pattern. Disciplined investors may watch for a strong volume-driven gain above its pivot point to trigger a technical buy signal. However it finished below that mark and near the middle of its intra-day range, so confirming gains are needed.

The high-ranked Retail - Internet firm has other strong leaders in the group confirming the L criteria, but the group's low ranks (see red circle) would otherwise be of greater concern. It reported earnings +54% on +20% sales revenues for the quarter ended September 30, 2011 versus the year ago period. Recent quarterly comparisons showed improved sales revenues increases, and its strong earnings increases satisfy the C criteria. Prior reports noted that its annual earnings (A criteria) history did not show strong and steady increases, however FY '10 showed a big increase following a couple of flat years. The number of top-rated funds owning its shares rose from 166 in Jun '11 to 199 in Dec '11, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 also provides an unbiased hint its shares have recently been under accumulation.