Graphic Packaging Hits New High With 6th Consecutive Gain - Thursday, June 8, 2023

Graphic Packaging Hldg (GPK +$0.14 or +0.53% to $26.45) hit a new all-time high with today's 6th consecutive gain. It did not form a sound new base of sufficient length but quickly recovered after testing its 4/27/23 low last week.GPK was last shown in this FSU section on 4/10/23 with an annotated graph under the headline, "Packaging Firm Due to Report Earnings News". It was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the 10/25/22 mid-day report (read here). It has an 98 Earnings Per Share Rating. It reported Mar '23 quarterly earnings +60% on +9% sales revenues versus the year ago period. The past 5 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 188th on the 197 Industry Groups list and it has a E (6) Group Relative Strength Rating, not reassuring concerning the L criteria. The number of top-rated funds owning its shares rose from 596 in Sep '21 to 825 in Mar '23, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

Chart courtesy of www.stockcharts.com

Packaging Firm Due to Report Earnings News - Monday, May 1, 2023

Graphic Packaging Hldg (GPK -$0.03 or -0.12% to $24.63) had a "negative reversal" today as it churned above average volume. A rebound above its 50-day moving average (DMA) line ($24.39) last week helped its outlook improve. It is perched just -3.9% below its all-time high. Recent gains lacked great volume conviction. Keep in mind it is due to report Mar '23 quarterly results in the morning on May 2nd. Volume and volatility often increase near earnings news.GPK was last shown in this FSU section on 4/10/23 with an annotated graph under the headline, "Quietly Consolidating Just Below 'Max Buy' Level". It was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the 10/25/22 mid-day report (read here). It has an 98 Earnings Per Share Rating. It reported Dec '22 quarterly earnings +74% on +20% sales revenues versus the year ago period. The past 4 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 164th on the 197 Industry Groups list and it has a D (18) Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 789 in Mar '23, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

Chart courtesy of www.stockcharts.com

Quietly Consolidating Just Below "Max Buy" Level - Monday, April 10, 2023

Graphic Packaging Hldg (GPK -$0.03 or -0.12% to $25.03) is quietly consolidating just below its "max buy" level and just -2.3% below its all-time high. Recent gains lacked great volume conviction. Its 50-day moving average (DMA) line ($24.04) and recent low ($22.99 on 3/16/23) define important near-term support to watch.GPK was last shown in this FSU section on 2/27/23 with an annotated graph under the headline, "Quietly Lingering Near High With Strong Fundamentals". It was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the 10/25/22 mid-day report (read here). It has an 98 Earnings Per Share Rating. It reported Dec '22 quarterly earnings +74% on +20% sales revenues versus the year ago period. The past 4 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 138th on the 197 Industry Groups list and it has a D+ (31) Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 784 in Mar '23, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days.

Chart courtesy of www.stockcharts.com

Found Encouraging Support Near 50-Day Moving Average Line - Tuesday, March 21, 2023

Graphic Packaging Hldg (GPK +$0.33 or +1.40% to $23.94) has recently been sputtering below the noted pivot point and testing support at its 50-day moving average (DMA) line ($23.38). More damaging losses would raise greater concerns and trigger a technical sell signal. Broader market weakness (M criteria) has been noted as a "correction" that has raised concerns.

Subsequent gains above the pivot point and for new highs backed by at least +40% above average volume may help provide a confirming technical buy signal. It was last shown in this FSU section on 2/27/23 with an annotated graph under the headline, "Quietly Lingering Near High With Strong Fundamentals".

GPK was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the 10/25/22 mid-day report (read here). GPK has a 98 Earnings Per Share Rating. It reported Dec '22 quarterly earnings +74% on +20% sales revenues versus the year ago period. The past 4 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 122nd on the 197 Industry Groups list and it has a C- (39) Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 754 in Dec '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.2 is an unbiased indication its shares have been under accumulation over the past 50 days.

Chart courtesy of www.stockcharts.com

Quietly Lingering Near High With Strong Fundamentals - Monday, February 27, 2023

Graphic Packaging Hldg (GPK +$0.08 or +0.34% to $23.80) posted a 3rd consecutive gain with below average volume and closed only -1.7% off its all-time high. It showed resilience after briefly violating its 50-day moving average (DMA) line on 2/07/23. Members were reminded - "Disciplined investors know that gains above a stock's pivot point must be backed by at least +40% above average volume to trigger a proper technical buy signal."

It faces very little resistance due to overhead supply. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. It was last shown in this FSU section on 1/27/23 with an annotated graph under the headline, "Graphic Packaging Perched Near Pivot Point".

GPK was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the 10/25/22 mid-day report (read here). GPK has a 98 Earnings Per Share Rating. It reported Dec '22 quarterly earnings +74% on +20% sales revenues versus the year ago period. The past 4 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 139th on the 197 Industry Groups list and it has a C (30) Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 722 in Dec '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

Chart courtesy of www.stockcharts.com

Graphic Packaging Perched Near Pivot Point - Friday, January 27, 2023

Graphic Packaging Hldg (GPK -$0.02 or -0.08% to $23.76) paused today after 5 consecutive gains approaching prior highs. It faces very little resistance due to overhead supply up to the $24 level. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. It was last shown in this FSU section on 1/10/23 with an annotated graph under the headline, "Found Support at 200-Day Moving Average and Still Faces Resistance".

GPK was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the 10/25/22 mid-day report (read here). GPK has a 98 Earnings Per Share Rating. It reported Sep '22 quarterly earnings +79% on +38% sales revenues versus the year ago period. The past 3 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 122nd on the 197 Industry Groups list and it has a C (39) Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 707 in Dec '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days.

Chart courtesy of www.stockcharts.com

Found Support at 200-Day Moving Average and Still Faces Resistance - Tuesday, January 10, 2023

Graphic Packaging Hldg (GPK -$0.16 or -0.71% to $22.24) is consolidating near its 50-day moving average (DMA) line ($22.35) after recently finding support at its 200 DMA line ($21.67). More damaging losses may raise concerns. It faces some resistance due to overhead supply up to the $24 level. Fundamentals remain strong.

GPK was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the 10/25/22 mid-day report (read here). GPK has a 98 Earnings Per Share Rating. It reported Sep '22 quarterly earnings +79% on +38% sales revenues versus the year ago period. It was last shown in this FSU section on 12/15/22 with an annotated graph under the headline, "Violated 50-Day Moving Average After Recently Failing to Break Out". The past 3 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 117th on the 197 Industry Groups list and it has a C (41) Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 697 in Dec '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distributional pressure over the past 50 days.

Chart courtesy of www.stockcharts.com

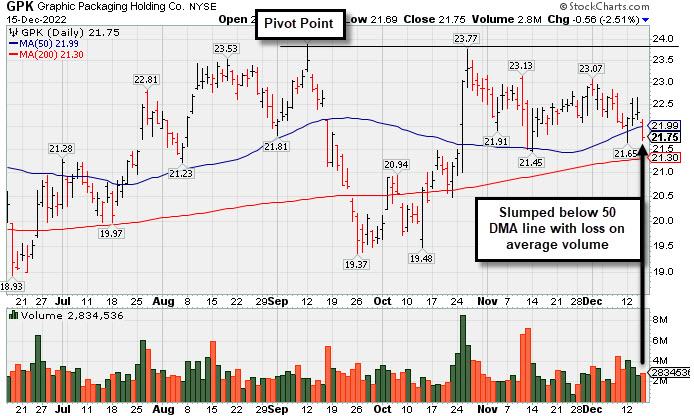

Violated 50-Day Moving Average After Recently Failing to Break Out - Thursday, December 15, 2022

Graphic Packaging Hldg (GPK -$0.56 or -2.51% to $21.75) pulled back below its 50-day moving average (DMA) line ($22.09) with today's loss on near average volume raising concerns and triggering a technical sell signal, and its color code was changed to green. A prompt rebound above the 50 DMA line is needed for its outlook to improve. It faces resistance due to overhead supply up to the $24 level.

GPK was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the 10/25/22 mid-day report (read here). GPK has a 99 Earnings Per Share Rating. It reported Sep '22 quarterly earnings +79% on +38% sales revenues versus the year ago period. It was last shown in this FSU section on 11/17/22 with an annotated graph under the headline, "Consolidating Above 50-Day Moving Average Still Perched Near High". Fundamentals have remained strong. The past 3 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good since a downturn in FY '16 and '17, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 107th on the 197 Industry Groups list and it has a C+ (46) Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 666 in Sep '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.1 is an unbiased indication its shares have been under distributional pressure over the past 50 days.

Chart courtesy of www.stockcharts.com

Consolidating Above 50-Day Moving Average Still Perched Near High - Thursday, November 17, 2022

Graphic Packaging Hldg (GPK -$0.18 or -0.80% to $22.28) has recently been testing support near its 50-day moving average (DMA) line ($21.59). More damaging losses would raise concerns and trigger a technical sell signal. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal.

GPK was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the 10/25/22 mid-day report (read here). GPK has a 99 Earnings Per Share Rating. It reported Sep '22 quarterly earnings +79% on +38% sales revenues versus the year ago period. It was last shown in this FSU section on 10/25/22 with an annotated graph under the headline, "Rebound Above 50-Day Moving Average Helped Outlook Improve". Fundamentals have remained strong. The past 3 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good since a downturn in FY '16 and '17, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 112th on the 197 Industry Groups list and it has a C+ (44) Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 655 in Sep '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 0.8 is an unbiased indication its shares have been under distributional pressure over the past 50 days.

Chart courtesy of www.stockcharts.com

Rebound Above 50-Day Moving Average Helped Outlook Improve - Tuesday, October 25, 2022

Graphic Packaging Hldg (GPK +$1.61 or +7.48% to $23.12) posted a considerable gain today as it was highlighted in yellow with pivot point cited based on its 9/12/22 high plus 10 cents in the earlier mid-day report (read here). Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. Today's big gain and rebound above its 50-day moving average (DMA) line ($21.73) is helped its outlook improve. It showed resilience after sputtering below its 200 DMA line since it was dropped from the Featured Stocks list on 9/20/22.

GPK has a 98 Earnings Per Share Rating. It reported Sep '22 quarterly earnings +79% on +38% sales revenues versus the year ago period. Fundamentals have remained strong. It was last shown in this FSU section on 9/06/22 with an annotated graph under the headline, "Recently Slipped Below Pivot Point Testing 50-Day Average". The past 3 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good since a downturn in FY '16 and '17, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 122nd on the 197 Industry Groups list and it has a C (39) Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 637 in Sep '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 0.9 is an unbiased indication its shares have been under slight distributional pressure over the past 50 days.

Chart courtesy of www.stockcharts.com

Recently Slipped Below Pivot Point Testing 50-Day Average - Tuesday, September 6, 2022

Graphic Packaging Hldg (GPK +$0.19 or +0.85% to $22.59) stalled since its 8/10/22 breakout and slumped back below its pivot point. Now it is consolidating just above its 50-day moving average (DMA) line ($22.00) which defines important near-term support. More damaging losses would raise greater concerns.

GPK was highlighted in yellow in the 7/26/22 mid-day report with pivot point cited based on its 6/06/22 high plus 10 cents (read here). It was last shown in this FSU section on 8/15/22 with an annotated graph under the headline, "Churned Heavy Volume Perched at High After 6 Straight Gains".

GPK has a 98 Earnings Per Share Rating. Earnings rose +108% on +36% sales revenues for the Jun '22 quarter versus the year ago period. Three of the past 4 quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good since a downturn in FY '16 and '17, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 71st on the 197 Industry Groups list and it has a B+ Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 644 in Jun '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days.

The Paper & Paper Products group is ranked 71st on the 197 Industry Groups list and it has a B+ Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 644 in Jun '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days.

Chart courtesy of www.stockcharts.com

Churned Heavy Volume Perched at High After 6 Straight Gains - Monday, August 15, 2022

Graphic Packaging Hldg (GPK -$0.01 or -0.04% to $23.28) paused today at its 52-week high after posting 6 consecutive gains as it rose above the pivot point triggering a technical buy signal. It was highlighted in yellow in the 7/26/22 mid-day report with pivot point cited based on its 6/06/22 high plus 10 cents (read here). However, it has made very little headway since last shown in this FSU section on 7/27/22 with an annotated graph under the headline, "Negative Reversal After Matching 52-Week High".

GPK has a 98 Earnings Per Share Rating. Earnings rose +108% on +36% sales revenues for the Jun '22 quarter versus the year ago period. Three of the past 4 quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good since a downturn in FY '16 and '17, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 51st on the 197 Industry Groups list and it has a B+ Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 636 in Jun '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days.

The Paper & Paper Products group is ranked 51st on the 197 Industry Groups list and it has a B+ Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 636 in Jun '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days.

Chart courtesy of www.stockcharts.com

Negative Reversal After Matching 52-Week High - Wednesday, July 27, 2022

Graphic Packaging Hldg (GPK -$0.25 or -1.11% to $22.35) matched its 52-week high today but reversed into the red and closed in the bottom third of its intra-day range, action indicative of distributional pressure. It was highlighted in yellow in the 7/26/22 mid-day report with pivot point cited based on its 6/06/22 high plus 10 cents (read here). Subsequent gains above the pivot point backed by at least +40% above average volume are needed to trigger a proper technical buy signal.

GPK has a 97 Earnings Per Share Rating. Earnings rose +108% on +36% sales revenues for the Jun '22 quarter versus the year ago period. Three of the past 4 quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Its annual earnings history has been good since a downturn in FY '16 and '17, meeting the fact-based investment system's fundamental guidelines (A criteria).

The Paper & Paper Products group is ranked 61st on the 197 Industry Groups list and it has a B+ Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 632 in Jun '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ration of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

The Paper & Paper Products group is ranked 61st on the 197 Industry Groups list and it has a B+ Group Relative Strength Rating (L criteria). The number of top-rated funds owning its shares rose from 596 in Sep '21 to 632 in Jun '22, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ration of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

Chart courtesy of www.stockcharts.com