You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 7, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, JUNE 17TH, 2015

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+31.26 |

17,935.74 |

+0.17% |

|

Volume |

699,612,150 |

+10% |

|

Volume |

1,603,247,360 |

+3% |

|

NASDAQ |

+9.33 |

5,064.88 |

+0.18% |

|

Advancers |

1,603 |

50% |

|

Advancers |

1,392 |

46% |

|

S&P 500 |

+4.15 |

2,100.44 |

+0.20% |

|

Decliners |

1,461 |

46% |

|

Decliners |

1,472 |

49% |

|

Russell 2000 |

-1.20 |

1,268.33 |

-0.09% |

|

52 Wk Highs |

93 |

|

|

52 Wk Highs |

145 |

|

|

S&P 600 |

-1.20 |

727.56 |

-0.16% |

|

52 Wk Lows |

79 |

|

|

52 Wk Lows |

36 |

|

|

|

Healthy Leadership Remains as Indices Consolidate Near Record Highs

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Stocks rose on Wednesday’s session. The Dow was up 31 points to 17935. The S&P 500 gained 4 points to 2100. The NASDAQ Composite advanced 9 points to 5064. Volume totals were slightly higher than the prior session totals on the NYSE and on the Nasdaq exchange. Advancers led decliners by an 8-7 margin on the NYSE while decliners led advancers by a narrow margin on the Nasdaq exchange. Leadership expanded as there were 66 high-ranked companies from theLeaders List that made new 52-week highs and appeared on the BreakOuts Page, up from the prior session total of 55 stocks. New 52-week highs outnumbered new 52-week lows on the NYSE and on the Nasdaq exchange. There were gains for 9 of the 15 high-ranked companies currently on the Featured Stocks Page.Healthy leadership (many stocks hitting new 52-week highs) remains a reassuring sign that investors have a favorable market environment (M criteria). The fact-based investment system encourages only buying stocks meeting all of the key fundamental and technical criteria. PICTURED: The 3-year weekly graph of the S&P 500 shows the benchmark index with volume totals generally cooling while consolidating near its record high. The major averages posted modest gains following the conclusion of the Fed’s policy meeting. As expected, the central bank remained accommodative and trimmed its year-end interest rate forecast. In her press conference, Chair Janet Yellen reiterated that the pace of eventual tightening will be gradual and data dependent. Attention was also on Greece as Eurozone finance ministers convene tomorrow in hopes of reaching a deal between the country and its creditors. Utilities were the best performing led by NiSource gaining 3.7% to $48.40. Tobacco stocks paced consumer staples higher with Reynolds American (RAI +1.8%) and Altria (MO +1.1%) both on the rise. Financials and energy were the lone sectors down on the session. Bank of America (BAC -1%)and Chesapeake Energy (CPK -3.5%) were both lower. On the earnings front, FedEx (FDX -3%) fell as quarterly results missed projections. Adobe (ADBE -2.5%) fell after reducing its sales forecast. Treasuries were mixed following the release of the Fed statement. Benchmark 10-year notes slipped 2/32 to yield 2.32%. In commodities, NYMEX crude dipped 0.2% to $59.83/barrel after a report showed U.S. inventories rose in the most recent week. COMEX gold rose 0.4% to $1185.70/ounce. The Featured Stocks Page shows the most current notes with headline links which direct members into the more detailed letter-by-letter analysis including price/volume graphs annotated by our experts. See the Premium Member Homepage for archives to all prior pay reports published.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

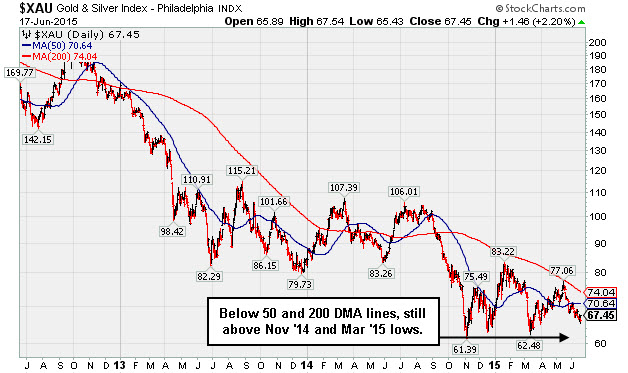

Gold & Silver Index Posted Standout Gain

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX +0.38%) edged higher, but the Bank Index ($BKX -0.79%) and the Broker/Dealer Index ($XBD -0.51%) both finished lower. The Biotechnology Index ($BTK+0.40%) and the Networking Index ($NWX +0.16%) both edged higher while the Semiconductor Index ($SOX +0.02%) finished flat. The Oil Services Index ($OSX +0.64%) rose while the Integrated Oil Index ($XOI -0.08%) ended slightly lower.

Charts courtesy www.stockcharts.com

PICTURED: The Gold & Silver Index ($XAU +2.21%) was a standout gainer on Wednesday's mixed session. The 3-year weekly graph shows it consolidating below its 50-day and 200-day moving average (DMA) lines, yet still remaining above its Nov '14 and Mar '15 lows. Year-to-date it is -1.93% while sputtering in the red and clearly lagging. This argues that very few gold and silver mining-related stocks have been doing well in recent months. Meanwhile, as the table below shows, the best gains thus far into 2015 have come from the Biotech (+18.96%), Networking (+10.38%), and Retail Index (+10.73%). The fact-based investment system requires investors to focus on only buying stocks from leading industry groups (L criteria), and never to speculate on stocks in industry groups which are currently out of favor in the marketplace.

| Oil Services |

$OSX |

210.72 |

+1.33 |

+0.64% |

-0.07% |

| Integrated Oil |

$XOI |

1,325.36 |

-1.09 |

-0.08% |

-1.69% |

| Semiconductor |

$SOX |

715.19 |

+0.12 |

+0.02% |

+4.12% |

| Networking |

$NWX |

395.10 |

+0.65 |

+0.16% |

+10.38% |

| Broker/Dealer |

$XBD |

199.26 |

-1.02 |

-0.51% |

+7.92% |

| Retail |

$RLX |

1,143.50 |

+4.38 |

+0.38% |

+10.73% |

| Gold & Silver |

$XAU |

67.45 |

+1.46 |

+2.21% |

-1.93% |

| Bank |

$BKX |

78.41 |

-0.62 |

-0.78% |

+5.59% |

| Biotech |

$BTK |

4,091.20 |

+16.34 |

+0.40% |

+18.96% |

|

|

|

|

Quietly Consolidating Near Highs With No Overhead Supply

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Luxoft Holding Inc Cl A (LXFT +$0.19 or +0.34% to $56.23) remains perched within close striking distance of its 52-week high following its latest small gains backed by average volume. LXFT was last shown in this FSU section on 5/26/15 with annotated graphs under the headline, "Gains For News Highs Still Needed to Trigger Technical Buy Signal", after highlighted in yellow with a pivot point cited based on its 4/23/15 high plus 10 cents in the earlier mid-day report (read here). Members were reminded - "Disciplined investors know that subsequent volume-driven gains above the pivot point for new highs (N criteria) are needed to trigger a proper technical buy signal."

Sales revenues growth has been strong while it reported earnings +32%, +23%, +50%, and +28% in the Jun, Sep, Dec '14 and Mar '15 quarters versus the year ago periods. Its strong quarterly and annual earnings history (C and A criteria) matches the guidelines of the fact-based investment system.

The number of top-rated funds owning its shares rose from 185 in Jun '14 to 251 in Mar '15. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days, very reassuring signs concerning the I criteria. It has earned a Timeliness Rating of A. Its small supply of only 30.2 million shares (S criteria) in the public float can contribute to greater price volatility in the event of institutional buying or selling.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

GSBC

-

NASDAQ

Great Southern Bancorp

BANKING - Savings and Loans

|

$40.47

|

-1.02

-2.46% |

$41.40

|

27,474

88.63% of 50 DAV

50 DAV is 31,000

|

$41.63

-2.79%

|

4/27/2015

|

$40.94

|

PP = $40.54

|

|

MB = $42.57

|

Most Recent Note - 6/16/2015 12:36:35 PM

Y - Still finding support above its 50 DMA line ($39.51) after stalling following its technical breakout in late April. Recent lows ($38.00 on 5/06/15) define the next important support where a violation would trigger a technical sell signal.

>>> FEATURED STOCK ARTICLE : Still Finding Support at 50-Day Moving Average - 6/9/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

BOFI

-

NASDAQ

B O F I Holding Inc

BANKING - Savings andamp; Loans

|

$98.36

|

-1.49

-1.49% |

$100.13

|

114,576

71.61% of 50 DAV

50 DAV is 160,000

|

$102.16

-3.72%

|

6/10/2015

|

$101.47

|

PP = $97.78

|

|

MB = $102.67

|

Most Recent Note - 6/17/2015 3:28:50 PM

Most Recent Note - 6/17/2015 3:28:50 PM

Y - Volume totals have been cooling while consolidating above prior highs in the $97 area. No resistance remains due to overhead supply, however, it stalled after highlighted in yellow in the 6/10/15 mid-day report. Subsequent losses leading to a close below its old high close ($97.27 on 3/20/15) would raise concerns by completely negating the recent breakout.

>>> FEATURED STOCK ARTICLE : Small Saving & Loan Shows More Signs of Accumulation - 6/10/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

EPAM

-

NYSE

Epam Systems Inc

COMPUTER SOFTWARE and SERVICES - Information Technology Service

|

$72.18

|

+0.76

1.06% |

$72.60

|

307,620

74.13% of 50 DAV

50 DAV is 415,000

|

$73.38

-1.64%

|

5/18/2015

|

$67.42

|

PP = $70.59

|

|

MB = $74.12

|

Most Recent Note - 6/17/2015 3:32:29 PM

Most Recent Note - 6/17/2015 3:32:29 PM

Y - Poised for a best-ever close with today's gain. Recently found support above prior highs in the $70 area and above its 50 DMA line. Subsequent damaging losses leading to violations would raise greater concerns and trigger technical sell signals.

>>> FEATURED STOCK ARTICLE : Volume Totals Cooling While Consolidating After Breakout - 6/5/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ILMN

-

NASDAQ

Illumina Inc

DRUGS - Biotechnology

|

$215.37

|

-0.57

-0.26% |

$217.08

|

639,159

50.73% of 50 DAV

50 DAV is 1,260,000

|

$219.09

-1.70%

|

6/8/2015

|

$209.97

|

PP = $213.43

|

|

MB = $224.10

|

Most Recent Note - 6/16/2015 6:09:35 PM

Y - Volume totals have been cooling while stubbornly holding its ground after volume-driven gains above its pivot point triggered a technical buy signal on 6/09/15. Highlighted in yellow in the 6/08/15 mid-day report (read here).Disciplined investors use a tactic called pyramiding which the fact-based system suggests to help investors to allow the market action to dictate their purchase decisions.

>>> FEATURED STOCK ARTICLE : Perched Within Striking Distance of All-Time Highs - 6/8/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

VRX

-

NYSE

Valeant Pharmaceuticals

DRUGS - Drug Manufacturers - Other

|

$230.20

|

+1.50

0.66% |

$231.92

|

1,230,759

70.69% of 50 DAV

50 DAV is 1,741,000

|

$246.01

-6.43%

|

1/5/2015

|

$144.84

|

PP = $149.90

|

|

MB = $157.40

|

Most Recent Note - 6/16/2015 6:05:20 PM

G - Consolidation above its 50 DMA line defining near term support is not a sound base of sufficient length. See the latest FSU analysis for more details and new annotated graphs.

>>> FEATURED STOCK ARTICLE : Latest Consolidation is Not a Sufficient Length Bade - 6/16/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

AVGO

-

NASDAQ

Avago Technologies Ltd

ELECTRONICS - Semiconductor - Broad Line

|

$140.69

|

-0.91

-0.64% |

$142.50

|

2,462,553

74.60% of 50 DAV

50 DAV is 3,301,000

|

$150.50

-6.52%

|

5/28/2015

|

$141.06

|

PP = $136.38

|

|

MB = $143.20

|

Most Recent Note - 6/17/2015 3:21:56 PM

Most Recent Note - 6/17/2015 3:21:56 PM

Y - Remains above its pivot point and below its max buy level. Volume totals have been cooling while consolidating above support at prior highs in the $136 area.

>>> FEATURED STOCK ARTICLE : Strong Sales and Earnings Acceleration For Tech Leader - 5/28/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NXPI

-

NASDAQ

Nxp Semiconductors N V

ELECTRONICS - Semiconductor - Broad Line

|

$102.18

|

-0.98

-0.95% |

$103.88

|

1,881,150

67.35% of 50 DAV

50 DAV is 2,793,000

|

$114.00

-10.37%

|

4/15/2015

|

$100.75

|

PP = $108.60

|

|

MB = $114.03

|

Most Recent Note - 6/15/2015 5:36:46 PM

Y - Slump below prior highs in the $108 area raised some concerns, yet it has found support near its 50 DMA line. More damaging losses may raise concerns and trigger worrisome technical sell signals.

>>> FEATURED STOCK ARTICLE : Quietly Perched at All-Time High Following Volume-Driven Gains - 6/1/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

SWKS

-

NASDAQ

Skyworks Solutions Inc

ELECTRONICS - Semiconductor - Integrated Cir

|

$106.57

|

+0.24

0.23% |

$107.03

|

1,854,348

55.49% of 50 DAV

50 DAV is 3,342,000

|

$111.60

-4.51%

|

5/1/2015

|

$97.51

|

PP = $102.87

|

|

MB = $108.01

|

Most Recent Note - 6/17/2015 3:36:38 PM

Most Recent Note - 6/17/2015 3:36:38 PM

Y - Holding its ground stubbornly while volume totals have been drying up since it found prompt support at its 50 DMA line after briefly undercutting prior highs in the $102 area. The recent low ($98.07 on 6/09/15) and its 50 DMA line define important near-term support where damaging violations may trigger technical sell signals.

>>> FEATURED STOCK ARTICLE : Found Support After Wedging From Late Stage Base - 6/11/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

AMBA

-

NASDAQ

Ambarella Inc

ELECTRONICS - Semiconductor - Specialized

|

$122.23

|

+4.38

3.72% |

$123.48

|

4,358,983

205.71% of 50 DAV

50 DAV is 2,119,000

|

$120.77

1.21%

|

5/1/2015

|

$75.99

|

PP = $77.49

|

|

MB = $81.36

|

Most Recent Note - 6/17/2015 12:18:30 PM

Most Recent Note - 6/17/2015 12:18:30 PM

G - Perched at its all-time high today, very extended from any sound base after volume-driven gains having the look of a "climax run". Disciplined investors avoid chasing extended stocks.

>>> FEATURED STOCK ARTICLE : Extended From Base Following Spurt of Volume-Driven Gains - 6/2/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ACHC

-

NASDAQ

Acadia Healthcare Inc

HEALTH SERVICES - Specialized Health Services

|

$72.42

|

+0.40

0.56% |

$72.89

|

374,368

61.37% of 50 DAV

50 DAV is 610,000

|

$75.46

-4.03%

|

5/27/2015

|

$73.90

|

PP = $74.19

|

|

MB = $77.90

|

Most Recent Note - 6/17/2015 3:38:30 PM

Most Recent Note - 6/17/2015 3:38:30 PM

Y - Perched within striking distance of its 52-week high and still consolidating above its 50 DMA line. A strong gain above the pivot point with at least +40% above average volume may trigger a proper technical buy signal.

>>> FEATURED STOCK ARTICLE : Finished Below Pivot Point Despite Big Volume-Driven Gain and New 52-Week High - 5/27/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

APOG

-

NASDAQ

Apogee Enterprises

MATERIALS and CONSTRUCTION - General Building Materials

|

$58.18

|

-1.98

-3.29% |

$60.57

|

241,969

102.10% of 50 DAV

50 DAV is 237,000

|

$60.67

-4.10%

|

4/9/2015

|

$49.58

|

PP = $48.13

|

|

MB = $50.54

|

Most Recent Note - 6/17/2015 3:19:30 PM

Most Recent Note - 6/17/2015 3:19:30 PM

G - It is extended from any sound base and erasing most of the prior session's gain, retreating from a new 52-week high. Its 50 DMA line ($54.19) defines important support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Extended From Prior Base and Perched at High - 6/12/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

JLL

-

NYSE

Jones Lang Lasalle Inc

REAL ESTATE - Property Management/Developmen

|

$170.30

|

+0.95

0.56% |

$170.72

|

172,596

50.76% of 50 DAV

50 DAV is 340,000

|

$174.83

-2.59%

|

6/4/2015

|

$172.34

|

PP = $174.93

|

|

MB = $183.68

|

Most Recent Note - 6/16/2015 6:11:17 PM

Y - Consolidating just above its 50 DMA line ($168.15) which has acted as support. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal.

>>> FEATURED STOCK ARTICLE : Forming New Base and No Resistance Remains - 6/4/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$155.62

|

+0.12

0.08% |

$156.39

|

473,864

65.54% of 50 DAV

50 DAV is 723,000

|

$159.85

-2.65%

|

5/29/2015

|

$155.03

|

PP = $159.07

|

|

MB = $167.02

|

Most Recent Note - 6/15/2015 5:38:11 PM

Y - Volume totals have been cooling while consolidating near its 50 DMA line following a "negative reversal" on 5/29/15. A subsequent volume-driven gain and close above its pivot point may trigger a proper technical buy signal.

>>> FEATURED STOCK ARTICLE : Negative Reversal Today After Touching New Highs - 5/29/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LXFT

-

NYSE

Luxoft Holding Inc Cl A

Comp Sftwr-Spec Enterprs

|

$56.23

|

+0.19

0.34% |

$56.68

|

155,946

80.80% of 50 DAV

50 DAV is 193,000

|

$58.46

-3.81%

|

5/26/2015

|

$51.90

|

PP = $57.40

|

|

MB = $60.27

|

Most Recent Note - 6/17/2015 6:37:58 PM

Most Recent Note - 6/17/2015 6:37:58 PM

Y - Quietly consolidating, and gains above the pivot point backed by at least +40% above average volume are still needed to trigger a proper technical buy signal. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Quietly Consolidating Near Highs With No Overhead Supply - 6/17/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PANW

-

NYSE

Palo Alto Networks

Computer Sftwr-Security

|

$180.64

|

+3.94

2.23% |

$181.74

|

1,459,646

113.41% of 50 DAV

50 DAV is 1,287,000

|

$178.80

1.03%

|

3/27/2015

|

$146.44

|

PP = $149.45

|

|

MB = $156.92

|

Most Recent Note - 6/17/2015 3:34:09 PM

Most Recent Note - 6/17/2015 3:34:09 PM

G - Hitting another new all-time high today with a gain on near average volume, getting more extended from any sound base. Prior highs in the $158 area define initial support above its 50 DMA line where subsequent violations would raise concerns and trigger technical sell signals.

>>> FEATURED STOCK ARTICLE : Holding Ground Stubbornly at All-Time Highs Following +123% Rally - 6/3/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|