Volume Cools While Consolidating Above 50-Day Moving Average - Tuesday, August 31, 2021

Shopify Inc Cl A (SHOP -$24.22 or -1.56% to $1,524.78) has seen volume totals cooling since finding prompt support near its 50-day moving average (DMA) line ($1,510). SHOP also tested February 2021 highs which help define important near-term support to watch. More damaging losses would raise concerns and trigger technical sell signals. Fundamentals remain strong.

Subsequent gains with at least +40% above average volume for new highs may help confirm a new (or add-on) technical buy signal. SHOP was last shown in the FSU section on 7/19/21 with an annotated graph under the headline, "Managed a Positive Reversal After Early Weakness". Its Relative Strength Rating of 85 is above the 80+ minimum guideline for buy candidates.

SHOP reported Jun '21 quarterly earnings +113% on +57% sales revenues versus the year ago period, continuing its strong earnings track record. Prior quarters showed big earnings increases well above the +25% minimum guideline (C criteria) with very strong underlying sales revenues growth. After years of losses it had strong earnings growth in FY '17-19 (A criteria).

The Ontario, Canada-based Computer Software - Enterprise firm saw the number of top-rated funds owning its shares rise from 1,151 in Sep '19 to 2,009 in Jun '21 a reassuring sign concerning the I criteria. It has a Timeliness rating of B and a Sponsorship Rating of A. There are 116.1 million shares outstanding (S criteria) which can contribute to greater price volatility in the event of institutional buying or selling.

Chart courtesy of www.stockcharts.com

Managed a Positive Reversal After Early Weakness - Monday, July 19, 2021

Shopify Inc Cl A (SHOP +$29.38 or +2.04% to $1,472.01) managed a "positive reversal" today after early weakness. There were negative reversals noted on 7/07/21 after hitting a new high and again on 7/14/21. A new pivot point was recently cited based on its 6/21/21 high while building on a cup-with-high-handle base. However, it did not produce confirming gains with at least +40% above average volume for new highs which are needed to trigger a proper new (or add-on) technical buy signal. Subsequent gains would be a reassuring sign of fresh institutional buying demand that might lead to a more substantial leg higher.

SHOP was last shown in the FSU section on 6/16/21 with an annotated graph under the headline, "Rebounding After Choppy 4-Month Consolidation". Its Relative Strength Rating of 86 is above the 80+ minimum guideline for buy candidates.

Keep in mind it is due to report Jun '21 quarterly results on 7/28/21. Volume and volatility often increase near earnings news. SHOP reported Mar '21 quarterly earnings +958% on +110% sales revenues versus the year ago period, continuing its strong earnings track record. Prior quarters showed big earnings increases well above the +25% minimum guideline (C criteria) with very strong underlying sales revenues growth. After years of losses it had strong earnings growth in FY '17-19 (A criteria).

Chart courtesy of www.stockcharts.com

The Ontario, Canada-based Computer Software - Enterprise firm saw the number of top-rated funds owning its shares rise from 1,151 in Sep '19 to 1,971 in Jun '21 a reassuring sign concerning the I criteria. It has an A Timeliness rating and an A Sponsorship Rating. There are 116.1 million shares outstanding (S criteria) which can contribute to greater price volatility in the event of institutional buying or selling.

Chart courtesy of www.stockcharts.com

Rebounding After Choppy 4-Month Consolidation - Wednesday, June 16, 2021

Shopify Inc Cl A (SHOP +$45.22 or +3.42% to $1,366.30) was highlighted in yellow with new pivot point cited based on its 2/10/21 high plus 10 cents in the earlier mid-day report (read here). Subsequent gains above the pivot point backed by at least +40% above average volume are needed to trigger a technical buy signal. It was last shown in the FSU section on 3/02/21 with an annotated graph under the headline, "Found Support Near Prior High and 50-Day Moving Average". It found support after dipping below its 200 DMA line during the choppy consolidation since dropped from the Featured Stocks list on 3/04/21. The recent rebound above the 50 DMA line helped its outlook improve, however its Relative Strength Rating of 76 remains below the 80+ minimum guideline for buy candidates.SHOP reported Mar '21 quarterly earnings +958% on +110% sales revenues versus the year ago period, continuing its strong earnings track record. Prior quarters showed big earnings increases well above the +25% minimum guideline (C criteria) with very strong underlying sales revenues growth. After years of losses it had strong earnings growth in FY '17-19 (A criteria).

Chart courtesy of www.stockcharts.com

The Ontario, Canada-based Computer Software - Enterprise firm saw the number of top-rated funds owning its shares rise from 1,151 in Sep '19 to 1,967 in Dec '20, a reassuring sign concerning the I criteria. It has a B Timeliness rating and an A Sponsorship Rating. There are 116.1 million shares outstanding (S criteria) which can contribute to greater price volatility in the event of institutional buying or selling.

Chart courtesy of www.stockcharts.com

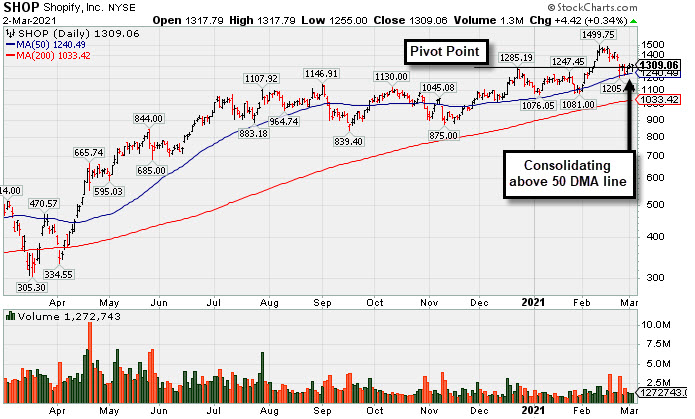

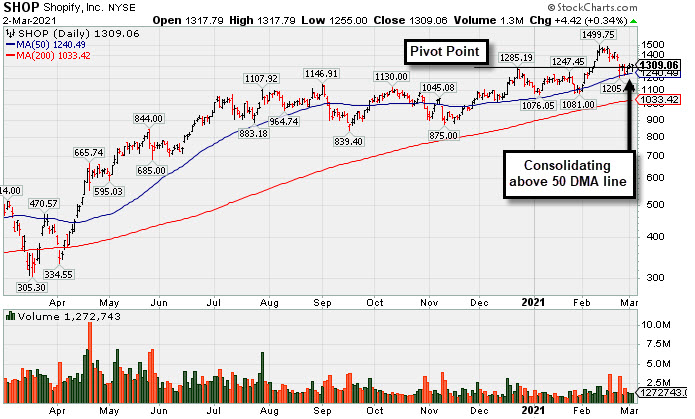

Found Support Near Prior High and 50-Day Moving Average - Tuesday, March 2, 2021

Shopify Inc Cl A (SHOP -$0.88 or -0.07% to $1,309.06) has been finding prompt support after undercutting the prior high ($1,285 on 12/22/20) and retesting important support near its 50-day moving average (DMA) line ($1,240). More damaging losses would raise serious concerns and trigger worrisome technical sell signals.Recently it reported Dec '20 quarterly earnings +267% on +94% sales revenues versus the year ago period. Prior quarters showed big earnings increases well above the +25% minimum guideline (C criteria) with very strong underlying sales revenues growth. After years of losses it had strong earnings growth in FY '17-19 (A criteria).

Chart courtesy of www.stockcharts.com

The Ontario, Canada-based Computer Software - Enterprise firm was highlighted in yellow with pivot point cited based on its 9/01/20 high plus 10 cents in the 12/15/20 mid-day report (read here). It was last shown in the FSU section on 2/03/21 with an annotated graph under the headline, "Perched Within Striking Distance of New Pivot Point".

The number of top-rated funds owning its shares rose from 1,151 in Sep '19 to 1,712 in Dec '20, a reassuring sign concerning the I criteria. It has a B Timeliness rating and an A Sponsorship Rating. There are 121.9 million shares outstanding (S criteria) which can contribute to greater price volatility in the event of institutional buying or selling.

Chart courtesy of www.stockcharts.com

Perched Within Striking Distance of New Pivot Point - Wednesday, February 3, 2021

Shopify Inc Cl A (SHOP -$11.19 or -0.91% to $1,224.16) quietly held its ground today following a volume-driven gain on the prior session. A new pivot point was cited based on its 12/22/20 high plus 10 cents. It faces little resistance due to overhead supply up to the $1,285 level. Subsequent gains and a close above the pivot point backed by at least +40% above average volume may trigger a new (or add-on) technical buy signal. It found prompt support near its 50-day moving average (DMA) line ($1,129) during the recent consolidation. The prior low ($1,076 on 1/06/21) defines the next important support to watch.SHOP was highlighted in yellow with pivot point cited based on its 9/01/20 high plus 10 cents in the 12/15/20 mid-day report (read here). It was last shown in the FSU section on 1/07/21 with an annotated graph under the headline, "Rebounded After Undercutting Prior Highs".

It reported Sep '20 quarterly earnings of $1.13 per share versus a loss of 29 cents per share on +96% sales revenues versus the year ago period. The Ontario, Canada-based Computer Software - Enterprise firm's prior quarters showed big earnings increases well above the +25% minimum guideline (C criteria) with very strong underlying sales revenues growth. After years of losses it had strong earnings growth in FY '17-19 (A criteria).

The number of top-rated funds owning its shares rose from 1,151 in Sep '19 to 1,651 in Dec '20, a reassuring sign concerning the I criteria. It has a C Timeliness rating and an A Sponsorship Rating. There are 121.9 million shares outstanding (S criteria) which can contribute to greater price volatility in the event of institutional buying or selling.

Chart courtesy of www.stockcharts.com

Rebounded After Undercutting Prior Highs - Thursday, January 7, 2021

Shopify Inc Cl A (SHOP +$72.22 or +6.64% to $1,159.53) rebounded today repairing a big loss on the prior session with a solid gain on higher (near average) volume. The prompt support came after a brief slump below prior highs in the $1,146-1,130 area, falling back into the prior base, raised concerns. Its recent low and its 50-day moving average (DMA) line ($1,051) define important near-term support to watch.SHOP was highlighted in yellow with pivot point cited based on its 9/01/20 high plus 10 cents in the 12/15/20 mid-day report (read here). It was shown in greater detail that evening with an annotated graph under the headline, "Volume-Driven Gain for New High After Long Consolidation", as it hit a new all-time high with a big gain backed by +117% above average volume while rising from a 15-week base. The gain and strong close above its pivot point clinched a convincing technical buy signal.

It reported Sep '20 quarterly earnings of $1.13 per share versus a loss of 29 cents per share on +96% sales revenues versus the year ago period. The Ontario, Canada-based Computer Software - Enterprise firm's prior quarters showed big earnings increases well above the +25% minimum guideline (C criteria) with very strong underlying sales revenues growth. After years of losses it had strong earnings growth in FY '17-19 (A criteria).

Chart courtesy of www.stockcharts.com

It reported Sep '20 quarterly earnings of $1.13 per share versus a loss of 29 cents per share on +96% sales revenues versus the year ago period. The Ontario, Canada-based Computer Software - Enterprise firm's prior quarters showed big earnings increases well above the +25% minimum guideline (C criteria) with very strong underlying sales revenues growth. After years of losses it had strong earnings growth in FY '17-19 (A criteria).

The number of top-rated funds owning its shares rose from 1,151 in Sep '19 to 1,609 in Sep '20, a reassuring sign concerning the I criteria. It has a C Timeliness rating and an A Sponsorship Rating. There are 121.9 million shares outstanding (S criteria) which can contribute to greater price volatility in the event of institutional buying or selling.

Chart courtesy of www.stockcharts.com

Volume-Driven Gain for New High After Long Consolidation - Wednesday, December 16, 2020

Shopify Inc Cl A (SHOP +$83.21 or +7.75% to $1,157.31) was highlighted in yellow with pivot point cited based on its 9/01/20 high plus 10 cents in the earlier mid-day report (read here). It hit a new all-time high with today's big gain backed by +117% above average volume while rising from a 15-week base. The gain and strong close above its pivot point clinched a convincing technical buy signal. Its 50-day moving average (DMA) line ($1,022) defines near-term support to watch above its 200 DMA line ($852).

It reported Sep '20 quarterly earnings of $1.13 per share versus a loss of 29 cents per share on +96% sales revenues versus the year ago period. The Ontario, Canada-based Computer Software - Enterprise firm's prior quarters showed big earnings increases well above the +25% minimum guideline (C criteria) with very strong underlying sales revenues growth. After years of losses it had strong earnings growth in FY '17-19 (A criteria).

Chart courtesy of www.stockcharts.com

It reported Sep '20 quarterly earnings of $1.13 per share versus a loss of 29 cents per share on +96% sales revenues versus the year ago period. The Ontario, Canada-based Computer Software - Enterprise firm's prior quarters showed big earnings increases well above the +25% minimum guideline (C criteria) with very strong underlying sales revenues growth. After years of losses it had strong earnings growth in FY '17-19 (A criteria).

The number of top-rated funds owning its shares rose from 1,151 in Sep '19 to 1,605 in Sep '20, a reassuring sign concerning the I criteria. It has a B Timeliness rating and an A Sponsorship Rating. There are 120.1 million shares outstanding (S criteria) which can contribute to greater price volatility in the event of instititonal buying or selling.

Chart courtesy of www.stockcharts.com