You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Tuesday, March 25, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, OCTOBER 24TH, 2018

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-608.01 |

24,583.42 |

-2.41% |

|

Volume |

1,081,810,570 |

+11% |

|

Volume |

2,886,288,100 |

+6% |

|

NASDAQ |

-329.14 |

7,108.40 |

-4.43% |

|

Advancers |

682 |

23% |

|

Advancers |

482 |

15% |

|

S&P 500 |

-84.59 |

2,656.10 |

-3.09% |

|

Decliners |

2,341 |

77% |

|

Decliners |

2,628 |

84% |

|

Russell 2000 |

-57.89 |

1,468.70 |

-3.79% |

|

52 Wk Highs |

25 |

|

|

52 Wk Highs |

21 |

|

|

S&P 600 |

-33.46 |

920.99 |

-3.51% |

|

52 Wk Lows |

484 |

|

|

52 Wk Lows |

564 |

|

|

|

Very Negative Breadth as Market Correction Deepens

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

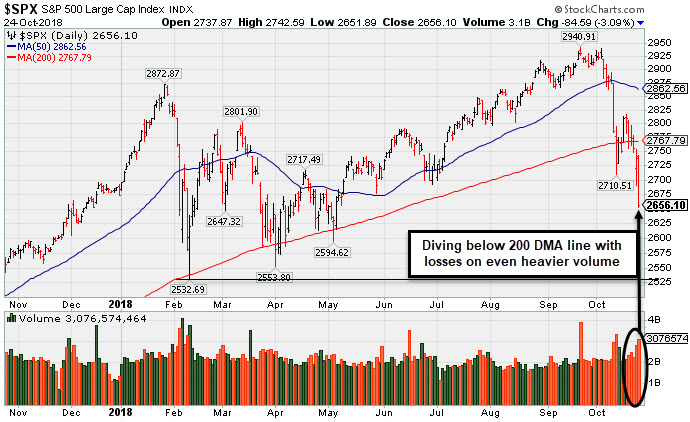

Stocks retreated once again Wednesday. The Dow lost 608 points to 24,583 while the S&P 500 declined 84 points to 2656, leaving both benchmarks in negative territory for the year. The Nasdaq Composite slid 329 points to 7108, the worst session for the index since 2011. Volume totals reported were higher on the NYSE and on the Nasdaq exchange versus the prior session, indicative of even more worrisome distributional pressure. Decliners outnumbered advancers by more than a 3-1 margin on the NYSE and more than 5-1 on the Nasdaq exchange. There were 8 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, versus 2 on the prior session, as market leadership remained very elusive. New 52-week lows totals easily outnumbered new 52-week highs on the NYSE and Nasdaq exchange. Recent reports have noted that the major indices (M criteria) have shown action indicative of a market correction while leadership disappeared. During market corrections investors should have a bias toward selling stocks on a case-by-case basis as technical sell signals occur, raising cash levels while reducing market exposure. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The S&P 500 Index and other major indices have severely undercut their respective October 11th lows. Technically, the market remains in a "correction" under the fact-based investment system. Members have been reminded again that new buying efforts are against the rules and discouraged until a convincing follow-through day occurs. A "follow-through day" of solid gains (at least +1%) from one or more of the major indices, backed by higher volume, and coupled with a leadership expansion (increase in new 52-week highs), are all of the necessary elements required to confirm a new rally. Until then, patience and discipline are paramount.

The S&P 500 fell for a sixth-consecutive session, with Technology and Communications falling after a flurry of disappointing earnings reports. Some of the stocks that have propelled the bull market led the selling Wednesday, including a 5.9% drop for the oft-mentioned “FAANG” group. U.S. Treasuries advanced the most since May, while Utilities and Real Estate stocks gained in a perceived “flight to safety.” The yield on the benchmark 10-year note slipped six basis points to 3.11%.

Technology stocks fell 4.4% on the session, with Texas Instruments (TXN -8.22%) down after the company offered disappointing forward guidance. That sparked a sell-off in semiconductors, with all 15 chipmakers in the S&P 500 finishing down at least 3.8%. AT&T (T -8.06%) pushed the Communications sector lower after missing Wall Street profit projections. Housing stocks were another weak spot, following a report which showed U.S. new home sales slipped to the lowest level since 2016 in September. One positive earnings report came from Boeing (BA +1.31%) after the aerospace manufacturer beat consensus earnings estimates and raised forward guidance. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Tech, Retail, Financial, and Commodity-Linked Groups Fell

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX -2.98%), Broker/Dealer Index ($XBD -3.45%), and Retail Index ($RLX -3.69%) were unanimously lower and created a big drag on the major indices. The tech sector also had a negative bias as the Biotech Index ($BTK -7.19%), Semiconductor Index ($SOX -6.61%), and the Networking Index ($NWX -2.65%) each lost ground. Commodity-linked groups also showed weakness as the Integrated Oil Index ($XOI -4.08%) and Oil Services Index ($OSX -5.26%) were among the standout decliners while the Gold & Silver Index ($XAU -2.10%) also ended lower.

Charts courtesy of www.stockcharts.com

PICTURED: The Broker/Dealer Index ($XBD -3.45%) is diving toward its November 2017 low.

| Oil Services |

$OSX |

123.66 |

-6.87 |

-5.26% |

-17.31% |

| Integrated Oil |

$XOI |

1,335.43 |

-56.76 |

-4.08% |

-0.01% |

| Semiconductor |

$SOX |

1,146.41 |

-81.20 |

-6.61% |

-8.51% |

| Networking |

$NWX |

504.22 |

-13.74 |

-2.65% |

+2.79% |

| Broker/Dealer |

$XBD |

247.59 |

-8.85 |

-3.45% |

-6.65% |

| Retail |

$RLX |

2,106.04 |

-80.70 |

-3.69% |

+21.47% |

| Gold & Silver |

$XAU |

68.04 |

-1.46 |

-2.10% |

-20.21% |

| Bank |

$BKX |

93.87 |

-2.88 |

-2.98% |

-12.03% |

| Biotech |

$BTK |

4,432.75 |

-343.58 |

-7.19% |

+4.99% |

|

|

|

|

Weak Finish Amid Widely Negative Market Environment

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Marine Products Corp (MPX -$1.89 or -8.26% to $21.00) finished weak after highlighted in yellow with pivot point cited based on its 9/12/18 high plus 10 cents in the earlier mid-day report (read here). It gapped up today and challenged its all-time high before reversing into the red. It raised concerns as it closed below its 50-day moving average (DMA) line ($20.42) which acted as support in recent weeks while forming an orderly base.

Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. Disciplined investors know that new buying efforts in stocks are discouraged until a follow-through day confirms a new rally (M criteria is covered in bold in the FACTBASEDINVESTING.com Market Commentary).

Recently it reported earnings +62% on +22% sales revenues for the Sep '18 quarter, so the past 4 quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Its annual earnings history (A criteria) has been strong and steady, helping it earn the highest possible 99 Earnings Per Share Rating.

The number of top-rated funds owning its shares rose from 126 in Mar '18 to 136 in Sep '18, a reassuring sign concerning the I criteria. It has an A Timeliness Rating and a C Sponsorship Rating. Its small supply of only 7.3 million shares (S criteria) in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

MPX

-

NYSE

Marine Products Corp

AUTOMOTIVE - Recreational Vehicles

|

$21.00

|

-1.89

-8.26% |

$24.67

|

104,337

298.11% of 50 DAV

50 DAV is 35,000

|

$24.82

-15.39%

|

10/24/2018

|

$23.00

|

PP = $24.92

|

|

MB = $26.17

|

Most Recent Note - 10/24/2018 5:48:48 PM

Most Recent Note - 10/24/2018 5:48:48 PM

Y - Finished weak after highlighted in yellow with pivot point cited based on its 9/12/18 high plus 10 cents in the earlier mid-day report. Gapped up today and challenged its all-time high before reversing into the red and violating its 50 DMA line ($20.16). Subsequent gains above the pivot point backed by at least +40% above average volume are needed to trigger a technical buy signal. Disciplined investors know that new buying efforts in stocks are discouraged until a follow-through day confirms a new rally (M criteria is covered in bold in the FACTBASEDINVESTING.com Market Commentary). Reported earnings +62% on +22% sales revenues for the Sep '18 quarter, so the past 4 quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Small supply of only 7.3 million shares (S criteria) in the public float. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Weak Finish Amid Widely Negative Market Environment - 10/24/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

GMED

-

NYSE

Globus Medical Inc Cl A

CHEMICALS - Specialty Chemicals

|

$51.75

|

-1.23

-2.32% |

$53.72

|

1,596,679

257.53% of 50 DAV

50 DAV is 620,000

|

$57.55

-10.08%

|

9/26/2018

|

$56.11

|

PP = $57.65

|

|

MB = $60.53

|

Most Recent Note - 10/19/2018 6:36:52 PM

G - Color code is changed to green after slumping back below its 50 DMA line ($52.88) with a volume-driven loss today hurting its outlook. A rebound and subsequent gains above the pivot point backed by more than +40% above average volume are needed to trigger a proper technical buy signal.

>>> FEATURED STOCK ARTICLE : Consolidating After Rally at 200-Day Moving Average Line - 10/22/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ZBRA

-

NASDAQ

Zebra Tech Corp Cl A

COMPUTER HARDWARE - Computer Peripherals

|

$159.74

|

-6.96

-4.18% |

$168.45

|

787,601

209.47% of 50 DAV

50 DAV is 376,000

|

$179.47

-10.99%

|

8/7/2018

|

$164.26

|

PP = $161.82

|

|

MB = $169.91

|

Most Recent Note - 10/24/2018 5:46:49 PM

Most Recent Note - 10/24/2018 5:46:49 PM

G - Suffered a damaging volume-driven loss today. It met resistance after rebounding to its 50 DMA line ($168.41). Overhead supply remains up to the $179 level. Found support in recent weeks after a pullback near its 200 DMA line. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Zebra Tech Sputtering Near 50-Day Moving Average - 10/23/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CME

-

NASDAQ

C M E Group Inc

DIVERSIFIED SERVICES - Business/Management Services

|

$181.08

|

+0.28

0.15% |

$183.67

|

1,766,251

122.66% of 50 DAV

50 DAV is 1,440,000

|

$183.79

-1.47%

|

10/4/2018

|

$179.29

|

PP = $177.45

|

|

MB = $186.32

|

Most Recent Note - 10/22/2018 5:44:26 PM

Y - Remains perched near at its all-time high despite broad market weakness (M criteria). The 50 DMA line ($173.76) and prior lows define important near-term support.

>>> FEATURED STOCK ARTICLE : CME Group Blasted to New Record High - 10/4/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

MA

-

NYSE

Mastercard Inc Cl A

Finance-CrdtCard/PmtPr

|

$195.69

|

-6.74

-3.33% |

$203.47

|

3,684,662

100.59% of 50 DAV

50 DAV is 3,663,000

|

$225.35

-13.16%

|

7/11/2018

|

$203.84

|

PP = $204.10

|

|

MB = $214.31

|

Most Recent Note - 10/24/2018 5:56:06 PM

Most Recent Note - 10/24/2018 5:56:06 PM

A rebound above the 50 DMA line ($211) is needed for its outlook to improve. Slumped near its 200 DMA line ($192) which recently acted as support. It will be dropped from the Featured Stocks list tonight.

>>> FEATURED STOCK ARTICLE : Hovering Near High, Extended From Any Sound Base - 9/27/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

V

-

NYSE

Visa Inc Cl A

Finance-CrdtCard/PmtPr

|

$134.26

|

-4.86

-3.49% |

$140.18

|

13,194,379

164.48% of 50 DAV

50 DAV is 8,022,000

|

$151.56

-11.41%

|

4/26/2018

|

$126.68

|

PP = $126.98

|

|

MB = $133.33

|

Most Recent Note - 10/24/2018 5:58:00 PM

Most Recent Note - 10/24/2018 5:58:00 PM

Slumped near its 200 DMA line ($132) which recently acted as support. A rebound above the 50 DMA line ($144) is needed for its outlook to improve. It will be dropped from the Featured Stocks list tonight.

>>> FEATURED STOCK ARTICLE : Rebounding Toward 50-Day Moving Average - 10/17/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

DPZ

-

NYSE

Dominos Pizza Inc

Retail-Restaurants

|

$255.49

|

-10.33

-3.89% |

$265.81

|

546,928

96.63% of 50 DAV

50 DAV is 566,000

|

$305.34

-16.33%

|

8/13/2018

|

$288.60

|

PP = $293.91

|

|

MB = $308.61

|

Most Recent Note - 10/24/2018 5:50:55 PM

Most Recent Note - 10/24/2018 5:50:55 PM

G - Suffered another loss today on average volume testing its 200 DMA line ($255.40). A subsequent rebound above the 50 DMA line ($283) is needed for its outlook to improve. The prior low ($253.63 on 7/31/18) and 200 DMA line define important near-term support to watch. Reported earnings +54% on +22% sales revenues for the Sep '18 quarter, continuing its strong earnings track record.

>>> FEATURED STOCK ARTICLE : Sank Below 50 DMA Line Ahead of Earnings News - 10/15/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

FIVE

-

NASDAQ

Five Below Inc

Retail-DiscountandVariety

|

$111.50

|

-4.51

-3.89% |

$117.12

|

833,872

86.59% of 50 DAV

50 DAV is 963,000

|

$136.13

-18.09%

|

7/6/2018

|

$98.90

|

PP = $104.09

|

|

MB = $109.29

|

Most Recent Note - 10/24/2018 5:52:59 PM

Most Recent Note - 10/24/2018 5:52:59 PM

G - Fell further below its 50 DMA line ($119.95) and ended near the session low today. A rebound above the 50 DMA line is needed for its outlook to improve. The prior high ($109.09 on 7/19/18) defines the next important support level to watch.

>>> FEATURED STOCK ARTICLE : Retreating After +138% Rally in Under 12 Months - 10/2/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NVEE

-

NASDAQ

N V 5 Global Inc

Comml Svcs-Consulting

|

$77.66

|

-5.47

-6.58% |

$83.37

|

67,429

93.65% of 50 DAV

50 DAV is 72,000

|

$92.75

-16.27%

|

6/15/2018

|

$7,070.00

|

PP = $72.00

|

|

MB = $75.60

|

Most Recent Note - 10/24/2018 5:41:50 PM

Most Recent Note - 10/24/2018 5:41:50 PM

G - Violated the recent low ($80.73 on 10/11/18) and finished near the session low with a big loss today triggering another technical sell signal. A rebound above the 50 DMA line ($86.39) is needed for its outlook to improve.

>>> FEATURED STOCK ARTICLE : Recently Slumped Below 50-Day Moving Average Line - 10/8/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

HQY

-

NASDAQ

Healthequity Inc

COMPUTER SOFTWARE and SERVICES - Healthcare Information Service

|

$80.67

|

-5.17

-6.02% |

$86.25

|

433,205

53.55% of 50 DAV

50 DAV is 809,000

|

$99.99

-19.32%

|

8/13/2018

|

$82.39

|

PP = $83.44

|

|

MB = $87.61

|

Most Recent Note - 10/24/2018 5:44:26 PM

Most Recent Note - 10/24/2018 5:44:26 PM

G - Ended near the session low with a big loss on light volume today raising more serious concerns and triggering another technical sell signal. A rebound above the 50 DMA line ($90.36) is needed for its outlook to improve.

>>> FEATURED STOCK ARTICLE : Below 50-Day Moving Average Which May Act as Resistance - 10/16/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

OLLI

-

NASDAQ

Ollie's Bargain Outlet

Retail-DiscountandVariety

|

$87.80

|

-1.01

-1.14% |

$91.40

|

685,166

104.93% of 50 DAV

50 DAV is 653,000

|

$97.61

-10.05%

|

7/12/2018

|

$74.43

|

PP = $77.60

|

|

MB = $81.48

|

Most Recent Note - 10/19/2018 6:35:06 PM

G - The 50 DMA line ($87) and recent low ($84.66 on 10/11/18) define near-term support well above prior highs in the $77 area. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Encountered Distributional Pressure After a Great Rally - 10/9/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|