Recently Found Support and Rose Toward All-Time High - Friday, May 17, 2019

Texas Pacific Land Trust (TPL +$18.08 or +2.13% to $866.41) was highlighted in yellow with new pivot point cited based on its 4/11/19 high plus 10 cents in the 5/15/19 mid-day report (read here). Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal.

It abruptly retreated from its all-time high yet found support near its 50-day moving average (DMA) line ($808) in recent weeks. TPL was last shown in this FSU section on 10/12/18 with an annotated graph under the headline, "Slump Below 50-Day Moving Average Hurt Technical Stance" It went through a deep consolidation below its 200 DMA line and rebounded impressively since 10/22/18 when dropped from the Featured Stocks list.

Recently it reported earnings +222% on +219% sales revenues for the Mar '19 quarter marking its 10th very strong quarterly comparison above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been strong.

Recently it reported earnings +222% on +219% sales revenues for the Mar '19 quarter marking its 10th very strong quarterly comparison above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been strong.

The thinly-traded Texas Real Estate Development firm has only 7.8 million shares outstanding (S criteria).The number of top-rated funds owning its shares rose from 37 in Dec '16 to 102 in Mar '19, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 0.7 is an unbiased indication its shares have been under distributional pressure over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of B.

Charts courtesy www.stockcharts.com

f B.

Charts courtesy www.stockcharts.com

Slump Below 50-Day Moving Average Hurt Technical Stance - Friday, October 12, 2018

Texas Pacific Land Trust (TPL +$13.70 or +1.75% to $798.70) bounced today after 6 consecutive losses marked by higher volume. Recently it violated its 50-day moving average (DMA) line and prior low ($828) triggering technical sell signals. A rebound above the 50 DMA line is needed for its outlook to improve. The prior low ($760 on 8/15/18) defines the next important near-term support to watch.

The thinly-traded Texas Real Estate Development firm has only 7.8 million shares outstanding (S criteria). It reported earnings +161% on +129% sales revenues for the Jun '18 quarter, marking its 7th very strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong.

TPL was last shown in this FSU section on 9/04/18 with an annotated graph under the headline, "Best Ever Close After a Solid Gain on Higher Volume". The number of top-rated funds owning its shares rose from 37 in Dec '16 to 74 in Jun '18, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 1.1 is an unbiased indication its shares have been under slight institutional accumulation over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of B.

Charts courtesy www.stockcharts.com

Best Ever Close After a Solid Gain on Higher Volume - Tuesday, September 4, 2018

Texas Pacific Land Trust (TPL +$22.29 or +2.67% to $856.90) rallied with higher volume today, challenging its all-time high and ending the session at a best-ever close. It is extended from any sound base. The 50-day moving average (DMA) line ($776) and recent low ($760 on 8/15/18) define important near-term support to watch on pullbacks. It has shown bullish action since last shown in this FSU section on 7/20/18 with an annotated graph under the headline, "Volume Totals Cooling While Consolidating Above Prior High".

The thinly-traded Texas Real Estate Development firm has only 7.8 million shares outstanding (S criteria). It reported earnings +161% on +129% sales revenues for the Jun '18 quarter, marking its 7th very strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong.

The number of top-rated funds owning its shares rose from 37 in Dec '16 to 60 in Jun '18, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 1.6 is an unbiased indication its shares have been under institutional accumulation over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of B.

Charts courtesy www.stockcharts.com

Volume Totals Cooling While Consolidating Above Prior High - Friday, July 20, 2018

Texas Pacific Land Trust's (TPL +$9.44 or +1.23% to $774.94) volume totals have been cooling while consolidating back below its "max buy" level. Its prior high in the $740 area defines initial support above its 50-day moving average (DMA) line ($707.22). It has shown bullish action since last shown in this FSU section on 6/04/18 with an annotated graph under the headline, "Negative Reversal on Higher Volume After Hitting New All-Time High".

The thinly-traded Texas Real Estate Development firm has only 7.8 million shares outstanding (S criteria). It reported earnings +130% on +97% sales revenues for the Mar '18 quarter, marking its 6th very strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong.

The number of top-rated funds owning its shares rose from 37 in Dec '16 to 54 in Jun '18, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 1.2 is an unbiased indication its shares have been under institutional accumulation over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of B.

Charts courtesy www.stockcharts.com

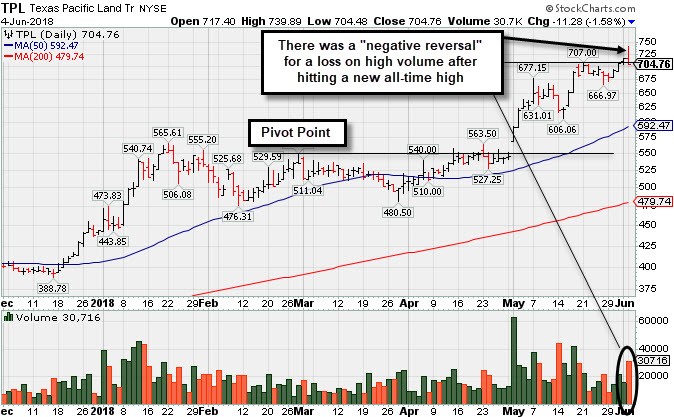

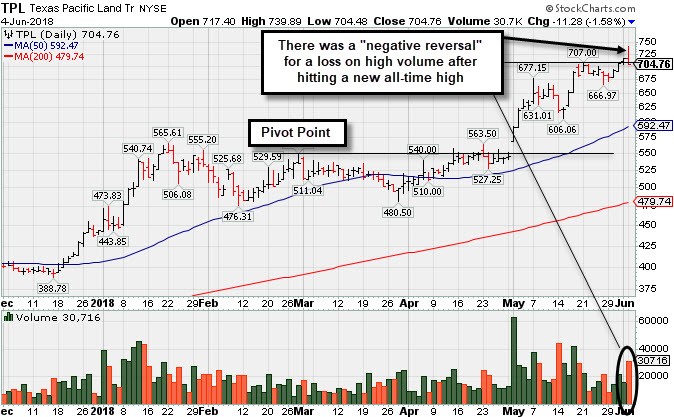

Negative Reversal on Higher Volume After Hitting New All-Time High - Monday, June 4, 2018

Texas Pacific Land Trust (TPL -$11.28 or -1.58% to 704.76) spiked to a new all-time high today but ended the session lower on higher volume after a "negative reversal". It is well above its 50-day moving average (DMA) line ($592) defining important support to watch above prior highs in the $569-552 area.

TPL tallied gains of greater than +20% in the first 2-3 weeks after its latest technical breakout. When such substantial gains are quickly produced, the fact-based investment system's rules suggest holding for a minimum of 8 weeks. It has shown bullish action since last shown in this FSU section on 4/20/18 with an annotated graph under the headline, "Perched Near Prior High After Showing Resilience".

The thinly-traded Texas Real Estate Development firm has only 7.8 million shares outstanding (S criteria). It reported earnings +130% on +97% sales revenues for the Mar '18 quarter, marking its 6th very strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong.

The number of top-rated funds owning its shares rose from 37 in Dec '16 to 57 in Mar '18, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 2.3 is an unbiased indication of institutional accumulation over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of B.

Charts courtesy www.stockcharts.com

Perched Near Prior High After Showing Resilience - Friday, April 20, 2018

Texas Pacific Land Trust's (TPL +$2.81 or +0.51% to $549.00) has been holding its ground with volume totals recently cooling. A new pivot point was cited based on its 2/28/18 high plus 10 cents. Subsequent gains above the pivot point with more than+40% above average volume may trigger a new (or add-on) technical buy signal. Very little resistance remains due to overhead supply up to the $569 level. Recent lows ($480) define important support where damaging losses may trigger a worrisome technical sell signal.

It has shown resilience since last shown in this FSU section on 3/23/18 with an annotated graph under the headline, "Slump Under 50-Day Average Line Hurt Near Term Outlook". The thinly-traded Texas Real Estate Development firm has only 7.9 million shares outstanding (S criteria). It reported earnings +29% on +118% sales revenues for the Dec '17 quarter, marking its 5th very strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong.

The number of top-rated funds owning its shares rose from 37 in Dec '16 to 57 in Mar '18, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 2.1 is an unbiased indication of institutional accumulation over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of C.

Charts courtesy www.stockcharts.com

Slump Under 50-Day Average Line Hurt Near Term Outlook - Friday, March 23, 2018

Texas Pacific Land Trust's (TPL $501.19-$10.81 -2.11%) color code was changed to green after slumping and closing below its 50-day moving average (DMA) line ($518.95). A prompt rebound above the 50 DMA line is needed for its outlook to improve. The prior low defines the next important support level.

It was highlighted in yellow with pivot point cited based on its 10/13/17 high plus 10 cents in the 12/21/17 mid-day report (read here). Subsequent volume-driven gains above the pivot point triggered a technical buy signal under the fact-based investment system's rules. It was last shown in the FSU on 2/22/18 with an annotated graph under the headline, "Finding Support Above 50-Day Moving Average Line - 2/22/2018

The thinly-traded Texas Real Estate Development firm has only 7.9 million shares outstanding (S criteria). It reported earnings +29% on +118% sales revenues for the Dec '17 quarter, marking its 5th very strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong.

The number of top-rated funds owning its shares rose from 37 in Dec '16 to 59 in Dec '17, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 1.1 is an unbiased indication that institutional accumulation/distribution action has been near neutral over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of C.

Charts courtesy www.stockcharts.com

Finding Support Above 50-Day Moving Average Line - Thursday, February 22, 2018

Texas Pacific Land Trust (TPL +$5.97 or +1.18% to $512.00) is consolidating above its 50-day moving average line ($485.56) and recent low ($480 on 2/09/18) defining near-term support. A valid secondary buy point exists up to +5% above the latest high after it successfully tested the 10 week moving average (WMA) line following an earlier technical breakout.

It was highlighted in yellow with pivot point cited based on its 10/13/17 high plus 10 cents in the 12/21/17 mid-day report (read here). Subsequent volume-driven gains above the pivot point triggered a technical buy signal under the fact-based investment system's rules. It was last shown in the FSU on 1/23/18 with an annotated graph under the headline, "Considerable Gains in First 2-3 Weeks After Recent Breakout".

The thinly-traded Texas Real Estate Development firm has only 7.9 million shares outstanding (S criteria). It reported earnings +29% on +118% sales revenues for the Dec '17 quarter, marking its 5th very strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong.

The number of top-rated funds owning its shares rose from 37 in Dec '16 to 58 in Dec '17, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 1.4 is an unbiased indication that institutional accumulation/distribution action has been neutral over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of C.

Charts courtesy www.stockcharts.com

Considerable Gains in First 2-3 Weeks After Recent Breakout - Tuesday, January 23, 2018

Texas Pacific Land Trust (TPL -$18.07 or -3.23% to $541.03) is consolidating after getting very extended from the prior base. Disciplined investors avoid chasing stocks more than +5% above the prior high or pivot point. Prior highs in the $434 area define initial support to watch on pullbacks.

TPL tallied gains of greater than +20% in the first 2-3 weeks after its technical breakout. When such substantial gains are quickly produced, the fact-based investment system's rules suggest holding for a minimum of 8 weeks. It was highlighted in yellow with pivot point cited based on its 10/13/17 high plus 10 cents in the 12/21/17 mid-day report (read here). Subsequent volume-driven gains above the pivot point triggered a technical buy signal under the fact-based investment system's rules. It was last shown in the FSU on 12/21/17 with an annotated graph under the headline, "Real Estate Trust Perched Within Striking Distance of Prior High".

The thinly-traded Texas Real Estate Development firm has only 7.9 million shares outstanding (S criteria). It reported earnings +200% on +198% sales revenues for the Sep '17 quarter, marking its 4th very strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong.

The number of top-rated funds owning its shares rose from 37 in Dec '16 to 57 in Sep '17, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 1.9 is an unbiased indication that institutional accumulation/distribution action has been neutral over the past 50 days. It has earned a Timeliness rating of A and a Sponsorship Rating of C.

Charts courtesy www.stockcharts.com

Real Estate Trust Perched Within Striking Distance of Prior High - Thursday, December 21, 2017

Texas Pacific Land Trust (TPL +$5.23 or +1.27% to $418.35) was highlighted in yellow with pivot point cited based on its 10/13/17 high plus 10 cents in the earlier mid-day report (read here). It rebounded above its 50-day moving average (DMA) line ($406) this week, helping its outlook. It is within striking distance of prior highs. Subsequent volume-driven gains above the pivot point are needed to trigger a technical buy signal under the fact-based investment system's rules. Disciplined investors know that fresh proof of institutional buying is needed before action may be warranted.

The thinly-traded Texas Real Estate Development firm has only 7.9 million shares outstanding (S criteria). It reported earnings +200% on +198% sales revenues for the Sep '17 quarter, marking its 4th very strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong.

The number of top-rated funds owning its shares rose from 37 in Dec '16 to 52 in Sep '17, a reassuring sign concerning the I criteria. The current Up/Down Volume ratio of 1.0 is an unbiased indication that institutional accumulation/distribution action has been neutral over the past 50 days. It has earned a Timeliness rating of B and a Sponsorship Rating of C.

Charts courtesy www.stockcharts.com