Testing Support at 50-Day Moving Average Line - Thursday, April 28, 2022

Volume Totals Have Been Light While Hovering at All-Time High - Monday, April 4, 2022

6th Straight Gain Leaves Regeneron Near Record High - Wednesday, March 16, 2022

Still Quietly Consolidating Above 200 DMA Line - Wednesday, March 2, 2022

Earnings News Due While Consolidating Above 200 DMA Line - Tuesday, February 1, 2022

Regeneron Still Lingering Below 50-Day Moving Average Line - Tuesday, January 11, 2022

Consolidating Near All-Time High With Little Resistance Remaining - Monday, December 13, 2021

Regeneron Featured Hitting a New High - Friday, August 20, 2021

Testing Support at 50-Day Moving Average Line - Thursday, April 28, 2022

Regeneron Pharmaceuticals Inc (REGN +$2.07 or +0.31% to $675.58) showed some resilience today and managed a "positive reversal" after undercutting its 50-day moving average (DMA) line ($670). The recent deterioration below prior highs ($686 and $673) raised concerns. Keep in mind it is due to report earnings results for the quarter ended March 31, 2022 on Wednesday, May 4th. Volume and volatility often increase near earnings news.

REGN found support near its 200 DMA line ($632) during its consolidation in recent months. A new pivot point was cited based on its 12/14/21 high plus 10 cents. It hit a new high but then stalled since last covered in greater detail on 4/04/22 with an annotated graph under the headline, "Volume Totals Have Been Light While Hovering at All-Time High".

The high-ranked DRUGS - Biotechnology firm reported earnings +149% on +104% sales revenues for the Dec '21 quarter versus the year ago period. That marked its 6th quarterly comparison above the +25% minimum earnings guideline (C criteria) and with a strong sales revenues growth rate. Its annual earnings (A criteria) growth has been strong. It has a highest possible 99 Earnings Per Share Rating.

There are 2,775 top-rated funds that own its shares as of Mar '22, up from 2,376 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days. REGN completed a Secondary Offering on 5/28/20. There are 97.1 million shares in the public float (S criteria) which can contribute to greater volatility in the event of institutional buying or selling.

Volume Totals Have Been Light While Hovering at All-Time High - Monday, April 4, 2022

Regeneron Pharmaceuticals Inc (REGN +$3.58 or +0.52% to $698.41) has seen lighter volume totals while hovering near its all-time high after last Thursday's noted gain backed by +41% above average volume. Its 50-day moving average (DMA) line ($640) defines important near-term support to watch on pullbacks. It is still less than +5% above the pivot point, not too extended from a sound base pattern.

REGN found support above its 200 DMA line ($620) during its consolidation in recent months and its color code was changed to yellow with new pivot point cited based on its 12/14/21 high plus 10 cents. It has made gradual progress since last covered in greater detail on 3/16/22 with an annotated graph under the headline, "6th Straight Gain Leaves Regeneron Near Record High".

The high-ranked DRUGS - Biotechnology firm reported earnings +149% on +104% sales revenues for the Dec '21 quarter versus the year ago period. That marked its 6th quarterly comparison above the +25% minimum earnings guideline (C criteria) and with a strong sales revenues growth rate. Its annual earnings (A criteria) growth has been strong. It has a highest possible 99 Earnings Per Share Rating.

There are 2,738 top-rated funds that own its shares as of Dec '21, up from 2,376 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.7 is an unbiased indication its shares have been under slight accumulation over the past 50 days. REGN completed a Secondary Offering on 5/28/20. There are 97.1 million shares in the public float (S criteria) which can contribute to greater volatility in the event of institutional buying or selling.

6th Straight Gain Leaves Regeneron Near Record High - Wednesday, March 16, 2022

Regeneron Pharmaceuticals Inc (REGN +$12.05 or +1.81% to $677.98) posted a 6th consecutive gain today with near average volume, wedging above its December high. Its color code was changed to yellow with new pivot point cited based on its 12/14/21 high plus 10 cents. REGN found support above its 200 DMA line ($609) during its consolidation in recent months and it has made steady progress since last covered in greater detail on 3/02/22 with an annotated graph under the headline, "Still Quietly Consolidating Above 200 DMA Line". Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal.

The high-ranked DRUGS - Biotechnology firm reported earnings +149% on +104% sales revenues for the Dec '21 quarter versus the year ago period. That marked its 6th quarterly comparison above the +25% minimum earnings guideline (C criteria) and with a strong sales revenues growth rate. Its annual earnings (A criteria) growth has been strong. It has a highest possible 99 Earnings Per Share Rating.

There are 2,746 top-rated funds that own its shares as of Dec '21, up from 2,376 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.2 is an unbiased indication its shares have been under slight accumulation over the past 50 days. REGN completed a Secondary Offering on 5/28/20. There are 97.1 million shares in the public float (S criteria) which can contribute to greater volatility in the event of institutional buying or selling.

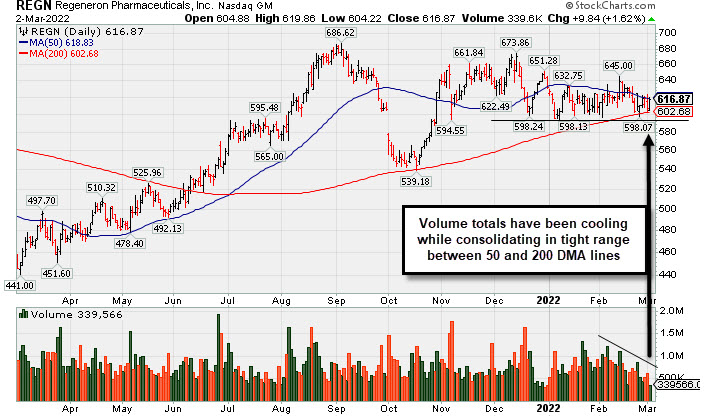

Still Quietly Consolidating Above 200 DMA Line - Wednesday, March 2, 2022

Regeneron Pharmaceuticals Inc (REGN +$9.84 or +1.62% to $616.87) volume totals have been cooling while still consolidating in a tight range below its 50-day moving average (DMA) line ($618.83) and above its 200 DMA line ($602.68). Prior lows in the $592-596 area define additional near-term support to watch. Its Relative Strength rating is 85, still well above the 80+ minimum guideline for buy candidates. A rebound above the 50 DMA line is needed for its outlook to improve, but it faces additional resistance due to overhead supply.

REGN was last covered in greater detail on 2/01/22 with an annotated graph under the headline, "Earnings News Due While Consolidating Above 200 DMA Line". The high-ranked DRUGS - Biotechnology firm reported earnings +149% on +104% sales revenues for the Dec '21 quarter versus the year ago period. That marked its 6th quarterly comparison above the +25% minimum earnings guideline (C criteria) and with a strong sales revenues growth rate. Its annual earnings (A criteria) growth has been strong. It has a 99 Earnings Per Share Rating.

There are 2,743 top-rated funds that own its shares as of Dec '21, up from 2,376 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.1 is an unbiased indication its shares have been under slight accumulation over the past 50 days. REGN completed a Secondary Offering on 5/28/20. There are 97.1 million shares in the public float (S criteria) which can contribute to greater volatility in the event of institutional buying or selling.

Earnings News Due While Consolidating Above 200 DMA Line - Tuesday, February 1, 2022

Regeneron Pharmaceutical (REGN +$4.77 or +0.78% to $613.36) has recently been holding its ground in a tight range above prior lows and above its 200-day moving average (DMA) line ($590.51) which define important near-term support. Keep in mind it is due to report Dec '21 quarterly results on Friday, 2/04/22. Volume and volatility often increase near earnings news. The lack of price progress with higher volume totals in recent weeks is action indicative of distributional pressure. Its Relative Strength rating is 85, still well above the 80+ minimum guideline for buy candidates. A rebound above the 50 DMA line ($629.33) is needed for its outlook to improve.

The high-ranked DRUGS - Biotechnology firm reported earnings +84% on +51% sales revenues for the Sep '21 quarter versus the year ago period. That marked its 5th quarterly comparison above the +25% minimum earnings guideline (C criteria) and with a strong sales revenues growth rate. Its annual earnings (A criteria) growth has been strong. It has a 99 Earnings Per Share Rating.

There are 2,733 top-rated funds that own its shares as of Dec '21, up from 2,376 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.1 is an unbiased indication its shares have been under slight acumulation over the past 50 days. REGN completed a Secondary Offering on 5/28/20. There are 96.2 million shares in the public float (S criteria) which can contribute to greater volatility in the event of institutional buying or selling.

Regeneron Still Lingering Below 50-Day Moving Average Line - Tuesday, January 11, 2022

Regeneron Pharmaceutical (REGN +$4.82 or +0.78% to $626.09) posted a 4th consecutive gain today. A rebound above the 50-day moving average (DMA) line ($635) is still needed for its outlook to improve. Its Relative Strength rating is 88, still well above the 80+ minimum guideline for buy candidates.

REGN was highlighted in yellow with new pivot point cited based on its 9/01/21 high plus 10 cents in the 12/13/21 mid-day report (read here) and it was covered in greater detail that evening with an annotated graph under the headline, "Consolidating Near All-Time High With Little Resistance Remaining". It found support above its 200 DMA line and then rebounded since dropped from the Featured Stocks list on 9/28/21.

The high-ranked DRUGS - Biotechnology firm reported earnings +84% on +51% sales revenues for the Sep '21 quarter versus the year ago period. That marked its 5th quarterly comparison above the +25% minimum earnings guideline (C criteria) and with a strong sales revenues growth rate. Its annual earnings (A criteria) growth has been strong. It has a 99 Earnings Per Share Rating.

There are 2,718 top-rated funds that own its shares as of Sep '21, up from 2,376 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 0.9 is an unbiased indication its shares have been under slight distributional pressure over the past 50 days. REGN completed a Secondary Offering on 5/28/20. There are 96.2 million shares in the public float (S criteria) which can contribute to greater volatility in the event of institutional buying or selling.

Consolidating Near All-Time High With Little Resistance Remaining - Monday, December 13, 2021

Regeneron Pharmaceutical (REGN -$9.37 or -1.40% to $660.15) was highlighted in yellow with new pivot point cited based on its 9/01/21 high plus 10 cents in the earlier mid-day report (read here). It showed resilience and finished near the session high for a small loss after gapping down and trading much lower. It still remains perched within close striking distance of its all-time high. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. The market direction (M criteria) remains a concern regarding any new buying until a new confirmed rally with a follow-through day.

REGN was shown in this FSU section that evening with an annotated graph under the headline, "Regeneron Featured Hitting a New High". It found support above its 200 DMA line and then rebounded since dropped from the Featured Stocks list on 9/28/21. Its Relative Strength rating has improved to 89, well above the 80+ minimum guideline for buy candidates.

The high-ranked DRUGS - Biotechnology firm reported earnings +84% on +51% sales revenues for the Sep '21 quarter versus the year ago period. That marked its 5th quarterly comparison above the +25% minimum earnings guideline (C criteria) and with a strong sales revenues growth rate. Its annual earnings (A criteria) growth has been strong. It has a 99 Earnings Per Share Rating.

There are 2,665 top-rated funds that own its shares as of Sep '21, up from 2,376 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days. REGN completed a Secondary Offering on 5/28/20. There are 96.2 million shares in the public float (S criteria) which can contribute to greater volatility in the event of institutional buying or selling.

Regeneron Featured Hitting a New High - Friday, August 20, 2021

Regeneron Pharmaceutical (REGN +$7.64 or +1.17% to $663.27) was highlighted in yellow with pivot point cited based on its 7/20/20 high plus 10 cents in the earlier mid-day report (read here). It hit a new all-time high today but ended the session just below the middle of its intra-day range. Subsequent gains and a strong close above its pivot point backed by at least +40% above average volume may trigger a proper technical buy signal.

The high-ranked DRUGS - Biotechnology firm reported earnings +260% on +163% sales revenues for the Jun '21 quarter versus the year ago period. The prior 3 quarterly comparisons also were above the +25% minimum earnings guideline (C criteria) and sequential comparisons show impressive acceleration in its sales revenues and earnings growth rate. Its annual earnings (A criteria) growth has been strong. It has a 99 Earnings Per Share Rating.

There are 2,625 top-rated funds that own its shares as of Jun '21, up from 2,421 in Sep '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.7 is an unbiased indication its shares have been under accumulation over the past 50 days. REGN completed a Secondary Offering on 5/28/20. There are 72.5 million shares in the public float (S criteria) which can contribute to greater volatility in the event of institutional buying or selling.