Still Below 50-Day Moving Average - Monday, January 3, 2022

Entegris Inc (ENTG -$0.19 or -0.14% to $138.39) suffered a small loss today with below average volume. A rebound above the 50-day moving average (DMA) line ($144.25) is needed for its outlook to improve.Fundamentals remain strong after it recently reported Sep '21 quarterly earnings +37% on +20% sales revenues versus the year ago period, its 6th strong quarter backed with an improving sales revenues growth rate, helping it match the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady.

ENTG was highlighted in yellow with pivot point cited based on its 4/05/21 high plus 10 cents in the 8/04/21 mid-day report (read here). It has a 94 Earnings Per Share Rating and its Relative Strength Rating is 87, both above the 80+ minimum guideline for buy candidates. It was last shown in this FSU section on 11/29/21 with an annotated graph under the headline, "Best Ever Close After Volume-Driven Gain".

The company hails from the ELECTRONICS - Semiconductor Equipment and Materials industry group which is currently ranked 21st on the 197 Industry Groups list (L criteria). There are 135.5 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 617 in Mar '20 to 735 in Sep '21, a reassuring sign concerning the I criteria. It has a Timeliness Rating of B and Sponsorship Rating of B.

Best Ever Close After Volume-Driven Gain - Monday, November 29, 2021

Entegris Inc (ENTG +$5.74 or +3.85% to $154.75) posted a volume-driven gain today for a best-ever close while hovering near its all-time high. It is very extended from any sound base, with its prior high ($136) and its 50-day moving average (DMA) line ($137) defining near-term support to watch. Fundamentals remain strong after it recently reported Sep '21 quarterly earnings +37% on +20% sales revenues versus the year ago period, its 6th strong quarter backed with an improving sales revenues growth rate, helping it match the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady.ENTG was highlighted in yellow with pivot point cited based on its 4/05/21 high plus 10 cents in the 8/04/21 mid-day report (read here). It has a 94 Earnings Per Share Rating and its Relative Strength Rating is 94, both above the 80+ minimum guideline for buy candidates. It was last shown in this FSU section on 10/22/21 with an annotated graph under the headline, "Hit New Record High With Another Volume-Driven Gain".

The company hails from the ELECTRONICS - Semiconductor Equipment and Materials industry group which is currently ranked 54th on the 197 Industry Groups list (L criteria). There are 135.6 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 617 in Mar '20 to 726 in Sep '21, a reassuring sign concerning the I criteria. It has a Timeliness Rating of B and Sponsorship Rating of B.

Hit New Record High With Another Volume-Driven Gain - Friday, October 22, 2021

Entegris Inc (ENTG +$3.41 or +2.55% to $137.28) hit a new all-time high with above average volume behind today's gain. As it rose further above its "max buy" level, getting extended from the previously noted base, its color code was changed to green. On pullbacks the 50-day moving average (DMA) line ($123.54) defines initial support to watch above recent lows in the $109 area.ENTG was highlighted in yellow with pivot point cited based on its 4/05/21 high plus 10 cents in the 8/04/21 mid-day report (read here). It has a 93 Earnings Per Share Rating and its Relative Strength Rating is 84, both above the 80+ minimum guideline for buy candidates. It was last shown in this FSU section on 9/23/21 with an annotated graph under the headline, "Hit New High and Rose Above its Max Buy Level". Jun '21 quarterly earnings rose +42% on +27% sales revenues versus the year ago period, its 5th strong quarter backed with an improving sales revenues growth rate, helping it match the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady.

The company hails from the ELECTRONICS - Semiconductor Equipment and Materials industry group which is currently ranked 107th on the 197 Industry Groups list (L criteria). There are 135.6 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 617 in Mar '20 to 733 in Sep '21, a reassuring sign concerning the I criteria. It has a Timeliness Rating of C and Sponsorship Rating of B.

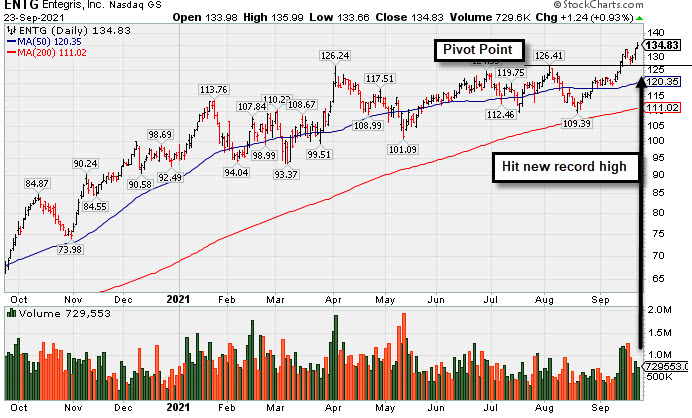

Hit New High and Rose Above its Max Buy Level - Thursday, September 23, 2021

Entegris Inc (ENTG +$1.24 or +0.93% to $134.83) hit another new high as it rose further above its "max buy" level with today's volume-driven gain and its color code was changed to green. The 50-day moving average (DMA) line ($120) defines initial support to watch above recent lows in the $109 area.ENTG was highlighted in yellow with pivot point cited based on its 4/05/21 high plus 10 cents in the 8/04/21 mid-day report (read here). It has a 92 Earnings Per Share Rating and its Relative Strength Rating is 90, both above the 80+ minimum guideline for buy candidates. It was last shown in this FSU section on 8/04/21 with an annotated graph under the headline, "Perched Near High After 6th Consecutive Gain". Fundamentals remain strong as it reported Jun '21 quarterly earnings +42% on +27% sales revenues, its 5th strong quarter backed with an improving sales revenues growth rate, helping it match the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady.

The company hails from the ELECTRONICS - Semiconductor Equipment and Materials industry group which is currently ranked 58th on the 197 Industry Groups list (L criteria). There are 135.6 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 617 in Mar '20 to 738 in Jun '21, a reassuring sign concerning the I criteria. It has a Timeliness Rating of B and Sponsorship Rating of B.

Perched Near High After 6th Consecutive Gain - Wednesday, August 4, 2021

Entegris Inc (ENTG +$1.47 or +1.20% to $124.21) finished in the middle of its intra-day range after highlighted in yellow with pivot point cited based on its 4/05/21 high plus 10 cents in the earlier mid-day report (read here). It matched its 52-week high with today's 6th consecutive gain. Subsequent gains and a close above the pivot point backed by at least +40% above average volume may trigger a proper technical buy signal. It showed resilience during its consolidation above and below its 50-day moving average DMA line ($117.65) since dropped from the Featured Stocks list on 5/12/21.ENTG has a 93 Earnings Per Share Rating and its Relative Strength Rating is 84, both above the 80+ minimum guideline for buy candidates. It was last shown in this FSU section on 4/22/21 with an annotated graph under the headline, "Negated Recent Breakout and Sputtering Near Prior High". Fundamentals remain strong as it reported Jun '21 quarterly earnings +42% on +27% sales revenues, its 5th strong quarter backed with an improving sales revenues growth rate, helping it match the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady.

The company hails from the ELECTRONICS - Semiconductor Equipment and Materials industry group which is currently ranked 38th on the 197 Industry Groups list (L criteria). There are 135.6 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 617 in Mar '20 to 740 in Jun '21, a reassuring sign concerning the I criteria. It has a Timeliness Rating of B and Sponsorship Rating of B.

Negated Recent Breakout and Sputtering Near Prior High - Thursday, April 22, 2021

Entegris Inc (ENTG -$3.22 or -2.84% to $109.99) is sputtering below its pivot point and near the prior high in the $110 area which defines the important near-term support to watch above its 50-day moving average (DMA) line ($107.83). More damaging losses would raise greater concerns and trigger technical sell signals.ENTG finished strong after highlighted in yellow in the 4/01/21 mid day report (read here) with pivot point cited based on its 3/02/21 high after a 9-week "double bottom" base. It rallied for a new all-time high (N criteria) when last shown in this FSU section that evening with an annotated graph under the headline, "Strong Breakout Action With +67% Above Average Volume".

The company hails from the ELECTRONICS - Semiconductor Equipment and Materials industry group which is currently ranked 14th on the 197 Industry Groups list (L criteria). It has a 95 Earnings Per Share rating and favorable fundamentals were previously noted in the 2/16/21 mid-day report - "Reported earnings +29% on +21% sales revenues for the Dec '20 quarter versus the year-ago period, its 3rd strong quarter backed with an improving sales revenues growth rate, helping it better match the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady after a downturn in FY '12."

There are 134.9 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 617 in Mar '20 to 762 in Mar '21, a reassuring sign concerning the I criteria. It has a Timeliness Rating of B and Sponsorship Rating of B.

Strong Breakout Action With +67% Above Average Volume - Thursday, April 1, 2021

Entegris Inc (ENTG +$8.29 or +7.,42% to $120.09) finished strong after highlighted in yellow in the earlier mid day report (read here) with pivot point cited based on its 3/02/21 high after a 9-week "double bottom" base. It rallied for a new all-time high (N criteria) with today's 3rd consecutive gain backed by ever-increasing volume, quickly getting extended from prior highs. Technically, it broke out on the prior session with +40% above average volume.The company hails from the ELECTRONICS - Semiconductor Equipment and Materials industry group which is currently ranked 30th on the 197 Industry Groups list (L criteria). It has a 95 Earnings Per Share rating and favorable fundamentals were previously noted in the 2/16/21 mid-day report - "Reported earnings +29% on +21% sales revenues for the Dec '20 quarter versus the year-ago period, its 3rd strong quarter backed with an improving sales revenues growth rate, helping it better match the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady after a downturn in FY '12."

There are 134.9 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 617 in Mar '20 to 730 in Dec '20, a reassuring sign concerning the I criteria. It has a Timeliness rating of A and Sponsorship rating of B.