Close in Lower Half of Range Indicates Distributional Pressure - Thursday, September 9, 2021

Topbuild Corp (BLD +$3.75 or +1.70% to $223.73) finished in the lower half of its intra-day range, encountering distributional pressure after highlighted in yellow in the earlier mid-day report (read here). The pivot point cited was based on its 8/12 /21 high after a cup-with-handle base. Subsequent gains and a strong close above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. Little resistance remains while rallying near its all-time high.

BLD reported Jun '21 quarterly earnings +64% on +29% sales revenues versus the year ago period, marking its 4th consecutive comparison above the +25% minimum guideline (C criteria). Sequential comparisons show encouraging acceleration in its sales revenues growth rate, also helping it better match the fact-based investment system's winning models. Annual earnings growth (A criteria) has been strong. It has a 98 Earnings Per Share Rating.

It hails from the Bldg-Constr Prds/Misc group which is currently ranked 58th on the 197 Industry Groups list (L criteria).BLD was dropped from the Featured Stocks list on 2/28/20 and went through a deep consolidation then showed great strength after its last appearance in this FSU section with an annotated graph under the headline, "50-Day Moving Average Violation Has Hurt Outlook". It had traded up as much as +52.9% since first highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 380 in Dec '18 to 651 in Jun '21, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of B.

Charts used courtesy of www.stockcharts.com

50-Day Moving Average Violation Has Hurt Outlook - Thursday, February 27, 2020

Topbuild Corp (BLD -$2.34 or -2.15% to $106.36) violated its 50-day moving average (DMA) line ($111) triggering a technical sell signal during a streak of 5 consecutive volume-driven losses. Only a prompt rebound above the 50 DMA line would help its outlook improve.

It reported earnings were +23% on +3% sales revenues for the Dec '19 quarter versus the year ago period, its second quarterly comparison just below the +25% minimum guideline (C criteria). Still, it has a 99 Earnings Per Share Rating. Its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 2/06/20 with an annotated graph under the headline, "Volume Totals Cooling While Consolidating Near All-Time High". It traded up as much as +52.9% since first highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 380 in Dec '18 to 525 in Dec '19. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A, but it still has a Sponsorship Rating of D.

Charts used courtesy of www.stockcharts.com

Volume Totals Cooling While Consolidating Near All-Time High - Thursday, February 6, 2020

Topbuild Corp (BLD +$1.04 or +0.91% to $115.55) has been quietly consolidating near its all-time high with volume totals cooling following an impressive streak of volume-driven gains. The prior high ($113.74) defines near-term support above its 50-day moving average (DMA) line ($108.67).

It is not due to report earnings news until 12/25/20. Warnings were +24% on +5% sales revenues for the Sep '19 quarter versus the year ago period, just below the +25% minimum guideline (C criteria). Still, it has a 98 Earnings Per Share Rating. Its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 1/17/20 with an annotated graph under the headline, "Fifth Consecutive Gain Leaves TopBuild Near 52-Week High". It traded up as much as +45.9% since first highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

BLD was last shown in this FSU section on 1/17/20 with an annotated graph under the headline, "Fifth Consecutive Gain Leaves TopBuild Near 52-Week High". It traded up as much as +45.9% since first highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 380 in Dec '18 to 498 in Dec '19. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A, but it still has a Sponsorship Rating of D.

Charts used courtesy of www.stockcharts.com

Fifth Consecutive Gain Leaves TopBuild Near 52-Week High - Friday, January 17, 2020

Topbuild Corp (BLD +$1.19 or +1.08% to $111.60) challenged its all-time high with today's 5th consecutive gain. The recent rebound above its 50-day moving average (DMA) line ($106.92) helped its outlook to improve. Previously noted damaging volume-driven losses triggered a technical sell signal. Subsequent gains for new highs backed by at least +40% above average volume may trigger a new (or add on) technical buy signal.

Recently it reported earnings +24% on +5% sales revenues for the Sep '19 quarter versus the year ago period, just below the +25% minimum guideline (C criteria). It still has a 98 Earnings Per Share Rating. Its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14. BLD was last shown in this FSU section on 12/24/19 with an annotated graph under the headline, "Recent Slump Below 50-Day Moving Average Did Technical Damage". It traded up as much as 38.4% since first highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 380 in Dec '18 to 486 in Dec '19. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A, but it still has a Sponsorship Rating of D.

Charts used courtesy of www.stockcharts.com

Recent Slump Below 50-Day Moving Average Did Technical Damage - Tuesday, December 24, 2019

Topbuild Corp (BLD +$2.21 or +2.17% to $103.95) has been sputtering below its 50-day moving average (DMA) line ($105.74) after damaging volume-driven losses triggered a technical sell signal. Only a prompt rebound above its 50 DMA line would help its outlook improve. Recently it reported earnings +24% on +5% sales revenues for the Sep '19 quarter versus the year ago period, just below the +25% minimum guideline (C criteria).

It still has a 98 Earnings Per Share Rating. Its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14. BLD was last shown in this FSU section on 12/03/19 with an annotated graph under the headline, "Consolidating After Getting Extended From Any Sound Base". It traded up as much as 38.4% since first highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 380 in Dec '18 to 454 in Sep '19. Its current Up/Down Volume Ratio of 1.1 is an unbiased indication its shares have been under slight accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of D.

Charts used courtesy of www.stockcharts.com

Consolidating After Getting Extended From Any Sound Base - Tuesday, December 3, 2019

Topbuild Corp (BLD +$1.89 or +1.75% to $109.59) is extended from any sound base. Its 50-day moving average (DMA) line ($102.71) acted as support during its ongoing ascent.

Recently it reported earnings +24% on +5% sales revenues for the Sep '19 quarter versus the year ago period, just below the +25% minimum guideline (C criteria). It still has a 98 Earnings Per Share Rating, as its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

Recently it reported earnings +24% on +5% sales revenues for the Sep '19 quarter versus the year ago period, just below the +25% minimum guideline (C criteria). It still has a 98 Earnings Per Share Rating, as its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 11/12/19 with an annotated graph under the headline, "Perched Near High Following Recent Volume-Driven Gains". It was highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 380 in Dec '18 to 454 in Sep '19. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of D.

Charts used courtesy of www.stockcharts.com

Perched Near High Following Recent Volume-Driven Gains - Tuesday, November 12, 2019

Topbuild Corp (BLD +$1.01 or +0.95% to $107.32) is consolidating after getting very extended from any sound base with volume-driven gains last week for new all-time highs. Recently it reported earnings +24% on +5% sales revenues for the Sep '19 quarter versus the year ago period, just below the +25% minimum guideline (C criteria). It still has a 98 Earnings Per Share Rating, as its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 10/23/19 with an annotated graph under the headline, "Pulling Back After Recently Wedging Into New High Territory". It was highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here). It found prompt support near its 50-day moving average (DMA) line ($98.13) during its ongoing ascent.

The number of top-rated funds owning its shares rose from 380 in Dec '18 to 453 in Sep '19. Its current Up/Down Volume Ratio of 1.1 is an unbiased indication its shares have been under slight accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of D.

Charts used courtesy of www.stockcharts.com

Pulling Back After Recently Wedging Into New High Territory - Wednesday, October 23, 2019

Topbuild Corp (BLD -$1.68 or -1.67% to $98.82) pulled back for a 4th consecutive loss with light volume after wedging into all-time high territory with 5 consecutive gains lacking great volume conviction. It is extended from the prior base. Its 50-day moving average (DMA) line ($94.42) defines important support to watch along with its prior low ($91.31 on 10/03/19).

It reported earnings +39% on +9% sales revenues for the Jun '19 quarter versus the year ago period, continuing its strong earnings track record of quarterly earnings increases above the +25% minimum guideline (C criteria). It has a 99 Earnings Per Share Rating, as its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 10/07/19 with an annotated graph under the headline, "Near High After Finding Support at 50-Day Average". It was highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 380 in Dec '18 to 437 in Sep '19. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of D.

Charts used courtesy of www.stockcharts.com

Near High After Finding Support at 50-Day Average - Monday, October 7, 2019

Topbuild Corp (BLD -$1.19 or -1.23% to $95.41) recently stayed above its 50-day moving average (DMA) line and remains perched near its all-time high. It is extended from the prior base after wedging higher with gains lacking great volume conviction. Its 50 DMA line ($91.55) defines important support to watch along with its prior low ($86.53 on 8/28/19).

It reported earnings +39% on +9% sales revenues for the Jun '19 quarter versus the year ago period, continuing its strong earnings track record of quarterly earnings increases above the +25% minimum guideline (C criteria). It has a 99 Earnings Per Share Rating, as its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 9/23/19 with an annotated graph under the headline, "Perched Near Record High, Extended From Prior Base". It was highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 380 in Dec '18 to 417 in Sep '19. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of D.

Charts used courtesy of www.stockcharts.com

Perched Near Record High, Extended From Prior Base - Monday, September 23, 2019

Topbuild Corp (BLD +$0.12 or +0.13% to $95.24) is perched near its all-time high, extended from the prior base. Its 50-day moving average (DMA) line ($88.71) and prior highs in the $86 area define important near-term support to watch on pullbacks.

It reported earnings +39% on +9% sales revenues for the Jun '19 quarter versus the year ago period, continuing its strong earnings track record of quarterly earnings increases above the +25% minimum guideline (C criteria). It has a 99 Earnings Per Share Rating, as its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 9/10/19 with an annotated graph under the headline, "Holding Ground Stubbornly in Tight Range Near Record High". It was highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 383 in Dec '18 to 430 in Jun '19. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of C.

Charts used courtesy of www.stockcharts.com

Holding Ground Stubbornly in Tight Range Near Record High - Tuesday, September 10, 2019

Topbuild Corp (BLD -$0.44 or -0.48% to $91.89) is still perched within close striking distance of its all-time high. Earnings rose +39% on +9% sales revenues for the Jun '19 quarter versus the year ago period. Prior highs in the $86 area and its 50-day moving average (DMA) line ($86.51) coincide defining important support to watch on pullbacks.

It reported earnings +39% on +9% sales revenues for the Jun '19 quarter versus the year ago period, continuing its strong earnings track record of quarterly earnings increases above the +25% minimum guideline (C criteria). It has a 99 Earnings Per Share Rating, as its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 8/19/19 with an annotated graph under the headline, "Topbuild Has 4 Consecutive Weekly Gains and Stubbornly Held Ground". It was highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 383 in Dec '18 to 425 in Jun '19. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of C.

The annotated graphs below show how it has recently been wedging higher and stubbornly holding its ground in a tight range. The second graph shows a longer (18-month) term view which illustrates its previous breakout.

Charts used courtesy of www.stockcharts.com

Topbuild Has 4 Consecutive Weekly Gains and Stubbornly Held Ground - Monday, August 19, 2019

Topbuild Corp (BLD +$2.25 or +2.49% to $92.55) hit a new all-time high with below average volume behind today's 3rd consecutive gain. It has been stubbornly holding its ground after bullish action, tallying 4 consecutive weekly gains. Prior highs in the $86 area define initial support to watch above its 50 DMA line ($83.09) on pullbacks.

It reported earnings +39% on +9% sales revenues for the Jun '19 quarter versus the year ago period, continuing its strong earnings track record of quarterly earnings increases above the +25% minimum guideline (C criteria). It has a 99 Earnings Per Share Rating, as its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 7/25/19 with an annotated graph under the headline, "Perched Near 52-Week High Finding Support". It was highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 383 in Dec '18 to 423 in Jun '19. Its current Up/Down Volume Ration of 1.1 is an unbiased indication its shares have been under slight distributional pressure over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of C.

Charts used courtesy of www.stockcharts.com

Perched Near 52-Week High Finding Support - Thursday, July 25, 2019

Topbuild Corp (BLD +$1.03 or +1.27% to $82.20) rebounded further above its 50-day moving average (DMA) line ($80.74) with today's gain on higher (near average) volume. Its next near-term support below the 50 DMA line is at the recent low ($78.26 on 7/23/19). It stalled after challenging its all-time high on 7/12/19 with its early gain. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal.

Keep in mind that it is due to report earnings news on 8/01/19. Volume and volatility often increase near earnings news. It has a 98 Earnings Per Share Rating. Recently it reported earnings +45% on +26% sales revenues for the Mar '19 quarter. Quarterly earnings increases have been above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 6/20/19 with an annotated graph under the headline, "Found Support at 50-Day Moving Average Line". It was highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 383 in Dec '18 to 408 in Mar '19. Its current Up/Down Volume Ration of 0.8 is an unbiased indication its shares have been under slight distributional pressure over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of C.

Charts used courtesy of www.stockcharts.com

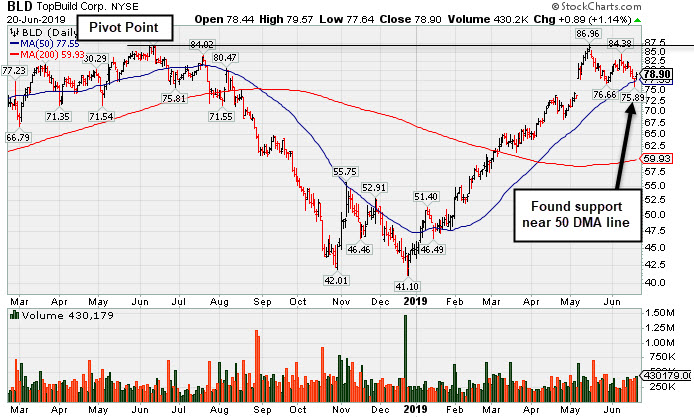

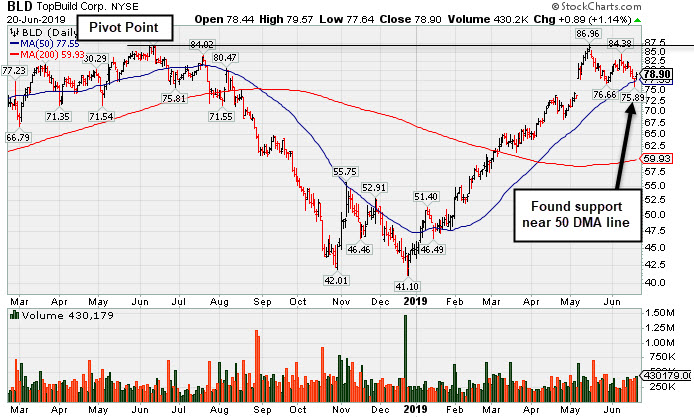

Found Support at 50-Day Moving Averge Line - Thursday, June 20, 2019

Topbuild Corp (BLD +$0.89 +1.14% to $78.90) found prompt support today after undercutting the prior low and its 50-day moving average (DMA) line ($77.55) with a streak of 4 consecutive losses. Recent action has been noted as indicative of distributional pressure and it is 9.3% off its 52-week high. Subsequent gains for new highs above the pivot point backed by at least +40% above average volume are needed to trigger a technical buy signal.

Fundamentals remain strong. It has a 98 Earnings Per Share Rating. Recently it reported earnings +45% on +26% sales revenues for the Mar '19 quarter. Quarterly earnings increases have been above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong and steady since turning profitable in FY '14.

BLD was last shown in this FSU section on 5/20/19 with an annotated graph under the headline, "Encountered Distributional Pressure Near Prior High". It was highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here).

The number of top-rated funds owning its shares rose from 383 in Dec '18 to 398 in Mar '19. Its current Up/Down Volume Ration of 1.1 is an unbiased indication its shares have been under slight accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of C.

Charts used courtesy of www.stockcharts.com

Encountered Distributional Pressure Near Prior High - Monday, May 20, 2019

Topbuild Corp (BLD -$1.18 or -1.44% to $80.87) suffered a 3rd consecutive loss today. It has encountered distributional pressure after highlighted in yellow with new pivot point cited based on its 8/12/18 high plus 10 cents in the 5/17/19 mid-day report (read here). Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal.

It has a 98 Earnings Per Share Rating. Recently it reported earnings +45% on +26% sales revenues for the Mar '19 quarter. Quarterly earnings increases have been above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong and steady since turning profitable in FY '14.

The number of top-rated funds owning its shares rose from 383 in Dec '18 to 396 in Mar '19. Its current Up/Down Volume Ration of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of C.