You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Friday, March 21, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - MONDAY, SEPTEMBER 23RD, 2019

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+14.92 |

26,949.99 |

+0.06% |

|

Volume |

821,155,030 |

-70% |

|

Volume |

1,733,691,444 |

-47% |

|

NASDAQ |

-5.21 |

8,112.46 |

-0.06% |

|

Advancers |

1,562 |

55% |

|

Advancers |

1,384 |

45% |

|

S&P 500 |

-0.29 |

2,991.78 |

-0.01% |

|

Decliners |

1,271 |

45% |

|

Decliners |

1,716 |

55% |

|

Russell 2000 |

-1.52 |

1,558.25 |

-0.10% |

|

52 Wk Highs |

113 |

|

|

52 Wk Highs |

61 |

|

|

S&P 600 |

+0.33 |

962.44 |

+0.03% |

|

52 Wk Lows |

16 |

|

|

52 Wk Lows |

53 |

|

|

|

Leadership Thin as Major Indices Show Indecisiveness

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Dow gained 14 points, while both the S&P 500 and Nasdaq Composite lost less than 0.1%. The volume totals reported were much lighter than the prior session on the NYSE and on the Nasdaq exchange, as the prior session totals were inflated by options expirations. Advancers led decliners by a 5-4 margin on the Nasdaq exchange while decliners led advancers by about the same margin on the NYSE. Leadership remained thin as there were 17 high-ranked companies from the Leaders List hit new 52-week highs and were listed on the BreakOuts Page, versus the total of 18 on the prior session. New 52-week highs totals outnumbered new 52-week lows totals on the NYSE and on the Nasdaq exchange.Concerning the M criteria of the fact-based investment system, investors have a green light to make carefully selected new buying efforts. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

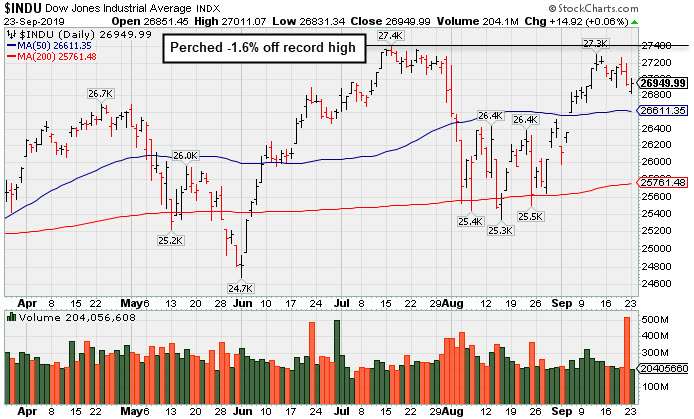

PICTURED: The Dow Jones Industrial Average is perched -1.6% off its record high.

U Stocks ended Monday mixed as investors weighed economic data and trade updates. On the data front, flash readings of manufacturing and service activity from research firm IHS Markit revealed that each of the U.S. sectors improved in September from the prior month. The updates followed disappointing manufacturing figures out of the Eurozone, with factory activity in Germany declining at its fastest pace since 2009. Treasuries strengthened, with the yield on the benchmark 10-year note down one basis points to 1.71%.

Trade remains in focus, after a Chinese delegation cancelled their planned visit to the American heartland on Friday. However, an update over the weekend revealed the U.S. requested the cancellation of the visit. Further, Beijing referred to the meetings in Washington last week as “constructive,” with U.S. officials echoing the sentiments. Following the deputy-level talks, China agreed to import 10 boat loads of soybeans ahead of high-level talks scheduled to take place on October 10th and 11th.

Seven of 11 S&P 500 sectors ended the day in positive territory with Consumer Staples outperforming. Kimberly-Clark (KMB +1.33%) rose following an analyst upgrade, while Target (TGT +1.98%) rose after an analyst reiterated his outperform rating. Facebook (FB -1.64%) fell after reports alleging that competitors are speaking to the Federal Trade Commission about the social media companies anti-competitive conduct. The Health Care sector lagged after Barron’s came out with a cautious report surrounding the opioid crisis. In commodities, WTI crude gained 0.7% to $58.48/barrel, while COMEX gold climbed 1.1%.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Commodity-Linked Groups and Semiconductor Index Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX +0.17%), Broker/Dealer Index ($XBD -0.04%), and the Retail Index ($RLX +0.08%) each finished little changed. The tech sector was mixed as the Semiconductor Index ($SOX +0.96%) outpaced the Networking Index ($NWX +0.25%), but the Biotech Index ($BTK -0.49%) finished the session with a modest loss. Commodity-linked groups had a positive bias as the Gold & Silver Index ($XAU +2.19%) outpaced the Oil Services Index ($OSX +0.57%) and the Integrated Oil Index ($XOI +0.24%).

PICTURED: The Integrated Oil Index ($XOI +0.24%) met resistance at its 200-day moving average (DMA) line in recent months.

| Oil Services |

$OSX |

72.49 |

+0.41 |

+0.57% |

-10.06% |

| Integrated Oil |

$XOI |

1,247.20 |

+2.98 |

+0.24% |

+7.60% |

| Semiconductor |

$SOX |

1,578.09 |

+15.09 |

+0.97% |

+36.61% |

| Networking |

$NWX |

562.09 |

+1.39 |

+0.25% |

+15.02% |

| Broker/Dealer |

$XBD |

273.57 |

-0.10 |

-0.04% |

+15.27% |

| Retail |

$RLX |

2,370.73 |

+1.96 |

+0.08% |

+21.49% |

| Gold & Silver |

$XAU |

96.68 |

+2.08 |

+2.20% |

+36.82% |

| Bank |

$BKX |

100.56 |

+0.17 |

+0.17% |

+17.22% |

| Biotech |

$BTK |

4,453.97 |

-21.71 |

-0.49% |

+5.52% |

|

|

|

|

Perched Near Record High, Extended From Prior Base

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Topbuild Corp (BLD +$0.12 or +0.13% to $95.24) is perched near its all-time high, extended from the prior base. Its 50-day moving average (DMA) line ($88.71) and prior highs in the $86 area define important near-term support to watch on pullbacks.

It reported earnings +39% on +9% sales revenues for the Jun '19 quarter versus the year ago period, continuing its strong earnings track record of quarterly earnings increases above the +25% minimum guideline (C criteria). It has a 99 Earnings Per Share Rating, as its annual earnings (A criteria) history has also been strong and steady since turning profitable in FY '14.

The number of top-rated funds owning its shares rose from 383 in Dec '18 to 430 in Jun '19. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of C.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

CCBG

-

NASDAQ

CCBG

-

NASDAQ

Capital City Bk Gp

BANKING - Regional - Mid-Atlantic Banks

|

$26.92

|

-0.60

-2.18% |

$27.47

|

40,743

177.14% of 50 DAV

50 DAV is 23,000

|

$28.00

-3.86%

|

9/13/2019

|

$27.03

|

PP = $27.05

|

|

MB = $28.40

|

Most Recent Note - 9/23/2019 12:07:35 PM

Most Recent Note - 9/23/2019 12:07:35 PM

Y - Pulling back today. Hit a new 52-week high on the prior session with a solid gain above the pivot point backed by +339% above average volume triggering a technical buy signal.

>>> FEATURED STOCK ARTICLE : Thinly Traded Bank Rallied To Multi-Year Highs - 9/13/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

EPAM

-

NYSE

EPAM

-

NYSE

Epam Systems Inc

COMPUTER SOFTWARE and SERVICES - Information Technology Service

|

$184.76

|

-1.03

-0.55% |

$186.90

|

191,577

52.63% of 50 DAV

50 DAV is 364,000

|

$201.00

-8.08%

|

5/9/2019

|

$169.25

|

PP = $180.55

|

|

MB = $189.58

|

Most Recent Note - 9/23/2019 5:42:06 PM

Most Recent Note - 9/23/2019 5:42:06 PM

G - A rebound above its 50 DMA line ($189.64) is still needed for its outlook to improve. Prior lows in the $174-175 area define the next important support level. Reported earnings +27% on +24% sales revenues for the Jun '19 quarter.

>>> FEATURED STOCK ARTICLE : Recent Slump Below 50-Day Average Hurt Outlook - 9/16/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

AUDC

-

NASDAQ

AUDC

-

NASDAQ

Audiocodes Ltd

ELECTRONICS - Scientific and Technical Instrum

|

$21.69

|

+0.92

4.43% |

$22.06

|

350,126

165.15% of 50 DAV

50 DAV is 212,000

|

$21.66

0.14%

|

9/13/2019

|

$19.68

|

PP = $19.84

|

|

MB = $20.83

|

Most Recent Note - 9/23/2019 12:05:34 PM

Most Recent Note - 9/23/2019 12:05:34 PM

G - Rallying further above its "max buy" level and hitting another new all-time high with today's gain. Stubbornly held its ground after 6 consecutive gains marked by volume. Its 50 DMA line ($18.11) defines important support.

>>> FEATURED STOCK ARTICLE : Recent Spurt of Gains for New Highs Marked By Volume - 9/17/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LHCG

-

NASDAQ

LHCG

-

NASDAQ

L H C Group Inc

HEALTH SERVICES - Home Health Care

|

$119.12

|

+1.47

1.25% |

$119.37

|

212,200

98.24% of 50 DAV

50 DAV is 216,000

|

$129.37

-7.92%

|

7/1/2019

|

$110.94

|

PP = $122.20

|

|

MB = $128.31

|

Most Recent Note - 9/23/2019 5:35:37 PM

Most Recent Note - 9/23/2019 5:35:37 PM

G - A rebound above its 50 DMA line ($120.74) is needed to help its outlook, however it has recently acted as resistance. The recent low ($115.06 9/10/19) defines near-term support above its 200 DMA line ($111.94).

>>> FEATURED STOCK ARTICLE : 50-Day Moving Average Recently Acted as Resistance - 9/12/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CHDN

-

NASDAQ

CHDN

-

NASDAQ

Churchill Downs Inc

LEISURE - Gaming Activities

|

$123.28

|

+0.25

0.20% |

$124.72

|

187,834

83.48% of 50 DAV

50 DAV is 225,000

|

$132.73

-7.12%

|

7/22/2019

|

$118.45

|

PP = $118.89

|

|

MB = $124.83

|

Most Recent Note - 9/23/2019 5:38:57 PM

Most Recent Note - 9/23/2019 5:38:57 PM

Y - Consolidating above its 50 DMA line ($121). Prior lows define the next important support to watch. Jun '19 earnings +10% on +26% sales revenues versus the year ago period were below the +25% minimum earnings guideline (C criteria), noted recently raising fundamental concerns. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Consolidating Above 50-Day Moving Average Line - 9/20/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

LULU

-

NASDAQ

LULU

-

NASDAQ

Lululemon Athletica

MANUFACTURING - Textile Manufacturing

|

$195.18

|

+5.88

3.11% |

$195.87

|

2,339,725

132.49% of 50 DAV

50 DAV is 1,766,000

|

$204.44

-4.53%

|

9/6/2019

|

$201.25

|

PP = $194.35

|

|

MB = $204.07

|

Most Recent Note - 9/23/2019 12:27:27 PM

Most Recent Note - 9/23/2019 12:27:27 PM

Y - Rebounding today after a loss with above average volume on the prior session undercut the prior high ($194.25). Its 50 DMA line ($186.83) defines important near-term support to watch.

>>> FEATURED STOCK ARTICLE : Consolidating Near Prior High Following Latest Breakout - 9/18/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CPRT

-

NASDAQ

CPRT

-

NASDAQ

Copart Inc

SPECIALTY RETAIL - Auto Dealerships

|

$81.80

|

-0.79

-0.95% |

$83.28

|

1,667,613

127.88% of 50 DAV

50 DAV is 1,304,000

|

$83.70

-2.28%

|

9/5/2019

|

$79.13

|

PP = $79.84

|

|

MB = $83.83

|

Most Recent Note - 9/23/2019 5:40:08 PM

Most Recent Note - 9/23/2019 5:40:08 PM

Y - Remains perched near its all-time high. Held its ground stubbornly after the big volume-driven gain above the pivot point on 9/05/19 clinched a technical buy signal. Fundamentals are strong. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Hovering Near All-Time High Following Recent Breakout - 9/19/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

BLD

-

NYSE

BLD

-

NYSE

Topbuild Corp

Bldg-Constr Prds/Misc

|

$95.24

|

+0.12

0.13% |

$96.21

|

213,825

73.23% of 50 DAV

50 DAV is 292,000

|

$96.63

-1.44%

|

5/17/2019

|

$82.19

|

PP = $87.31

|

|

MB = $91.68

|

Most Recent Note - 9/23/2019 5:34:17 PM

Most Recent Note - 9/23/2019 5:34:17 PM

G - Perched near its all-time high, extended from the prior base. Earnings rose +39% on +9% sales revenues for the Jun '19 quarter versus the year ago period. Its 50 DMA line ($88.71) defines important support to watch along with its prior low ($86.53 on 8/28/19). See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Perched Near Record High, Extended From Prior Base - 9/23/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PAGS

-

NYSE

PAGS

-

NYSE

Pagseguro Digital Cl A

Finance-CrdtCard/PmtPr

|

$46.16

|

-1.33

-2.80% |

$47.42

|

1,153,048

56.16% of 50 DAV

50 DAV is 2,053,000

|

$53.43

-13.61%

|

6/25/2019

|

$37.69

|

PP = $40.07

|

|

MB = $42.07

|

Most Recent Note - 9/23/2019 5:37:48 PM

Most Recent Note - 9/23/2019 5:37:48 PM

G - Quietly slumped back below its 50 DMA line ($47.40) again raising concerns. Prior lows in the $42-43 area define the next important chart support level to watch. Fundamentals are strong.

>>> FEATURED STOCK ARTICLE : 50-Day Moving Average Violation Triggered Technical Sell Signal - 9/11/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|