Met Resistance at 50-Day Moving Average Line - Thursday, January 20, 2022

Avantor Inc (AVTR -$0.22 or -0.59% to $36.93) met resistance near its 50-day moving average (DMA) line recently when rebounding, and yet it has still been finding support near its 200 DMA line ($37.16) and prior low. Its Relative Strength Rating has slumped to 77, below the 80+ minimum guideline for buy candidates. A rebound above the 50 DMA line ($39.25) is needed for its outlook to improve.

It has an Earnings Per Share Rating of 97 based on strong fundamentals. The Sep '21 quarter marked its 5th consecutive quarterly comparison with earnings above the year ago period by at least the +25% minimum guideline (C criteria). Annual earnings growth has been strong (A criteria). Bullish action came after it reported Sep '21 quarterly earnings +46% above the year ago period.

AVTR traded up as much as +34.7% after highlighted in the 6/10/21 mid-day report (read here) yellow with pivot point cited based on its 4/29/21 high plus 10 cents. It completed a Secondary Offering on 9/13/21. It was last shown in this FSU section on 12/21/21 with an annotated graph included with additional analysis under the headline, "Rebounding With Volume-Driven Gains".

Following its $14 IPO on 5/17/19 it completed Secondary Offerings on 5/21/20, 8/21/20 and 11/09/20. The high-ranked Medical-Research Eqp/Svc firm has seen the number of top-rated funds owning its shares rise from 562 in Jun '20 to 1,308 in Dec '21 a reassuring sign concerning the I criteria. Its current Up/Down Volume ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of B and a Sponsorship Rating of B.

Rebounding With Volume-Driven Gains - Tuesday, December 21, 2021

Avantor Inc (AVTR +$1.45 or +3.67% to $40.95) posted a 3rd solid volume-driven gain in the span of 5 sessions, rebounding further above its 50-day moving average (DMA) line ($39) helping its technical stance improve. It still faces resistance due to overhead supply up to the $44 level. Prior lows in the high $36 area define important near-term support.

It has an Earnings Per Share Rating of 97 based on strong fundamentals. The Sep '21 quarter marked its 5th consecutive quarterly comparison with earnings above the year ago period by at least the +25% minimum guideline (C criteria). Annual earnings growth has been strong (A criteria). Bullish action came after it reported Sep '21 quarterly earnings +46% above the year ago period.

AVTR traded up as much as +34.7% since highlighted in the 6/10/21 mid-day report (read here) yellow with pivot point cited based on its 4/29/21 high plus 10 cents. It completed a Secondary Offering on 9/13/21. It was last shown in this FSU section on 11/12/21 with an annotated graph included with additional analysis under the headline, "Faces Resistance While Sputtering Below 50 DMA Line".

Following its $14 IPO on 5/17/19 it completed Secondary Offerings on 5/21/20, 8/21/20 and 11/09/20. The high-ranked Medical-Research Eqp/Svc firm has seen the number of top-rated funds owning its shares rise from 562 in Jun '20 to 1,234 in Sep '21 a reassuring sign concerning the I criteria. Its current Up/Down Volume ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days. It has a Timeliness Rating of B and a Sponsorship Rating of B.

Faces Resistance While Sputtering Below 50 DMA Line - Friday, November 12, 2021

Avantor Inc (AVTR -$0.50 or -1.30% to $38.03) has sputtered in recent weeks after meeting resistance at its 50-day moving average (DMA) line ($40.22). Resistance remains due to overhead supply up to the $44 level. A rebound above the 50 DMA line is needed for its outlook to improve. It completed a Secondary Offering on 9/13/21 while perched at its all-time high, very extended from any sound base.

It has an Earnings Per Share Rating of 97 based on strong fundamentals. The Sep '21 quarter marked its 5th consecutive quarterly comparison with earnings above the year ago period by at least the +25% minimum guideline (C criteria). Annual earnings growth has been strong (A criteria). Bullish action came after it reported Sep '21 quarterly earnings +46% above the year ago period.

AVTR traded up as much as +34.7% since highlighted in the 6/10/21 mid-day report (read here) yellow with pivot point cited based on its 4/29/21 high plus 10 cents. It was last shown in this FSU section on 10/11/21 with an annotated graph included with additional analysis under the headline, "Pulled Back Finding Support Near 50-Day Moving Average".

Following its $14 IPO on 5/17/19 it completed Secondary Offerings on 5/21/20, 8/21/20 and 11/09/20. The high-ranked Medical-Research Eqp/Svc firm has seen the number of top-rated funds owning its shares rise from 562 in Jun '20 to 1,219 in Sep '21 a reassuring sign concerning the I criteria. Its current Up/Down Volume ratio of 1.1 is an unbiased indication its shares have been under slight accumulation over the past 50 days. It has a Timeliness Rating of B and a Sponsorship Rating of B.

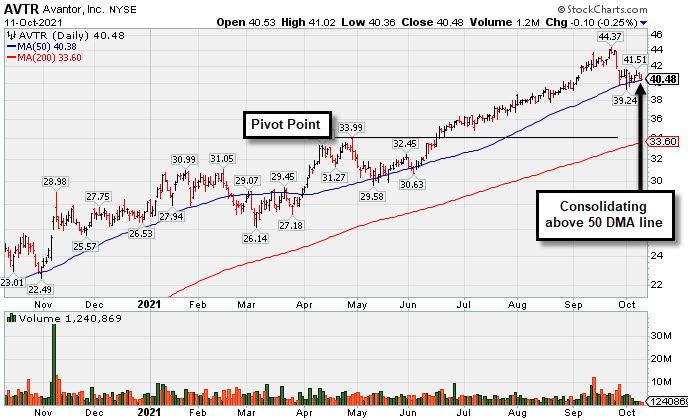

Pulled Back Finding Support Near 50-Day Moving Average - Monday, October 11, 2021

Avantor Inc (AVTR -$0.10 or -0.25% to $40.48) is still finding support at its 50-day moving average (DMA) line ($40.48). A damaging violation of the 50 DMA line and recent low ($39.24) may trigger technical sell signals. It completed a Secondary Offering on 9/13/21 while perched at its all-time high, very extended from any sound base.

AVTR has traded up as much as +34.7% since highlighted in the 6/10/21 mid-day report (read here) yellow with pivot point cited based on its 4/29/21 high plus 10 cents. It was last shown in this FSU section on 8/27/21 with an annotated graph included with additional analysis under the headline, "Steady Progress Made Since Featured". It has an Earnings Per Share Rating of 97 based on strong fundamentals. The Jun '21 quarter marked its 4th consecutive quarterly comparison with earnings above the year ago period by at least the +25% minimum guideline (C criteria). Annual earnings growth has been strong (A criteria).

Following its $14 IPO on 5/17/19 it completed Secondary Offerings on 5/21/20, 8/21/20 and 11/09/20. The high-ranked Medical-Research Eqp/Svc firm has seen the number of top-rated funds owning its shares rise from 562 in Jun '20 to 1,178 in Jun '21 a reassuring sign concerning the I criteria. Its current Up/Down Volume ratio of 1.7 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of B.

Steady Progress Made Since Featured - Friday, August 27, 2021

Avantor Inc (AVTR -$0.10 or -0.25% to $39.28) paused on Friday. It has been quietly wedging into new all-time high territory, and it is extended from any sound base. Its 50-day moving average (DMA) line ($37.12) defines near-term support to watch on pullback.

AVTR has traded up as much as +22% since highlighted in the 6/10/21 mid-day report (read here) yellow with pivot point cited based on its 4/29/21 high plus 10 cents. It was last shown in this FSU section on 7/12/21 with an annotated graph included with additional analysis under the headline, "Held Ground But Made Little Price Progress Since Featured". It has an Earnings Per Share Rating of 97 based on strong fundamentals. The Mar '21 quarter marked its 3rd consecutive quarterly comparison with earnings above the year ago period by at least the +25% minimum guideline (C criteria). Annual earnings growth has been strong (A criteria).

Following its $14 IPO on 5/17/19 it completed Secondary Offerings on 5/21/20, 8/21/20 and 11/09/20. The high-ranked Medical-Research Eqp/Svc firm has seen the number of top-rated funds owning its shares rise from 562 in Jun '20 to 1,148 in Jun '21 a reassuring sign concerning the I criteria. Its current Up/Down Volume ratio of 2.0 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of B.

Held Ground But Made Little Price Progress Since Featured - Wednesday, July 14, 2021

Avantor Inc (AVTR $36.05) has stubbornly held its ground but made little progress since triggering a technical buy signal. Prior highs and its 50-day moving average (DMA) line coincide in the $33 area defining important support to watch on pullbacks.

AVTR was highlighted in the 6/10/21 mid-day report (read here) yellow with pivot point cited based on its 4/29/21 high plus 10 cents. An annotated graph was included with additional analysis that evening under the headline, "Medical Research Firm Challenging Prior High".

It has an Earnings Per Share Rating of 97 based on strong fundamentals. The Mar '21 quarter marked its 3rd consecutive quarterly comparison with earnings above the year ago period by at least the +25% minimum guideline (C criteria). Annual earnings growth has been strong (A criteria).

Following its $14 IPO on 5/17/19 it completed Secondary Offerings on 5/21/20, 8/21/20 and 11/09/20. The high-ranked Medical-Research Eqp/Svc firm has seen the number of top-rated funds owning its shares rise from 562 in Jun '20 to 1,088 in Jun '21 a reassuring sign concerning the I criteria. Its current Up/Down Volume ratio of 1.1 is an unbiased indication its shares have been under slight accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of B.

Medical Research Firm Challenging Prior High - Thursday, June 10, 2021

Avantor Inc (AVTR +$1.60 or +5.02% to $33.47 ) finished at the session high with volume +28% above average behind today's big gain. It was highlighted in the earlier mid-day report (read here) yellow with pivot point cited based on its 4/29/21 high plus 10 cents. Found support at its 50 DMA line during the recent consolidation. Subsequent gains above the pivot point backed by at least +40% are needed to trigger a proper technical buy signal.

It has an Earnings Per Share Rating of 97 based on strong fundamentals. The Mar '21 quarter marked its 3rd consecutive quarterly comparison with earnings above the year ago period by at least the +25% minimum guideline (C criteria). Annual earnings growth has been strong (A criteria).

Following its $14 IPO on 5/17/19 it completed Secondary Offerings on 5/21/20, 8/21/20 and 11/09/20. The high-ranked Medical-Research Eqp/Svc firm has seen the number of top-rated funds owning its shares rise from 562 in Jun '20 to 1,001 in Mar '21 a reassuring sign concerning the I criteria. Its current Up/Down Volume ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a Timeliness Rating of A and a Sponsorship Rating of B.