You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Wednesday, April 9, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, AUGUST 21ST, 2015

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-530.94 |

16,459.75 |

-3.12% |

|

Volume |

1,300,867,650 |

+44% |

|

Volume |

2,542,812,800 |

+29% |

|

NASDAQ |

-171.45 |

4,706.04 |

-3.52% |

|

Advancers |

448 |

14% |

|

Advancers |

833 |

27% |

|

S&P 500 |

-64.84 |

1,970.89 |

-3.19% |

|

Decliners |

2,687 |

86% |

|

Decliners |

2,209 |

73% |

|

Russell 2000 |

-15.74 |

1,156.79 |

-1.34% |

|

52 Wk Highs |

0 |

|

|

52 Wk Highs |

13 |

|

|

S&P 600 |

-9.39 |

676.91 |

-1.37% |

|

52 Wk Lows |

627 |

|

|

52 Wk Lows |

345 |

|

|

Professional Money Management Services - A Winning System - Inquire today!

Our skilled portfolio manager knows how to follow the rules of this fact-based investment system. We do not follow opinion or the "conviction list" of some large Wall Street institution which would have us fully invested even during horrific bear markets. Instead, we remain fluid and only buy the best stocks when they are triggering proper technical buy signals. If you are not completely satisfied with the way your portfolio is being managed, Click here and indicate "Find a Broker" to get connected with our portfolio managers. *Accounts over $250,000 please. ** Serious inquires only, please.

|

|

Leadership Evaporates and "Correction" Takes Indices Much Lower

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

For the week, the Dow and S&P 500 lost 5.8%, while the NASDAQ tumbled 6.8%. Technical deterioration in the charts of the major averages (M criteria) coupled with an evaporation of leadership earned the label of a market "correction". U.S. stocks experienced their worst session of the year on Friday. The Dow slid 530 points to 16459. The S&P 500 fell 64 points to 1970. The NASDAQ declined 171 points to 4706. The volume totals were inflated by options expirations and totals were reported much higher than the prior session on the NYSE and on the Nasdaq exchange, a sign of increasing selling pressure coming from the institutional crowd. Breadth was solidly negative as decliners led advancers by a 6-1 margin on the NYSE and 11-4 on the Nasdaq exchange. Leadership completely evaporated as there were zero high-ranked companies from the Leaders List that made new 52-week highs and appeared on the BreakOuts Page, down from the prior session total of 4 stocks, and down considerably from 107 back on July 16th. There were losses for 11 of the 12 high-ranked companies currently on the Featured Stocks Page, a list that has been getting trimmed lately - as market action dictates! The number of new 52-week lows swelled again and solidly outnumbered new 52-week highs on both the Nasdaq and on the NYSE.

PICTURED: The Dow Jones Industrial Average has seen losses on higher volume totals and gains were backed by light volume.

The S&P 500 Index and Nasdaq Composite Index both violated their 200-day moving average (DMA) lines and undercut their July lows with big losses on higher volume. The Dow Jones Industrial Average and S&P 500 both fell to lows not seen since October 2014.

Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price. This is precisely how the fact-based investment system prompts investors to reduce exposure in weak markets, preserving cash until another confirmed rally marked by solid leadership.

The major averages retreated, capping their worst week since 2011. Investors flocked to government bonds and gold as the rout in global equities deepened. Chinese manufacturing data released overnight triggered losses in the emerging markets, which spread to Europe and the U.S. In domestic news, U.S. manufacturing PMI came in at the lowest level since 2012.

Volume in the final hour of the session spiked to four times average trading activity. All ten sectors in the S&P 500 finished in the red, with five sectors dropping at least -3%. Energy, tech and consumer discretionary stocks were the worst performers. Apple (AAPL -5.9%) tumbled. Exxon (XOM -3.3%) and Amazon (AMZN -3.6%) paced the losses. In earnings, economic bellwether Deere & Co (DE -8.1%) slid after missing on revenue and lowering forward guidance.

Treasuries gained as investors flocked to perceived “safe-haven” assets. The 10-year note climbed 5/32 to yield 2.05%. Commodities were mostly lower, with gold representing the lone exception. WTI crude declined 2.6% to $40.24/barrel. COMEX gold finished 0.6% higher to $1159.60/ounce. In FOREX, the Dollar Index retreated 1% with weakness against the yen and euro.

The number of stocks currently listed to the Featured Stocks Page has waned based on deteriorating market conditions. The most current notes with headline links help members have access to more detailed letter-by-letter analysis including price/volume graphs annotated by our experts. See the Premium Member Homepage for archives to all prior pay reports.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Retail, Tech, and Commodity-Linked Groups Dive

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

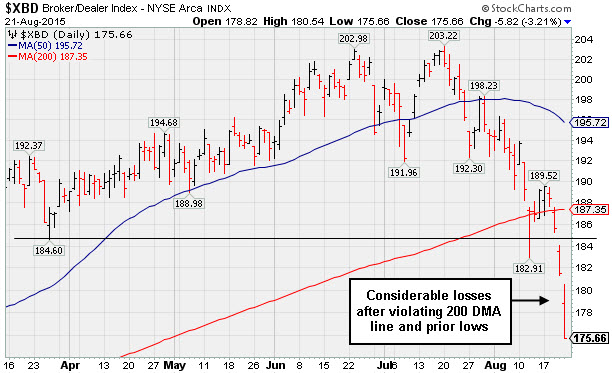

The Retail Index ($RLX -3.96%) slumped badly and financial shares were a negative influence on the major averages as the Broker/Dealer Index ($XBD -3.21%) and the Bank Index ($BKX -3.09%) fell hard again on Friday. The tech sector was punished as the Biotechnology Index ($BTK -2.34%), Semiconductor Index ($SOX -2.72%), and the Networking Index ($NWX -1.25%) suffered unanimous losses. Energy-linked groups were down again as the Oil Services Index ($OSX -2.33%) and the Integrated Oil Index ($XOI -3.72%) both sank again. The Gold & Silver Index ($XAU +-2.94%) also fell.

PICTURED: The Broker/Dealer Index ($XBD -3.21%) suffered considerable losses after violating the prior lows and its 200 DMA line.

PICTURED: The Bank Index ($BKX -3.09%) violated prior lows and its 200 DMA line. Longtime readers of this commentary may remember that weak action from financial shares hurts the broader market outlook because financial stocks have a history of being reliable "leading indicators".

| Oil Services |

$OSX |

163.60 |

-3.90 |

-2.33% |

-22.42% |

| Integrated Oil |

$XOI |

1,103.18 |

-42.63 |

-3.72% |

-18.17% |

| Semiconductor |

$SOX |

578.59 |

-16.19 |

-2.72% |

-15.76% |

| Networking |

$NWX |

368.77 |

-4.66 |

-1.25% |

+3.03% |

| Broker/Dealer |

$XBD |

175.66 |

-5.82 |

-3.21% |

-4.86% |

| Retail |

$RLX |

1,176.73 |

-48.46 |

-3.96% |

+13.94% |

| Gold & Silver |

$XAU |

52.17 |

-1.58 |

-2.94% |

-24.15% |

| Bank |

$BKX |

72.99 |

-2.33 |

-3.09% |

-1.71% |

| Biotech |

$BTK |

3,765.77 |

-90.26 |

-2.34% |

+9.50% |

|

|

|

|

JAZZ Off Key Due to Fundamental and Technical Deterioration

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Jazz Pharmaceuticals Plc (JAZZ -$11.38 or -6.26% to $170.32) violated its 200-day moving average (DMA) line with a damaging volume-driven loss triggering another technical sell signal. Fundamental concerns were recently noted after it reported earnings +19% on +15% sales revenues for the Jun '15 quarter, below the +25% minimum earnings guideline (C criteria). Due to fundamental and technical deterioration it will be dropped from the Featured Stocks list tonight.

It stalled following its last appearance in this FSU section on 7/29/15 with annotated graphs under the headline, "No Resistance Due to Overhead Supply For Drug Firm". It was highlighted in yellow with pivot point cited based on its 4/27/15 high plus 10 cents in the 7/29/15 mid-day report (read here) perched near its 52-week high following a technical breakout with a considerable volume-driven gain.

Its annual earnings (A criteria) history, after years of losses, shows earnings per share of $1.55, $3.52, $4.82, $6.31, and $8.40 from FY '10 through '14. The number of top-rated funds owning its shares rose from 661 in Sep '14 to 819 in Jun '15, a very reassuring sign concerning the I criteria. The Medical - Ethical Drugs group is currently showing good leadership (L criteria) while coming in with an A+ rating for its Group Relative Strength.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

BOFI

-

NASDAQ

B O F I Holding Inc

BANKING - Savings andamp; Loans

|

$123.99

|

-4.41

-3.43% |

$127.50

|

528,458

221.11% of 50 DAV

50 DAV is 239,000

|

$134.79

-8.01%

|

6/10/2015

|

$101.47

|

PP = $97.78

|

|

MB = $102.67

|

Most Recent Note - 8/21/2015 12:18:24 PM

Most Recent Note - 8/21/2015 12:18:24 PM

G - Pulling back today with higher volume amid widespread market weakness (M criteria). Very extended from its prior base. Near term support to watch is at its 50 DMA line ($114.96).

>>> FEATURED STOCK ARTICLE : Hovering Near Highs Very Extended From Sound Base - 8/20/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

AHS

-

NYSE

A M N Healthcare Svcs

DIVERSIFIED SERVICES - Staffing and Outsourcing Service

|

$34.12

|

-1.33

-3.75% |

$34.62

|

1,402,024

204.68% of 50 DAV

50 DAV is 685,000

|

$37.25

-8.40%

|

8/5/2015

|

$34.50

|

PP = $32.53

|

|

MB = $34.16

|

Most Recent Note - 8/21/2015 12:16:25 PM

Most Recent Note - 8/21/2015 12:16:25 PM

G - Gapped down today amid widespread market weakness (M criteria). Undercut its "max buy" level and traded near prior highs in the $32 area defining initial support to watch above its 50 DMA line.

>>> FEATURED STOCK ARTICLE : Gap Up Gain Triggered Technical Buy Signal Following Earnings - 8/5/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ILMN

-

NASDAQ

Illumina Inc

DRUGS - Biotechnology

|

$199.95

|

-0.48

-0.24% |

$202.54

|

1,849,271

126.66% of 50 DAV

50 DAV is 1,460,000

|

$242.37

-17.50%

|

6/8/2015

|

$209.97

|

PP = $213.43

|

|

MB = $224.10

|

Most Recent Note - 8/21/2015 4:44:12 PM

Most Recent Note - 8/21/2015 4:44:12 PM

Will be dropped from the Featured Stocks list tonight. Testing its 200 DMA line that defines very important near-term support. Widespread market weakness (M criteria) is cause for concern.

>>> FEATURED STOCK ARTICLE : Sputtering Below 50-Day Average and Below Prior Highs - 8/18/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

JAZZ

-

NASDAQ

Jazz Pharmaceuticals Plc

DRUGS - Biotechnology

|

$170.32

|

-11.38

-6.26% |

$180.50

|

943,245

223.89% of 50 DAV

50 DAV is 421,300

|

$194.73

-12.54%

|

7/29/2015

|

$190.13

|

PP = $191.11

|

|

MB = $200.67

|

Most Recent Note - 8/21/2015 4:28:22 PM

Most Recent Note - 8/21/2015 4:28:22 PM

Violated its 200 DMA line today with a damaging volume-driven loss triggering another technical sell signal. Fundamental concerns were recently noted after it reported earnings +19% on +15% sales revenues for the Jun '15 quarter, below the +25% minimum earnings guideline (C criteria). It will be dropped from the Featured Stocks list tonight.

>>> FEATURED STOCK ARTICLE : JAZZ Off Key Due to Fundamental and Technical Deterioration - 8/21/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

VRX

-

NYSE

Valeant Pharmaceuticals

DRUGS - Drug Manufacturers - Other

|

$222.19

|

-6.87

-3.00% |

$228.28

|

3,924,010

233.02% of 50 DAV

50 DAV is 1,684,000

|

$263.81

-15.78%

|

7/14/2015

|

$236.75

|

PP = $246.11

|

|

MB = $258.42

|

Most Recent Note - 8/21/2015 4:37:44 PM

Most Recent Note - 8/21/2015 4:37:44 PM

G - Slumped further below its 50 DMA line after damaging volume-driven losses triggering a technical sell signal. Widespread market weakness (M criteria) is cause for concern.

>>> FEATURED STOCK ARTICLE : Holding Ground Following Latest Technical Breakout - 8/3/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

USNA

-

NYSE

U S A N A Health Science

DRUGS - Drug Related Products

|

$153.13

|

-4.22

-2.68% |

$156.91

|

172,694

129.85% of 50 DAV

50 DAV is 133,000

|

$176.88

-13.43%

|

8/5/2015

|

$157.22

|

PP = $145.15

|

|

MB = $152.41

|

Most Recent Note - 8/21/2015 4:35:07 PM

Most Recent Note - 8/21/2015 4:35:07 PM

G -Suffered a 6th consecutive loss and volume was higher today. Prior highs in the $145 area define initial support to watch. Widespread market weakness (M criteria) is cause for concern.

>>> FEATURED STOCK ARTICLE : Abrupt Retreat Following Breakout for Stock With Small Supply - 8/6/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ACHC

-

NASDAQ

Acadia Healthcare Inc

HEALTH SERVICES - Specialized Health Services

|

$73.69

|

-2.35

-3.08% |

$75.01

|

1,433,332

189.34% of 50 DAV

50 DAV is 757,000

|

$85.62

-13.94%

|

5/27/2015

|

$73.90

|

PP = $74.19

|

|

MB = $77.90

|

Most Recent Note - 8/21/2015 4:39:41 PM

Most Recent Note - 8/21/2015 4:39:41 PM

G - Slumped well below its 50 DMA line with volume-driven losses triggering technical sell signals. Completed a Secondary Offering on 8/12/15. Widespread market weakness (M criteria) is cause for concern.

>>> FEATURED STOCK ARTICLE : Pullback Followed Another Strong Quarter Reported With Acceleration - 8/4/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

JLL

-

NYSE

Jones Lang Lasalle Inc

REAL ESTATE - Property Management/Developmen

|

$162.55

|

-6.30

-3.73% |

$167.72

|

397,581

145.63% of 50 DAV

50 DAV is 273,000

|

$179.97

-9.68%

|

6/4/2015

|

$172.34

|

PP = $174.93

|

|

MB = $183.68

|

Most Recent Note - 8/21/2015 4:31:48 PM

Most Recent Note - 8/21/2015 4:31:48 PM

Testing support at its 200 DMA line today after triggering a technical sell signal with volume-driven losses. Fundamental concerns were raised as Jun '15 earnings were +20% on +8% sales revenues, below the +25% minimum earnings guideline (C criteria). It will be dropped from the Featured Stocks Iist tonight.

>>> FEATURED STOCK ARTICLE : Fundamental Concerns Raised - Earnings Below +25% Guideline - 8/17/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

RH

-

NYSE

Restoration Hardware Hld

RETAIL - Home Furnishing Stores

|

$94.97

|

-1.71

-1.77% |

$96.66

|

1,035,217

132.04% of 50 DAV

50 DAV is 784,000

|

$105.98

-10.39%

|

7/28/2015

|

$102.40

|

PP = $102.10

|

|

MB = $107.21

|

Most Recent Note - 8/21/2015 4:48:49 PM

Most Recent Note - 8/21/2015 4:48:49 PM

G - Violated its 50 DMA line and recent low ($96.13 on 8/12/15) raising concerns and triggering worrisome technical sell signals. Color code is changed to green and the 200 DMA line defines important near-term support to watch.

>>> FEATURED STOCK ARTICLE : Slumped Quietly Below 50-Day Moving Average Line - 8/19/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$162.57

|

-8.73

-5.10% |

$168.46

|

1,808,070

272.71% of 50 DAV

50 DAV is 663,000

|

$176.77

-8.03%

|

5/29/2015

|

$155.03

|

PP = $159.95

|

|

MB = $167.95

|

Most Recent Note - 8/21/2015 1:23:47 PM

Most Recent Note - 8/21/2015 1:23:47 PM

G - Undercutting recent lows and its 50 DMA line raising concerns with today's gap down and volume-driven loss amid broad based market (M criteria) weakness.

>>> FEATURED STOCK ARTICLE : Recent Gains Have Still Lacked Substantial Volume Conviction - 8/13/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

LXFT

-

NYSE

Luxoft Holding Inc Cl A

Comp Sftwr-Spec Enterprs

|

$60.43

|

-2.54

-4.03% |

$62.81

|

510,351

193.31% of 50 DAV

50 DAV is 264,000

|

$68.16

-11.34%

|

5/26/2015

|

$51.90

|

PP = $57.40

|

|

MB = $60.27

|

Most Recent Note - 8/21/2015 12:50:43 PM

Most Recent Note - 8/21/2015 12:50:43 PM

G - On track for a 6th consecutive loss today, slumping near its 50 DMA line ($60.23) and prior lows ($58.82 on 8/06/15) defining near-term support. More damaging losses would raise concerns and trigger technical sell signals.

>>> FEATURED STOCK ARTICLE : Earnings News Often Leads to Greater Volume and Volatility - 8/10/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

INGN

-

NASDAQ

Inogen Inc

HEALTH SERVICES - Medical Instruments and Supplies

|

$49.98

|

+0.56

1.13% |

$50.38

|

229,158

85.83% of 50 DAV

50 DAV is 267,000

|

$51.86

-3.63%

|

8/12/2015

|

$49.01

|

PP = $45.85

|

|

MB = $48.14

|

Most Recent Note - 8/21/2015 4:46:19 PM

Most Recent Note - 8/21/2015 4:46:19 PM

G - Stubbornly holding its ground after rallying above its "max buy" level. Prior highs near $45 define initial support above its 50 DMA line. Widespread market weakness (M criteria) is cause for concern.

>>> FEATURED STOCK ARTICLE : Finished Strong With Volume-Driven Breakout Gain - 8/12/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|