You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Sunday, March 23, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, DECEMBER 17TH, 2019

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+31.27 |

28,267.16 |

+0.11% |

|

Volume |

935,922,270 |

-13% |

|

Volume |

2,305,042,140 |

-0% |

|

NASDAQ |

+9.13 |

8,823.36 |

+0.10% |

|

Advancers |

1,804 |

63% |

|

Advancers |

1,758 |

56% |

|

S&P 500 |

+1.07 |

3,192.52 |

+0.03% |

|

Decliners |

1,073 |

37% |

|

Decliners |

1,392 |

44% |

|

Russell 2000 |

+7.63 |

1,657.56 |

+0.46% |

|

52 Wk Highs |

179 |

|

|

52 Wk Highs |

245 |

|

|

S&P 600 |

+7.79 |

1,015.72 |

+0.77% |

|

52 Wk Lows |

13 |

|

|

52 Wk Lows |

58 |

|

|

|

Major Indices Ratcheted to New Record Highs

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

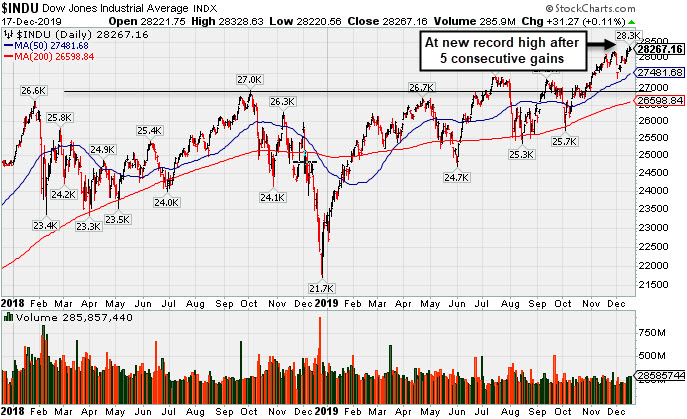

The Dow gained 31 points, while the S&P 500 finished just above the flat line. The Nasdaq Composite advanced 0.1%. Advancers led decliners by more than a 3-2 margin on the NYSE and by a narrower 9-7 margin on the Nasdaq exchange. The volume totals were lighter than the prior session on the NYSE and on the Nasdaq exchange. There were 60 high-ranked companies from the Leaders List that hit a new 52-week high and were listed on the BreakOuts Page, versus the total of 101 on the prior session. New 52-week highs totals contracted yet still easily outnumbered new 52-week lows totals on the NYSE and on the Nasdaq exchange. The major indices (M criteria) are in a "confirmed uptrend" after enduring distributional pressure in recent weeks. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The Dow Jones Industrial Average is perched at a record high after posting its 5th gain. It recently found support well above prior highs and above its 50-day moving average (DMA) line.

U.S. stocks inched higher on Tuesday, notching fresh record highs and extending their recent rally to five straight sessions. Upbeat economic data updates, and continued optimism around the U.S. and China “phase one” trade deal bolstered risk sentiment.

On the data front, housing starts jumped 3.2% in November, while the prior month’s reading was upwardly revised to 4.5% from 3.8%. A separate update showed building permits unexpectedly climbed 1.4% in November to the highest level since 2007. Another report showed U.S. factory production rebounded 1.1% last month, the largest advance since early 2018. Separately, the Jobs Openings and Labor Turnover Survey (JOLTS) revealed job openings increased to 7.2 million in October. Treasuries was little changed along the curve, with the yield on the benchmark 10-year note holding steady at 1.88%. In commodities, WTI crude gained 1.2% to $60.90/barrel, the highest in three months.

In corporate news, Netflix (NFLX +3.70%) rose following reports of accelerating growth in its Asia-Pacific segment. Elsewhere, consumer goods giant Unilever (UL -9.09%) fell after issuing a profit warning. In earnings, Navistar International (NAV -10.45%) fell after the truck maker missed consensus revenue forecasts amid decreased demand and constraints in supplier production.

Investors also kept tabs on geopolitical developments across the pond. Reports suggested that U.K. Prime Minister Boris Johnson could use his newly won Parliamentary majority to prevent any extension to the post-Brexit transition period, thus renewing concerns of a no-deal Brexit.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Retail, Financial, Semiconductor, and Networking Indexes Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Broker/Dealer Index ($XBD +0.50%) and Bank Index ($BKX +0.79%) gained ground along with the Retail Index ($RLX +0.85%). The tech sector was mixed as | | | |