You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, February 3, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - THURSDAY, DECEMBER 12TH, 2019

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+220.75 |

28,132.05 |

+0.79% |

|

Volume |

892,638,620 |

+19% |

|

Volume |

2,382,926,850 |

+20% |

|

NASDAQ |

+63.27 |

8,717.32 |

+0.73% |

|

Advancers |

1,772 |

62% |

|

Advancers |

2,002 |

63% |

|

S&P 500 |

+26.94 |

3,168.57 |

+0.86% |

|

Decliners |

1,086 |

38% |

|

Decliners |

1,173 |

37% |

|

Russell 2000 |

+12.89 |

1,644.81 |

+0.79% |

|

52 Wk Highs |

215 |

|

|

52 Wk Highs |

328 |

|

|

S&P 600 |

+10.55 |

1,009.59 |

+1.06% |

|

52 Wk Lows |

21 |

|

|

52 Wk Lows |

65 |

|

|

|

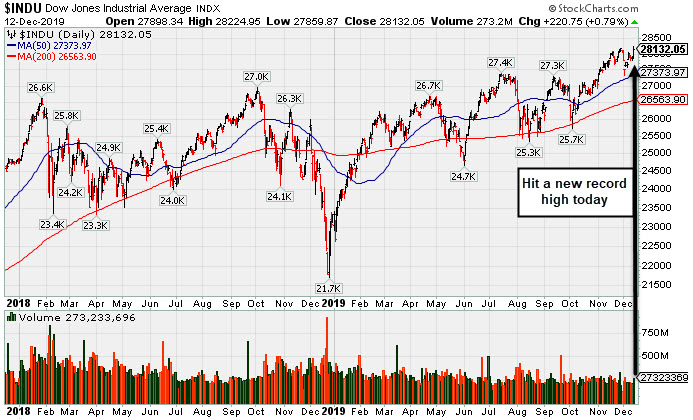

Major Indices Surged to New Record Highs

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Dow rallied 220 points, closing within 0.1% of its all-time high. The S&P 500 jumped 0.9%, and the Nasdaq Composite climbed 0.7%, to send both indexes to their first record levels since November 27. Breadth was positive as advancers led decliners by a 3-2 margin on the NYSE and 5-3 on the Nasdaq exchange. The volume totals were higher than the prior session on the NYSE and on the Nasdaq exchange, indicative of greater institutional buying demand. Leadership expanded as there were 107 high-ranked companies from the Leaders List that hit a new 52-week high and were listed on the BreakOuts Page, versus the total of 48 on the prior session. New 52-week highs totals expanded and easily outnumbered new 52-week lows totals on the NYSE and on the Nasdaq exchange. The major indices (M criteria) are in a "confirmed uptrend" after enduring distributional pressure in recent weeks. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The Dow Jones Industrial Average hit a new record high. It recently found support above prior highs and above its 50-day moving average (DMA) line.

Stock finished firmly higher on Thursday, as investors digested updates on the trade front. A report revealed Washington and Beijing had reached a phase-one deal in principle that awaited President Trump’s approval. The agreement is widely expected to delay U.S. tariffs that are set to take place on December 15, and reduce existing duties.

Amid the risk-on mood, perceived safe-haven assets retreated. Treasuries posted their largest decline since mid-September, with the yield on the 10-year note jumping ten basis points to 1.89%. COMEX gold slipped 0.1% to $1,468.50/ounce.

Seven of 11 S&P 500 sectors ended the session in positive territory. The Financials group paced the gains, jumping 2%, amid a spike in Treasury yields. Energy also outperformed as WTI crude added 1.1% to $59.42/barrel. Meanwhile, the Communication Services sector was weighed down by Facebook (FB -3.72%) amid news the FTC may seek a preliminary injunction against the social media giant, with federal officials citing antitrust concerns.

In central bank news, both the European Central Bank and Federal Reserve left respective key rates unchanged in policy decisions this week. Fed Chair Jerome Powell reiterated on Wednesday that the current state of policy is likely to remain appropriate. On the data front, initial jobless claims jumped to a two-year high to 252,000. Separately, core producer price index (ex-food and energy), dipped to 1.3% year-over-year.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Energy, and Tech Indexes Led Group Gainers

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX +2.88%) and Broker/Dealer Index ($XBD +2.04%) both posted solid gains while the Retail Index ($RLX +0.66%) also edged higher. The tech sector had a positive bias as the Semiconductor Index ($SOX +2.71%) and Networking Index ($NWX +2.59%) both posted solid gains and outpaced the | | | |