You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, February 3, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - MONDAY, DECEMBER 9TH, 2019

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-105.46 |

27,909.60 |

-0.38% |

|

Volume |

860,565,750 |

+1% |

|

Volume |

2,067,454,940 |

+3% |

|

NASDAQ |

-34.70 |

8,621.83 |

-0.40% |

|

Advancers |

1,488 |

52% |

|

Advancers |

1,353 |

43% |

|

S&P 500 |

-9.95 |

3,135.96 |

-0.32% |

|

Decliners |

1,394 |

48% |

|

Decliners |

1,766 |

57% |

|

Russell 2000 |

-4.22 |

1,629.62 |

-0.26% |

|

52 Wk Highs |

106 |

|

|

52 Wk Highs |

122 |

|

|

S&P 600 |

-3.07 |

999.06 |

-0.31% |

|

52 Wk Lows |

18 |

|

|

52 Wk Lows |

59 |

|

|

|

Major Indices Pulled Back With Less Leadership

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Dow slipped 105 points, breaking a three day winning streak. The S&P 500 declined 0.3%, while the Nasdaq Composite dropped 0.4%. Advancers led decliners by a narrow margin on the NYSE but decliners led advancers by a 9-7 margin on the Nasdaq exchange. The volume totals were higher than the prior session on the NYSE and on the Nasdaq exchange. Leadership thinned as there were 40 high-ranked companies from the Leaders List that hit a new 52-week high and were listed on the BreakOuts Page, versus the total of 68 on the prior session. New 52-week highs totals contracted yet solidly outnumbered new 52-week lows totals on the NYSE and on the Nasdaq exchange. The major indices (M criteria) are in a "confirmed uptrend" after enduring distributional pressure in recent weeks. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

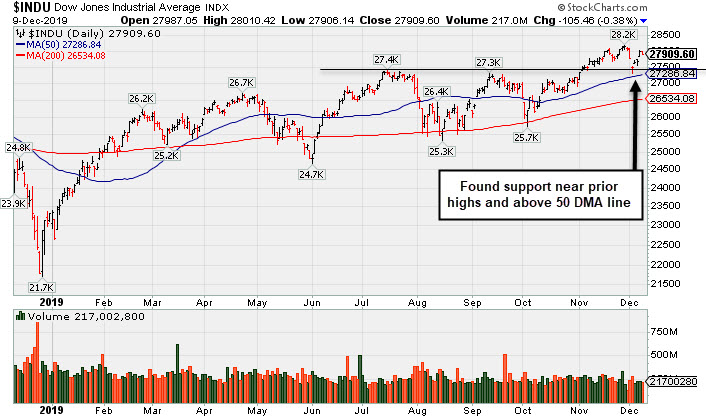

PICTURED: The Dow Jones Industrial Average is near its record high. It recently found support near prior highs and above its 50-day moving average (DMA) line.

Stocks finished lower Monday as investors braced for a potentially busy week of geopolitical updates and potential market catalysts. U.S.-China trade developments remain in focus ahead of the December 15th tariff deadline, in which Washington is scheduled to implement duties on $156 billion of Chinese consumer products. The session’s losses followed Friday’s session in which stocks rebounded following a robust November jobs report.

Global economic data was in focus, with a report showing Chinese exports unexpectedly fell 1.1% year-over-year in November. In the U.S. there were no notable economic updates. Treasuries were little changed, with the yield on the 10-year note down one basis points to 1.83%. Later this week, global central banks will grab headlines with both the U.S. Federal Reserve and European Central Bank holding policy meetings.

Eight of 11 S&P 500 sectors declined with Health Care and Utilities shares leading the laggards. In corporate news, Boeing (BA -0.81%) and Apple (AAPL -1.40%) both weighed on the Dow. Merck (MRK -0.15%) finished slightly lower after announcing the acquisition of cancer drug maker ArQule (ARQL +103.83%) for roughly $2.7 billion. Texas Capital Bancshares (TCBI +9.67%) and Independent Bank Group (IBTX +3.97%) rose following an all-stock merger of equals valued at $5.5 billion.

Over in Europe, Thursday’s general election in Britain will garner attention, as the vote will decide the future of Brexit. In commodities, WTI crude lost 0.4% to $58.97/barrel after advancing roughly 7% last week.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Broker/Dealer and Tech Indices Lost Ground

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX +0.18%) eked out a small gain and the Bank Index ($BKX -0.09%) finished flat while the Broker/Dealer Index ($XBD -0.73%) fell. The tech sector had a negative bias as the Semiconductor Index ($SOX -0.54%), | | | |