You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, NOVEMBER 2ND, 2016

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-77.46 |

17,959.64 |

-0.43% |

|

Volume |

970,159,580 |

-8% |

|

Volume |

1,925,677,710 |

+12% |

|

NASDAQ |

-48.01 |

5,105.57 |

-0.93% |

|

Advancers |

702 |

24% |

|

Advancers |

796 |

25% |

|

S&P 500 |

-13.78 |

2,097.94 |

-0.65% |

|

Decliners |

2,253 |

76% |

|

Decliners |

2,340 |

75% |

|

Russell 2000 |

-15.42 |

1,162.52 |

-1.31% |

|

52 Wk Highs |

29 |

|

|

52 Wk Highs |

38 |

|

|

S&P 600 |

-7.09 |

705.68 |

-0.99% |

|

52 Wk Lows |

83 |

|

|

52 Wk Lows |

156 |

|

|

|

Damage to Major Averages Has Look of a More Serious Correction

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Stocks finished lower on Wednesday. The Dow was down 77 points to 17959. The S&P 500 lost 13 points to 2097 and the Nasdaq Composite fell 48 points to 5105. The S&P 500 Index and the Dow Jones Industrial Average both slumped below prior lows having the look of a more serious "correction". The volume totals were reported mixed, lighter than the prior session total on the NYSE and higher on the Nasdaq exchange. Breadth was negative as decliners led advancers by more than 3-1 on the NYSE and nearly 3-1 on the Nasdaq exchange. There were 5 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, versus 15 on the prior session. New 52-week lows solidly outnumbered new 52-week highs on the NYSE and Nasdaq exchange.

PICTURED: The Dow Jones Industrial Average met resistance at its 50-day moving average (DMA) line and slumped to new lows with a streak of losses.

Recent deterioration in the charts of the major averages (M criteria) and less leadership (fewer stocks hitting new highs) are signs of poor market conditions. Disciplined investors following the fact-based investment system will have a bias toward reducing exposure until recognized strength returns. The Featured Stocks Page lists noteworthy high-ranked leaders.

The S&P 500 declined for a seventh-straight session after Federal Reserve officials signaled the case for a rate hike is getting stronger. As expected, the central bank left the benchmark interest rate unchanged ahead of next week’s U.S. presidential election. Policy makers however made no direct nod to a coming rate increase at the December meeting. On the data front, an ADP report showed that 147,000 workers were added to private payrolls in October, the fewest in five months.

All 11 sectors in the S&P 500 finished in negative territory. In Health Care, Allergan (AGN -5.16%) fell after missing analyst estimates on the top and bottom line. Anthem (ANTM +4.74%) rose as enrollment grew by 1.2 million members from a year earlier. AmerisourceBergen (ABC +8.84%) rose after announcing a $1 billion share repurchase plan. In the consumer space, Estee Lauder (EL -5.45%) fell as the cosmetics maker reported lower retail store traffic. Shares of Clorox (CLX -3.20%) after the company reduced its forward earnings guidance.

Treasuries advanced with the benchmark 10-year note up 8/32 to yield 1.79%. In commodities, NYMEX WTI crude retreated 2.6% to $45.47/barrel. COMEX gold gained 0.9% to $1298.90/ounce. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Retail, Most Tech and Commodity-Linked Groups Fell

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

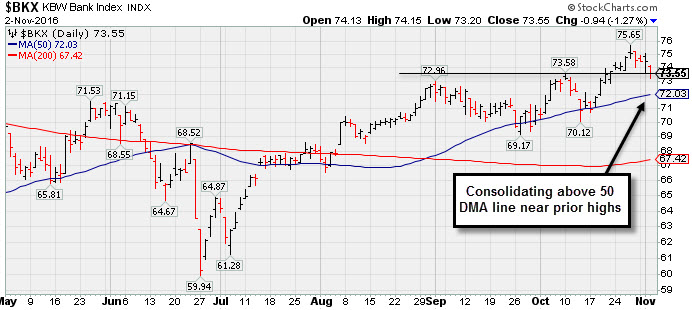

The Retail Index ($RLX -0.83%), Broker/Dealer Index ($XBD -1.31%), and the Bank Index ($BKX -1.27%) fell on Wednesday. The Gold & Silver Index ($XAU -1.78%), Oil Services Index ($OSX -1.51%%), and the Integrated Oil Index ($XOI -1.17%) each lost ground. The Biotechnology Index ($BTK -2.37%) and the Semiconductor Index ($SOX -0.68%) fell while the Networking Index ($NWX +0.72%) was a standout gainer. Charts courtesy www.stockcharts.com

PICTURED: The Bank Index ($BKX -1.27%) is consolidating above its 50-day moving average (DMA) line near prior highs.

| Oil Services |

$OSX |

149.26 |

-2.28 |

-1.50% |

-5.37% |

| Integrated Oil |

$XOI |

1,130.56 |

-13.42 |

-1.17% |

+5.39% |

| Semiconductor |

$SOX |

810.57 |

-5.51 |

-0.68% |

+22.17% |

| Networking |

$NWX |

400.48 |

+2.85 |

+0.72% |

+6.53% |

| Broker/Dealer |

$XBD |

167.14 |

-2.23 |

-1.31% |

-6.15% |

| Retail |

$RLX |

1,296.96 |

-10.82 |

-0.83% |

+1.05% |

| Gold & Silver |

$XAU |

87.72 |

-1.59 |

-1.78% |

+93.64% |

| Bank |

$BKX |

73.55 |

-0.94 |

-1.26% |

+0.64% |

| Biotech |

$BTK |

2,908.45 |

-70.62 |

-2.37% |

-23.74% |

|

|

|

|

Seriously Applying the Fact-Based System Now

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Asset Management Services Using the Fact-Based Investment System You can have professional help in limiting your losses and maximizing your gains in all market environments. For help with how your portfolio is managed click here and indicate "Find a Broker". Account minimum $250,000. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

TDG

-

NYSE

Transdigm Group Inc

AEROSPACE/DEFENSE - Aerospace/Defense Products and; Services

|

$265.82

|

-4.34

-1.61% |

$271.50

|

456,555

119.52% of 50 DAV

50 DAV is 382,000

|

$294.38

-9.70%

|

10/25/2016

|

$268.12

|

PP = $269.41

|

|

MB = $282.88

|

Most Recent Note - 10/31/2016 5:48:12 PM

Y - Wedged to new highs with recent gains lacking great volume conviction. Gains above a stock's pivot point must be backed by at least +40% above average volume to trigger a proper new (or add-on) technical buy signal. Rebounded above its 50 DMA line with volume-driven gains after issuing a Special Dividend effective 10/20/16.

>>> FEATURED STOCK ARTICLE : Rebound Above 50-Day Moving Average Line Needed - 10/19/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CSFL

-

NASDAQ

Centerstate Banks Inc

Banks-Southeast

|

$18.24

|

-0.27

-1.46% |

$18.51

|

179,783

110.30% of 50 DAV

50 DAV is 163,000

|

$19.08

-4.40%

|

10/10/2016

|

$18.20

|

PP = $18.37

|

|

MB = $19.29

|

Most Recent Note - 10/31/2016 5:40:51 PM

Y - Posted a solid gain today with above average volume. Found support when consolidating above prior highs and its 50 DMA line defining near-term support in the $18 area. Subsequent losses leading to violations would trigger technical sell signals.

>>> FEATURED STOCK ARTICLE : Challenged 52-Week High With Another Volume-Driven Gain - 10/10/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NTES

-

NASDAQ

Netease Inc Adr

INTERNET - Internet Information Providers

|

$242.94

|

-6.09

-2.45% |

$249.00

|

1,663,916

142.46% of 50 DAV

50 DAV is 1,168,000

|

$272.58

-10.87%

|

6/29/2016

|

$182.42

|

PP = $186.55

|

|

MB = $195.88

|

Most Recent Note - 11/2/2016 12:57:55 PM

Most Recent Note - 11/2/2016 12:57:55 PM

G - Testing its 50 DMA line ($243.17) which defines important support to watch. Slumped on higher volume on the prior session raising concerns after getting very extended from any sound base.

>>> FEATURED STOCK ARTICLE : Very Extended From Base Following Additional Gains - 10/21/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

HTHT

-

NASDAQ

China Lodging Group Ads

LEISURE - Lodging

|

$41.90

|

-0.57

-1.34% |

$42.79

|

333,011

220.54% of 50 DAV

50 DAV is 151,000

|

$47.72

-12.20%

|

9/29/2016

|

$46.12

|

PP = $47.82

|

|

MB = $50.21

|

Most Recent Note - 11/2/2016 12:41:50 PM

Most Recent Note - 11/2/2016 12:41:50 PM

G - Recently slumping below its 50 DMA line and undercutting prior lows with a streak of losses raising concerns and triggering technical sell signals. Prior highs in the $39-41 area define the next important support level to watch. A rebound above the 50 DMA line ($45.15) is needed for its outlook to improve.

>>> FEATURED STOCK ARTICLE : Still Building on New Base Pattern - 10/25/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LMAT

-

NASDAQ

Lemaitre Vascular Inc

Medical-Products

|

$20.49

|

-0.14

-0.68% |

$20.79

|

122,773

75.32% of 50 DAV

50 DAV is 163,000

|

$22.50

-8.93%

|

10/27/2016

|

$21.03

|

PP = $22.60

|

|

MB = $23.73

|

Most Recent Note - 10/31/2016 5:50:04 PM

Y - Pulled back on lighter volume today following 2 big volume-driven gains. Highlighted in yellow with pivot point cited based on its 9/20/16 high plus 10 cents in the 10/27/16 mid-day report. Subsequent volume-driven gains for new highs may trigger a technical buy signal following a base-on-base pattern. Found support above prior highs in the $18 area during its quiet consolidation and little resistance remains due to overhead supply.

>>> FEATURED STOCK ARTICLE : Challenged 52-Week High With Gap Up and Volume-Driven Gain - 10/27/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

PAYC

-

NYSE

Paycom Software Inc

COMPUTER SOFTWARE and SERVICES - Application Software

|

$43.70

|

-8.30

-15.96% |

$45.44

|

8,198,605

1,408.70% of 50 DAV

50 DAV is 582,000

|

$52.93

-17.44%

|

10/18/2016

|

$50.25

|

PP = $53.03

|

|

MB = $55.68

|

Most Recent Note - 11/2/2016 6:01:08 PM

Most Recent Note - 11/2/2016 6:01:08 PM

G - Reported earnings +86% on +40% sales revenues for the Sep '16 quarter. Gapped down today violating its 50 DMA line and prior lows triggering a worrisome technical sell signal. Disciplined investors will note that a technical buy signal was not triggered after featured in yellow on 10/18/16. Its color code is changed to green. A rebound above its 50 DMA line is needed for its outlook to improve.

>>> FEATURED STOCK ARTICLE : Technical Breakout Needed to Trigger a Proper Buy Signal - 10/18/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

SFBS

-

NASDAQ

Servisfirst Bancshares

BANKING - Regional - Southeast Banks

|

$53.48

|

-0.37

-0.69% |

$53.90

|

93,374

155.62% of 50 DAV

50 DAV is 60,000

|

$54.42

-1.73%

|

7/19/2016

|

$53.28

|

PP = $52.82

|

|

MB = $55.46

|

Most Recent Note - 10/31/2016 5:46:34 PM

Y - Overcame early weakness to hit another new high and finish strong. Today's gain backed by +52% above average volume helped reconfirm a technical buy signal. Found support after undercutting its 50 DMA line ($52.23) More damaging losses would raise concerns.

>>> FEATURED STOCK ARTICLE : Relative Strength Rating is Under Guidelines While Perched Near Highs - 9/22/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

OLLI

-

NASDAQ

Ollie's Bargain Outlet

Retail-DiscountandVariety

|

$26.65

|

+0.10

0.38% |

$26.90

|

415,266

38.03% of 50 DAV

50 DAV is 1,092,000

|

$28.72

-7.21%

|

10/4/2016

|

$27.36

|

PP = $28.70

|

|

MB = $30.14

|

Most Recent Note - 10/31/2016 5:38:49 PM

Y - Consolidating above its 50 DMA line ($26.52) with volume totals cooling in recent weeks. Since highlighted in yellow with new pivot point cited based on its 9/01/16 high plus 10 cents, members were repeatedly reminded - "Volume-driven gains above the pivot point are still needed to trigger a convincing technical buy signal."

>>> FEATURED STOCK ARTICLE : Gapped Up on News Being Added to S&P 600 Small Cap Index - 10/4/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|