You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Friday, March 28, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, JANUARY 4TH, 2017

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+60.40 |

19,942.16 |

+0.30% |

|

Volume |

1,192,149,220 |

-1% |

|

Volume |

1,715,357,000 |

+0% |

|

NASDAQ |

+47.92 |

5,477.00 |

+0.88% |

|

Advancers |

2,590 |

85% |

|

Advancers |

2,501 |

79% |

|

S&P 500 |

+12.92 |

2,270.75 |

+0.57% |

|

Decliners |

445 |

15% |

|

Decliners |

675 |

21% |

|

Russell 2000 |

+30.82 |

1,387.95 |

+2.27% |

|

52 Wk Highs |

189 |

|

|

52 Wk Highs |

168 |

|

|

S&P 600 |

+14.01 |

857.37 |

+1.66% |

|

52 Wk Lows |

7 |

|

|

52 Wk Lows |

26 |

|

|

|

Breadth Positive as Gains Lift Major Indices Near Recent Record Highs

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Stocks finished higher on Wednesday. The Dow was up 60 points to 19942. The S&P 500 added 12 points to 2270 and the Nasdaq Composite gained 47 points to 5477. Volume totals were near the prior session totals on the NYSE and on the Nasdaq exchange. Advancers solidly led decliners by nearly a 6-1 margin on the NYSE and nearly 4-1 on the Nasdaq exchange. Leadership improved as there were 60 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, versus the total of 52 on the prior session. New 52-week highs totals expanded and easily outnumbered new 52-week lows on both the NYSE and the Nasdaq exchange while the new lows total on the NYSE fell into the single digits.

PICTURED: The S&P 500 Index chart shows the benchmark index challenging its recent highs with a 2nd consecutive gain.

Near record high territory, the major averages (M criteria) are in a confirmed uptrend. New buying efforts should only be made in candidates with superior fundamental and technical characteristics. The Featured Stocks Page lists noteworthy high-ranked leaders.

The major averages advanced, extending gains for a second-straight session after the Federal Reserve released the minutes from its December FOMC meeting. The release showed that Fed officials prefer gradual rate hikes in 2017 but would need to be ready to hasten the increases if necessary to combat inflation. Policy makers also believe they may need to accelerate future tightening if a faster-growing economy pushes down the unemployment rate farther-than-expected.

Nine of 11 sectors in the S&P 500 finished in positive territory. In the consumer space, car-makers led the advance as U.S. auto sales climbed to record highs in 2016. Shares of the new General Motors Company (GM +5.52%) and Ford (F +4.61%) rose. Hertz Rental Car (HTZ +4.93%) rose after GAMCO Investors (GBL +2.04%) increased its stake in the company to 5.1% from 2.5%. In earnings, UniFirst Corp (UNF -4.14%) as the uniform maker reduced its forward revenue guidance. Shares of Valero Energy (VLO -3.59%) fell after being the subject of negative analyst commentary.

Treasuries edged higher with the benchmark 10-year note up 3/32 to yield 2.43%. In commodities, NYMEX WTI crude added 1.5% to $53.13/barrel. COMEX gold ticked up 0.2% to $1164.40/ounce. In FOREX, the Dollar Index fell 0.6%. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Retail, Most Tech, and Commodity-Linked Groups Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

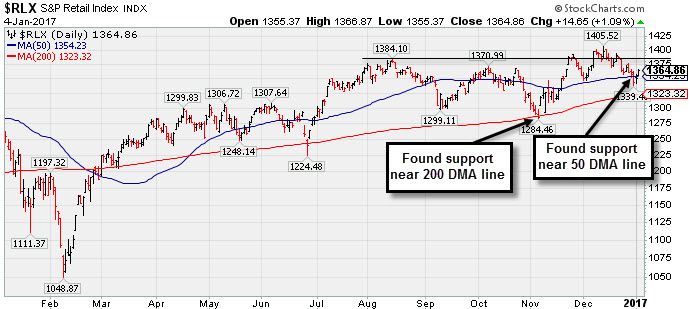

The Broker/Dealer Index ($XBD +2.67%), Bank Index ($BKX +1.12%) , and the Retail Index ($RLX +1.09%) each ended higher on Wednesday's session. The Biotechnology Index ($BTK +3.79%) led the tech sector and the Networking Index ($NWX +1.12%) also finished higher while the Semiconductor Index ($SOX +0.27%) posted a smaller gain. Commodity-linked groups were mostly higher as the Gold & Silver Index ($XAU +1.69%) outpaced the Oil Services Index ($OSX +1.24%) but the Integrated Oil Index ($XOI -0.34%) sputtered. Charts courtesy www.stockcharts.com

PICTURED: The Retail Index ($RLX +1.09%) chart illustrates how it found support near its 200-day moving average (DMA) line on a prior consolidation and more recently found support near its 50 DMA line. It overcame a weak start last year and ultimately finished with a +4.64% gain for 2016.

| Oil Services |

$OSX |

189.74 |

+2.34 |

+1.25% |

+3.24% |

| Integrated Oil |

$XOI |

1,281.46 |

-4.38 |

-0.34% |

+1.06% |

| Semiconductor |

$SOX |

909.77 |

+2.43 |

+0.27% |

+0.36% |

| Networking |

$NWX |

453.81 |

+5.01 |

+1.12% |

+1.73% |

| Broker/Dealer |

$XBD |

213.17 |

+5.54 |

+2.67% |

+3.85% |

| Retail |

$RLX |

1,364.91 |

+14.70 |

+1.09% |

+1.63% |

| Gold & Silver |

$XAU |

83.39 |

+1.38 |

+1.68% |

+5.74% |

| Bank |

$BKX |

93.71 |

+1.04 |

+1.12% |

+2.09% |

| Biotech |

$BTK |

3,234.22 |

+118.07 |

+3.79% |

+5.18% |

|

|

|

|

Bank Stock Perched Near Record Highs After Considerable Rally

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Centerstate Banks Inc (CSFL +$0.26 or +1.04% to $25.28) has been stubbornly holding its ground near all-time highs, very extended from any sound base. Its 50-day moving average (DMA) line ($22) defines near-term support above prior highs in the $19 area. It has risen +38.9% since highlighted in yellow with new pivot point cited based on its 9/08/16 high plus 10 cents in the 10/10/16 mid-day report (read here). It rallied further and stubbornly held its ground since last shown in this FSU section on 12/02/16 with an annotated graph under the headline, "Very Extended From Base Following Additional Gains on Volume". CSFL was first featured at $15.80 in the 5/27/16 mid-day report (read here).

The Sep '16 quarter marked its 8th consecutive earnings increase above the +25% minimum guideline (C criteria), and its annual earnings (A criteria) history has been good. Its small supply of only 46.1 millions shares (S criteria) in the public float can contribute to greater price volatility in the event of institutional buying or selling.

The number of top-rated funds owning its shares rose from 180 in Jun '15 to 259 in Sep '16, a reassuring sign. Its current Up/Down Volume ratio of 2.2 is an unbiased indication its shares have been under only slight accumulation over the past 50 days (I criteria). |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

CSFL

-

NASDAQ

Centerstate Banks Inc

Banks-Southeast

|

$25.28

|

+0.26

1.04% |

$25.55

|

216,984

81.88% of 50 DAV

50 DAV is 265,000

|

$25.83

-2.14%

|

10/10/2016

|

$18.20

|

PP = $18.37

|

|

MB = $19.29

|

Most Recent Note - 1/4/2017 5:52:25 PM

Most Recent Note - 1/4/2017 5:52:25 PM

G - Stubbornly holding its ground near all-time highs, very extended from any sound base. Its 50 DMA line $22 defines near-term support above prior highs in the $19 area. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Bank Stock Perched Near Record Highs After Considerable Rally - 1/4/2017 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

IESC

-

NASDAQ

I E S Holdings Inc

Bldg-Maintenance and Svc

|

$20.30

|

+0.55

2.78% |

$20.35

|

69,586

73.25% of 50 DAV

50 DAV is 95,000

|

$23.00

-11.74%

|

11/23/2016

|

$19.35

|

PP = $18.26

|

|

MB = $19.17

|

Most Recent Note - 1/4/2017 5:59:19 PM

Most Recent Note - 1/4/2017 5:59:19 PM

G - Finding support while consolidating above prior highs and its 50 DMA line which coincide in the $18 area.

>>> FEATURED STOCK ARTICLE : Consolidating After Strong Sep '16 Quarterly Earnings News - 12/21/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

BERY

-

NYSE

Berry Plastics Group Inc

CONSUMER NON-DURABLES - Packaging and Containers

|

$50.20

|

+0.83

1.68% |

$50.40

|

1,209,284

83.11% of 50 DAV

50 DAV is 1,455,000

|

$51.68

-2.86%

|

11/30/2016

|

$50.26

|

PP = $46.47

|

|

MB = $48.79

|

Most Recent Note - 1/3/2017 5:27:54 PM

G - Posted a gain today with volume picking up to near average, still consolidating above its "max buy" level with volume totals generally cooling since its breakout. Prior highs in the $46 area and its 50 DMA line ($47.37) define support to watch on pullbacks. See the latest FSU analysis for additional details and a new annontated graph.

>>> FEATURED STOCK ARTICLE : Orderly Consolidation Continues Well Above Support - 1/3/2017 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

EVR

-

NYSE

Evercore Partners Inc

FINANCIAL SERVICES - Investment Banking

|

$71.20

|

+1.55

2.23% |

$71.45

|

289,775

60.62% of 50 DAV

50 DAV is 478,000

|

$71.97

-1.06%

|

11/14/2016

|

$63.30

|

PP = $60.73

|

|

MB = $63.77

|

Most Recent Note - 1/4/2017 6:00:53 PM

Most Recent Note - 1/4/2017 6:00:53 PM

G - Posted a gain with light volume today ending near its all-time high, very extended from its prior base. Its 50 DMA line ($64.61) and prior highs define important support.

>>> FEATURED STOCK ARTICLE : Hit Another New High Today With Volume-Driven Gain - 12/5/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

HTHT

-

NASDAQ

China Lodging Group Ads

LEISURE - Lodging

|

$49.19

|

-1.07

-2.13% |

$50.55

|

91,195

48.77% of 50 DAV

50 DAV is 187,000

|

$54.23

-9.29%

|

9/29/2016

|

$46.12

|

PP = $47.82

|

|

MB = $50.21

|

Most Recent Note - 1/4/2017 5:58:15 PM

Most Recent Note - 1/4/2017 5:58:15 PM

G - Pulled back today with lighter volume. Its 50 DMA line ($47.74) and prior low ($45.61 on 12/20/16) define important near-term support levels to watch on pullbacks. Repeatedly noted with caution in prior reports - "Reported earnings +10% on +6% sales revenues for the Sep '16 quarter, below the +25% minimum earnings guideline (C criteria), raising concerns."

>>> FEATURED STOCK ARTICLE : Mostly Bullish Action Continues to Bode Well for China Lodging - 12/9/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

DW

-

NYSE

LCI Industries Inc

MATERIALS and CONSTRUCTION - General Building Materials

|

$109.10

|

-7.40

-6.35% |

$115.80

|

217,958

93.95% of 50 DAV

50 DAV is 232,000

|

$116.50

-6.35%

|

11/29/2016

|

$106.29

|

PP = $101.00

|

|

MB = $106.05

|

Most Recent Note - 1/4/2017 10:32:15 AM

Most Recent Note - 1/4/2017 10:32:15 AM

G - Pulling back today from new all-time highs hit on the prior session. Drew Industries (DW) announced a new name LCI Indusries (LCII) and new trading symbol effective as of the market open on January 3, 2017. Prior highs in the $101-103 area define support to watch above its 50 DMA line. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Consolidating Well Above Prior Highs and 50-Day Moving Average - 12/30/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LMAT

-

NASDAQ

Lemaitre Vascular Inc

Medical-Products

|

$25.20

|

-0.03

-0.12% |

$25.50

|

98,472

63.53% of 50 DAV

50 DAV is 155,000

|

$25.87

-2.59%

|

12/22/2016

|

$24.99

|

PP = $25.09

|

|

MB = $26.34

|

Most Recent Note - 1/3/2017 5:33:45 PM

Y - Hovering near its high after wedging higher with recent gains lacking great volume conviction. New pivot point was cited based on its 11/17/16 high plus 10 cents after an orderly base-on-base pattern. A volume-driven gain and strong close above the pivot point may clinch a new (or add-on) technical buy signal. Recent lows in the $22 area and its 50 DMA line ($22.95) coincide defining important support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Built an Orderly Base-On-Base Pattern - 12/23/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

BEAT

-

NASDAQ

BioTelemetry Inc

Medical-Services

|

$23.05

|

+0.70

3.13% |

$23.10

|

287,644

89.89% of 50 DAV

50 DAV is 320,000

|

$24.10

-4.36%

|

12/19/2016

|

$22.91

|

PP = $21.78

|

|

MB = $22.87

|

Most Recent Note - 1/4/2017 5:57:00 PM

Most Recent Note - 1/4/2017 5:57:00 PM

G - Posted a gain with average volume and its color code is changed to green after rising above its "max buy" level again. Prior highs in the $21-22 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Breakaway Gap Technically Clears 11-Week V Shaped Base - 12/19/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PATK

-

NASDAQ

Patrick Industries Inc

WHOLESALE - Building Materials Wholesale

|

$80.05

|

+2.60

3.36% |

$80.50

|

248,400

208.74% of 50 DAV

50 DAV is 119,000

|

$79.15

1.14%

|

11/29/2016

|

$72.45

|

PP = $69.63

|

|

MB = $73.11

|

Most Recent Note - 1/4/2017 12:48:51 PM

Most Recent Note - 1/4/2017 12:48:51 PM

G - Touched a new all-time high today. It has been stubbornly holding its ground, extended from its prior base. Prior highs in the $69 area and its 50 DMA line ($67.97) define support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Stubbornly Held Ground and Rose Since Featured Again - 12/28/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ANET

-

NYSE

Arista Networks Inc

TELECOMMUNICATIONS - Communication Equipment

|

$101.73

|

+4.67

4.81% |

$102.28

|

2,121,951

290.68% of 50 DAV

50 DAV is 730,000

|

$98.90

2.86%

|

12/30/2016

|

$96.77

|

PP = $99.00

|

|

MB = $103.95

|

Most Recent Note - 1/4/2017 12:27:20 PM

Most Recent Note - 1/4/2017 12:27:20 PM

Y - Volume is running at an above average pace today while rallying from the previously noted advanced "3-weeks tight" base pattern hitting new all-time highs. On 12/30/16 it was last noted -"Subsequent volume-driven gains above the new pivot point cited may trigger a new (or add-on) technical buy signal. Its 50 DMA line and prior lows in the $91 area define important support to watch on pullbacks."

>>> FEATURED STOCK ARTICLE : Holding Ground After Rally More Than 5% Beyond Prior Highs - 12/20/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

SFBS

-

NASDAQ

Servisfirst Bancshares

BANKING - Regional - Southeast Banks

|

$38.56

|

+0.95

2.53% |

$38.65

|

248,375

86.24% of 50 DAV

50 DAV is 288,000

|

$38.65

-0.23%

|

7/19/2016

|

$26.64

|

PP = $26.41

|

|

MB = $27.73

|

Most Recent Note - 1/3/2017 5:25:27 PM

G - Still holding its ground near all-time highs, extended from its prior base. Its 50 DMA line ($33.32) defines important support to watch on pullbacks. Do not be confused by 2-1 stock split effective 12/21/16 so the Featured Price, Pivot Point and Max Buy levels were adjusted accordingly

>>> FEATURED STOCK ARTICLE : Financial Firm Remains Extended Well Above Prior Highs - 12/14/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

OLLI

-

NASDAQ

"Ollies Bargain Outlet Holdings, Inc"

Retail-DiscountandVariety

|

$29.40

|

+0.95

3.34% |

$29.45

|

724,438

109.63% of 50 DAV

50 DAV is 660,800

|

$32.75

-10.23%

|

10/4/2016

|

$27.36

|

PP = $28.70

|

|

MB = $30.14

|

Most Recent Note - 1/4/2017 5:55:29 PM

Most Recent Note - 1/4/2017 5:55:29 PM

G - Managed a positive reversal today and ended higher with better volume (near average) and closed near its 50 DMA line ($29.41) helping its outlook improve. Prior highs in the $28 area define important support to watch. More damaging losses below the recent low ($28.00) would raise greater concerns

>>> FEATURED STOCK ARTICLE : Distributional Action Plus Slump Below 50-Day Moving Average - 12/29/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LITE

-

NASDAQ

Lumentum Holdings Inc

TELECOMMUNICATIONS - Cables / Satalite Equipment

|

$37.60

|

+0.30

0.80% |

$38.45

|

1,085,085

108.08% of 50 DAV

50 DAV is 1,004,000

|

$45.25

-16.91%

|

12/8/2016

|

$42.80

|

PP = $45.35

|

|

MB = $47.62

|

Most Recent Note - 1/3/2017 5:31:44 PM

G - Slumped well below its 50 DMA line ($39.18) raising concerns and its color code is changed to green. Only a prompt rebound above the 50 DMA line would help its outlook improve. Bullish action has not been seen since members were repeatedly reminded - "Subsequent volume-driven gains for new highs are needed to trigger a proper technical buy signal."

>>> FEATURED STOCK ARTICLE : Challenging its High With Big Volume-Driven Gain - 12/8/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|