Reversed From High After Recently Wedging Higher Without Volume - Friday, August 13, 2021

Docusign Inc (DOCU +$0.43 or +0.15% to $295.97) has been hovering near its high after a "negative reversal" on 8/10/21 at its all-time high. It wedged into new high territory with recent gains lacking great volume conviction. The 50-day moving average (DMA) line ($282) defines initial support above its prior low ($270.41 on 7/15/21).

DOCU was highlighted in yellow with pivot point cited based on its 9/02/20 high plus 10 cents in 7/06/21 mid-day report (read here). Fundamentals remain strong after reporting very strong Apr '21 quarterly results. It was last shown in this FSU section on 7/06/21 with an annotated graph under the headline, "Touched New High With Average Volume Behind Today's Gain".

It has an Earnings Per Share Rating of 99. The past 8 quarterly comparisons versus the year ago period were well above the +25% minimum guideline with solid underlying sales revenues growth. After years of losses it had solid earnings in FY '19 and '20.

The number of top-rated funds owning its shares rose from 558 on Jun '19 to 1,662 in Jun '21, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 2.7 also is an unbiased indication its shares have been under accumulation over the past 50 days. The Computer Software-Enterprise industry group is currently ranked 106th of the 197 Industry Groups (L criteria), however there are several strong stocks in the group showing confirming leadership.

Chart courtesy of www.stockcharts.com

Touched New High With Average Volume Behind Today's Gain - Tuesday, July 6, 2021

Docusign Inc (DOCU +$9.36 or +3.36% to $288.18) was highlighted in yellow with pivot point cited based on its 9/02/20 high plus 10 cents in the earlier mid-day report (read here). It hit a new high with today's early gain. Subsequent gains and a strong close above the pivot point cited backed by at least +40% above average volume may trigger a convincing new (or add-on) technical buy signal.

Fundamentals remain strong after reporting very strong Apr '21 quarterly results. It went through a choppy consolidation then rebounded since last noted on 3/03/21 when dropped from the Featured Stocks list. DOCU was last shown in this FSU section on 2/09/21 with an annotated graph under the headline, "Consolidating Back Above 50-Day Moving Average Near Prior High".

It has an Earnings Per Share Rating of 99. The past 8 quarterly comparisons versus the year ago period were well above the +25% minimum guideline with solid underlying sales revenues growth. After years of losses it had solid earnings in FY '19 and '20.

The number of top-rated funds owning its shares rose from 558 on Jun '19 to 1,611 in Jun '21, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 2.0 also is an unbiased indication its shares have been under accumulation over the past 50 days. The Computer Software-Enterprise industry group is currently ranked 95th of the 197 Industry Groups (L criteria), however there are several strong stocks in the group showing confirming leadership.

Chart courtesy of www.stockcharts.com

Consolidating Back Above 50-Day Moving Average Near Prior High - Tuesday, February 9, 2021

Docusign Inc (DOCU +$6.92 or +2.78% to $255.82) has posted several gains with below average volume since recently rebounding above the 50-day moving average (DMA) line ($238). It faces little resistance due to overhead supply. The prior low ($216.50 on 1/04/21) defines the next important support to watch.

DOCU finished strong after highlighted in yellow with pivot point cited based on its 12/04/20 high plus 10 cents in the 1/12/21 mid-day report (read here). However, it stalled and sputtered since last shown in this FSU section on 1/12/21 with an annotated graph under the headline, "Twice Average Volume Behind Breakout Gain".

Fundamentals remain strong. It has an Earnings Per Share Rating of 84. It reported very strong July and Oct '20 quarterly results versus the year ago periods. The past 6 quarterly comparisons versus the year ago period were well above the +25% minimum guideline with solid underlying sales revenues growth. After years of losses it had solid earnings in FY '19 and '20.

The number of top-rated funds owning its shares rose from 558 on Jun '19 to 1,418 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 also is an unbiased indication its shares have been under accumulation over the past 50 days. The Computer Software-Enterprise industry group is currently ranked 81st of the 197 Industry Groups (L criteria), however there are several strong stocks in the group showing confirming leadership.

Chart courtesy of www.stockcharts.com

Twice Average Volume Behind Breakout Gain - Tuesday, January 12, 2021

Docusign Inc (DOCU +$21.69 or +9.00% to $262.65) finished strong after highlighted in yellow with pivot point cited based on its 12/04/20 high plus 10 cents in the earlier mid-day report (read here). The big gain and close above the pivot point backed by twice average volume clinched a new technical buy signal. Little resistance remains dur to overhead supply up to the $293 level. During the 6-week flat base it found support near its 50-day moving average (DMA) line ($226.29).

Fundamentals remained strong after it was dropped from the Featured Stocks list on 9/11/20. It reported very strong July and Oct '20 quarterly results versus the year ago periods. It has an Earnings Per Share Rating of 75.

Fundamentals remained strong after it was dropped from the Featured Stocks list on 9/11/20. It reported very strong July and Oct '20 quarterly results versus the year ago periods. It has an Earnings Per Share Rating of 75.

DOCU was last shown in this FSU section on 8/31/20 with an annotated graph under the headline, "Perched Near All-Time High After Finding Support Above 50 DMA".

The past 5 quarterly comparisons versus the year ago period were well above the +25% minimum guideline with solid underlying sales revenues growth. After years of losses it had solid earnings in FY '19 and '20.

The number of top-rated funds owning its shares rose from 558 on Jun '19 to 1,375 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.9 also is an unbiased indication its shares have been under accumulation over the past 50 days. The Computer Software-Enterprise industry group is currently ranked 118th of the 197 Industry Groups (L criteria), however there are several strong stocks in the group showing confirming leadership.

Chart courtesy of www.stockcharts.com

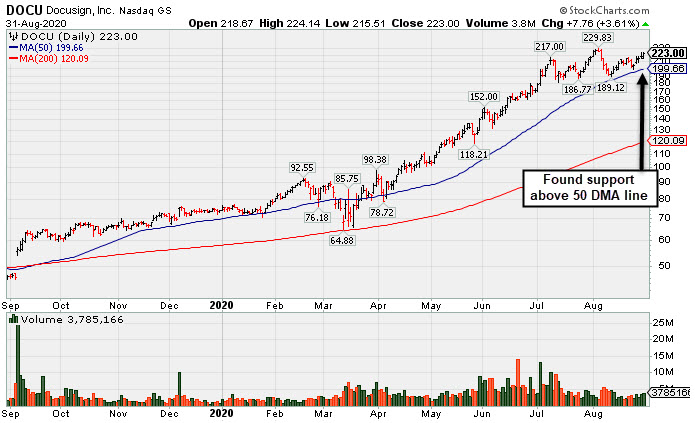

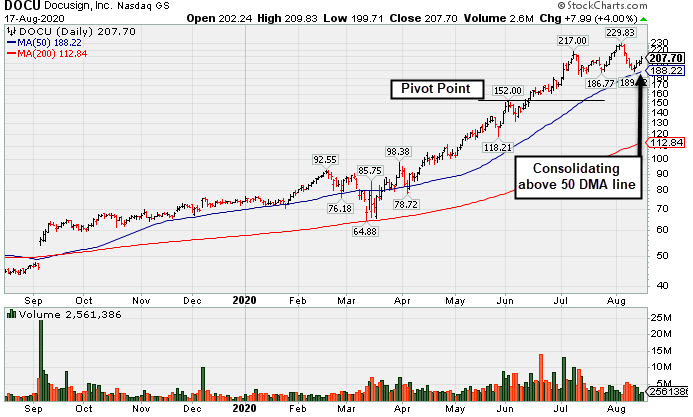

Perched Near All-Time High After Finding Support Above 50 DMA - Monday, August 31, 2020

Docusign Inc (DOCU +$7.76 or +3.61% to $223.00) posted a 5th consecutive gain today with below average volume. It has not formed a sound base of sufficient length. Its 50-day moving average (DMA) line ($199.66) and prior low ($189.12 on 8/12/20) define important near-term support to watch on pullbacks. Subsequent losses leading to violations may trigger technical sell signals. Keep in mind it is scheduled to report July '20 quarterly results after the close on Thursday, 9/03/20.

DOCU is now priced +86% above its 200 DMA price, and it is taught in the Certification that a stock trading +70-100% or more above the 200 DMA is to be recognized as a "sell signal". It was last shown in this FSU section on 8/17/20 with an annotated graph under the headline, "Consolidating Above 50-Day Moving Average Line and Recent Low". It was highlighted in yellow in the 6/01/20 mid-day report (read here) with pivot point cited based on its 5/02/20 high plus 10 cents after forming an advanced "ascending base" marked by 3 pullbacks of 10-20% during its ongoing ascent.

It has an Earnings Per Share Rating of 84, above the 80+ minimum for buy candidates. Recently it reported earnings +71% on +39% sales revenues for the Apr '20 quarter versus the year ago period. Three of the past 4 quarterly comparisons versus the year ago period were above the +25% minimum guideline with solid underlying sales revenues growth. After years of losses it had solid earnings in FY '19 and '20.

The number of top-rated funds owning its shares rose from 558 on Jun '19 to 1,179 in Jun '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 also is an unbiased indication its shares have been under accumulation over the past 50 days. The Computer Software-Enterprise industry group is currently ranked 6th of the 197 Industry Groups (L criteria).

Chart courtesy of www.stockcharts.com

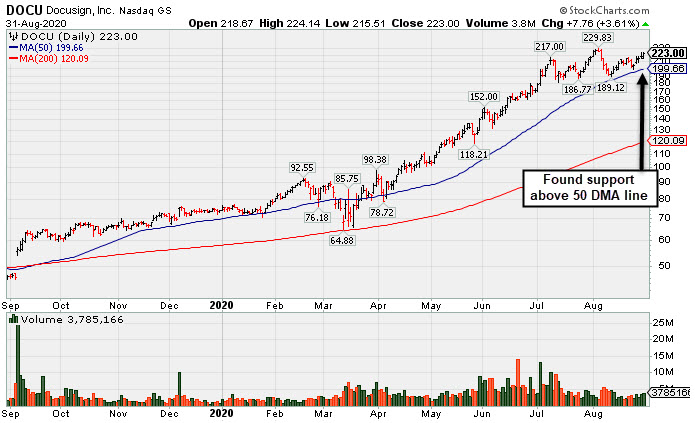

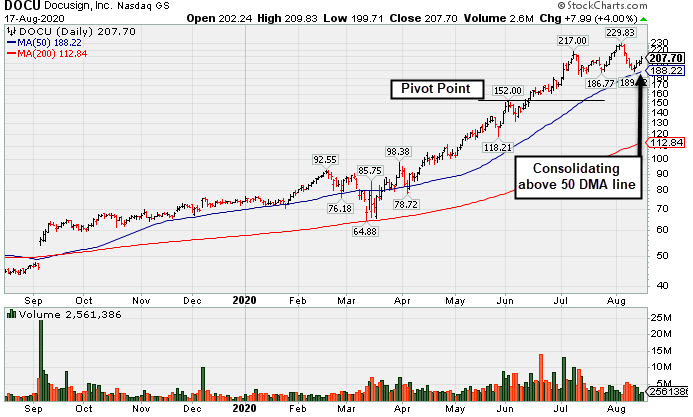

Consolidating Above 50-Day Moving Average Line and Recent Low - Monday, August 17, 2020

Docusign Inc (DOCU +$7.99 or +4.00% to $207.70) has not formed a sound base of sufficient length and it is consolidating above Its 50-day moving average (DMA) line ($188.22) and the recent low ($189.12 on 8/12/20) which define important near-term support to watch. Subsequent losses leading to violations may trigger technical sell signals. Keep in mind it is scheduled to report July '20 quarterly results on 9/03/20.

DOCU is now priced +84% above its 200 DMA price, and it is taught in the Certification that a stock trading +70-100% or more above the 200 DMA is to be recognized as a "sell signal". It was last shown in this FSU section on 7/28/20 with an annotated graph under the headline, "E-Signature Firm is Extended From Any Sound Base". It was highlighted in yellow in the 6/01/20 mid-day report (read here) with pivot point cited based on its 5/02/20 high plus 10 cents after forming an advanced "ascending base" marked by 3 pullbacks of 10-20% during its ongoing ascent.

It has an Earnings Per Share Rating of 84, above the 80+ minimum for buy candidates. Recently it reported earnings +71% on +39% sales revenues for the Apr '20 quarter versus the year ago period. Three of the past 4 quarterly comparisons versus the year ago period were above the +25% minimum guideline with solid underlying sales revenues growth. After years of losses it had solid earnings in FY '19 and '20.

The number of top-rated funds owning its shares rose from 558 on Jun '19 to 1,159 in Jun '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 also is an unbiased indication its shares have been under accumulation over the past 50 days. The Computer Software-Enterprise industry group is currently ranked 7th of the 197 Industry Groups (L criteria).

Chart courtesy of www.stockcharts.com

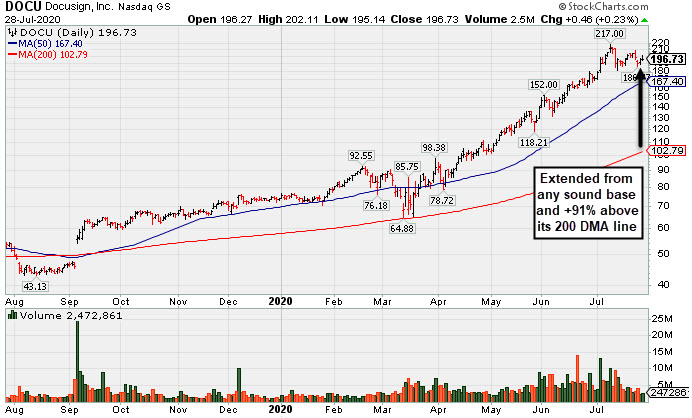

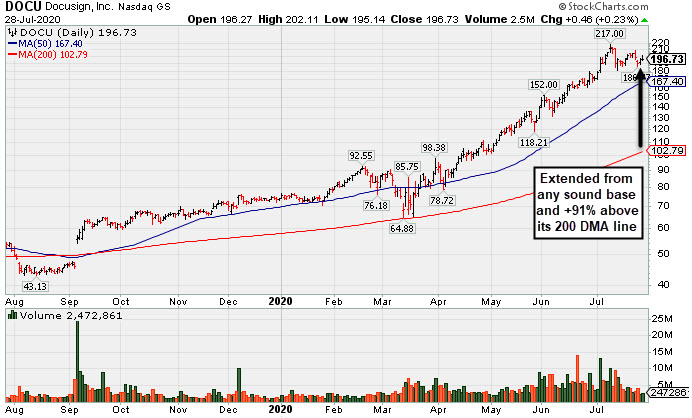

E-Signature Firm is Extended From Any Sound Base - Tuesday, July 28, 2020

Docusign Inc (DOCU +$0.46 or +0.23% to $196.73) is very extended from any sound base. Its 50-day moving average (DMA) line ($164.50) defines near-term support to watch. DOCU is now priced +91% above its 200 DMA price, and it is taught in the Certification that a stock trading +70-100% or more above the 200 DMA is to be recognized as a "sell signal".

DOCU was last shown in this FSU section on 7/01/20 with an annotated graph under the headline, "Rally From Ascending Base Leaves Stock Very Extended". It was highlighted in yellow in the 6/01/20 mid-day report (read here) with pivot point cited based on its 5/02/20 high plus 10 cents after forming an advanced "ascending base" marked by 3 pullbacks of 10-20% during its ongoing ascent.

It has an Earnings Per Share Rating of 84, above the 80+ minimum for buy candidates. Recently it reported earnings +71% on +39% sales revenues for the Apr '20 quarter versus the year ago period. Three of the past 4 quarterly comparisons versus the year ago period were above the +25% minimum guideline with solid underlying sales revenues growth. After years of losses it had solid earnings in FY '19 and '20.

The number of top-rated funds owning its shares rose from 558 on Jun '19 to 1,081 in Jun '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 also is an unbiased indication its shares have been under accumulation over the past 50 days. The Computer Software-Enterprise industry group is currently ranked 4th of the 197 Industry Groups (L criteria).

Chart courtesy of www.stockcharts.com

Rally From Ascending Base Leaves Stock Very Extended - Wednesday, July 1, 2020

Docusign Inc (DOCU +$6.75 or +3.92% to $178.96) finished at a best-ever close with a gain today on below average volume. It is very extended from any sound base. Prior high ($152 on 6/02/20) defines initial support to watch well above its 50-day moving average (DMA) line ($136.24. DOCU is now priced +97% above its 200 DMA price ($90.65), and it is taught in the Certification that a stock trading +70-100% or more above the 200 DMA is to be recognized as a "sell signal".

DOCU was last shown in this FSU section on 6/10/20 with an annotated graph under the headline, "Advanced Ascending Base Formed for Strong E-Signature Firm". It was highlighted in yellow in the earlier mid-day report (read here) with pivot point cited based on its 5/02/20 high plus 10 cents after forming an advanced "ascending base" marked by 3 pullbacks of 10-20% during its ongoing ascent.

It has an Earnings Per Share Rating of 84, above the 80+ minimum for buy candidates. Recently it reported earnings +71% on +39% sales revenues for the Apr '20 quarter versus the year ago period. Three of the past 4 quarterly comparisons versus the year ago period were above the +25% minimum guideline with solid underlying sales revenues growth. After years of losses it had solid earnings in FY '19 and '20.

The number of top-rated funds owning its shares rose from 558 on Jun '19 to 904 in Mar '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 also is an unbiased indication its shares have been under accumulation over the past 50 days. The Computer Software-Enterprise industry group is currently ranked 1st of the 197 Industry Groups (L criteria).

Chart courtesy of www.stockcharts.com

Advanced Ascending Base Formed for Strong E-Signature Firm - Wednesday, June 10, 2020

Docusign Inc (DOCU +$6.13 or +4.32% to $148.05) was highlighted in yellow in the earlier mid-day report (read here) with pivot point cited based on its 5/02/20 high plus 10 cents after forming an advanced "ascending base" marked by 3 pullbacks of 10-20% during its ongoing ascent. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a new (or add-on) technical buy signal.

It has an Earnings Per Share Rating of 84, above the 80+ minimum for buy candidates. Recently it reported earnings +71% on +39% sales revenues for the Apr '20 quarter versus the year ago period. Three of the past 4 quarterly comparisons versus the year ago period were above the +25% minimum guideline with solid underlying sales revenues growth. After years of losses it had solid earnings in FY '19 and '20.

The number of top-rated funds owning its shares rose from 558 on Jun '19 to 880 in Mar '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 also is an unbiased indication its shares have been under accumulation over the past 50 days. The Computer Software-Enterprise industry group is currently ranked 2nd of the 197 Industry Groups (L criteria).

Chart courtesy of www.stockcharts.com