Volume +55% Above Average Behind Gain for a New High - Thursday, September 2, 2021

Ameresco Inc Cl A (AMRC +$2.13 or +3.06% to $71.74) was highlighted in yellow with new pivot point cited based on its 8/25/21 high in the earlier mid-day report (read here). It hit a new all-time high with today's gain backed by +55% above average volume triggering a technical buy signal. It found support near its 50-day moving average (DMA) line ($65.68) in recent weeks while consolidating.

Fundamentals remain strong after it reported Jun '21 quarterly earnings +79% on +23% sales revenues versus the year ago period. Five of the past 7 quarterly comparisons were well above the +25% minimum earnings guideline (C criteria) with solid sales revenues growth. Its annual earnings (A criteria) history has been good. It has a 93 Earnings Per Share Rating, well above the 80+ minimum for buy candidates.

AMRC was last shown in detail in the 2/01/21 report with an annotated graph under the headline, "Rebounding After Retreat From Record High". It was dropped from the Featured Stocks list on 2/25/21 then completed a new Public Offering on 3/05/21 and went through a deep consolidation. It found support at its 200 DMA line. AMRC traded up +35.8% after first highlighted in yellow with pivot point cited based on its 11/24/20 high plus 10 cents in the 12/15/20 mid-day report (read here).

AMRC was last shown in detail in the 2/01/21 report with an annotated graph under the headline, "Rebounding After Retreat From Record High". It was dropped from the Featured Stocks list on 2/25/21 then completed a new Public Offering on 3/05/21 and went through a deep consolidation. It found support at its 200 DMA line. AMRC traded up +35.8% after first highlighted in yellow with pivot point cited based on its 11/24/20 high plus 10 cents in the 12/15/20 mid-day report (read here).

Charts courtesy of www.stockcharts.com

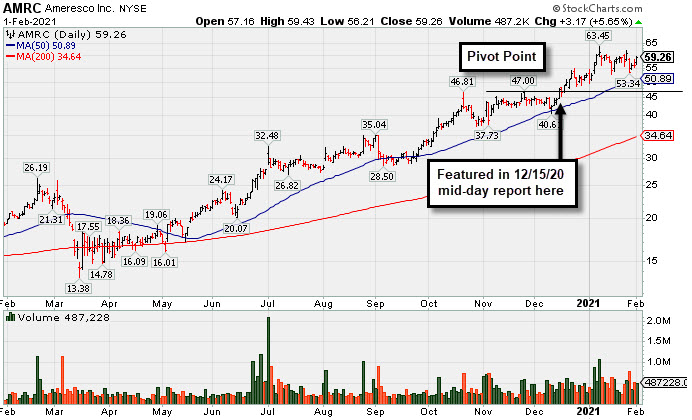

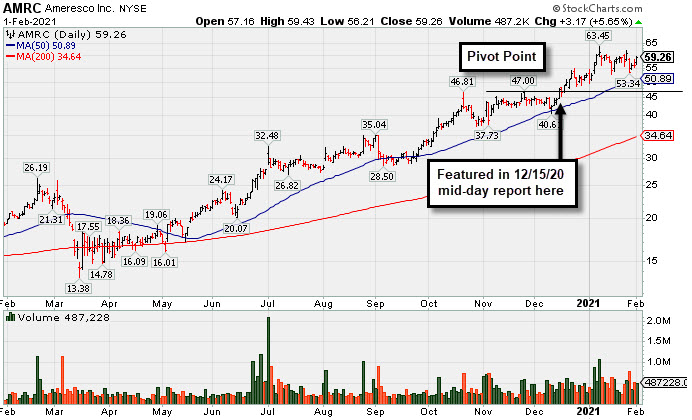

Rebounding After Retreat From Record High - Monday, February 1, 2021

Ameresco Inc Cl A (AMRC +$3.17 or +5.65% to $59.26) bounced back impressively today after large volume-driven losses last week while retreating from its all-time high. It remains very extended from any sound base. Its 50-day moving average (DMA) line ($50.89) defines near-term support to watch above prior highs in the $46-47 area.

AMRC has traded up as much as +35.8% since it was highlighted in yellow with pivot point cited based on its 11/24/20 high plus 10 cents in the 12/15/20 mid-day report (read here). It was last covered in detail in the 1/06/21 report with an annotated graph under the headline, "Very Extended From Base After Another Powerful Gain".

AMRC reported earnings +111% on +33% sales revenues for the Sep '20 quarter versus the year ago period. Three of the 4 latest quarterly comparisons were above the +25% minimum earnings guideline (C criteria) with solid sales revenues growth. Its annual earnings (A criteria) history has been good and it has a 93 Earnings Per Share Rating, well above the 80+ minimum for buy candidates.

The ENERGY - Alternative group currently has 98 Group Relative Strength Rating (L criteria). It has only 21.2 million shares in the public float (S criteria) which can contribute to great price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 199 in Dec '19 to 293 in Dec '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days.

Charts courtesy of www.stockcharts.com

Very Extended From Base After Another Powerful Gain - Wednesday, January 6, 2021

Ameresco Inc Cl A (AMRC +$3.48 or +6.64% to $55.89) powered to a new all-time high, getting more extended from any sound base with a big gain today backed by +129% above average volume. Prior highs in the $46-47 area define initial support to watch on pullbacks.

AMRC has traded up as much as +22.3% since it was highlighted in yellow with pivot point cited based on its 11/24/20 high plus 10 cents in the 12/15/20 mid-day report (read here). It was covered in greater detail in that evening's FSU section with an annotated graph under the headline, "Gain From Ascending Base Pattern Backed by Above Average Volume" It hit a new all-time high with +43% above average volume behind a 4th consecutive gain, rising from an advanced "ascending base" pattern.

AMRC reported earnings +111% on +33% sales revenues for the Sep '20 quarter versus the year ago period. Three of the 4 latest quarterly comparisons were above the +25% minimum earnings guideline (C criteria) with solid sales revenues growth. Its annual earnings (A criteria) history has been good and it has a 94 Earnings Per Share Rating, well above the 80+ minimum for buy candidates.

The ENERGY - Alternative group currently has 95 Group Relative Strength Rating (L criteria). It has only 21.2 million shares in the public float (S criteria) which can contribute to great price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 199 in Dec '19 to 286 in Sep '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 2.0 is an unbiased indication its shares have been under accumulation over the past 50 days.

Charts courtesy of www.stockcharts.com

Gain From Ascending Base Pattern Backed by Above Average Volume - Tuesday, December 15, 2020

Ameresco Inc Cl A (AMRC +$3.05 or +6.85% to $47.59) was highlighted in yellow with pivot point cited based on its 11/24/20 high plus 10 cents in the earlier mid-day report (read here). It hit a new all-time high with +43% above average volume behind today's 4th consecutive gain, rising from an advanced "ascending base" pattern. The gain and close above the pivot point backed by at least +40% above averge volume clinched a new technical buy signal. The share price tested its 50-day moving average (DMA) line ($41.93) last week and it found prompt support.

AMRC reported earnings +111% on +33% sales revenues for the Sep '20 quarter versus the year ago period. Three of the 4 latest quarterly comparisons were above the +25% minimum earnings guideline (C criteria) with solid sales revenues growth. Its annual earnings (A criteria) history has been good and it has a 94 Earnings Per Share Rating, well above the 80+ minimum for buy candidates.

AMRC reported earnings +111% on +33% sales revenues for the Sep '20 quarter versus the year ago period. Three of the 4 latest quarterly comparisons were above the +25% minimum earnings guideline (C criteria) with solid sales revenues growth. Its annual earnings (A criteria) history has been good and it has a 94 Earnings Per Share Rating, well above the 80+ minimum for buy candidates.

The ENERGY - Alternative group currently has 95 Group Relative Strength Rating (L criteria). It has only 21.2 million shares in the public float (S criteria) which can contribute to great price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 199 in Dec '19 to 278 in Sep '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 2.2 is an unbiased indication its shares have been under accumulation over the past 50 days.

Charts courtesy of www.stockcharts.com