You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Tuesday, April 8, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, NOVEMBER 27TH, 2015

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-14.90 |

17,798.49 |

-0.08% |

|

Volume |

378,256,250 |

-43% |

|

Volume |

723,264,990 |

-50% |

|

NASDAQ |

+11.38 |

5,127.52 |

+0.22% |

|

Advancers |

1,834 |

61% |

|

Advancers |

1,702 |

63% |

|

S&P 500 |

+1.24 |

2,090.11 |

+0.06% |

|

Decliners |

1,151 |

39% |

|

Decliners |

986 |

37% |

|

Russell 2000 |

+4.36 |

1,202.38 |

+0.36% |

|

52 Wk Highs |

94 |

|

|

52 Wk Highs |

87 |

|

|

S&P 600 |

+2.25 |

709.50 |

+0.32% |

|

52 Wk Lows |

48 |

|

|

52 Wk Lows |

38 |

|

|

|

Breadh Positive and Leadership Improved on Holiday-Shortened Session

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

For the week, the Dow was down 0.1%, the S&P 500 was up less than 0.1% and the NASDAQ Composite rose 0.4%. Stocks were little changed on Friday. The Dow was down 15 points to 17798. The S&P 500 gained a point to 2090 and the NASDAQ Composite increased 11 points to 5127. Volume totals on Friday's shortened session were light on the NYSE and on the Nasdaq exchange. Advancers led decliners by a 3-2 margin on the NYSE and by almost 2-1 margin on the Nasdaq exchange. Leadership improved as there were 57 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, up from 49 on the prior session. There were gains for 6 of the 12 high-ranked companies currently on the Featured Stocks Page. New 52-week highs outnumbered new 52-week lows on both the Nasdaq exchange and the NYSE for a second consecutive session.

PICTURED: The Nasdaq Composite Index is perched -1.98% off its all-time high, above its rising 50-day and 200-day moving average (DMA) lines.

All three major averages (M criteria) showed impressive strength and recently rebounded above their respective 200 DMA lines while leadership (stocks hitting new highs) improved. New buying efforts may only be considered in stocks meeting all key criteria.The major averages finished mixed on the shortened trading session. With no

scheduled economic data releases, investors focused on retailers as the holiday

shopping season kicked off in earnest. Amazon.com (AMZN -0.31%) edged lower

despite reports of strong online sales on Thanksgiving. Target (TGT +0.38%)

edged higher while Wal-Mart (WMT -0.58%) fell.

Telecom and financials were the best-performing sectors. Verizon Communications (VZ +0.7%) and JP Morgan Chase & Co (JPM +0.5%) were both higher. Energy and media stocks were down

the most on the session. Shares of Southwestern Energy (SWN -7.2%) slumped and

ConocoPhillips (COP -1.7%) fell in sympathy with a decline in oil prices.

Shares of Walt Disney (DIS -3%) retreated after saying subscriptions at its

ESPN network declined 3% from a year ago. Viacom (VIA -2.3%) was also lower.

Treasuries were mostly higher with the benchmark 10-year note up 3/32 to

yield 2.22%. In commodities, NYMEX WTI crude slumped 2.7% to $41.90/barrel amid

continued supply concerns. COMEX gold was 1.2% lower at $1057.00/ounce amid a

stronger dollar. . The Featured Stocks Page saw some new names recently added. The most current notes with headline links help members have access to more detailed letter-by-letter analysis including price/volume graphs annotated by our experts. See the Premium Member Homepage for archives to all prior pay reports.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Commodity-Linked Groups Fell as Techs and Financials Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

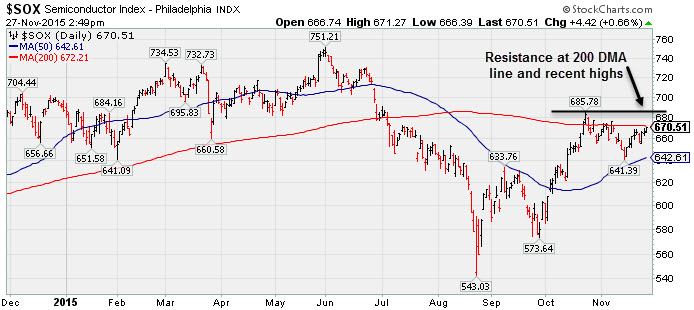

Commodity-linked groups ended lower on Friday as the Oil Services Index ($OSX -1.96%), Integrated Oil Index ($XOI -1.00%), and the Gold & Silver Index ($XAU -2.28%) fell. The Retail Index ($RLX -0.15%) ended slightly lower while the Broker/Dealer Index ($XBD +0.60%) and the Bank Index ($BKX+0.35%) both finished slightly higher. The Biotechnology Index ($BTK +0.44%), Networking Index ($NWX +0.48%) and the Semiconductor Index ($SOX +0.66%) finished unanimously higher, each tech index ending with a small gain. Charts courtesy www.stockcharts.com

PICTURED: The Semiconductor Index ($SOX +0.66%) has been meeting resistance when trying to rebound above its 200-day moving average (DMA) line following its August lows. Most meaningful market rallies have historically included a healthy dose of leadership from the tech sector. Subsequent gains above the 200 DMA line and above recent highs for the SOX would be encouraging signs of strength coming from influential tech stocks.

| Oil Services |

$OSX |

176.60 |

-3.53 |

-1.96% |

-16.25% |

| Integrated Oil |

$XOI |

1,189.61 |

-12.06 |

-1.00% |

-11.76% |

| Semiconductor |

$SOX |

670.51 |

+4.42 |

+0.66% |

-2.38% |

| Networking |

$NWX |

392.63 |

+1.89 |

+0.48% |

+9.69% |

| Broker/Dealer |

$XBD |

186.18 |

+1.11 |

+0.60% |

+0.84% |

| Retail |

$RLX |

1,308.88 |

-1.91 |

-0.15% |

+26.74% |

| Gold & Silver |

$XAU |

44.92 |

-1.04 |

-2.26% |

-34.69% |

| Bank |

$BKX |

75.90 |

+0.26 |

+0.34% |

+2.21% |

| Biotech |

$BTK |

3,842.11 |

+16.99 |

+0.44% |

+11.72% |

|

|

|

|

After Successful Test of 10-Week Average a Valid Secondary Buy Point Exists

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Natural Health Trends (NHTC +$0.41 or +0.86% to $48.28) posted a gain on light volume Friday. A new pivot point was not noted because its consolidation is not a sufficient length base pattern, however its color code was changed to yellow while a valid "secondary buy point" was recently noted. In the Master's class they teach that if you miss an earlier technical breakout a valid secondary buy point may present itself before a sound new base forms. Following an earlier breakout, upon a pullback and its first successful test of the 10 WMA line a stock can be bought from there up to +5% above the latest high. In this case the latest high was $55.45 X 1.05 = $58.22. Risk increases the further away from a sound base that any stock is bought, however, and odds are less favorable when investors buy pullbacks as opposed to buying in on fresh breakouts. NHTC was last shown in this FSU section on 11/10/15 with an annotated graph under the headline, "Wedging Higher Following Volume-Driven Breakout". Volume-driven gains in late October triggered a technical buy signal shortly after it was highlighted in yellow with new pivot point cited based on its 6/25/15 high plus 10 cents in the 10/23/15 mid-day report (read here). Members were then reminded - "Convincing signs of fresh institutional buying demand might mark the beginning of a substantial new leg up in price." The high-ranked Cosmetics / Personal Care firm reported Sep '15 quarterly earnings +181% on +154% sales revenues versus the year ago period, continuing its track record of strong sales and earnings increases well above the +25% minimum guideline (C criteria). Earnings rose +767%, +513%, +250%, +221%, +108%, and +100% in the Mar, Jun, Sep, Dec '14, Mar and Jun '15 quarters, versus the year earlier periods, respectively. Sales revenues rose +168%, +223%, +124%, 85%, +76%, and +104% during than span. There are 124 top-rated funds reportedly owning an interest through Sep '15, up from only 2 in Dec '14, a reassuring sign concerning the I criteria. It has a Timeliness Rating of B and a Sponsorship Rating of C. The current Up/Down Volume Ratio of 1.2 also is an unbiased indication its shares have been under slight accumulation over the past 50 days. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

PNFP

-

NASDAQ

Pinnacle Financial Prtnr

BANKING - Regional - Southeast Banks

|

$54.91

|

+0.31

0.57% |

$54.99

|

57,101

33.20% of 50 DAV

50 DAV is 172,000

|

$57.99

-5.31%

|

11/6/2015

|

$56.34

|

PP = $55.58

|

|

MB = $58.36

|

Most Recent Note - 11/24/2015 6:12:01 PM

Y - Concerns were raised as it slumped back into the prior base. Its 50 DMA line defines the next important support level. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Negated Breakout Then Finding Support Above 50 Day Average - 11/24/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

SFNC

-

NASDAQ

Simmons First Natl Cp A

BANKING - Regional - Southeast Banks

|

$57.30

|

+0.42

0.74% |

$57.42

|

60,088

32.31% of 50 DAV

50 DAV is 186,000

|

$58.58

-2.19%

|

10/22/2015

|

$50.13

|

PP = $48.98

|

|

MB = $51.43

|

Most Recent Note - 11/24/2015 6:17:17 PM

G - Posted a 3rd consecutive small gain with light volume today and finished near the session high for a best-ever close. Extended from its prior base. Prior highs in the $48 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Extended From Prior Base and Perched Near High - 11/19/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

MANH

-

NASDAQ

Manhattan Associates Inc

COMPUTER SOFTWARE and SERVICES - Technical and System Software

|

$76.02

|

+1.16

1.55% |

$76.24

|

230,987

42.62% of 50 DAV

50 DAV is 542,000

|

$76.49

-0.61%

|

10/21/2015

|

$69.18

|

PP = $69.91

|

|

MB = $73.41

|

Most Recent Note - 11/23/2015 5:11:15 PM

G - Color code is changed to green after rallying back above its "max buy" level. Prior highs in the $69 area and its 50 DMA line define support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Consolidating Above Prior Highs and 50-Day Moving Average - 11/18/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

HAWK

-

NASDAQ

Blackhawk Network Inc

DIVERSIFIED SERVICES - Business/Management Services

|

$47.55

|

-0.40

-0.83% |

$48.39

|

145,784

26.46% of 50 DAV

50 DAV is 551,000

|

$48.40

-1.76%

|

11/25/2015

|

$47.63

|

PP = $47.07

|

|

MB = $49.42

|

Most Recent Note - 11/25/2015 5:54:56 PM

Y - Finished above its new pivot point cited based on its 10/09/15 high plus 10 cents, but volume behind the gain fort a new high today was below the minimum guideline. Fundamentals remain strong. Volume must be at least +40% above average behind gains above a stock's pivot point to trigger a proper technical buy signal. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Gain For New High With +36% Above Average Volume - 11/25/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

JBSS

-

NASDAQ

Sanfilippo John B & Son

FOOD and BEVERAGE - Processed and Packaged Goods

|

$61.04

|

-0.20

-0.33% |

$61.81

|

30,213

37.77% of 50 DAV

50 DAV is 80,000

|

$66.29

-7.92%

|

10/27/2015

|

$56.00

|

PP = $57.33

|

|

MB = $60.20

|

Most Recent Note - 11/23/2015 5:12:39 PM

G - Still consolidating above its "max buy" level. Prior highs in the $57 area and its 50 DMA line define support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Consolidating Near "Max Buy" Level and Well Above Prior Highs - 11/12/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

STMP

-

NASDAQ

Stamps.com Inc

INTERNET - Internet Software and Services

|

$101.94

|

-0.06

-0.06% |

$102.21

|

128,238

44.07% of 50 DAV

50 DAV is 291,000

|

$106.43

-4.22%

|

11/6/2015

|

$100.75

|

PP = $88.97

|

|

MB = $93.42

|

Most Recent Note - 11/23/2015 5:09:44 PM

G - Volume-driven gain today for its 2nd best close. Prior highs in the $88 area define important near-term support to watch. Disciplined investors avoid chasing extended stocks. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Volume-Driven Gain For Second Best Close - 11/23/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ULTI

-

NASDAQ

Ultimate Software Group

INTERNET - Internet Software and Services

|

$198.00

|

-0.18

-0.09% |

$198.52

|

135,585

51.75% of 50 DAV

50 DAV is 262,000

|

$216.27

-8.45%

|

10/28/2015

|

$204.38

|

PP = $195.28

|

|

MB = $205.04

|

Most Recent Note - 11/24/2015 6:19:09 PM

Y - Pulled back today for a 3rd consecutive small loss with light volume. Prior highs in the $195 area define support along with its 50 DMA line ($193.24).

>>> FEATURED STOCK ARTICLE : Following Big Breakout Volume Totals Have Cooled - 11/16/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$170.98

|

+0.87

0.51% |

$171.84

|

352,574

47.97% of 50 DAV

50 DAV is 735,000

|

$176.77

-3.28%

|

10/22/2015

|

$168.02

|

PP = $170.31

|

|

MB = $178.83

|

Most Recent Note - 11/27/2015 3:37:10 PM

Most Recent Note - 11/27/2015 3:37:10 PM

G - Volume totals cooled while holding its ground following a rebound above its 50 DMA line. Found support near its 200 DMA line. Little resistance remains due to overhead supply up through the $176 level. Fundamental concerns remain after the Sep '15 quarter earnings were below the +25% minimum guideline (C criteria).

>>> FEATURED STOCK ARTICLE : Gains on Light Volume Before Decisive Drop on Heavy Volume - 11/13/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

FLTX

-

NYSE

Fleetmatics Group Plc

Computer Sftwr-Enterprse

|

$59.34

|

-0.20

-0.34% |

$59.80

|

82,852

18.41% of 50 DAV

50 DAV is 450,000

|

$61.75

-3.90%

|

9/23/2015

|

$51.26

|

PP = $52.55

|

|

MB = $55.18

|

Most Recent Note - 11/24/2015 6:15:01 PM

G - Pulled back on light volume today. It is extended from any sound base. Prior highs in the $56 area define near-term support above its 50 DMA line ($54.58).

>>> FEATURED STOCK ARTICLE : Extended From Prior Base and Perched Near High - 11/17/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LXFT

-

NYSE

Luxoft Holding Inc Cl A

Comp Sftwr-Spec Enterprs

|

$76.50

|

+0.05

0.07% |

$76.73

|

57,211

24.98% of 50 DAV

50 DAV is 229,000

|

$78.18

-2.15%

|

10/22/2015

|

$66.65

|

PP = $68.95

|

|

MB = $72.40

|

Most Recent Note - 11/27/2015 3:35:37 PM

Most Recent Note - 11/27/2015 3:35:37 PM

G - Posted 4 consecutive weekly gains and volume totals have cooled while stubbornly holding its ground near its all-time high, a sign that very few investors have been heading to the exit. Disciplined investors avoid chasing extended stocks.

>>> FEATURED STOCK ARTICLE : Gap Up Gain Getting More Extended From Prior Base - 11/11/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

VBTX

-

NASDAQ

Veritex Holdings Inc

BANKING - Regional - Southwest Banks

|

$16.87

|

-0.02

-0.12% |

$17.14

|

6,966

40.98% of 50 DAV

50 DAV is 17,000

|

$17.95

-6.02%

|

11/4/2015

|

$17.00

|

PP = $18.05

|

|

MB = $18.95

|

Most Recent Note - 11/23/2015 5:13:59 PM

Y - Finished near the session high today. Found support above its 50 DMA line last week. Still has not produced the necessary gains above its pivot point backed by at least +40% above average volume needed to trigger a technical buy signal.

>>> FEATURED STOCK ARTICLE : Found Support This Week Above 50-Day Moving Average - 11/20/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NHTC

-

NASDAQ

Natural Health Trends

Cosmetics/Personal Care

|

$48.28

|

+0.41

0.86% |

$49.68

|

224,952

53.18% of 50 DAV

50 DAV is 423,000

|

$55.45

-12.93%

|

10/23/2015

|

$42.12

|

PP = $44.85

|

|

MB = $47.09

|

Most Recent Note - 11/27/2015 3:32:27 PM

Most Recent Note - 11/27/2015 3:32:27 PM

Y - See the latest FSU analysis for more details and a new annotated graph showing a valid secondary buy point noted from its first successful test of the 10 WMA line up to +5% above the latest high ($55.45 X 1.05 =$58.22).

>>> FEATURED STOCK ARTICLE : After Successful Test of 10-Week Average a Valid Secondary Buy Point Exists - 11/27/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|