You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Thursday, April 10, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, OCTOBER 7TH, 2011

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-20.21 |

11,103.12 |

-0.18% |

|

Volume |

1,137,246,110 |

+2% |

|

Volume |

2,046,413,520 |

-5% |

|

NASDAQ |

-27.47 |

2,479.35 |

-1.10% |

|

Advancers |

863 |

28% |

|

Advancers |

618 |

23% |

|

S&P 500 |

-9.51 |

1,155.46 |

-0.82% |

|

Decliners |

2,150 |

69% |

|

Decliners |

1,920 |

73% |

|

Russell 2000 |

-17.59 |

656.21 |

-2.61% |

|

52 Wk Highs |

9 |

|

|

52 Wk Highs |

10 |

|

|

S&P 600 |

-9.52 |

363.75 |

-2.55% |

|

52 Wk Lows |

32 |

|

|

52 Wk Lows |

59 |

|

|

|

Major Averages Pause as Investors Wait for New Follow Through Day

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

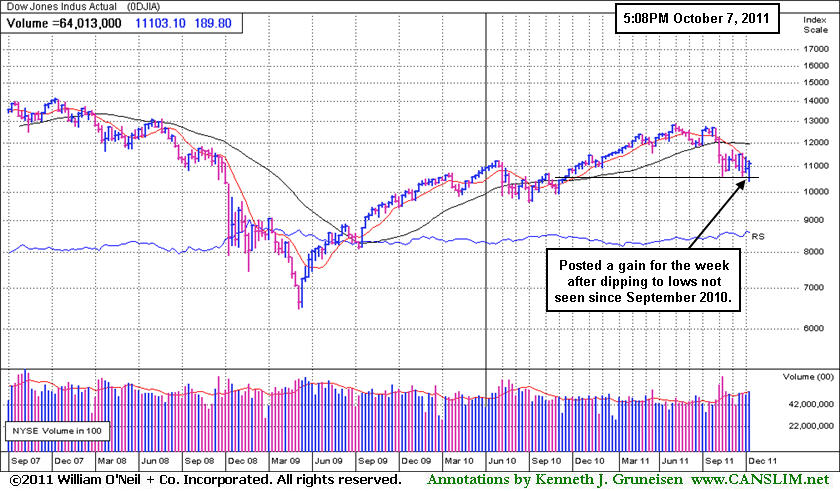

For the week, the Dow Jones Industrial Average gained +1.7%, the S&P 500 Index was up +2.1%, and the Nasdaq Composite Index rose +2.6%. The Friday volume total reported on the NYSE was marginally higher than the prior session total while on the Nasdaq exchange volume cooled. Breadth was negative as declining issues beat advancers by 5-2 on the NYSE and by 3-1 on the Nasdaq exchange. New 52-week lows still outnumbered new 52-week highs on both major exchanges, however, the new 52-week lows totals on both the Nasdaq exchange and the NYSE have greatly contracted since the major averages halted their recent slide. Tuesday's session had 1,198 new lows on the NYSE and 764 new lows on the Nasdaq exchange as the major averages sliced to new 2011 lows before rebounding. On Friday there were 4 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, up from 1 on the prior session. There were losses for all of the 5 high-ranked companies currently included on the Featured Stocks Page, a list that has been recently been shrinking.

There was a muted reaction to Friday's report on jobs from the Labor Department. The government reported non-farm payrolls in the U.S. grew more than expected in September and gains in previous months were revised higher. The September increase was 103,000. Analysts were looking for a gain of 60,000. Revisions of July and August data added 99,000 jobs. The September unemployment rate remained at 9.1%, in line with expectations.

A report released a half hour after the open showed inventories at U.S. wholesalers rose less than forecast in August as distributors kept stockpiles in line with sales. Shares of utilities and consumer goods companies were higher as investors appeared to gravitate toward dividend-paying stocks. Treasury yields rose for the fourth straight day. The 10-year Treasury note was down 21/32 to yield 2.06%.

Technology and financial stocks were dragging. Financial stocks lost ground after Fitch Ratings Agency cut credit ratings for Italy and Spain. JP Morgan Chase (JPM -5.19%) fell and subtracted nine points from the Dow. The Travelers Companies Inc (TRV -2.37%) and American Express Co (AXP -2.25%) also sank. Retail stocks got a boost from the jobs report, with modest gains for The Home Depot Inc (HD +1.62%) and Wal-Mart Stores Inc (WMT +1.80%). Sprint Nextel Corp (S -19.93%) slumped badly on concerns the company may have to raise capital to upgrade its network.

The market environment (M criteria) is still uncertain. A heavy wave of distributional action pushed the benchmark S&P 500 Index beyond the -20% Bear Market threshold at the week's lows, yet it finished Friday +7.5% above Tuesday's intra-day low. Disciplined investors are now watching for a follow-through day (FTD) of solid gains on higher volume from at least one of the major averages coupled with an expansion in the number of stocks hitting new highs. That could confirm a new rally and signal that odds are again favorable for making new buying efforts. Historic studies suggest that it is most ideal for a FTD to come between Day 4-7 of a new rally attempt. Monday's session will mark Day 5 of the current rally attempt.

The Q3 2011 Webcast (aired on September 28th) is now available "ON DEMAND" - (CLICK HERE) It provides an informative review of current market conditions, leading groups, and best buy candidates. All upgraded members are eligible to access the webcast presentation at no additional cost! Via the Premium Member Homepage links to all prior reports and webcasts are always available.

PICTURED: The Dow Jones Industrial Average posted a gain for the week after dipping to lows not seen since September 2010.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Tech, Energy, and Defensive Groups Backpedaled

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX +1.00%) posted a gain, but losses in the financial sector weighed on the major averages as the Broker/Dealer Index ($XBD -3.21%) and Bank Index ($BKX -2.80%) backpedaled on Friday. The Semiconductor Index ($SOX +0.44%) bucked a mostly negative tech sector while the Biotechnology Index ($BTK -3.22%), Networking Index ($NWX -1.75%), and Internet Index ($IIX -1.11%) fell. Energy-related shares were weak as the Oil Services Index ($OSX -1.67%) and Integrated Oil Index ($XOI -0.90%) slumped. Defensive groups also gave "safe haven" investors no reward as the Gold & Silver Index ($XAU -2.21%) and Healthcare Index ($HMO -0.82%) lost ground.

Charts courtesy www.stockcharts.com

PICTURED 1: The Bank Index ($BKX -2.80%) has a worrisome series of lower highs and lower lows while remaining well below its important moving averages.

Charts courtesy www.stockcharts.com

PICTURED 2: The Broker/Dealer Index ($XBD -3.21%) has a worrisome series of lower highs and lower lows while remaining well below its important moving averages.

| Oil Services |

$OSX |

197.26 |

-3.34 |

-1.67% |

-19.53% |

| Healthcare |

$HMO |

1,855.20 |

-15.25 |

-0.82% |

+9.65% |

| Integrated Oil |

$XOI |

1,068.63 |

-9.70 |

-0.90% |

-11.91% |

| Semiconductor |

$SOX |

356.73 |

+1.56 |

+0.44% |

-13.38% |

| Networking |

$NWX |

223.54 |

-3.98 |

-1.75% |

-20.32% |

| Internet |

$IIX |

273.82 |

-3.08 |

-1.11% |

-11.02% |

| Broker/Dealer |

$XBD |

80.54 |

-2.67 |

-3.21% |

-33.72% |

| Retail |

$RLX |

514.72 |

+5.10 |

+1.00% |

+1.25% |

| Gold & Silver |

$XAU |

187.44 |

-4.24 |

-2.21% |

-17.27% |

| Bank |

$BKX |

36.12 |

-1.04 |

-2.80% |

-30.82% |

| Biotech |

$BTK |

1,116.29 |

-37.18 |

-3.22% |

-13.97% |

|

|

|

|

53% Decline in Just Over 3 Months After Dropped From Featured Stocks

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

When the number of stocks included on the Featured Stocks page is low, and those currently listed have all received recent analysis in this FSU section, we occasionally go back to revisit a previously featured stock that was dropped. Today we will have another look at a stock that was dropped from the Featured Stocks list back on 4/28/11. CTCT sank as much as -53% lower in a little more than 3 months after it was dropped from the Featured Stocks list. That serves as a reminder that losses should always be limited by selling if ever any stock falls more than -7% from your purchase price. That is Rule #1 in the fact-based investment system CANSLIM.net supports.

Constant Contact Inc (CTCT -$0.55 or -3.10% to $17.22) made its last appearance in this FSU section with an annotated graph on 4/19/11 under the headline, "Damaging Distributional Action Negated Recent Breakout, as it was down considerably with a 2nd damaging loss with heavy volume in the span of 3 sessions. It had slumped below its 50-day moving average (DMA) line and finished near the session low, raising concerns and triggering worrisome technical sell signals. We observed that distributional pressure had completely negated its prior breakout from a choppy 13-week base, hurting its near-term chances of going on for much greater gains. From there it held its ground for another week, but it failed to rebound above the 50 DMA line. Then it was noted while being dropped from the Featured Stocks list as it reported earnings after the close on Thursday, April 28th. Earnings results for the quarter ended March 31, 2011 were disappointing, -33% from the year ago period despite a +27% increase in sales revenues. The stock gapped down badly the next day and since then it has continued to struggle.

It was previously noted that its sales revenues increases showed steady sequential deceleration from +55%, +49%, +47%, +43%, +40%, +37%, +34%, to +30% from the Mar '09 through the Dec '10 quarterly comparison(s) versus the respective year(s) earlier. Earnings increased by +245% on +24% sales revenues for the quarter ended June 30, 2011, maintaining its track record of steady sales revenues deceleration. Disciplined investors following the fact-based system would have a problem now with the flaw in its earnings track record. Additionally, increasing ownership by top-rated funds is normally a reassuring sign (I criteria) that disciplined investors look for in superior buy candidates. However, the number of top-rated funds owning CTCT shares has fallen from 314 in Mar '11 to 281 in Sep '11, not a very reassuring trend.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

Last |

Chg. |

Vol

% DAV |

Date Featured |

Price Featured |

Latest Pivot Point

Featured |

Status |

| Latest Max Buy Price |

AAPL - NASDAQ

Apple Computer Inc

COMPUTER HARDWARE - Personal Computers |

$369.80 |

-7.57 |

19,124,274

82% DAV

23,462,900 |

9/16/2011

(Date Featured) |

$399.14

(Price Featured) |

PP = $404.60 |

G |

| MB = $424.83 |

Most Recent Note - 10/7/2011 6:45:16 PM

G - Its 50 DMA line acted as a resistance level. Damaging losses triggered a technical sell signal and it tested support at its longer-term 200 DMA line this week. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 10/6/2011. click here. |

C A N S L I M | StockTalk | News | Chart |    SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS |

ALXN - NASDAQ

Alexion Pharmaceuticals

DRUGS - Drug Manufacturers - Other |

$65.18 |

-0.46 |

1,028,028

61% DAV

1,694,300 |

9/15/2011

(Date Featured) |

$63.20

(Price Featured) |

PP = $60.81 |

G |

| MB = $63.85 |

Most Recent Note - 10/7/2011 6:49:06 PM

G - Holding its ground with lighter volume following volume-driven gains for this high-ranked Medical - Biomed/Biotech group leader. Support to watch includes prior resistance in the $59-60 area and its upwardly tilted 50 DMA line. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 10/5/2011. click here. |

C A N S L I M | StockTalk | News | Chart |    SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS |

CELG - NASDAQ

Celgene Corp

DRUGS - Drug Manufacturers - Major |

$62.95 |

-0.40 |

3,171,155

71% DAV

4,462,000 |

9/16/2011

(Date Featured) |

$61.21

(Price Featured) |

PP = $62.59 |

Y |

| MB = $65.72 |

Most Recent Note - 10/7/2011 6:51:01 PM

Y - Small losses on lighter volume followed a prompt rebound above its pivot point. Managed a positive reversal on 10/04/11 after lows testing near its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 10/4/2011. click here. |

C A N S L I M | StockTalk | News | Chart |    SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS |

MG - NYSE

Mistras Group Inc

DIVERSIFIED SERVICES - Bulding and Faci;ity Management Services |

$19.60 |

-0.20 |

167,772

77% DAV

218,200 |

8/10/2011

(Date Featured) |

$17.89

(Price Featured) |

PP = $17.58 |

G |

| MB = $18.46 |

Most Recent Note - 10/7/2011 6:52:55 PM

G - Pulling back after it touched a new all-time high this week. It tried to rise without great volume conviction from a 5-week consolidation that may be considered a "base-on-base" type pattern, however no new pivot point was cited. Additionally, the M criteria argues against new (or add-on) buying efforts in otherwise worthy buy candidates until the nascent new rally effort is confirmed by a solid follow-through day.

>>> The latest Featured Stock Update with an annotated graph appeared on 9/30/2011. click here. |

C A N S L I M | StockTalk | News | Chart |    SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS |

V - NYSE

Visa Inc

DIVERSIFIED SERVICES - Business/Management Services |

$86.25 |

-0.88 |

4,388,251

69% DAV

6,320,400 |

9/20/2011

(Date Featured) |

$93.91

(Price Featured) |

PP = $90.93 |

G |

| MB = $95.48 |

Most Recent Note - 10/7/2011 6:54:32 PM

G - Perched near its 50 DMA line which recently began sloping downward. It recently stalled after rallying to a new all-time high. Mastercard Inc (MA), its peer in the Finance - Credit Card/Payment Processing group, remains below its 50 DMA line after recently dropped from the Featured Stocks list.

>>> The latest Featured Stock Update with an annotated graph appeared on 9/21/2011. click here. |

C A N S L I M | StockTalk | News | Chart |    SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS SEC View all notes Alert me of new notes CANSLIM.net Company Profile ZACKS | --

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|