You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Sunday, April 6, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - THURSDAY, SEPTEMBER 24TH, 2015

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-78.57 |

16,201.32 |

-0.48% |

|

Volume |

1,007,704,140 |

+32% |

|

Volume |

1,836,855,170 |

+24% |

|

NASDAQ |

-18.26 |

4,734.48 |

-0.38% |

|

Advancers |

1,232 |

40% |

|

Advancers |

1,270 |

43% |

|

S&P 500 |

-6.52 |

1,932.24 |

-0.34% |

|

Decliners |

1,843 |

60% |

|

Decliners |

1,715 |

57% |

|

Russell 2000 |

-2.52 |

1,137.54 |

-0.22% |

|

52 Wk Highs |

6 |

|

|

52 Wk Highs |

26 |

|

|

S&P 600 |

-0.49 |

663.23 |

-0.07% |

|

52 Wk Lows |

350 |

|

|

52 Wk Lows |

191 |

|

|

|

Major Averages Ended Up From Session Lows

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Stocks pared losses on Thursday. The Dow fell 78 points to 16201. The S&P 500 retreated 6 points to 1932. The NASDAQ sank 18 points to 4734. The volume totals were reported higher than the prior session totals on the NYSE and on the Nasdaq exchange. Breadth was negative as decliners led advancers by a 3-2 margin on the NYSE and nearly 3-2 on the Nasdaq exchange. There were 8 stocks that made it onto the BreakOuts Page, matching the 8 high-ranked companies from the Leaders List that made a new 52-week high on the prior session. The total number of new 52-week lows expanded and solidly outnumbered new 52-week highs on the NYSE and on the Nasdaq exchange. There were losses for 5 of the 6 high-ranked companies currently on the Featured Stocks Page.

PICTURED: The benchmark S&P 500 Index finished in the upper third of its intra-day range on Thursday, a reassuring sign stocks found some support on the session. It met resistance before prior lows and its 50-day moving average (DMA) lines when rebounding, then slumped again on higher volume indicative of distributional pressure. Its MACD indicator remains positive, however, it remains well below its 200-day moving average line.

At least 2 of the 3 major indices should be trading above their respective 200-day moving average (DMA) lines in order for a market environment to be considered technically "healthy". A lot of recovery work must be done to get the indices back into healthy shape, and that improvement could require some considerable time and patience.

New buying efforts may only be considered in stocks meeting all key criteria of the fact-based investment system. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price.

The major averages stemmed declines as investors sought clarity on the Fed’s interest rate policy. Traders will be watching Janet Yellen as she speaks in Massachusetts. Economic data was mixed. Initial jobless claims rose less than expected last week. In August, durable goods orders fell 0.2%, better than estimated, while capital goods orders met projections of a 0.2% fall. Over the same period, annualized new home sales rose 5.7% over July’s figure.

Six of 10 S&P 500 sectors were in negative territory. Health care was the worst performer as Biogen (BIIB -1.79%) fell. Industrials were weighed down by Caterpillar’s (CAT -6.27%) decline. However, Lockheed Martin (LMT +0.98%) rose after revamping a share buyback program. In energy stocks, Transocean (RIG -4.8%) amid reports of being ensnared in Petrobras’ (PBR +2.48%) corruption scandal. Fiat (FCAU -4.24%) in sympathy with European carmakers.

Treasuries climbed but finished off session highs. The benchmark 10-year note rose 6/32 to yield 2.13%.

Commodities were mostly higher. WTI crude advanced 1.5% to $45.15/barrel. COMEX gold jaded 2% to $1153.80/ounce amid dollar weakness.

The number of stocks listed to the Featured Stocks Page waned during deteriorating market conditions. The most current notes with headline links help members have access to more detailed letter-by-letter analysis including price/volume graphs annotated by our experts. See the Premium Member Homepage for archives to all prior pay reports.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Gold & Silver Index Posts Big Gain; Biotech and Financials Fell

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

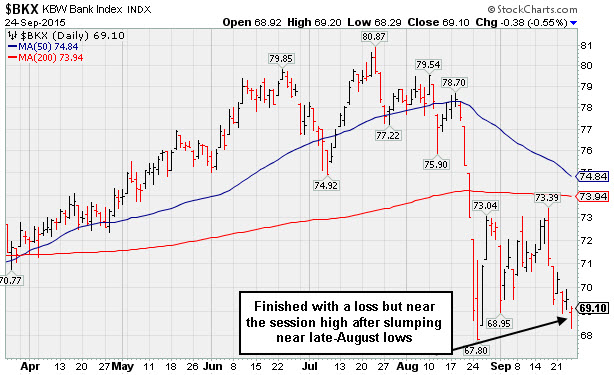

The Gold & Silver Index ($XAU +7.36%) was a standout gainer. The Broker/Dealer Index ($XBD -1.06%) and the Bank Index ($BKX -0.55%) fell on Thursday while the Retail Index ($RLX +0.11%) eked out a small gain. The tech sector was mixed as the Biotechnology Index ($BTK -1.72%) fell worst, and the Semiconductor Index ($SOX -0.17%) ended slightly lower, the Networking Index ($NWX +0.23%) overcame early weakness to close slightly higher. Energy-linked shares were mixed as the Integrated Oil Index ($XOI +0.41%) rose and the Oil Services Index ($OSX -0.24%) finished lower.

Charts courtesy www.stockcharts.com

PICTURED: The Bank Index ($BKX -0.55%) finished with a loss but near the session high after slumping near the late-August lows. It remains well below its 50-day and 220-day moving average (DMA) lines. More worrisome losses would bode poorly for the broader market outlook because the financials are reliable leading indicators.

| Oil Services |

$OSX |

165.44 |

-0.39 |

-0.24% |

-21.54% |

| Integrated Oil |

$XOI |

1,059.48 |

+4.29 |

+0.41% |

-21.41% |

| Semiconductor |

$SOX |

589.71 |

-1.03 |

-0.17% |

-14.15% |

| Networking |

$NWX |

360.88 |

+0.83 |

+0.23% |

+0.82% |

| Broker/Dealer |

$XBD |

167.95 |

-1.80 |

-1.06% |

-9.04% |

| Retail |

$RLX |

1,195.21 |

+1.28 |

+0.11% |

+15.73% |

| Gold & Silver |

$XAU |

47.89 |

+3.28 |

+7.35% |

-30.37% |

| Bank |

$BKX |

69.10 |

-0.38 |

-0.55% |

-6.95% |

| Biotech |

$BTK |

3,707.54 |

-64.96 |

-1.72% |

+7.81% |

|

|

|

|

Are You Using This Information to Make Fact-Based Buy/Sell Decisions With Success?

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

You want to get above average results, and market conditions (the M criteria) are challenging at times, so you must always remain disciplined, yet patient.

There are few stocks included on the Featured Stocks list now and none of the companies need additional review. At times like these we have an opportunity to look back and review. We recently reviewed Ambarella (AMBA) on 9/03/15 and Skyworks (SWKS) on 9/17/15 because previously featured stocks which were dropped can serve as educational examples of the investment system's tactics. It is also a reminder that high-ranked leaders eventually fall out of favor.

If you wish to request for a specific stock to receive more detailed coverage in this section please use the inquiry form to submit your request. Thank you!

Professional Money Management Services - A Winning System - Inquire today!

Our skilled portfolio manager knows how to follow the rules of this fact-based investment system. We do not follow opinion or the "conviction list" of some large Wall Street institution which would have us fully invested even during horrific bear markets. Instead, we remain fluid and only buy the best stocks when they are triggering proper technical buy signals. If you are not completely satisfied with the way your portfolio is being managed, Click here and indicate "Find a Broker" to get connected with our portfolio managers. *Accounts over $250,000 please. ** Serious inquires only, please. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

BOFI

-

NASDAQ

B O F I Holding Inc

BANKING - Savings andamp; Loans

|

$124.66

|

+1.00

0.81% |

$125.43

|

204,548

67.06% of 50 DAV

50 DAV is 305,000

|

$134.79

-7.52%

|

6/10/2015

|

$101.47

|

PP = $97.78

|

|

MB = $102.67

|

Most Recent Note - 9/21/2015 5:50:10 PM

G - Quietly consolidating above its 50 DMA ($120.43) line. It has not formed a sound base of sufficient length.

>>> FEATURED STOCK ARTICLE : Slumped Below 50-Day Average With Higher Volume Loss - 9/18/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

AHS

-

NYSE

A M N Healthcare Svcs

DIVERSIFIED SERVICES - Staffing and Outsourcing Service

|

$36.75

|

-0.46

-1.24% |

$37.45

|

939,041

129.17% of 50 DAV

50 DAV is 727,000

|

$37.47

-1.92%

|

8/5/2015

|

$34.50

|

PP = $32.53

|

|

MB = $34.16

|

Most Recent Note - 9/24/2015 6:45:08 PM

Most Recent Note - 9/24/2015 6:45:08 PM

G - Fell today with higher and above average volume indicative of distributional pressure. Still consolidating above its 50 DMA line ($33.57) and prior highs defining important near term support.

>>> FEATURED STOCK ARTICLE : Found Support Above 50-Day Moving Average - 9/14/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$168.01

|

-0.09

-0.05% |

$168.69

|

541,506

58.23% of 50 DAV

50 DAV is 930,000

|

$176.77

-4.96%

|

5/29/2015

|

$155.03

|

PP = $159.95

|

|

MB = $167.95

|

Most Recent Note - 9/21/2015 5:51:42 PM

G - Consolidating above its 50 DMA line ($165.30). It has not formed a sound base following the deep shakeout on 8/24/15.

>>> FEATURED STOCK ARTICLE : Consolidating Above 50-Day Moving Average Line - 9/21/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

FLTX

-

NYSE

Fleetmatics Group Plc

Computer Sftwr-Enterprse

|

$50.76

|

-1.43

-2.74% |

$52.00

|

462,748

134.13% of 50 DAV

50 DAV is 345,000

|

$52.45

-3.22%

|

9/23/2015

|

$51.26

|

PP = $52.55

|

|

MB = $55.18

|

Most Recent Note - 9/24/2015 6:43:35 PM

Most Recent Note - 9/24/2015 6:43:35 PM

Y - Pulled back with above average volume and finished near the session low. It was highlighted in yellow with pivot point cited based on its 8/07/15 high plus 10 cents in the 9/23/15 mid-day report. Subsequent volume-driven gains for new highs may trigger a technical buy signal. The high-ranked Ireland-based Computer Software - Enterprise firm found support at its 200 DMA line during its consolidation. Reported earnings +83% on +24% sales revenues for the Jun '15 quarter, its 3rd consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). That helped it better match the fact-based investment system's guidelines, however sequential quarterly comparisons have shown deceleration in its growth rate. No resistance remains due to overhead supply. See the latest FSU analysis for additional details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Perched New Prior High After Big Streak Of Gains - 9/23/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LXFT

-

NYSE

Luxoft Holding Inc Cl A

Comp Sftwr-Spec Enterprs

|

$63.19

|

-1.24

-1.92% |

$64.43

|

160,523

63.45% of 50 DAV

50 DAV is 253,000

|

$68.85

-8.22%

|

5/26/2015

|

$51.90

|

PP = $57.40

|

|

MB = $60.27

|

Most Recent Note - 9/21/2015 5:53:42 PM

G -No resistance remains while perched at its all-time high free of all overhead supply. It did not form a sound base, however it found prompt support after violating its 50 DMA line.

>>> FEATURED STOCK ARTICLE : Quiet Gain For Second Best Close Ever - 9/15/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

INGN

-

NASDAQ

Inogen Inc

HEALTH SERVICES - Medical Instruments and Supplies

|

$53.66

|

-0.73

-1.34% |

$54.45

|

326,016

111.65% of 50 DAV

50 DAV is 292,000

|

$55.98

-4.14%

|

8/12/2015

|

$49.01

|

PP = $45.85

|

|

MB = $48.14

|

Most Recent Note - 9/18/2015 5:59:37 PM

G - Finished near the session high today with a small gain on heavy volume amid broader market weakness. Extended from its prior base. Its 50 DMA line and prior highs define near-term support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Another New High Close For Medical Products Firm - 9/16/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|