You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Wednesday, April 16, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, JANUARY 12TH, 2016

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+117.65 |

16,516.22 |

+0.72% |

|

Volume |

1,102,661,540 |

+5% |

|

Volume |

1,945,092,130 |

-12% |

|

NASDAQ |

+47.93 |

4,685.92 |

+1.03% |

|

Advancers |

1,474 |

48% |

|

Advancers |

1,520 |

52% |

|

S&P 500 |

+15.01 |

1,938.68 |

+0.78% |

|

Decliners |

1,602 |

52% |

|

Decliners |

1,427 |

48% |

|

Russell 2000 |

+2.80 |

1,044.70 |

+0.27% |

|

52 Wk Highs |

14 |

|

|

52 Wk Highs |

11 |

|

|

S&P 600 |

+1.60 |

624.70 |

+0.26% |

|

52 Wk Lows |

577 |

|

|

52 Wk Lows |

364 |

|

|

|

Leadership Thin Behind Gains for Major Indices

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

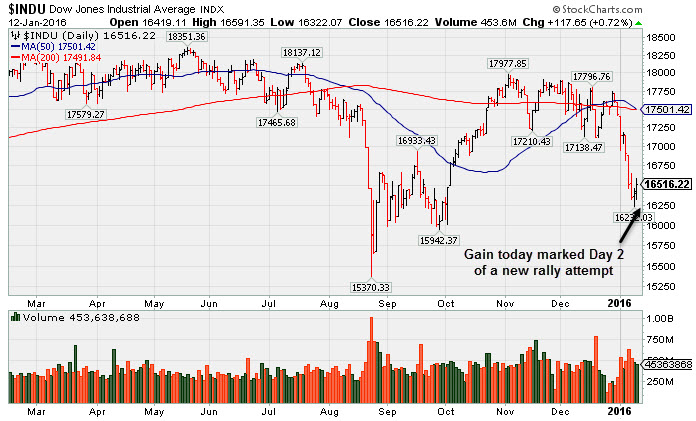

Stocks advanced on Tuesday. The Dow was up 117 points to 16516. The S&P 500 added 15 points to 1938. The NASDAQ climbed 47 points at 4685. Volume totals were mixed, higher than the prior session on the NYSE and lighter on the Nasdaq exchange. Decliners narrowly led advancers on the NYSE while advancers narrowly led decliners on the Nasdaq exchange. Leadership remained thin as there was only 1 high-ranked company from the Leaders List that made a new 52-week high and was listed on the BreakOuts Page, down from 5 on the prior session. There were gains for 2 of the 3 high-ranked companies remaining on the Featured Stocks Page. That list was trimmed as market weakness weighed on prior leaders and the broader market. New 52-week lows solidly outnumbered new 52-week highs on the NYSE and on the Nasdaq exchange.Charts used courtesy of www.stockcharts.com

PICTURED: The Dow Jones Industrial Average posted a gain on Tuesday, marking Day 2 of a new rally attempt. The Blue Chip index is -10% off its record high. Concerns rose as it and the other major averages again slumped well below their respective 50-day and 200-day moving average (DMA) lines. The fact-based investment system always prompts investors to reduce exposure by selling faltering stocks in weak markets. New leadership (stocks hitting new highs) has become elusive as the major averages (M criteria) resumed their previously noted "correction" and distributional pressure from the institutional crowd brought widespread damage to stocks. This is a good time to keep a watchlist of the strongest stocks, meanwhile, preserving cash and reducing risk until a new confirmed rally is finally noted. The major averages fluctuated for much of the session as optimism surrounding further Chinese stimulus measures was tempered by the continued descent in oil prices. On the Fed front, Richmond President Jeffrey Lacker indicated in a speech this afternoon that stronger-than-expected economic growth would necessitate a faster pace of interest rate hikes. In earnings, Alcoa (AA -9.00%) sank after beating earnings estimates but missing revenue expectations. Anthem (ANTM +5.64%) rallied after projecting 2016 earnings above consensus projections while Lululemon (LULU +3.82%) rose after lifting its quarterly forecast. In the oil patch, Freeport-McMoran (FCX -4.64%) fell to $4.11 amid more negative analyst commentary. Eight out of ten sectors in the S&P 500 traded higher on Tuesday. Tech and healthcare stocks outperformed while utilities and telecom shares lagged. Alphabet (GOOGL +1.67%) paced the gains in tech. Treasuries gained after strong demand in the latest $24 billion two-year note auction. The benchmark 10-year note added 18/32 to yield 2.11%, the lowest level since October. In commodities, NYMEX WTI crude slid another 2.7% to $30.56/barrel. COMEX gold declined 0.6% to $1090.00/ounce amid a stronger dollar. The Featured Stocks Page includes most current notes with headline links for access to more detailed letter-by-letter analysis including price/volume graphs annotated by our experts. See the Premium Member Homepage for archives to all prior pay reports.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Retail, Tech, and Financial Indices Led Group Gainers

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX+0.96%) posted a solid gain on Tuesday and the Bank Index ($BKX+0.84%) and Broker/Dealer Index ($XBD +0.22%) both finished higher. The Semiconductor Index ($SOX +0.83%), Networking Index ($NWX +0.92%), and the Biotechnology Index ($BTK +1.58%) posted unanimous gains. The Gold & Silver Index ($XAU -3.45%) fell hard again, meanwhile, energy-linked areas bounced back only slightly as the Oil Services Index ($OSX +0.58%) and Integrated Oil Index ($XOI +0.26%) both edged higher.Charts courtesy www.stockcharts.com

PICTURED: The Bank Index ($BKX+0.84%) slumped well below its 50-day and 200-day moving average (DMA) lines, yet halted its slide near prior lows.

| Oil Services |

$OSX |

139.21 |

+0.80 |

+0.58% |

-11.74% |

| Integrated Oil |

$XOI |

962.65 |

+2.54 |

+0.26% |

-10.26% |

| Semiconductor |

$SOX |

608.56 |

+5.01 |

+0.83% |

-8.28% |

| Networking |

$NWX |

353.39 |

+3.20 |

+0.92% |

-6.00% |

| Broker/Dealer |

$XBD |

161.48 |

+0.35 |

+0.22% |

-9.33% |

| Retail |

$RLX |

1,225.65 |

+11.63 |

+0.96% |

-4.50% |

| Gold & Silver |

$XAU |

42.85 |

-1.53 |

-3.45% |

-5.41% |

| Bank |

$BKX |

67.09 |

+0.56 |

+0.84% |

-8.20% |

| Biotech |

$BTK |

3,351.31 |

+52.20 |

+1.58% |

-12.13% |

|

|

|

|

Help Available For You in Making Fact-Based Buy/Sell Decisions With Greater Success

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

There are few stocks included on the Featured Stocks list now and none of the companies need additional review. At times like these we have an opportunity to look back. In the past we reviewed Ambarella (AMBA) on 9/03/15 and Skyworks (SWKS) on 9/17/15. Previously featured stocks which were dropped can serve as great educational examples of the investment system's tactics. Some are vivid reminders that all high-ranked leaders eventually fall out of favor. If you wish to request for a specific stock to receive more detailed coverage in this section please use the inquiry form to submit your request. Thank you! Professional Money Management Services - A Winning System - Inquire today!

Our skilled portfolio manager knows how to follow the rules of this fact-based investment system. We do not follow opinion or the "conviction list" of some large Wall Street institution which would have us fully invested even during horrific bear markets. Instead, we remain fluid and only buy the best stocks when they are triggering proper technical buy signals. If you are not completely satisfied with the way your portfolio is being managed, Click here and indicate "Find a Broker" to get connected with our portfolio managers. *Accounts over $250,000 please. ** Serious inquires only, please. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|