Violated 200-Day Moving Average Line Following Earnings News - Tuesday, January 25, 2022

United Microelectronics Inc's Adr (UMC -$0.78 or -7.15% to $10.13) color code was changed to green after today's big volume-driven loss violated its 200-day moving average (DMA) line triggering a worrisome technical sell signal. The weak action came after it reported Dec '21 quarterly earnings +44% on +32% sales revenues versus the year ago period. Volume and volatility often increase near earnings news. A prompt rebound above the 200 DMA and subsequent gains above the 50 DMA line ($11.43) are needed for its outlook to improve.

UMC was last shown in this FSU section on 1/04/22 with an annotated graph under the headline "Testing Support and Perched Not Far From Prior Highs". It has a 96 Earnings Per Share (EPS) rating. For the Sep '21 quarter earnings rose +100% on +30% sales revenues versus the year ago period, continuing its strong earnings track record. Recent quarters showed solid earnings and improved sales revenues increases satisfying the C criteria. Annual earnings (A criteria) growth has been strong after a noted downturn in FY '18.

The high-ranked ELECTRONICS - Semiconductor - Integrated Circuits firm saw the number of top rated funds owning its shares rise from 65 in Sep '20 to 94 in Dec '21, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days.

Testing Support and Perched Not Far From Prior Highs - Tuesday, January 4, 2022

United Microelectronics Inc Adr (UMC -$0.13 or -1.12% to $11.51) is still perched within striking distance of its all-time high after recently retesting support near its 50-day moving average (DMA) line ($11.32). More damaging losses would raise concerns. A gain and solid close above the pivot point may help clinch a proper new (or add-on) technical buy signal.

UMC was last shown in this FSU section on 10/26/21 with an annotated graph under the headline "Rebound Above 50-Day Moving Average Showed Resilience". It has a 96 Earnings Per Share (EPS) rating. For the Sep '21 quarter earnings rose +100% on +30% sales revenues versus the year ago period, continuing its strong earnings track record. Recent quarters showed solid earnings and improved sales revenues increases satisfying the C criteria. Annual earnings (A criteria) growth has been strong after a noted downturn in FY '18.

The high-ranked ELECTRONICS - Semiconductor - Integrated Circuits firm saw the number of top rated funds owning its shares rise from 65 in Sep '20 to 98 in Sep '21, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

Rebound Above 50-Day Moving Average Showed Resilience - Tuesday, November 30, 2021

United Microelectronics Inc Adr (UMC+$0.20 or +1.75% to $11.63) is consolidating above its 50-day moving average (DMA) line ($11.15) after a 2nd gain with volume near average. Recently it found support above its 200 DMA line ($10.07).

UMC was highlighted in yellow with pivot point cited based on its 2/16/21 high plus 10 cents in the 8/05/21 mid-day report (read here). It was last shown in this FSU section on 10/26/21 with an annotated graph under the headline "Earnings News Due From Taiwan-Based Semiconductor Firm". It has a 96 Earnings Per Share (EPS) rating. For the Sep '21 quarter earnings rose +100% on +30% sales revenues versus the year ago period, continuing its strong earnings track record. Recent quarters showed solid earnings and improved sales revenues increases satisfying the C criteria. Annual earnings (A criteria) growth has been strong after a noted downturn in FY '18.

The high-ranked ELECTRONICS - Semiconductor - Integrated Circuits firm saw the number of top rated funds owning its shares rise from 65 in Sep '20 to 97 in Sep '21, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.1 is an unbiased indication its shares have been under slight accumulation over the past 50 days.

Earnings News Due From Taiwan-Based Semiconductor Firm - Tuesday, October 26, 2021

United Microelectronics Inc Adr (UMC +$0.21 or +2.00% to $10.69) posted a volume-driven gain today but ended near the session low. It recently found support above its 200-day moving average (DMA) line ($9.90). A rebound above the 50 DMA line ($11.15) still is needed for its outlook to improve. It is due to report Sep '21 quarterly results before the open on Wednesday, 10/27/21. Volume and volatility often increase near earnings news.

UMC was highlighted in yellow with pivot point cited based on its 2/16/21 high plus 10 cents in the 8/05/21 mid-day report (read here). It gapped up hitting a new all-time high with a solid gain and strong close above the pivot point backed by +72% above average volume triggering a technical buy signal. It was last shown in this FSU section on 9/27/21 with an annotated graph under the headline "Consolidating Above 50-day Moving Average Near 'Max Buy' Level".

The high-ranked ELECTRONICS - Semiconductor - Integrated Circuits firm reported Jun '21 quarterly earnings +100% on +21% sales revenues versus the year ago period. Recent quarters showed solid earnings and improved sales revenues increases satisfying the C criteria. Annual earnings (A criteria) growth has been strong after a noted downturn in FY '18. It has a 93 Earnings Per Share (EPS) rating.

The number of top rated funds owning its shares rose from 65 in Sep '20 to 97 in Sep '21, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days.

Consolidating Above 50-day Moving Average Near "Max Buy" Level - Monday, September 27, 2021

United Microelectrnc Adr (UMC -$0.09 to $11.90) is quietly consolidating near its "max buy" level. The prior low in the $11.25 area defines initial support to watch above its 50-day moving average (DMA) line ($10.96). Any losses leading to damaging violations would raise concerns and trigger technical sell signals.

UMC was highlighted in yellow with pivot point cited based on its 2/16/21 high plus 10 cents in the 8/05/21 mid-day report (read here). It gapped up hitting a new all-time high with a solid gain and strong close above the pivot point backed by +72% above average volume triggering a technical buy signal. It was shown in greater detail in this FSU section on 8/06/21 with an annotated graph under the headline " Taiwan-Based Semiconductor Firm's Breakout Highlighted This Week".

The high-ranked ELECTRONICS - Semiconductor - Integrated Circuits firm reported Jun '21 quarterly earnings +100% on +21% sales revenues versus the year ago period. Recent quarters showed solid earnings and improved sales revenues increases satisfying the C criteria. Annual earnings (A criteria) growth has been strong after a noted downturn in FY '18. It has a 93 Earnings Per Share (EPS) rating.

The number of top rated funds owning its shares rose from 65 in Sep '20 to 89 in Jun '21, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days.

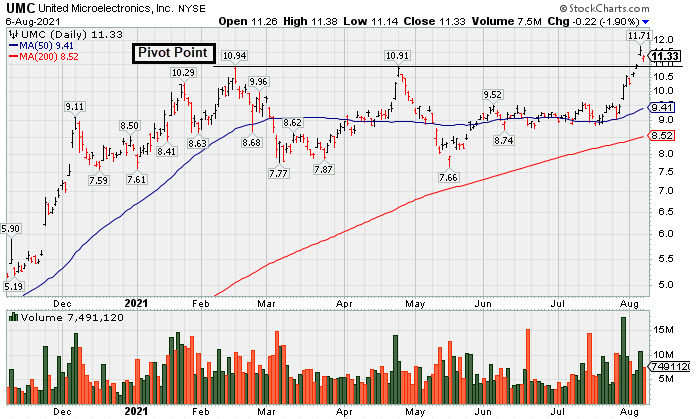

Taiwan-Based Semiconductor Firm's Breakout Highlighted This Week - Friday, August 6, 2021

United Microelectrnc Adr (UMC -0.22 or -1.90% to $11.33) pulled back today but showed resilience and closed in the upper third of its intra-day range. It was highlighted in yellow with pivot point cited based on its 2/16/21 high plus 10 cents in the 8/05/21 mid-day report (read here). It gapped up hitting a new all-time high with a solid gain and strong close above the pivot point backed by +72% above average volume triggering a technical buy signal. Prior highs in the $10.90 area define initial support to watch.

The high-ranked ELECTRONICS - Semiconductor - Integrated Circuits firm reported Jun '21 quarterly earnings +100% on +21% sales revenues versus the year ago period. Recent quarters showed solid earnings and improved sales revenues increases satisfying the C criteria. Annual earnings (A criteria) growth has been strong after a noted downturn in FY '18. It has a 93 Earnings Per Share (EPS) rating.

The number of top rated funds owning its shares rose from 65 in Sep '20 to 90 in Jun '21, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days.