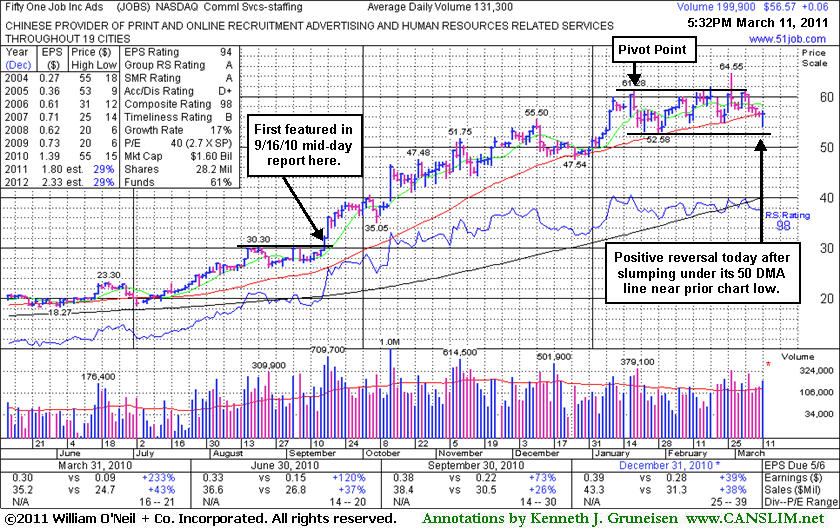

Fifty One Job Inc Ads (JOBS +$0.06 or +0.11% to $56.57) closed near the session high today after positively reversing, a sign of support near its 50-day moving average (DMA) line. Action indicative of distributional pressure recently raised concerns as it slumped below its pivot point noted more than a month ago. Gains for new highs with well above average volume would be a reassuring sign of accumulation by institutional investors, meanwhile its recent low ($52.58 on 1/28/11) defines support below its 50 DMA line where violations would trigger technical sell signals.

Its last appearance in this FSU section was on 2/07/11 with an annotated graph under the headline "Advanced Ascending Base After Rally From Earlier Breakout", but subsequent gains never materialized to trigger a new (or add-on) buy signal. It is an even later-stage candidate now, while long ago it was explained that - "It may be considered a riskier 'late-stage' breakout after having impressively rallied from March '09 lows near $6.00". JOBS has subsequently traded as much as +104% higher from $31.59 when noted in yellow in the 9/16/10 mid-day report while rising from a short flat base to a new 52-week high and within a penny of its 2006 high. It went on to trade above its 2004 highs near $55.

The number of top-rated funds owning its shares rose from 39 in Mar '10 to 69 in Dec '10, a reassuring sign with respect to the I criteria. Its small supply (S criteria) of only 28.2 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. The 4 latest quarterly comparisons show good sales growth and earnings improvement better than the +25% guideline. As previously noted, its annual earnings history (A criteria) was below strict guidelines of the fact-based investment system because of the downturn in its FY '08 earnings. Longtime readers may note that prior mid-day report appearances for JOBS earlier last year included cautionary remarks concerning its fundamentals, yet stronger sales growth in recent comparisons were cited as a very reassuring sign.

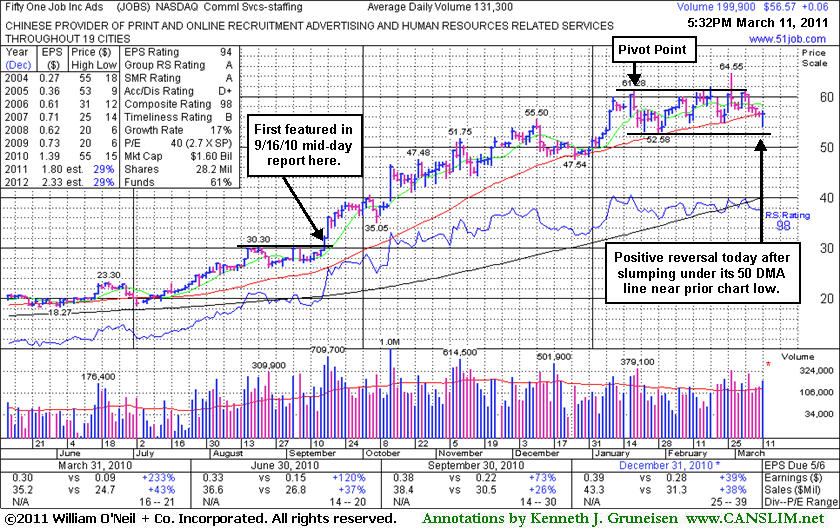

Fifty One Job Inc Ads (JOBS +$1.28 or +2.21% to $59.23) has been consolidating for the past couple of weeks and recently finding support above its 50-day moving average (DMA) line. Its last appearance in this FSU section was on 12/30/10 with an annotated graph under the headline "Perched At 50-Day Moving Average Line While Quietly Consolidating" after challenging its 2004 highs near $55. After staying above its 50 DMA line and making additional progress to new highs, JOBS has traded as much as +93.9% higher from $31.59 when noted in yellow in the 9/16/10 mid-day report rising from a short flat base to a new 52-week high and within a penny of its 2006 high.

Its 3 recent pullbacks in the 10-20% range, each resulting in a higher high and higher low, followed an earlier technical breakout and meaningful gains. It may now be considered an advanced "ascending base" type pattern. A surge with at least +50% above average volume behind gains to new high territory may trigger a new (or add-on) technical buy signal. Meanwhile, damaging losses below recent lows and its 50 DMA line could raise concerns and trigger technical sell signals.

The 4 latest quarterly comparisons show good sales growth and earnings improvement better than the +25% guideline, but its annual earnings history (A criteria) has been below strict guidelines of the fact-based investment system because of the downturn in its FY '08 earnings (see red oval). Regular readers may note that prior mid-day report appearances for JOBS earlier last year included cautionary remarks concerning its fundamentals, however it stronger sales growth in recent comparisons was a very reassuring sign. The number of top-rated funds owning its shares rose from 39 in Mar '10 to 53 in Dec '10, a reassuring sign with respect to the I criteria. Its small supply (S criteria) of only 28 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling.

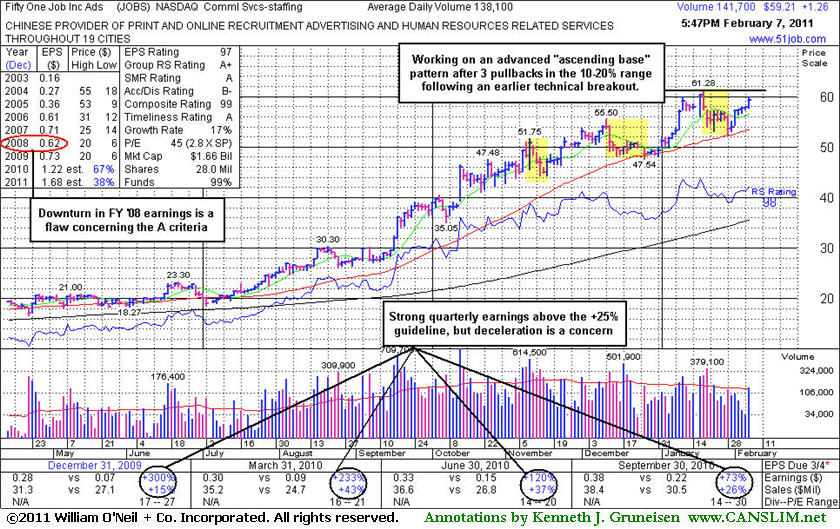

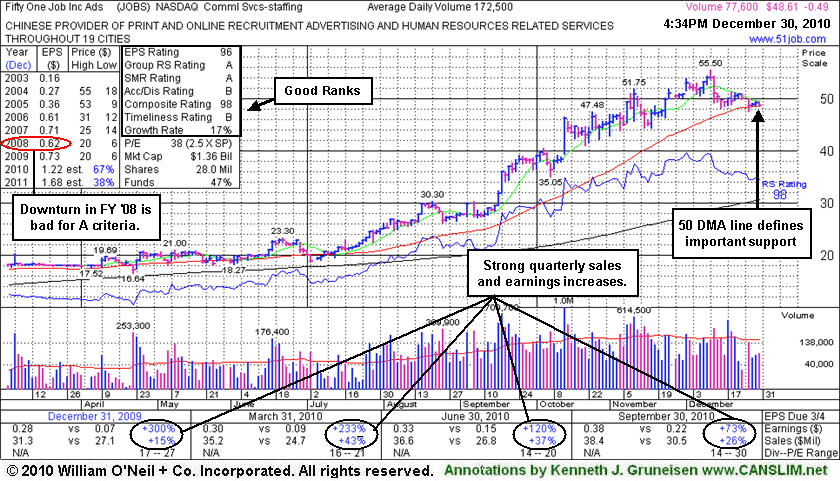

Fifty One Job Inc Ads (JOBS -$0.49 or -1.00% to $48.61) has been consolidating for the past 3 weeks after recently challenging its all-time high near $55 from 2004. It has recently been perched just above its 50-day moving average (DMA) line with volume totals cooling, but it has not formed a sound new base. more damaging losses could raise concerns and trigger technical sell signals.

The 4 latest quarterly comparisons show good sales growth and earnings improvement better than the +25% guideline, but its annual earnings history (A criteria) has been below strict guidelines of the fact-based investment system because of the downturn in its FY '08 earnings (see red oval). Regular readers may note that prior mid-day report appearances for JOBS this year included cautionary remarks concerning its fundamentals, however it stronger sales growth in recent comparisons was a very reassuring sign. The number of top-rated funds owning its shares rose from 39 in Mar '10 to 49 in Sept '10, a reassuring sign with respect to the I criteria. Its small supply (S criteria) of only 28 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling.

When it made its last appearance in this FSU section on 11/16/10 with an annotated graph under the headline "Distributional Pressure After Great Progress During Latest Rally" it had suffered damage due to distribution and violated a previously noted upward trendline connecting its July-November lows, raising concerns. Afterward it stayed well above its 50 DMA line and made additional progress to new highs. It traded as much as +75.7% higher from $31.59 when noted in yellow in the 9/16/10 mid-day report rising from a short flat base to a new 52-week high and within a penny of its 2006 high.

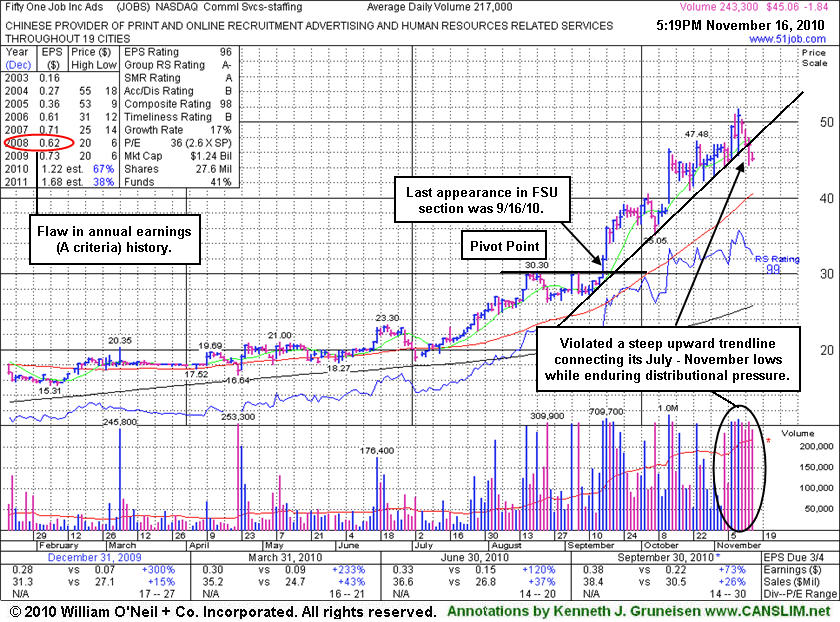

Fifty One Job Inc Ads (JOBS -$1.84 or -3.92% to $45.06) suffered another loss after a small gap down today followed a distribution day. It has violated the previously noted initial support defined buy an upward trendline connecting its July-November lows, raising concerns. Its 50-day moving average (DMA) line is the next important support level to watch. Currently, the broader market (M criteria) environment is also flashing warning signs helping to alert investors that it could be a smart time to lock in profits, since 3 out of 4 stocks may struggle if the the major averages continue downward in the final part of what has been a tumultuous year. Since Fifty One Job Inc's last appearance in this FSU section on 9/16/10 under the headline "Strong Close With Gain Backed By Four Times Average" the company had made great progress. It rallied as much as +63.8% higher from where it was noted in yellow in the 9/16/10 mid-day report rising from a short flat base to a new 52-week high and within a penny of its 2006 high.

The 4 latest quarterly comparisons show good sales growth and earnings improvement better than the +25% guideline, but its annual earnings history (A criteria) has been below strict guidelines of the fact-based investment system because of the downturn in its FY '08 earnings (see red oval). Its small supply (S criteria) of only 27.6 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. Disciplined investors always limit losses if a stock ever falls more than 7-8% from their buy price. Regular readers may note that prior mid-day report appearances for JOBS this year included cautionary remarks concerning its fundamentals, however it stronger sales growth in recent comparisons was a very reassuring sign.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

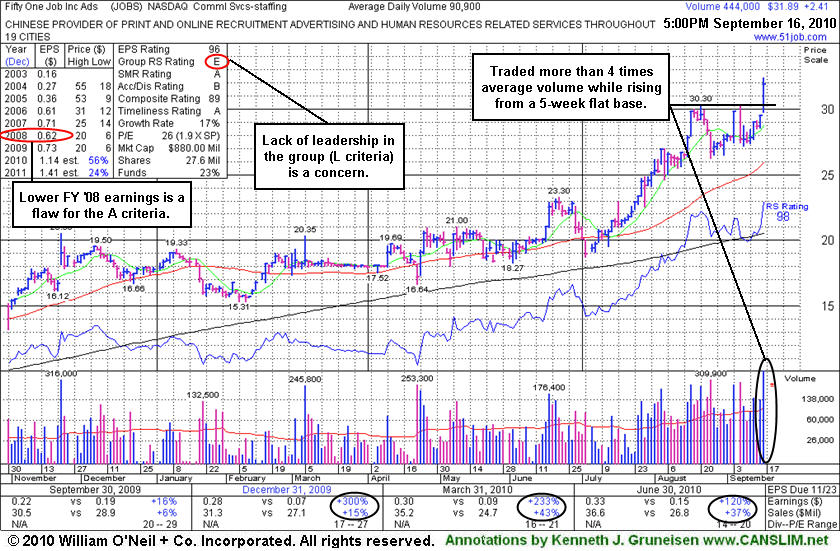

Fifty One Job Inc Ads (JOBS +$2.41 or +8.18% to $31.89) rallied for a considerable gain today and was noted in yellow in the mid-day report (read here) rising from a short flat base to a new 52-week high while it had traded within a penny of its 2006 high. Its strong close today with more than 4 times average volume confirmed a new technical buy signal, however it may be considered a riskier "late-stage" breakout after having impressively rallied from March '09 lows near $6.00. The 3 latest quarterly comparisons showed good sales growth and earnings improvement better than the +25% guideline, but its annual earnings history (A criteria) has been below strict guidelines of the fact-based investment system because of the downturn in its FY '08 earnings (see red oval). The lack of additional leadership in the Commercial Services - Staffing group (see red circle) is also a concern with respect to the L criteria. Most big stock market winners of the past were in a strong performing industry group. Its small supply (S criteria) of only 27.6 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. Disciplined investors always limit losses if a stock ever falls more than 7-8% from their buy price.

Regular readers may note that prior mid-day report appearances for JOBS this year included cautionary remarks concerning its fundamentals, however it stronger sales growth in recent comparisons is a very reassuring sign. Currently, the broader market (M criteria) environment is also helping investors odds, since 3 out of 4 stocks tend to go in the direction of the major averages.