Strong Close With Gain Backed By Four Times Average Volume

Thursday, September 16, 2010 CANSLIM.net

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

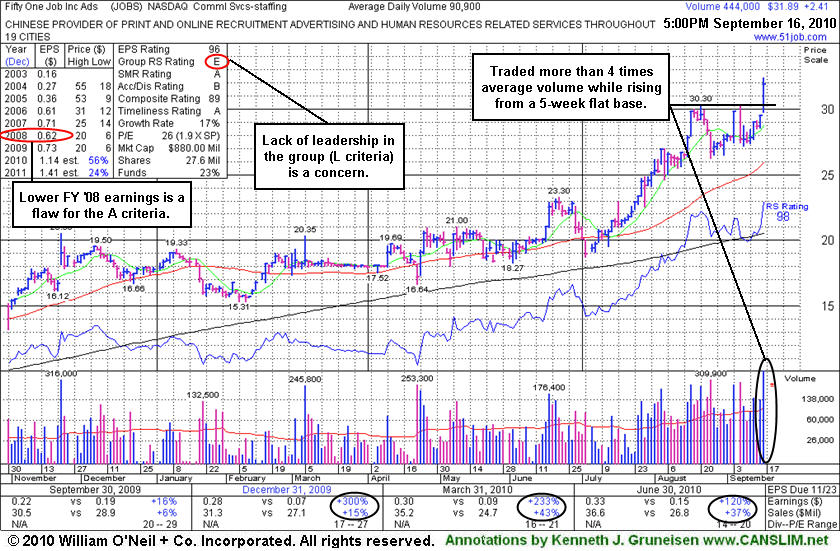

Fifty One Job Inc Ads (JOBS +$2.41 or +8.18% to $31.89) rallied for a considerable gain today and was noted in yellow in the mid-day report (read here) rising from a short flat base to a new 52-week high while it had traded within a penny of its 2006 high. Its strong close today with more than 4 times average volume confirmed a new technical buy signal, however it may be considered a riskier "late-stage" breakout after having impressively rallied from March '09 lows near $6.00. The 3 latest quarterly comparisons showed good sales growth and earnings improvement better than the +25% guideline, but its annual earnings history (A criteria) has been below strict guidelines of the fact-based investment system because of the downturn in its FY '08 earnings (see red oval). The lack of additional leadership in the Commercial Services - Staffing group (see red circle) is also a concern with respect to the L criteria. Most big stock market winners of the past were in a strong performing industry group. Its small supply (S criteria) of only 27.6 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. Disciplined investors always limit losses if a stock ever falls more than 7-8% from their buy price.

Regular readers may note that prior mid-day report appearances for JOBS this year included cautionary remarks concerning its fundamentals, however it stronger sales growth in recent comparisons is a very reassuring sign. Currently, the broader market (M criteria) environment is also helping investors odds, since 3 out of 4 stocks tend to go in the direction of the major averages.