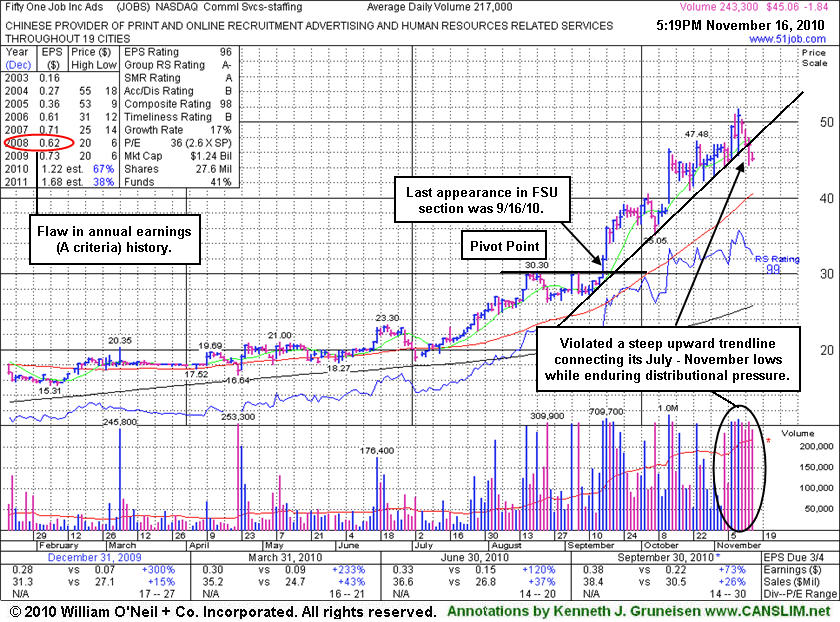

Distributional Pressure After Great Progress During Latest Rally

Tuesday, November 16, 2010 CANSLIM.net

Fifty One Job Inc Ads (JOBS -$1.84 or -3.92% to $45.06) suffered another loss after a small gap down today followed a distribution day. It has violated the previously noted initial support defined buy an upward trendline connecting its July-November lows, raising concerns. Its 50-day moving average (DMA) line is the next important support level to watch. Currently, the broader market (M criteria) environment is also flashing warning signs helping to alert investors that it could be a smart time to lock in profits, since 3 out of 4 stocks may struggle if the the major averages continue downward in the final part of what has been a tumultuous year. Since Fifty One Job Inc's last appearance in this FSU section on 9/16/10 under the headline "Strong Close With Gain Backed By Four Times Average" the company had made great progress. It rallied as much as +63.8% higher from where it was noted in yellow in the 9/16/10 mid-day report rising from a short flat base to a new 52-week high and within a penny of its 2006 high.

The 4 latest quarterly comparisons show good sales growth and earnings improvement better than the +25% guideline, but its annual earnings history (A criteria) has been below strict guidelines of the fact-based investment system because of the downturn in its FY '08 earnings (see red oval). Its small supply (S criteria) of only 27.6 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. Disciplined investors always limit losses if a stock ever falls more than 7-8% from their buy price. Regular readers may note that prior mid-day report appearances for JOBS this year included cautionary remarks concerning its fundamentals, however it stronger sales growth in recent comparisons was a very reassuring sign.