Halted Slide at 50-Day Moving Average After Earnings News - Monday, November 8, 2021

Prior Lows Define Near-Term Support After 50 DMA Violation - Wednesday, October 6, 2021

Rebound Above 50-Day Moving Average Helps Outlook - Monday, August 23, 2021

Gain for New High Leaves GNRC Very Extended From Prior Base - Monday, July 12, 2021

Gap Up Gain With +118% Above Average Volume - Tuesday, June 8, 2021

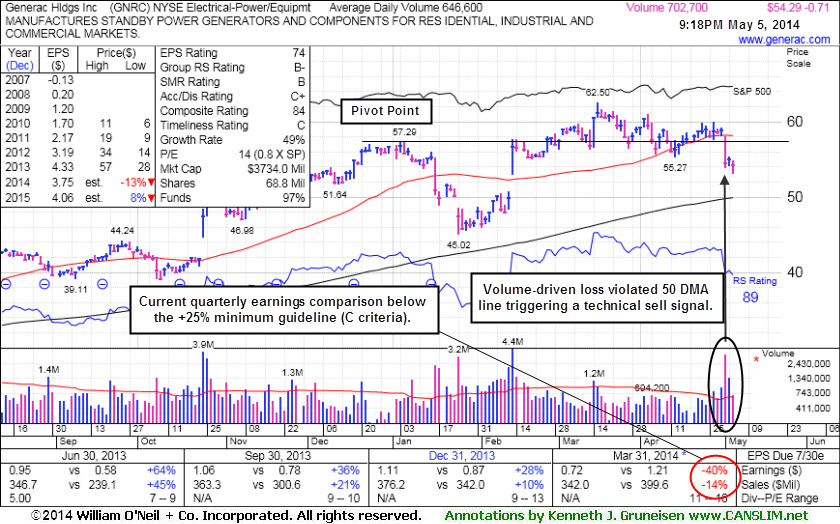

Fundamental and Technical Deterioration Raised Concerns - Monday, May 05, 2014

Generac Hldgs Inc (GNRC -$1.49 or -2.59% to $56.00) recently reported -40% earnings on -14% sales revenues for the Mar '14 quarter and violated support at its 50-day moving average (DMA) line with a volume-driven loss. The Electrical - Power/Equipment firm has subsequently seen its EPS rank slump to 74, below the 80+ minimum guideline for buy candidates. Prior sequential deceleration in the sales revenues growth rate was noted as a cause for concern while it was also noted that consensus estimates are calling for FY '14 earnings down -13%, and its currently low P/E valuation (0.8 X SP) suggests that the market has a timid outlook for future growth.

Technically, it also undercut its recent low ($55.27 on 4/14/14) raising greater concerns. Its color code was changed to green due to fundamental and technical deterioration. Since last shown in this FSU section on 4/11/14 with annotated graphs under the headline, "Finished Just Below its 50-Day Average Line", it did not showing compelling evidence of recent institutional accumulation and made limited headway above prior resistance in the $57 area. Members were previously cautioned - "Volume should be at least +40% above average as a stock rallies above its pivot point to trigger a proper technical buy signal."

It made limited progress since 2/14/14 mid-day report (read here) when highlighted in yellow as it returned to the Featured Stocks list with a new pivot point based on its 1/06/14 high plus 10 cents. Disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price. GNRC has seen little change lately in the number of top-rated funds owning its shares, actually reported at 438 in Sep '13 and 438 in Mar '14. However, its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. Its small float of only 42.6 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

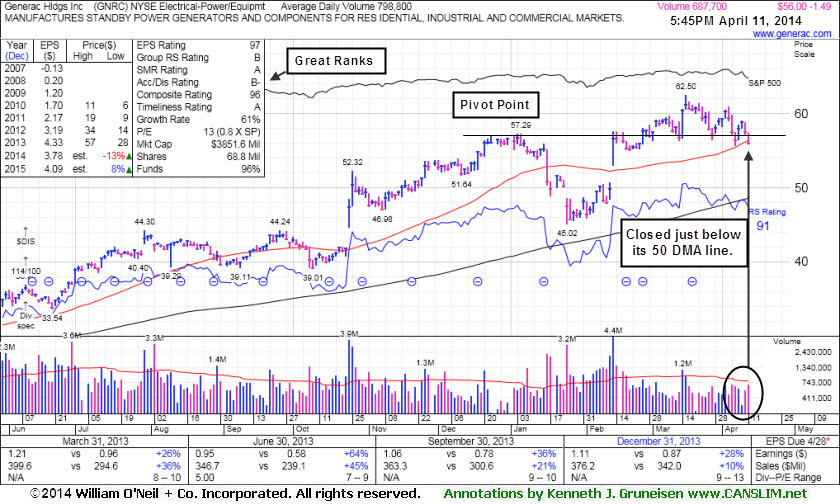

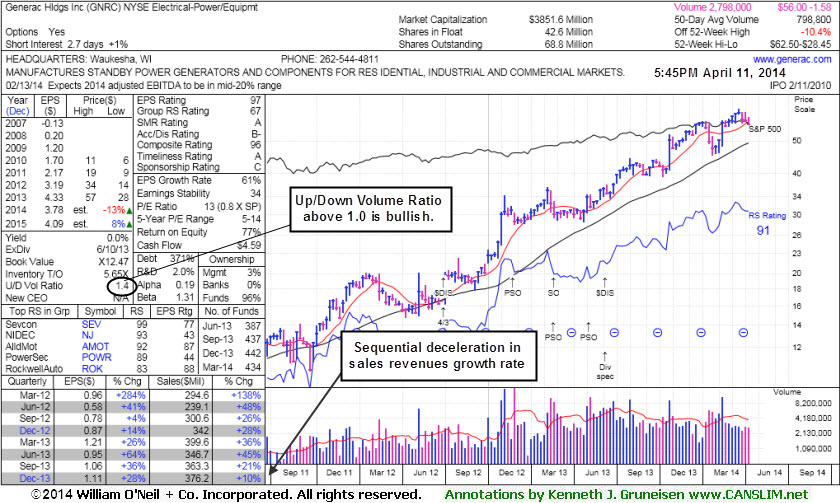

Finished Just Below its 50-Day Average Line - Friday, April 11, 2014

Generac Hldgs Inc (GNRC -$1.49 or -2.59% to $56.00) raised concerns and its color code was changed to green as it finished just below its 50-day moving average (DMA) line after undercutting prior highs in the $57 area. More damaging losses below its recent low ($55.65 on 4/07/14) would raise even greater concerns. It was last shown in this FSU section on 3/31/14 with annotated graphs under the headline, "Perched Near Highs With Mostly Quiet Volume Totals". It did not showing compelling evidence of recent institutional accumulation and made limited headway above prior resistance in the $57 area. The volume totals have not been above average behind its recent gains since its big gap up gain on 2/13/14. Members were previously cautioned - "Volume should be at least +40% above average as a stock rallies above its pivot point to trigger a proper technical buy signal."

It made limited progress since 2/14/14 mid-day report (read here) when highlighted in yellow as it returned to the Featured Stocks list with a new pivot point based on its 1/06/14 high plus 10 cents. Members were previously reminded - "It may likely encounter resistance near prior highs, however, any more convincing volume-driven gains into new high territory may confirm a new technical buy signal."

The high-ranked Electrical - Power/Equipment firm reported earnings +28% on +10% sales revenues for the Dec '13 quarter, continuing its strong earnings history satisfying the C criteria. However, sequential deceleration in the sales revenues growth rate is a cause for concern. Also, consensus estimates are calling for FY '14 earnings down -13%, and its currently low P/E valuation (0.8 X SP) suggests that the market has a timid outlook for future growth. Disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price.

GNRC has seen little change lately in the number of top-rated funds owning its shares, actually falling slightly from 437 in Sep '13, to 434 in Mar '14. However, its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. Its small float of only 42.6 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

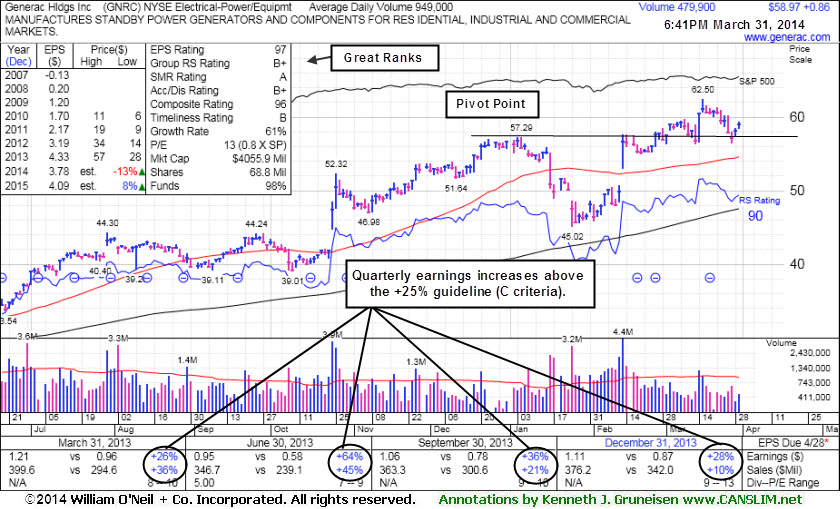

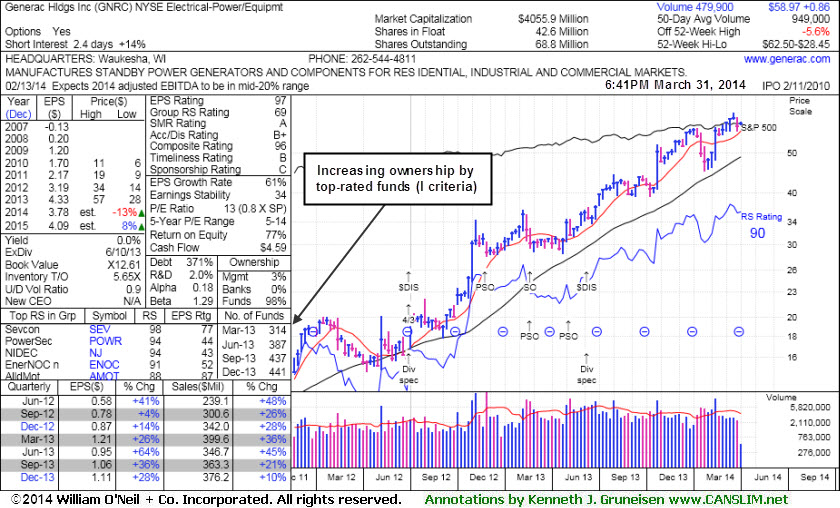

Perched Near Highs With Mostly Quiet Volume Totals - Monday, March 31, 2014

Generac Hldgs Inc (GNRC +$0.86 or +1.48% to $58.97) has been consolidating above prior highs in the $57 area defining near-term support to watch. It was last shown in this FSU section on 3/11/14 with annotated graphs under the headline, "Bullish Gap Up Followed By Wedging and Stalling Action", while not showing compelling evidence of recent institutional accumulation and making limited headway above prior resistance in the $57 area. The volume totals have not been above average behind its recent gains since its big gap up gain on 2/13/14. Members were previously cautioned - "Volume should be at least +40% above average as a stock rallies above its pivot point to trigger a proper technical buy signal."

It has held its ground and made gradual progress since 2/14/14 mid-day report (read here) when highlighted in yellow as it returned to the Featured Stocks list with a new pivot point based on its 1/06/14 high plus 10 cents. Members were previously reminded - "It may likely encounter resistance near prior highs, however, any more convincing volume-driven gains into new high territory may confirm a new technical buy signal."

The high-ranked Electrical - Power/Equipment firm reported earnings +28% on +10% sales revenues for the Dec '13 quarter, continuing its strong earnings history satisfying the C criteria. Consensus estimates are calling for FY '14 earnings down -13%, and its currently low P/E valuation (0.8 X SP) suggests that the market has a timid outlook for future growth which is cause for some concern. Disciplined investors avoid chasing stocks if they get extended more than +5% above their pivot point, and they always limit losses by selling if any stock falls more than -7% from their purchase price.

GNRC has seen an increase in the number of top-rated funds owning its shares from 280 in Dec '12 to 441 in Dec '13, an encouraging sign concerning the I criteria. Its small float of only 42.6 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

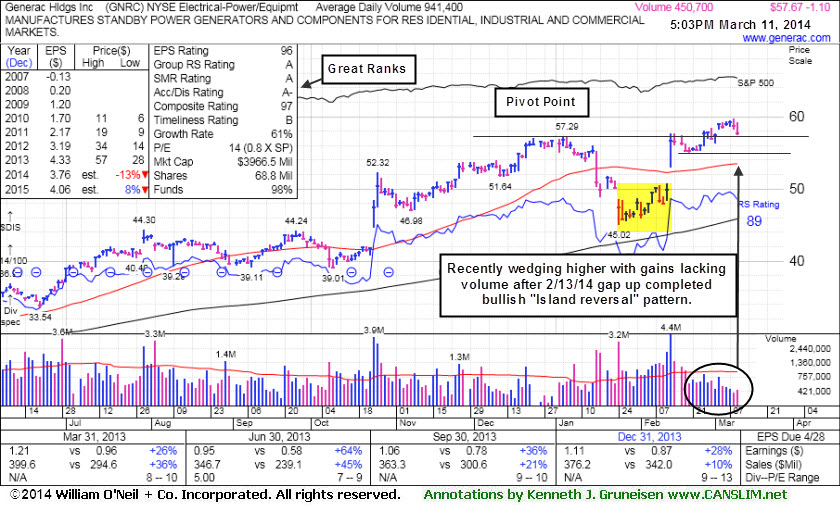

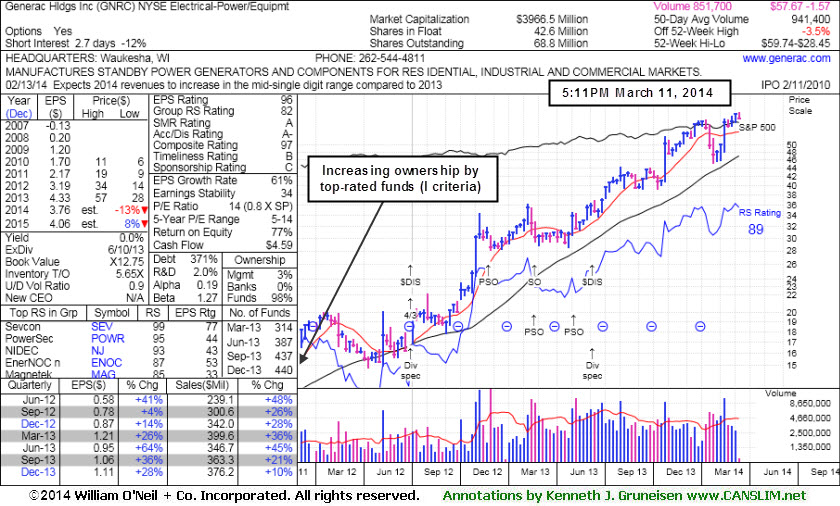

Bullish Gap Up Followed By Wedging and Stalling Action - Tuesday, March 11, 2014

Generac Hldgs Inc (GNRC -$1.10 or -1.87% to $57.67) has been "wedging" higher in recent weeks, not showing compelling evidence of recent institutional accumulation while making limited headway above prior resistance in the $57 area. The volume totals have been below average behind all of its recent gains since its big gap up gain on 2/13/14. Members were previously cautioned - "Volume should be at least +40% above average as a stock rallies above its pivot point to trigger a proper technical buy signal."It was last shown in this FSU section on 2/14/14 with annotated graphs under the headline, "Following Island Reversal Prior Highs May Act as Resistance", as it had gapped up on the prior session for a considerable volume-driven gain completing a bullish "island reversal" pattern (see yellow highlighted area on the daily graph). The "island" was created by its 1/24/14 gap down and then the 2/13/14 gap up, which helped its technical stance improve by rebounding from below its 50-day moving average (DMA) line to challenge its 52-week high. In the 2/14/14 mid-day report (read here) it was highlighted in yellow as it returned to the Featured Stocks list with a new pivot point based on its 1/06/14 high plus 10 cents. Members were previously reminded - "It may likely encounter resistance near prior highs, however, any more convincing volume-driven gains into new high territory may confirm a new technical buy signal."

The high-ranked Electrical - Power/Equipment firm reported earnings +28% on +10% sales revenues for the Dec '13 quarter, continuing its strong earnings history satisfying the C criteria. Consensus estimates are calling for FY '14 earnings down -13%, and its currently low P/E valuation (0.8 X SP) suggests that the market has a timid outlook for future growth which is cause for some concern. Disciplined investors avoid chasing stocks if they get extended more than +5% above their pivot point, and they always limit losses by selling if any stock falls more than -7% from their purchase price.

GNRC has seen an increase in the number of top-rated funds owning its shares from 280 in Dec '12 to 440 in Dec '13, an encouraging sign concerning the I criteria. Its small float of only 42.6 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

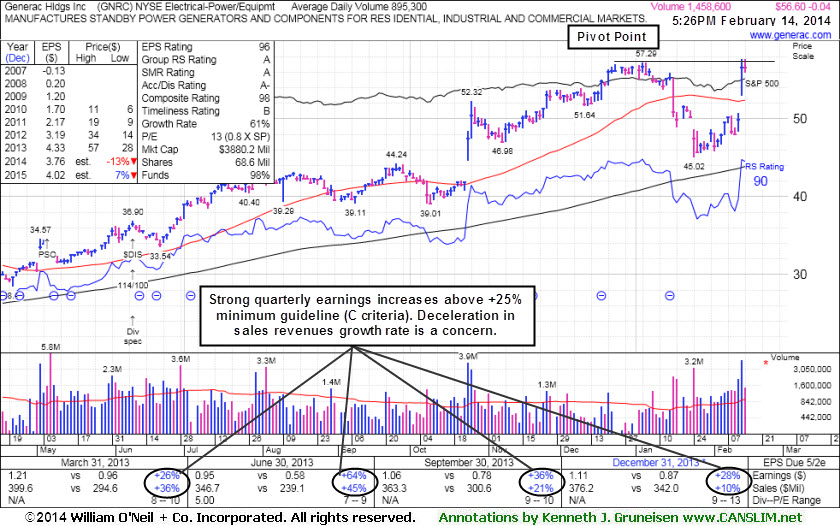

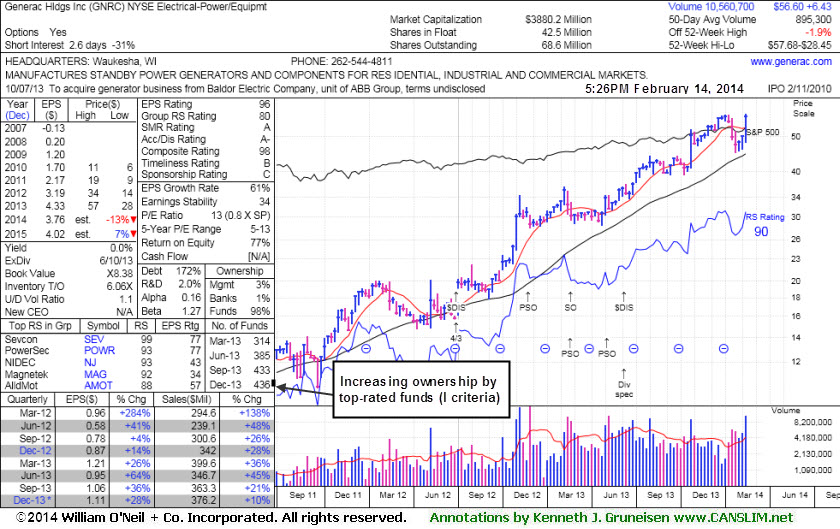

Following Island Reversal Prior Highs May Act as Resistance - Friday, February 14, 2014

Generac Hldgs Inc (GNRC -$0.04 or -0.07% to $56.60) gapped up on the prior session for a considerable volume-driven gain completing a bullish "island reversal" pattern. The "island" was created by its 1/24/14 gap down and then the 2/13/14 gap up, which helped its technical stance improve by rebounding from below its 50-day moving average (DMA) line to challenge its 52-week high. In today's mid-day report (read here) it was highlighted in yellow as it returned to the Featured Stocks list with a new pivot point based on its 1/06/14 high plus 10 cents. It may likely encounter resistance near prior highs, however, any more convincing volume-driven gains into new high territory may confirm a new technical buy signal.The high-ranked Electrical - Power/Equipment firm reported earnings +28% on +10% sales revenues for the Dec '13 quarter, continuing its strong earnings history satisfying the C criteria. Following its last appearance in this FSU section on 1/02/14 with annotated graphs under the headline, "Volume Totals Cooling While Holding Ground Near Highs", it violated its 50 DMA line and prior highs in the $52 area with a damaging volume-driven loss on 1/16/14 triggering worrisome technical sell signals. It had made limited progress since triggering an earlier technical buy signal.

Consensus estimates are calling for FY '14 earnings down -13%, and its currently low P/E valuation (0.8 X SP) suggests that the market has a timid outlook for future growth which is cause for some concern. Disciplined investors avoid chasing stocks if they get extended more than +5% above their pivot point, and they always limit losses by selling if any stock falls more than -7% from their purchase price.

GNRC has seen an increase in the number of top-rated funds owning its shares from 280 in Dec '12 to 436 in Dec '13, an encouraging sign concerning the I criteria. Its small float of only 42.5 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Volume Totals Cooling While Holding Ground Near Highs - Thursday, January 02, 2014

Generac Hldgs Inc (GNRC -$0.35 or -0.62% to $56.29) is holding its ground stubbornly near its all-time high with volume totals cooling, action indicating that few investors have been headed for the exit. Prior highs in the $52 area define initial support to watch on pullbacks. A volume-driven gain on 12/20/13 was its last gain with above average volume, and it has stubbornly held its ground and made gradual progress since its last appearance in this FSU section on 11/29/13 with annotated graphs under the headline, "Following Latest Breakout Prior Highs Define Support", while consolidating above prior highs in the $52 area. On 11/26/13 a new pivot point was cited based on its 10/25/13 high plus 10 cents as it rallied from a short flat base with +59% above average volume triggering a new (or-add on) technical buy signal. Disciplined investors avoid chasing stocks if they get extended more than +5% above their pivot point, and they always limit losses by selling if any stock falls more than -7% from their purchase price.

The high-ranked Electrical - Power/Equipment firm It reported earnings +36% on +21% sales revenues for the Sep '13 quarter, continuing its strong earnings increases satisfying the C criteria. Consensus estimates are calling for FY '13 earnings growth of +29%, yet FY '14 earnings are forecast at down -6%, and its currently low P/E valuation (0.8 X SP) suggests that the market has a timid outlook for future growth which is cause for some concern.

The number of top-rated funds owning its shares rose from 280 in Dec '12 to 427 in Sep '13, an encouraging sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.8 is also an unbiased indication that it shares have been under accumulation over the past 50 days.

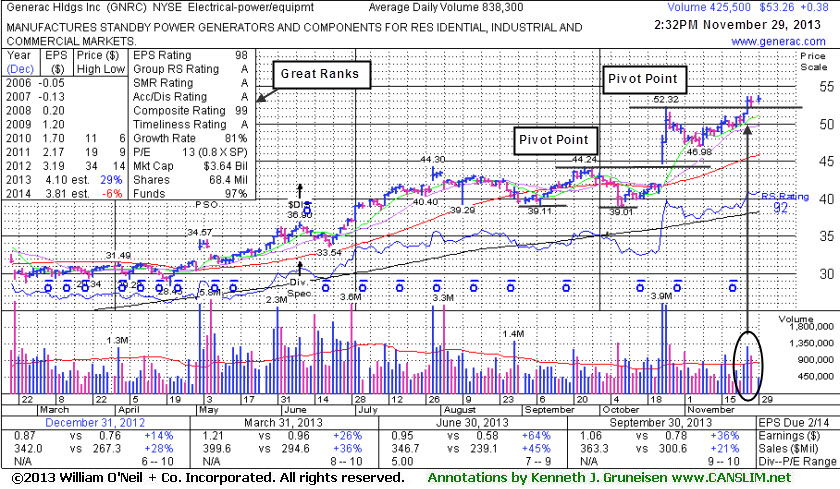

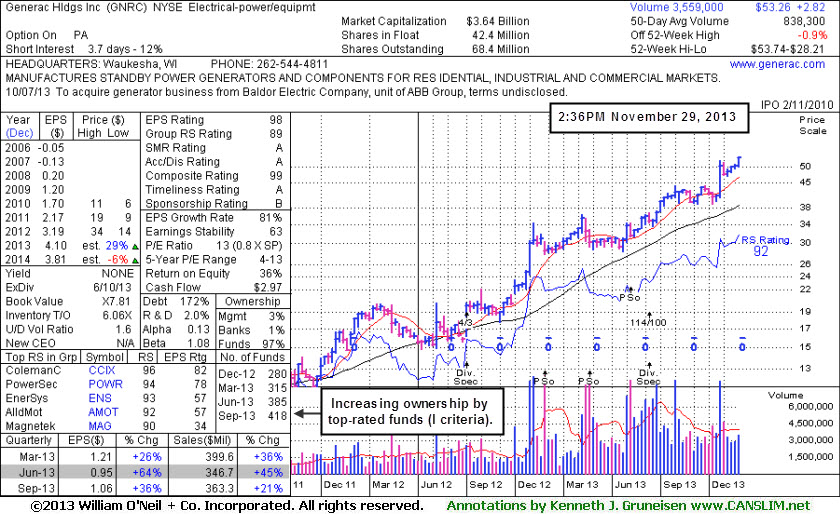

Following Latest Breakout Prior Highs Define Support - Friday, November 29, 2013

Generac Hldgs Inc (GNRC +$0.38 or +0.72% to $53.26) is consolidating above prior highs in the $52 area defining initial support to watch. On 11/26/13 a new pivot point was cited based on its 10/25/13 high plus 10 cents as it rallied from a short flat base with +59% above average volume triggering a new (or-add on) technical buy signal. Disciplined investors avoid chasing stocks if they get extended more than +5% above their pivot point, and they always limit losses by selling if any stock falls more than -7% from their purchase price.

The high-ranked Electrical - Power/Equipment firm spent a fair amount of time consolidating as volume totals cooled while building a new base since its last appearance in this FSU section was on 10/30/13 with an annotated graph under the headline, "Consolidating After "Breakaway Gap" With 4 Times Average Volume". It reported earnings +36% on +21% sales revenues for the Sep '13 quarter, continuing its strong earnings increases satisfying the C criteria. Consensus estimates are calling for FY '13 earnings growth of +29%, yet FY '14 earnings are forecast at down -6%, and its currently low P/E valuation (0.8 X SP) suggests that the market has a timid outlook for future growth which is cause for some concern.

The number of top-rated funds owning its shares rose from 280 in Dec '12 to 418 in Sep '13, an encouraging sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is also an unbiased indication that it shares have been under accumulation over the past 50 days.

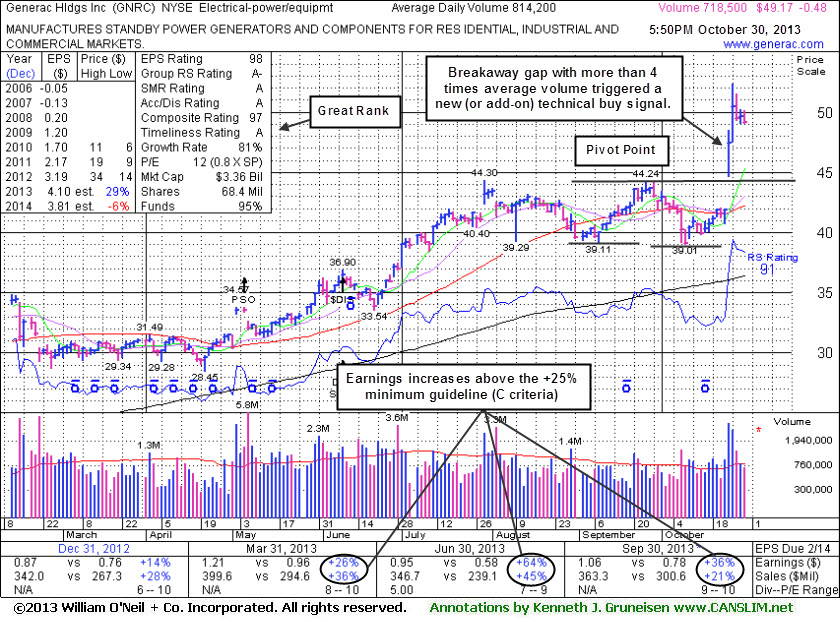

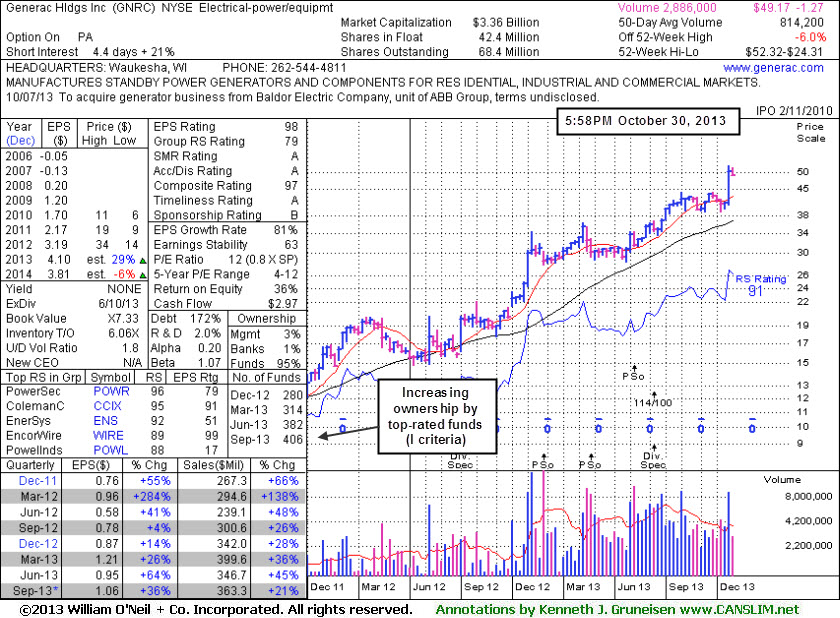

Consolidating After "Breakway Gap" With 4 Times Average Volume - Wednesday, October 30, 2013

Generac Hldgs Inc (GNRC -$0.48 or -0.97% to $49.17) has been consolidating with volume totals cooling after quickly getting very extended from its latest base. It was highlighted in yellow in the 10/24/13 mid-day report with a new pivot point cited based on its 9/25/13 high (read here) as a considerable "breakaway gap" with more than 4 times average volume triggered a new (or add-on) technical buy signal when it gapped up from its 50-day moving average (DMA) line. The bullish action came immediately after it reported earnings +36% on +21% sales revenues for the Sep '13 quarter, continuing its strong earnings increases satisfying the C criteria. The high-ranked Electrical - Power/Equipment firm's last appearance in this FSU section was on 9/23/13 with an annotated graph under the headline, "Pullback Following Friday's Technical Buy Signal".

Disciplined investors avoid chasing stocks if they get extended more than +5% above their pivot point, and they always limit losses by selling if any stock falls more than -7% from their purchase price. Consensus estimates are calling for FY '13 earnings growth of +29%, yet FY '14 earnings are forecast at down -6%, and its currently low P/E valuation (0.8 X SP) suggests that the market has a timid outlook for future growth which is cause for some concern.

The number of top-rated funds owning its shares rose from 201 in Dec '12 to 406 in Sep '13, an encouraging sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.8 is also an unbiased indication that it shares have been under accumulation over the past 50 days.

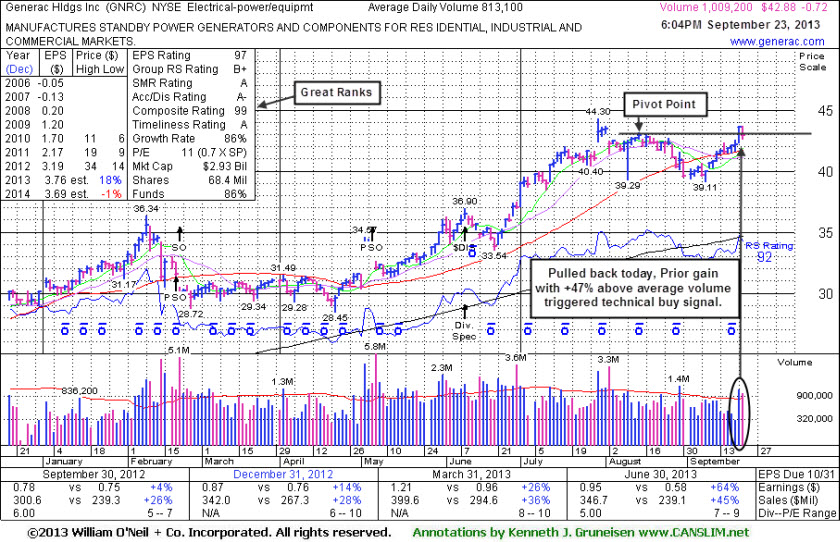

Pullback Following Friday's Technical Buy Signal - Monday, September 23, 2013

Generac Hldgs Inc (GNRC -$0.72 or -1.65% to $42.88) pulled back today with lighter but still above average volume. The high-ranked Electrical - Power/Equipment firm on Friday ended at a new high close after rallying above its pivot point with +47% above average volume triggering a new technical buy signal. Disciplined investors avoid chasing stocks if they get extended more than +5% above their pivot point, and they always limit losses by selling if any stock falls more than -7% from their purchase price.GNRC was last shown in this FSU section with an annotated graph on 8/22/13 under the headline, "Finding Support Well Above 50-Day Average". It subsequently slumped below its 50-day moving average (DMA) line and then rebounded with gains lacking great volume conviction while building a sound new base pattern. It reported earnings +64% on +45% sales for the June '13 quarter versus the year ago period. Recent quarterly comparisons show impressive sequential acceleration in its sales revenues and earnings growth, making it a better match with the C criteria of the fact-based system. Consensus estimates are calling for FY '13 earnings growth of +18%, yet FY '14 earnings are forecast at down -1%, and its currently low P/E valuation (0.7 X SP) suggests that the market has a timid outlook for future growth which is cause for some concern.

The number of top-rated funds owning its shares rose from 201 in Dec '12 to 379 in Jun '13, an encouraging sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.7 is also an unbiased indication that it shares have been under accumulation over the past 50 days.

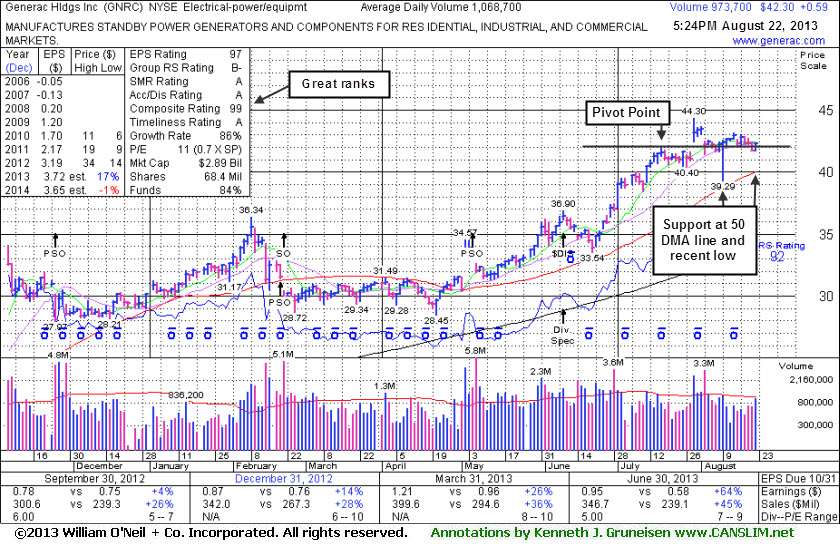

Finding Support Well Above 50-Day Average - Thursday, August 22, 2013

Generac Hldgs Inc (GNRC +$0.59 or +1.41% to $42.30) is holding its ground stubbornly near prior highs after it recently rallied from an advanced "3-weeks tight" base and priced a Secondary Offering. Disciplined investors always limit losses by selling if any stock falls more than -7% from its purchase price. The high-ranked Electrical - Power/Equipment firm was last shown in this FSU section with an annotated graph on 7/30/13 under the headline, "Gapped Up Following Strong Earnings News", after highlighted in yellow with pivot point based on its 7/17/13 high plus 10 cents with an annotated weekly graph in the earlier mid-day report (read here). Its considerable gain was backed by more than 2 times average volume, triggering a technical buy signal

It reported earnings +64% on +45% sales for the June '13 quarter versus the year ago period. Recent quarterly comparisons show impressive sequential acceleration in its sales revenues and earnings growth, making it a better match with the C criteria of the fact-based system. Previously noted consensus estimates calling for FY '13 earnings growth of +17% and FY '14 at -1%, and its currently low P/E valuation (0.7 X SP) suggest a timid outlook for future growth, which is cause for some concern.

The number of top-rated funds owning its shares rose from 201 in Dec '12 to 365 in Jun '13, an encouraging sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is also an unbiased indication that it shares have been under accumulation over the past 50 days. Disciplined investors avoid chasing stocks if they get extended more than +5% above their pivot point, and they always limit losses by selling if any stock falls more than -7% from their purchase price.

Keep in mind that the broader market direction (M criteria) weighs heavily into the mix as historic studies showed that 3 out of 4 stocks typically move in the same direction of the major averages. For as long as the current market correction continues, odds are not favorable for most stocks making meaningful headway.

Pay close attention to stocks that hold up well during corrections and watch for those that are the first ones breaking into new high ground upon any new confirmed rally. Meanwhile, if holding onto current gains, investors should stand ready to reduce exposure before too much damage starts to mount. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price, but sometimes weak technical action may hint that it is a smart time to sell even before losses reach that important maximum loss threshold.

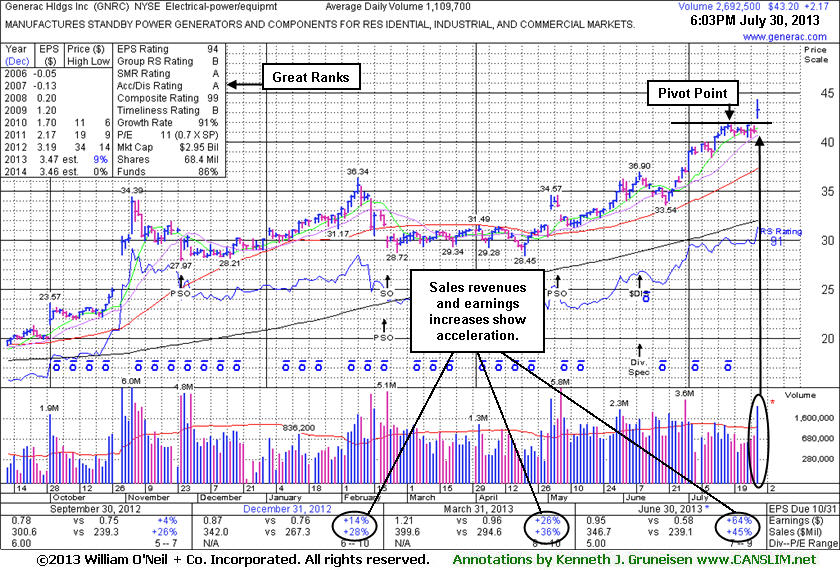

Gapped Up Following Strong Earnings News - Tuesday, July 30, 2013

Generac Hldgs Inc (GNRC +$2.17 or +5.29% to $43.20) was highlighted in yellow with pivot point based on its 7/17/13 high plus 10 cents with an annotated weekly graph in the earlier mid-day report (read here). The daily graph annotated below shows how the high-ranked Electrical - Power/Equipment firm gapped up today and hit a new 52-week high with a considerable gain backed by more than 2 times average volume, triggering a technical buy signal while rallying from an advanced "3-weeks tight" base. It just reported earnings +64% on +45% sales for the June '13 quarter versus the year ago period. Recent quarterly comparisons show impressive sequential acceleration in its sales revenues and earnings growth, making it a better match with the C criteria of the fact-based system. Previously noted consensus estimates calling for FY '13 earnings growth of +9% and FY '14 at 0%, and its currently low P/E valuation (0.7 X SP) suggest a timid outlook for future growth, which is cause for some concern.

The number of top-rated funds owning its shares rose from 201 in Dec '12 to 346 in Jun '13, an encouraging sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.7 is also an unbiased indication that it shares have been under accumulation over the past 50 days. Disciplined investors avoid chasing stocks if they get extended more than +5% above their pivot point, and they always limit losses by selling if any stock falls more than -7% from their purchase price.