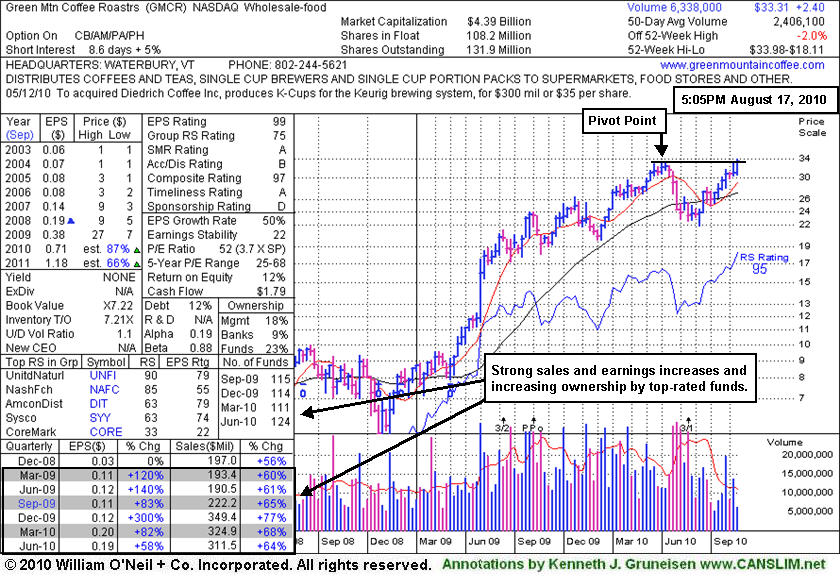

Green Mountain Coffee Roasters (GMCR +$1.03 or +3.19% to $33.31) hit a new 52-week high today with a gain backed by +67% above average volume while rising from a 19-week cup shaped pattern without forming a handle. It is now clear of resistance due to overhead supply, even though its latest base did not include the "shakeout" period. It could also stall or form a high handle, meanwhile disciplined investors might watch for more reassuring price/volume action in the near-term. The weekly datagraph below illustrates its history of strong sales revenues and earnings increases. The number of top-rated funds owning its shares rose to 124 in Jun '10 from 111 in Mar '10, helping satisfy the I criteria of the fact-based investment system.

GMCR was dropped from the Featured Stocks list on 4/28/10 and subsequently slumped below its 200-day moving average line before rebounding. Do not be confused when looking back at past reports as its share price was impacted by a 3:1 stock split effective on 5/18/10. It rallied more than 5-fold from its November '08 low. It traded up as much as +282% after appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

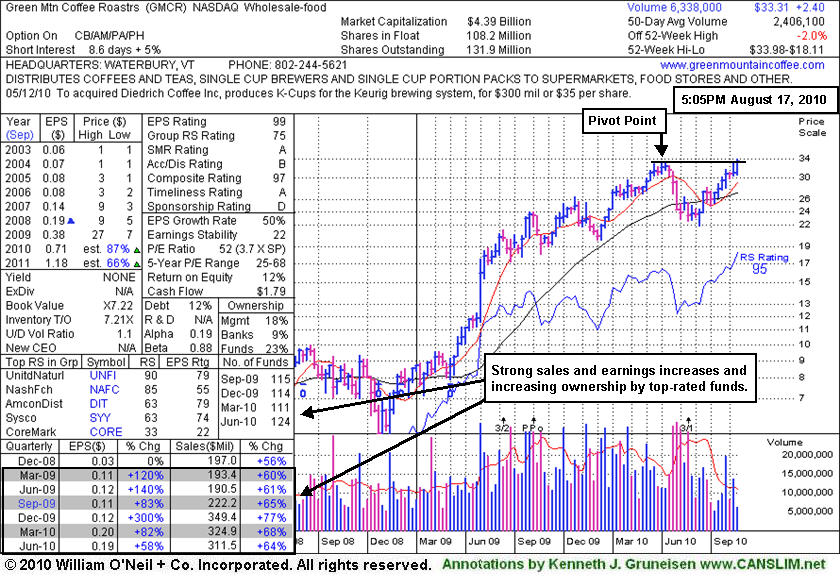

Green Mountain Coffee Roasters (GMCR +$0.46 or +0.48% to $96.94) posted a gain on very light volume today, closing just 67 cents below its best ever close. This high-ranked leader is extended from an ideal base and trading above the "max buy" level previously cited. Its gain on 3/08/10 with above average volume was noted as it triggered a most recent technical buy signal. Initial support to watch on pullbacks is at prior chart highs and its 50-day moving average (DMA) line now coinciding in the $88 area.

GMCR has shown mostly healthy action since showing up on 12/28/09 in the mid-day report (read here), returning the previously featured favorite to the Featured Stocks page at CANSLIM.net. Weak action had led it to be dropped from the Featured Stocks list on 12/01/09, but the repair of its prior 50-day moving average (DMA) line violation improved its outlook. Its has traded up as much as +282% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR +$0.29 or +0.28% to $92.65) posted a third consecutive gain on light volume today. This high-ranked leader has rallied from a recent tight trading range since the last time it was analyzed in this FSU section on 2/23/10 with an annotated graph under the headline, "Volume Cooling As High-Ranked Leader Consolidates." It has stubbornly held it ground near all-time highs between its pivot point and max buy level since its gain on 3/08/10 triggered a new technical buy signal. Initial support to watch now would be prior chart highs in the $86-88 area.

GMCR has shown mostly healthy action since showing up on 12/28/09 in the mid-day report (read here), returning the previously featured favorite to the Featured Stocks page at CANSLIM.net. Weak action had led it to be dropped from the Featured Stocks list on 12/01/09, but the repair of its prior 50-day moving average (DMA) line violation improved its outlook. Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +264% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

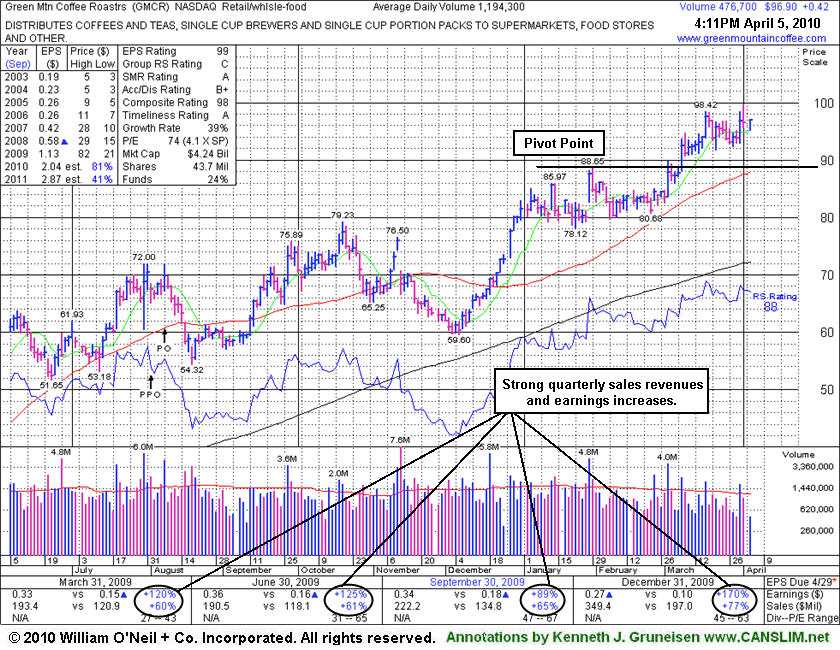

Green Mountain Coffee Roasters (GMCR -$1.48 or -1.80% to $81.12) is a high-ranked leader that continues consolidating in a very tight trading range near all-time highs with volume totals cooling off in recent weeks. Since hitting a $88.65 high on 1/29/10 it has been base building for a few weeks above its 50-day moving average (DMA) line. That short-term average and recent chart lows that define an important technical support level to watch now. It is within close striking range of its 52-week and all-time highs, however it has not formed a sound new base of sufficient length. Also, until a follow-through day from one of the major market averages, the M criteria argues against any new buying efforts under the rules of the investment system.

GMCR has shown mostly healthy action since showing up on 12/28/09 in the mid-day report (read here), returning the previously featured favorite to the Featured Stocks page at CANSLIM.net. Weak action had led it to be dropped from the Featured Stocks list on 12/01/09, but the repair of its prior 50-day moving average (DMA) line violation improved its outlook. Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +240% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

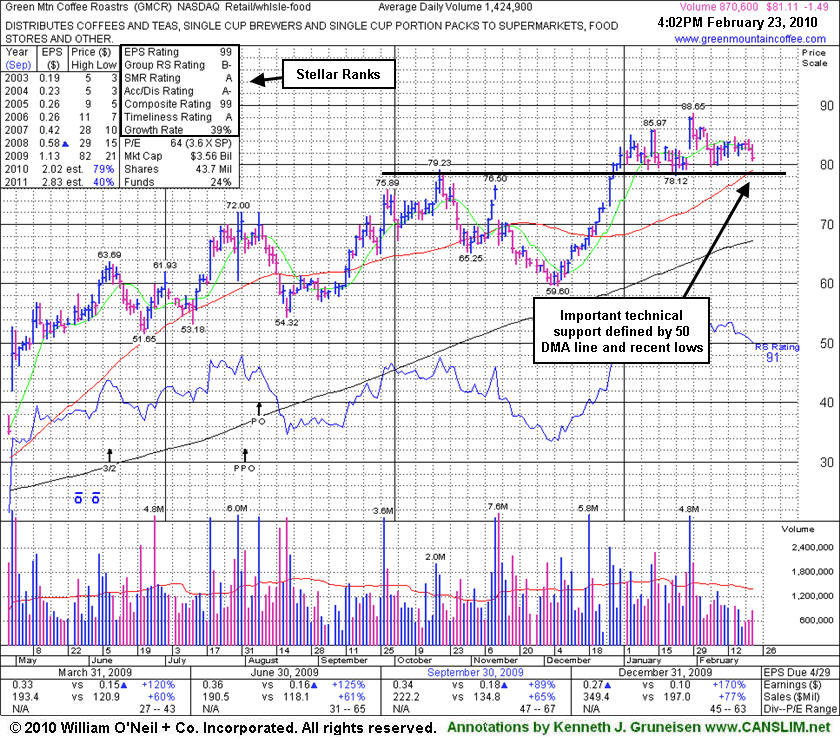

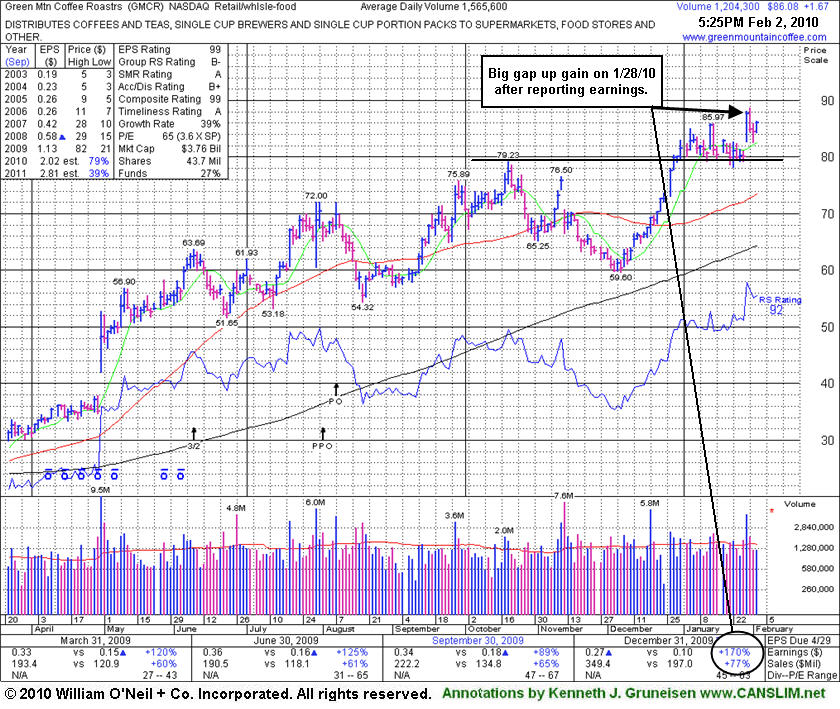

Green Mountain Coffee Roasters (GMCR +$1.67 or +1.98% to $86.08) is perched near all-time highs above its "max buy" level. Its small gain today on light volume led to its second best close ever. Recent chart lows in the $78 area are an important support level to watch now. It is clear of resistance due to overhead supply, a factor making it more likely to sprint higher, unhindered. Disciplined investors would avoid chasing it more than +5% above its latest pivot point. Meanwhile, losses should always be kept small by strictly selling any time any stock falls more than -7% from your buy price.

GMCR has stayed well above prior chart highs while recently consolidating, and it has shown healthy action since its last appearance in this Featured Stock Update (FSU) section on January 13, 2010 under the headline "Gains Leave Winner Extended From Latest Base. GMCR had made a new appearance on 12/28/09 in yellow in the mid-day report (read here), returning the previously featured favorite to the Featured Stocks page at CANSLIM.net. Weak action had led it to be dropped from the Featured Stocks list on 12/01/09, but the repair of its prior 50-day moving average (DMA) line violation had improve its outlook. Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +240% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

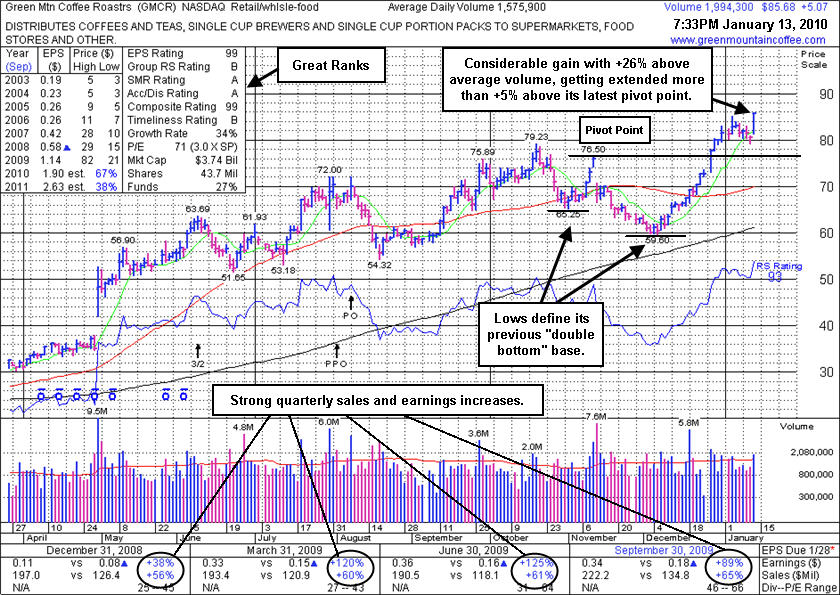

Green Mountain Coffee Roasters (GMCR +$5.07 or +6.29% to $85.68) gapped up today and tallied a considerable gain with just +26% above average volume as it rallied to a new all-time high well above its "max buy" level. It is clear of resistance due to overhead supply, a factor making it more likely to sprint higher, unhindered by resistance. Disciplined investors would avoid chasing it more than +5% above its latest pivot point. Meanwhile, losses should always be kept small by strictly selling any time any stock falls more than -7% from your buy price. Prior chart highs in the $76-77 area are important support levels to watch now.

GMCR has stayed well above prior chart highs while recently consolidating, and it has shown healthy action since its last appearance in this Featured Stock Update (FSU) section on 12/28/09 with an annotated graph under the headline "New High Close As Buying Demand Warms Up Again". That evening's report illustrated its gain above the pivot point of a 10-week "double bottom" type base with +62% above average volume confirming a new technical buy signal. GMCR had made a new appearance on 12/28/09 in yellow in the mid-day report (read here), returning the previously featured favorite to the Featured Stocks page at CANSLIM.net. Weak action had led it to be dropped from the Featured Stocks list on 12/01/09, but the repair of its prior 50-day moving average (DMA) line violation had improve its outlook. Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +204% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR +$4.98 or +6.58% to $77.86) posted a considerable gain today as it rose above the pivot point of a 10-week "double bottom" type base. It ended near the session high at its highest close ever with a considerable gain on +62% above average volume, confirming a new technical buy signal. Early strength prompted its appearance in yellow in the mid-day report (read here), returning the previously featured favorite to the Featured Stocks page at CANSLIM.net. It is clear of resistance due to overhead supply, a factor making it more likely to sprint higher, unhindered by resistance. Additional gains to new all-time high ground would be a solid reassurance of institutional buying demand, but disciplined investors would avoid chasing it more than +5% above its latest pivot point which would mean paying more than the $80.33 "max buy" price in this case. Meanwhile, losses should always be kept small by strictly selling any time any stock falls more than -7% from your buy price.

Weak action had led it to be dropped from the Featured Stocks list on 12/01/09. It rebounded impressively in recent weeks, and its 12/18/09 gain on heavy volume repaired its prior 50-day moving average (DMA) line violation, helping its outlook improve.

Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +204% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR -$0.12 or -0.18% to $65.01) has slumped badly since its last appearance in the FSU section on November 11, 2009 under the headline "Choppy Action Has Not Allowed Sound Base To Form." It gapped down on 12/12/09 after reporting strong quarterly results for the period ended Sept 30, 2009, suffering a considerable loss on heavy volume, closing below its 50 DMA line. It negated its recent breakout from a cup-with-high-handle pattern and slumped below its July highs, triggering technical sell signals. It has also slumped under a longer-term upward trendline. It would need to rally back above its recent chart highs near $76 for its outlook to improve.

Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +204% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR +$2.77 or +3.79% to $75.91) posted a third consecutive gain today, rising with above average volume for its third highest close ever. That leaves almost no overhead supply remaining to act as resistance, however its choppy action in recent weeks has not allowed for a sound new base to form. It found support near its 50-day moving average line after it negated its recent breakout from a cup-with-high-handle pattern and slumped below its July highs, triggering technical sell signals.

Disciplined investors avoid buying stocks with flawed base patterns, and they always limit losses at any time a stock falls more than 7-8% from their buy price. If any add-on purchases were made after GMCR's later stage breakouts, those positions might have been sold to effectively limit risk, meanwhile, shares of the stock bought at earlier levels might still be justifiable to hold. Any deterioration under recent chart lows would raise concerns, and subsequent losses under its 50 DMA line would trigger technical sell signals as more worrisome signs of weakness.

Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +204% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR +$1.30 or +1.90% to $68.48) halted its slide right at its 50-day moving average line with today's gain on lighter volume following two damaging losses on higher volume. It has negated its recent breakout from a cup-with-high-handle pattern and slumped below its July highs. Disciplined investors always limit losses at any time a stock falls more than 7-8% from their buy price. If any add-on purchases were made after GMCR's later stage breakouts, those positions might need to be sold, meanwhile, shares of the stock bought at earlier levels might still be justifiable to hold. Any deterioration under recent chart lows would raise concerns, and subsequent losses under its 50 DMA line would trigger technical sell signals as more worrisome signs of weakness.

Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +204% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR -$1.40 or -1.94% to $72.03) has been quietly consolidating on the right side of a cup-with-high-handle pattern. It completed an additional share offering on 8/07/09, then slumped under its 50-day moving average (DMA) line and nearly tested support at prior chart lows before rallying back. Its big gain for a new 52-week high on 9/28/09 came with high volume, but while it cleared all chart resistance, it had not completed a sufficient length base or a proper handle for a cup-with-handle pattern. It negatively reversed on the next session after reaching the $75.89 high, which is the basis for the pivot point of its "high handle" being cited in notes since 10/05/09. Any deterioration under recent chart lows would raise concerns, and subsequent losses under its 50 DMA line would be even more worrisome signs of waekness.

A fresh breakout to new highs with a gain on heavy volume would trigger a valid technical buy signal, meanwhile it should remain on investors' watch lists. Disciplined investors will watch for volume-driven gains to trigger a new technical buy signal before making any initial buys or add-on purchases. Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +191% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR -$1.68 or -2.52% to $67.11) is consolidating on the right side of a 6-week cup shaped base, and it closed the session less than -7% off its all-time high. It did a great job of overcoming distributional pressure since its last appearance in this FSU section on 9/10/09 under the headline, "Struggling Below 50 Day Average 4 Weeks With Lack Of Volume Behind Gains," showing a possible "head-and-shoulders" top taking shape. It avoided losses afterward that would have undercut its neckline and triggered a worrisome technical sell signal.

It completed an additional share offering on 8/07/09. Volume totals have been light or near average as it recently rose back above its 50-day moving average (DMA) line and rallied up through most overhead supply. It may go on to form a sound cup-with-handle type pattern in due time. GMCR traded up more than +168% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR +$0.20 or +0.34% to $59.62) has been hovering in a tight trading range for the past 4 weeks under its 50-day moving average (DMA) line with volume drying up. As previously noted, "a violation of its prior chart low ($54.32 on 8/18/09) would complete a bearish 'head-and-shoulders' pattern and may trigger more worrisome technical sell signals." It last appearance in this FSU section on 8/26/09 (read here) came under the headline, "Coffee Stock Cooling Off Since Share Offering Recently Completed", which described some current concerns that have arisen since GMCR traded up more than +168% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

After a stock slumps under its 50 DMA line its outlook becomes increasingly questionable the longer it stays trading under its 50 DMA line. That important short-term average can be a source of near-term technical resistance, so for its outlook to improve, GMCR now needs to produce gains to get back above it. Meanwhile, the next support is at prior chart lows in the $54-53 area, where violations would trigger additional sell signals and raise more serious concerns. As previously noted, "Its gap down and considerable loss on 8/17/09 on heavy volume triggered technical sell signals."

Green Mountain Coffee Roasters (GMCR -1.09 or -1.84% to $59.40) has been cooling off, and its outlook is increasingly questionable the longer it stays trading under its 50-day moving average (DMA) line which is now downward sloping and a source of near-term technical resistance. The next support is at prior chart lows in the $54-53 area, where violations would trigger additional sell signals and raise more serious concerns. As previously noted, "its gap down and considerable loss on 8/17/09 on heavy volume triggered technical sell signals." Sell signals were noted since the stock's last appearance in this section under the headline "Increase In Share Supply May Be A Hindrance" on 8/14/2009 when it was observed that, "Strong leaders tend to keep on leading, however those who are watching for early sell signals should look out for a violation of the multi-month upward trendline, any subsequent deterioration under prior highs in the $62-63 area, or a violation of its 50-day moving average (DMA) line (now $61.68). If you have 'force fed' your winners over time, accumulating at multiple buy points, always be disciplined about limiting losses by selling any higher priced shares you may have bought if the stock falls more than -7% from the price you paid for them. You might decide to hold shares owned at a lower cost basis, but be prompt to lock in profits whenever clear technical sell signals occur."

Bank of America Merrill Lynch was the "sole" book-running manager of the recent offering, with Canaccord Adams "co-lead manager." ; William Blair & Co, SunTrust Robinson Humphrey, and Janney Montgomery Scott were co-managers (see here). Numerous high-ranked leaders have taken advantage of investment bankers' eagerness to raise capital for publicly traded companies, and it is admirable to see these large financial institutions actually underwriting deals that raise money for those in need other than themselves. Investors have reasons to be a bit cynical and skeptical, especially when companies that are generating record revenue and earnings are "in need" of additional working capital.

Often times, new share offerings can hinder the upward price progress in companies for the near term, and GMCR has been sputtering ever since it completed an offering of 5 million common shares. Do not be confused by the 3:2 stock split effective 6/09/09. That also had the effect of increasing the number of GMCR shares. The supply (the S criteria) of outstanding shares now sits at 42.7 million shares, up from 24.6 million shares at the beginning of the year when it was featured in the January 2009 issue of CANSLIM.net News. That is a +73.5% increase in total shares outstanding! GMCR has traded as much as +176.28% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR -1.36 or -2.10% to $63.37) fell for a 5th consecutive session on below average volume. It has been consolidating toward its 50 DMA line ever since it completed an offering of 5 million common shares. Strong leaders tend to keep on leading, however those who are watching for early sell signals should look out for a violation of the multi-month upward trendline, any subsequent deterioration under prior highs in the $62-63 area, or a violation of its 50-day moving average (DMA) line (now $61.68). If you have "force fed" your winners over time, accumulating at multiple buy points, always be disciplined about limiting losses by selling any higher priced shares you may have bought if the stock falls more than -7% from the price you paid for them. You might decide to hold shares owned at a lower cost basis, but be prompt to lock in profits whenever clear technical sell signals occur.

Bank of America Merrill Lynch was the "sole" book-running manager of the recent offering, with Canaccord Adams "co-lead manager." William Blair & Co, SunTrust Robinson Humphrey, and Janney Montgomery Scott were co-managers (see here). Numerous high-ranked leaders have taken advantage of investment bankers' eagerness to raise capital for publicly traded companies, and it is admirable to see these large financial institutions actually underwriting deals that raise money for those in need other than themselves. Investors have reasons to be a bit cynical and skeptical, especially when companies that are generating record revenue and earnings are "in need" of additional working capital. But don't let that scare you, simply rely upon the price volume action to let you know what direction the institutional holders are rushing. Thus far, this leader has been finding great support from the institutional crowd.

Often times, new share offerings can hinder the upward price progress in companies for the near term. Do not be confused by the 3:2 stock split effective 6/09/09. That also had the effect of increasing the number of GMCR shares. the supply (the S criteria) of outstanding shares now sits at 42.7 million shares, up from 24.6 million shares at the beginning of the year when it was featured in the January 2009 issue of CANSLIM.net News. That is a +73.5% increase in total shares outstanding! GMCR has traded as much as +176.28% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" in the January 2009 CANSLIM.net News (read here).

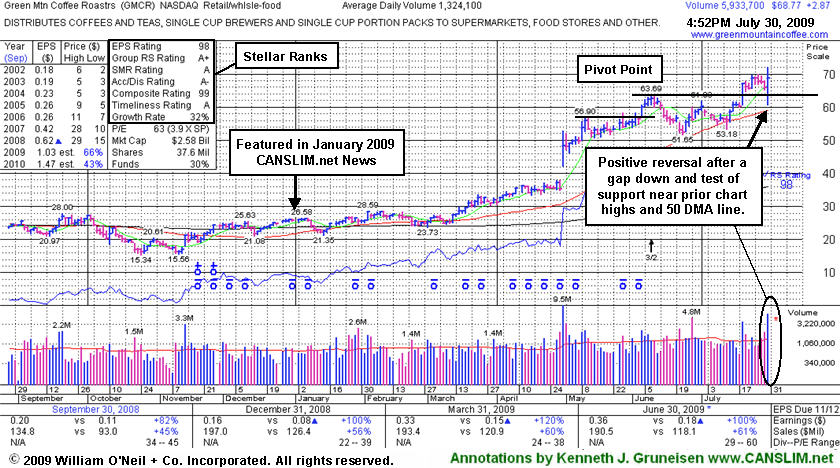

Greater than usual volume and volatility are common around earnings news, and this earnings season has offered up numerous examples of shakeouts and some ugly technical failures. [On Tuesday an earnings announcement is coming from Longtop Financl Tech Ads (LFT).] GMCR positively reversed on July 30th and rallied to new highs after initially gapping down following another strong financial report for the latest quarter ended June 30, 2009. It had held its ground stubbornly since July 20th, when its rally above its latest pivot point to a new all-time high with three times average volume triggered a technical buy signal. Using the "view all notes" link, one can see that from July 17-22 it was color coded yellow (Y- at the front of the notes) after the latest pivot point was identified. Its color code was changed to green after it rose more than +5% above its pivot point, indicating that it was getting extended from an ideal entry point within the investment system's guidelines.

Green Mountain Coffee Roasters (GMCR +$2.87 or +4.36% to $68.77) positively reversed today and rallied to new highs after initially gapping down following another strong financial report for the latest quarter ended June 30, 2009. It had held its ground stubbornly since July 20th, when its rally above its latest pivot point to a new all-time high with three times average volume triggered a technical buy signal. Using the "view all notes" link, one can see that from July 17-22 it was color coded yellow (Y- at the front of the notes) after the latest pivot point was identified. Its color code was changed to green after it rose more than +5% above its pivot point, indicating that it was getting extended from an ideal entry point within the investment system's guidelines. Greater than usual volume and volatility are common around earnings news, and today's shakeout offered a brief window of opportunity to buy shares without chasing the stock.

If you have "force fed" your winners over time, accumulating at multiple buy points, always be disciplined about limiting losses by selling any higher priced shares you may have bought if the stock falls more than -7% from the price you paid for them. You might decide to hold shares owned at a lower cost basis, but be prompt to lock in profits whenever clear technical sell signals occur. Strong leaders tend to keep on leading, however any subsequent deterioration under prior highs in the $62-63 area would negate its latest breakout. Prior highs are initial chart support to watch above its 50-day moving average (DMA) line. Do not be confused by the 3:2 stock split effective 6/09/09. GMCR has traded as much as +176.28% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

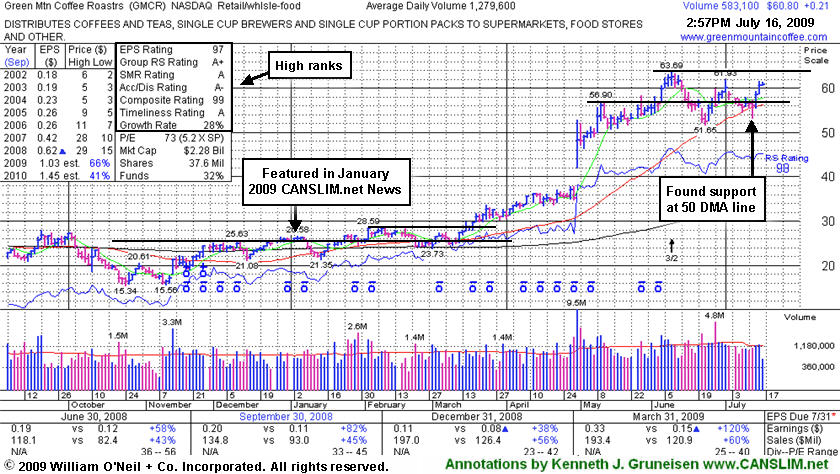

Green Mountain Coffee Roasters (GMCR +$0.08 to $60.67) recently found support when consolidating above its 50-day moving average (DMA) line. A violation of it and the recent chart low ($51.65) would raise concerns and trigger technical sell signals. Losses negated its latest breakout from a "high-tight flag" type pattern. It barely claimed its all-time high with a small gain on light volume as its 3:2 stock split took effect on 6/09/09, then subsequently slumped back into its prior base before finding support at its short-term average and rebounding. Do not be confused by the effect of the split on share prices, GMCR traded up an astonishing +144% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

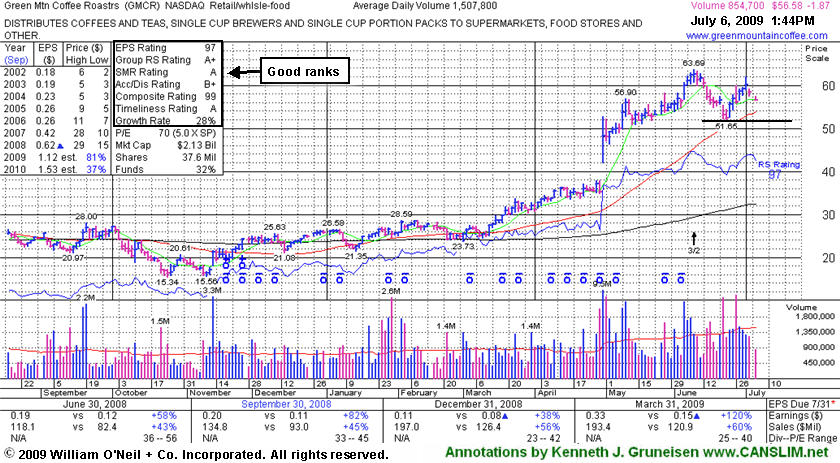

Taking a closer look at the annotated chart below that shows its action since January, a breakout on February 3rd helped it reach $28.59, but then it struggled and slumped into its prior base. At best, it built a sort of base-on-base type pattern, and it was not until mid-March that it made progress above $29 and $30, with the confirmation of a follow-through-day of big gains on higher volume from the major averages as an important reasurrance concerning the M criteria (market direction). Its big gap up on April 30th followed a short consolidation. The stock's latest appearance in this Featured Stock Update section came under the headline "Consolidating Above 50 DMA; Late-Stage Breakout Failed" (read here). Some have called it just a "second stage" base and questioned the characterization of GMCR as "late stage", however it is worth noting that the stock is currently trading more than +70% above its 200 DMA line. In the Certification program, they teach that when a stock is trading 70-100% or more above its 200 DMA line investors should probably not be looking for buy signals or reasons to hold, they shoud be watching out for sell signals which might prompt them to lock in profits!

Strong leaders tend to keep on leading, so this is not to say that another sound base might not form in due time. Investors must be especially disciplined about their entries after a stock has rallied from the low $20 range to $60 in about 4 months, and always disciplined about limiting losses if a stock ever falls more than -7% from their buy price.

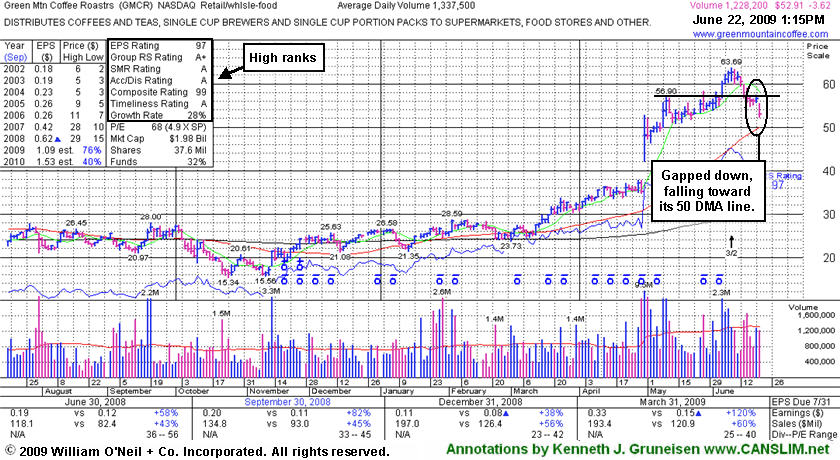

Green Mountain Coffee Roasters (GMCR -$0.95 or -1.63% to $57.50) has been quietly consolidating above its 50-day moving average (DMA) line. Its 50 DMA line is an important support level to watch. A violation of it and the recent chart low ($51.65) would raise concerns and trigger technical sell signals. Losses negated its latest breakout from a "high-tight flag" type pattern. Under the headline "Gap Down Today Indicative Of Distributional Pressure" an annotated graph illustrated as its late stage breakout failed amid "worrisome signs of distributional pressure" in the Featured Stock Update section on June 22nd (read here). It barely claimed its all-time high with a small gain on light volume as its 3:2 stock split took effect on 6/09/09. Do not be confused by the effect of the split on share prices, GMCR traded up an astonishing +144% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR -$3.46 or -6.12% to $53.07) gapped down today and volume was almost twice its daily average volume while falling toward its 50 DMA line -important support to watch. Gaps down are worrisome signs of distributional pressure. It recently showed signs of institutional selling when volume spiked behind losses that negated its latest breakout from a "high-tight flag" type pattern. It had vaulted to a fresh all-time high when it made its last appearance in the Featured Stock Update section on Monday, June 8th (read here). It barely claimed its all-time high with a small gain on light volume as its 3:2 stock split took effect on 6/09/09. GMCR traded up more than +144% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

Green Mountain Coffee Roasters (GMCR $2.12 or +2.32% to $93.54) vaulted to a fresh all-time high on Monday after recently breaking out of a high tight flag. GMCR's most recent Featured Stock Update appearance was on Tuesday May 26, 2009 under the headline "Possible High Tight Flag Pattern For High Ranked Leader" (read here). The article identified that this issue may be forming a "high tight flag" pattern and identified the bullish traits that were occurring at the time. The story said, "This type of setup can occur when a stock doubles in 4 to 8 weeks, then moves sideways, correcting 10-20% in 3-5 weeks. The buy point is the high before the sideways movement, and gains backed by sufficiently heavy volume are required to trigger a proper technical buy signal." The new technical buy signal was triggered on June 2, 2009 when this stock traded above $85.35 and enjoyed a fresh new high close. Since then, GMCR has rallied nearly +10% and is currently too extended to be considered buyable under proper guidelines.

Green Mountain Coffee Roasters (GMCR $3.08 or +3.86% to $82.86) may be forming a "high tight flag" pattern. This type of setup can occur when a stock doubles in 4 to 8 weeks, then moves sideways, correcting 10-20% in 3-5 weeks. The buy point is the high before the sideways movement, and gains backed by sufficiently heavy volume are required to trigger a proper technical buy signal. Disciplined investors resist the urge to jump in "early" and, as always, they limit losses by selling any stock that falls -7% from their buy point to reduce the possibility of losses. Meanwhile, GMCR is now trading +100% above its 200-day moving average line, which raises a caution flag too. That serves as a reminder for disciplined investors to be watching for future sell signals which might prompt swift profit taking.

Its Featured Stock Update appearance on 4/29/2009 included a weekly graph under the headline "Strong Coffee Firm's Latest Earnings and Deal With Wal-Mart Bode Well" showing its advanced "3-weeks tight" pattern (similar to the high tight flag) which was noted in the days immediately ahead of its "breakaway gap" on 4/30/09 that followed its latest strong earnings report (read here).

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Green Mountain Coffee Roasters (GMCR -$3.94 or -4.96% to $80.00) pulled back today on volume closer to average after 2 consecutive gains on heavy volume for new all-time highs. Its previous Featured Stock Update appearance on 4/29/2009 included a weekly graph under the headline "Strong Coffee Firm's Latest Earnings and Deal With Wal-Mart Bode Well" showing its advanced "3-weeks tight" pattern which was noted in the days immediately ahead of its "breakaway gap" on 4/30/09 that followed its latest strong earnings report (read here). It is extended from a sound base now, putting it outside the investment system's guidelines for a proper buy candidate. Trading more than +100% above its 200-day moving average line raises a caution flag too. That serves as a reminder for disciplined investors to be watching for future sell signals which might prompt profit taking, even though it may get more extended.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Green Mountain Coffee Roasters (GMCR -$2.97 or -5.33% to $52.73) fell today with above average volume. It then reported strong sales and earnings increases for the latest quarter and announced a new distribution partnership with retail giant Wal-Mart Stores after the close, and it has traded up considerably in the limited action after-hours. The weekly chart below shows that it is now extended from a sound base well above its 10-week average (the red line) and well above prior chart highs in the $42 area have been noted as "an important chart support level to watch on pullbacks." GMCR has traded up as much as +45.22% since it was featured in the January 2009 CANSLIM.net News at at $39.09 (read here).

Caution was advised with earnings news due (as volume and volatility often increase near earnings reports) when noted in the After Market Update on 4/28/09 as its gain with +65% above average volume helped it rise from an advanced "3-weeks tight" chart pattern - where 3 weekly closes came in very close proximity. Although a new pivot point was not cited in CANSLIM.net reports, breakouts from this type of advanced pattern can be valid secondary buy points in very strong leaders. Another secondary buy point to watch for is when a high-ranked leader pulls back to its 10-week average line for the first time following a breakout from a sound base pattern. Healthy stocks normally stay above that line because institutional owners often support their existing positions with additional buying during ordinary consolidations near that technically important level.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Green Mountain Coffee Roasters (GMCR -$0.15 or -0.31% to $52.25) has been consolidating in a tight range for the past couple of weeks while remaining perched near all-time highs. It is due to release financial results for its fiscal second quarter after the close on Wednesday, April 29, 2009. Volume and volatility are often greater when companies report financial news, especially if also providing guidance either better or worse than analysts' expectations. This stock is currently extended from a sound base and well above its "max buy" level cited in earlier CANSLIM.net reports. Disciplined investors know to avoid chasing stocks extended more than +5% above their pivot point. Its 50 DMA line and prior highs have been noted as "an important chart support level to watch on pullbacks."

While GMCR could continue higher, remember that the guidelines of the investment system are designed to help investors avoid costly mistakes. Discipline and patience remain critical to investors' success, as always! In a healthy bull market, many strong leaders can be accumulated within the system's proper guidelines. Questionable volume was behind GMCR's initial gains above its pivot point, and since 3/19/09 it has been color coded green in CANSLIM.net reports to alert members that this high-ranked leader is outside of the strict parameters suggested for buy candidates per the instructions in the Certification course.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Green Mountain Coffee Roasters (GMCR -$0.32 or -0.63% to $50.22) hit a new all-time high this week with gains on near average volume. After 5 consecutive weekly gains, it has been repeatedly noted as "extended" from a sound base. It is well above its "max buy" level cited in earlier CANSLIM.net reports, and disciplined investors know to avoid chasing stocks extended more than +5% above their pivot point. Its 50 DMA line and prior highs in the $42 area have been noted as "an important chart support level to watch on pullbacks."

While GMCR could continue higher, remember that the guidelines of the investment system are designed to help investors avoid costly mistakes. Discipline and patience remain critical to investors' success, as always! In a healthy bull market, many strong leaders can be accumulated within the system's proper guidelines. Questionable volume was behind GMCR's initial gains above its pivot point, and since 3/19/09 it has been color coded green in CANSLIM.net reports to alert members that this high-ranked leader is outside of the strict parameters suggested for buy candidates per the instructions in the Certification course.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

A proper technical buy signal under the investment system's guidelines requires a gain above the pivot backed by more than +50% above average volume. Most big winners in market history, in fact, blasted off with very heavy volume, they did not barely limp over their pivot points. Volume is a critical component to a sound technical breakout, as the intense burst of trading activity is what gives investors evidence of serious institutional buying demand - which is needed for a sustained advance!

Green Mountain Coffee Roasters (GMCR -$1.65 or -3.38% to $47.15) gapped down today and ended the session with a loss on very light volume. It rose with only average volume and reversed to close back under its pivot point when it was last analyzed on 3/17/09 in this FSU section (read here). Its subsequent gain on 3/24/09 was backed by near the minimum +50% above average volume, however that gain came after its price was already too extended above its pivot point. That made it very difficult for disciplined investors to justify taking action, especially in a market still lacking lots of healthy leadership. Patience may allow for its shares to be accumulated on lighter volume pullbacks toward prior chart highs in the $42 area that are now an important technical support level to watch. Since GMCR is extended from a proper buy point, one might also be wise to wait and see if a new base is formed above its prior base, which might eventually allow for a more ideal entry point with the guidelines of the investment system.

The company hails from the Retail/Whlsle-Food group which is presently ranked in the much coveted top quartile of industry groups, easily satisfying the L criteria. The company's Return On Equity is reported at a +21%, which is higher than the +17% guideline. It has a strong quarterly and annual earnings history. The number of top-rated funds owning its shares increased from 55 in March '08 to 102 in December '08, which is a nice reassurance with respect to the I criteria. GMCR has been added to the CANSLIM.net Featured Stocks lists and dropped a couple of times in the past year (use the "view all notes" link to review all prior coverage). It was most recently featured again in the January 2009 CANSLIM.net News (read here). The Dec '07 quarter earnings, from what has been determined, were increased by 2 cents per share due to a one-time accounting change and not a result of ongoing operations. Without the change, its latest quarterly comparison may have been a +33% increase.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Green Mountain Coffee Roasters (GMCR unchanged, at $43.00) paused today after trading in a wide intra-day range on Monday with only average volume as it traded above its pivot point. A proper technical buy signal under the investment system's guidelines requires a gain above the pivot backed by more than +50% above average volume. Most big winners in market history, in fact, blasted off with very heavy volume, they did not barely limp over their pivot points. Volume is a critical component to a sound technical breakout, as the intense burst of trading activity is what gives investors evidence of serious institutional buying demand - which is needed for a sustained advance!

Important support is at its 200 DMA line and recent chart lows in the $35 area. Its gain with above average volume on 3/02/09 led to a bullish "positive reversal" as it found prompt support at its longer-term average. GMCR has proven resilient since triggering a technical sell signal with a considerable loss on 2/23/09 with above average volume. The company hails from the Retail/Whlsle-Food group which is presently ranked 24th on the 197 Industry Groups list, which places it in the much coveted top quartile of industry groups, easily satisfying the L criteria. The company's Return On Equity is reported at a +21%, which is higher than the +17% guideline. It has a strong quarterly and annual earnings history. The number of top-rated funds owning its shares increased from 55 in March '08 to 102 in December '08, which is a nice reassurance with respect to the I criteria. GMCR has been added to the CANSLIM.net Featured Stocks lists and dropped a couple of times in the past year (use the "view all notes" link to review all prior coverage). It was most recently featured again in the January 2009 CANSLIM.net News (read here). The Dec '07 quarter earnings, from what has been determined, were increased by 2 cents per share due to a one-time accounting change and not a result of ongoing operations. Without the change, its latest quarterly comparison may have been a +33% increase.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Green Mountain Coffee Roasters (GMCR -$0.12 or -0.30% to $39.94) is now consolidating above its 50-day and 200-day moving average (DMA) lines. Its color code was changed to yellow based on recent strength which has it trading within close striking distance of its pivot point again. A gain with above average volume on 3/02/09 led to a bullish "positive reversal" as it found prompt support at its longer-term 200 DMA line. GMCR has proven resilient since triggering a technical sell signal with a considerable loss on 2/23/09 with above average volume.

The company hails from the Retail/Whlsle-Food group which is presently ranked 21st on the 197 Industry Groups list, which places it in the much coveted top quartile of industry groups, easily satisfying the L criteria. The company's Return On Equity is reported at a +21%, which is higher than the +17% guideline. It has a strong quarterly and annual earnings history The number of top-rated funds owning its shares increased from 55 in March '08 to 101 in December '08, which is a nice reassurance with respect to the I criteria. GMCR has been added to the CANSLIM.net Featured Stocks lists and dropped a couple of times in the past year (use the "view all notes" link to review all prior coverage). It was most recently featured again in the January 2009 CANSLIM.net News (read here). The Dec '07 quarter earnings, from what has been determined, were increased by 2 cents per share due to a one-time accounting change and not a result of ongoing operations. Without the change, its latest quarterly comparison may have been a +33% increase.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Green Mountain Coffee Roasters (GMCR -$3.58 or -10.90% to $36.43) triggered a technical sell signal today with a considerable loss on above average volume, violating its 50 DMA line and closing near its 200 DMA line. Its color code was changed to green based on technical deterioration under its short-term average line. It encountered resistance in the $42-44 area, near its all-time high. Technically, its gain on 1/28/08 was backed by more than +50% above average volume above the previous pivot point cited. The company hails from the Retail/Whlsle-Food group which is presently ranked 15th on the 197 Industry Groups list, which places it in the much coveted top quartile of industry groups, easily satisfying the L criteria. The company's Return On Equity is reported at a +21%, which is higher than the +17% guideline. It has a strong quarterly and annual earnings history The number of top-rated funds owning its shares increased from 55 in March '08 to 101 in December '08, which is a nice reassurance with respect to the I criteria. GMCR has been added to the CANSLIM.net Featured Stocks lists and dropped a couple of times in the past year (use the "view all notes" link to review all prior coverage). It was most recently featured again in the January 2009 CANSLIM.net News (read here). The Dec '07 quarter earnings, from what has been determined, were increased by 2 cents per share due to a one-time accounting change and not a result of ongoing operations. Without the change, its latest quarterly comparison may have been a +33% increase.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Green Mountain Coffee Roasters (GMCR $+0.70 or +1.72% to $41.40) has been holding its ground impressively while perched near all-time highs. Quietly consolidating in the $40 area, its 50-day and 200-day moving average lines and upward trendline are key technical support levels to watch, where any deterioration would raise more concerns and trigger technical sell signals. Its color code was changed to yellow with new pivot point and max buy levels noted. Technically, its gain on 1/28/08 was backed by more than +50% above average volume above the previous pivot point cited. The company hails from the Retail/Whlsle-Food group which is presently ranked 20th on the 197 Industry Groups list, which places it in the much coveted top quartile of industry groups, easily satisfying the L criteria. The company's Return On Equity is reported at a +21%, which is higher than the +17% guideline. It has a strong quarterly and annual earnings history The number of top-rated funds owning its shares increased from 55 in March '08 to 99 in December '08, which is a nice reassurance with respect to the I criteria. GMCR has been added to the CANSLIM.net Featured Stocks lists and dropped a couple of times in the past year (use the "view all notes" link to review all prior coverage). It was most recently featured again in the January 2009 CANSLIM.net News (read here).

The Dec '07 quarter earnings, from what has been determined, were increased by 2 cents per share due to a one-time accounting change and not a result of ongoing operations. Without the change, its latest quarterly comparison may have been a +33% increase, and considering all other factors it is among few ideal looking candidates.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

It is very important to isolate the noise and pay attention to price and volume as we make our way through yet another earnings season. There are a slew of analysts that come out and set "targets" and who constantly engage in publishing upgrades or downgrades on various securities. An important element in profitably navigating through a busy earnings season is to see how your individual holdings react to their latest earnings news and guidance. While it is a common occurrence to see stocks sell off after a new earnings report, it is healthy to see investors promptly bid the stocks higher after a company reports their quarterly results. Investors that objectively analyze price and volume will likely do better than blindly following a plethora of analysts' upgrades and downgrades.

Green Mountain Coffee Roasters (GMCR +$2.05 or +5.42% to $39.85) reported its latest quarterly earnings after today's close. Greater volume and volatility are common after fresh earnings news and accompanying guidance. The company reportedly beat expectations and raised guidance for its FY '09, but concerns are raised by the fact it showed only a +14% earnings increase despite a strong +56% increase in sales revenues. The C criteria of the investment system tells investors to look for at least 3 or 4 quarters of increases at least +25%.

Technically, its gain today was the first gain backed by more than +50% above average volume above the latest pivot point cited. The most recent high volume totals have been noted as "indicative of distributional pressure." Meanwhile, only average volume was behind its 1/23/09 gain for a close above its previously cited pivot point. The company hails from the Retail/Whlsle-Food group which is presently ranked 8th on the 197 Industry Groups list, which places it in the much coveted top quartile of industry groups, easily satisfying the L criteria. The company's Return On Equity is reported at a +21%, which is higher than the +17% guideline. Its strong quarterly and annual earnings history satisfies the C and A criteria of this prime candidate for an updated watch list. The number of top-rated funds owning its shares increased from 55 in March '08 to 99 in December '08, which is a nice reassurance with respect to the I criteria. GMCR has been added to the CANSLIM.net Featured Stocks lists and dropped a couple of times in the past year (use the "view all notes" link to review all prior coverage). It was most recently featured again in the January 2009 CANSLIM.net News (read here).

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

|

Green Mountain Coffee Roasters |

| |

|

Ticker Symbol: GMCR (NASDAQ) |

Industry Group: Retail/Whlsle-Food |

Shares Outstanding: 24,600,000 |

|

Price: $39.09 1/2/2009 |

Day's Volume: 407,700 1/2/2009 |

Shares in Float: 16,900,000 |

|

52 Week High: $44.75 6/17/2008 |

50-Day Average Volume: 492,300 |

Up/Down Volume Ratio: 1.7 |

|

Pivot Point: $38.54 12/10/2008 (high plus $0.10) |

Pivot Point +5% = Max Buy Price: $40.47 |

Web Address: http://www.greenmountaincoffee.com/ |

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports |

View all notes | Alert me of new notes | CANSLIM.net Company Profile

CANSLIM.net Profile: Green Mountain Coffee Roasters, Inc. operates in specialty coffee industry in the United States and internationally. The company sells approximately 100 whole bean and ground coffee selections, hot cocoa, teas, and coffees. It also offers Arabica coffees and coffee selections, including single-origins, estates, certified organics, Fair Trade Certified, proprietary blends, and flavored coffees under the Green Mountain Coffee Roasters and Newmans Own Organics brands. The company primarily sells coffee to distributors for offices and hotels; and retailers, such as department stores and club stores, as well as directly to consumers. Green Mountain Coffee Roasters, Inc. was founded in 1981 and is headquartered in Waterbury, Vermont. The company hails from the Retail/Whlsle-Food group which is presently ranked 8th on the 197 Industry Groups list, which places it in the much coveted top quartile of industry groups, easily satisfying the L criteria. The company's Return On Equity is reported at a +21%, which is higher than the +17% guideline. Its strong quarterly and annual earnings history satisfies the C and A criteria of this prime candidate for an updated watch list. The number of top-rated funds owning its shares increased from 55 in March '08 to 97 in September '08, which is a nice reassurance with respect to the I criteria. Regular readers may recognize GMCR because it was actually added to the CANSLIM.net Featured Stocks lists and dropped a couple of times in the past year (use the "view all notes" link to review all prior coverage).

What to Look For and What to Look Out For: Look for the stock to trigger a new technical buy signal by breaking out in the coming days and weeks above its $38.54 pivot point on heavy volume. Remember that buyable breakouts must clear their pivot point with convincing gains backed by at least +50% above average volume during a confirmed rally. Its small supply (the S criteria) of 24.6 million shares outstanding could contribute to greater volatility in the event of institutional positioning (accumulation/distribution). Any deterioration under its 200-day moving average (DMA) line would hurt its outlook, technically, and raise concerns. A gain with heavy volume leading to a close above its pivot point would trigger a technical buy signal.

Technical Analysis: The stock has traced out a cup-with-handle base pattern, falling -45% in the September-October period, which is a permissible pullback during bear markets. The fact that the stock is only -12.6% below its 52-week high is a strong sign of strength considering the average stock is down much more than that. The stock recently rallied above that pivot point, but did so on lackluster volume and finished weak, so a convincing and proper technical buy signal has yet to be triggered. Disciplined investors would wait for a solid buy signal before initiating a position.

Proper buy and sell discipline cannot be lacking. Without a proper technical buy signal to satisfy the investment system's guidelines, odds are not in your favor. Without adherence to the sell rules, odds of bigger losses are in your favor. With that in mind, remember that the M criteria is of utmost importance now, because 3 out of 4 stocks tend to follow the direction of the major averages. During a market correction (which regular readers have certainly been hearing about lately) the odds are stacked against you.

Green Mountain Coffee Roasters (GMCR -$0.91 or -2.17% to $42.83) suffered a second consecutive loss with above average volume today, which is a sign it is encountering distributional pressure after reaching new all-time highs. It has no overhead supply to hinder its upward price progress, but investors must keep in mind the shape of the market. A follow through day from the major averages is needed before there is a confirmed rally to work with. GMCR was featured in yellow in the 6/13/08 CANSLIM.net Mid-Day BreakOuts Report with a $43.80 pivot point and $45.99 max buy price (read here), having recovered from a deep pullback under its 50-day and 200-day moving average lines. That pullback followed its earlier appearance in the January 2008 issue of CANSLIM.net News in the "Stocks to Watch in This New Market" section (read here).

Taking time for some attention to the details members can review through the "view all notes" links in CANSLIM.net can turn up important comments from prior reports, like the one dated 1/07/08 which pointed out "GMCR has recently enjoyed a very strong rally from the $30 area. That sprint higher helped send this stock above its current pivot point of $41.20, but volume failed to properly confirm the breakout. Disciplined investors will watch for a technical buy signal and signs of institutional buying demand which requires gains on at least +50% above average volume (to satisfy the I criteria) as this stock rises above its pivot point. Until then, patience is paramount."

Proper buy and sell discipline cannot be lacking. Suppose you were anxious, and undisciplined, and you bought GMCR in January without a proper technical buy signal to satisfy the investment system's guidelines. When you were down 7-8% and did not follow the investment system's guideline for selling, guess what happened? You may have endured the -40% pullback from $42 to $25 in the months that followed. Investors should always remain cognizant of the fact that any stock can fall that badly, or worse - even the high-ranked leaders that are featured and noted by CANSLIM.net's experts!

One contributing factor to the great volatility in GMCR is that it has a small supply (the S criteria) of shares outstanding - only 24.0 million, with just 16.6 million in the float. Keep in mind that 95 percent of the biggest market winners the investment system is based upon had 30 million or fewer shares outstanding.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

|

Green Mtn Coffee Roasters |

||

|

Ticker Symbol: GMCR (NASDAQ) |

Industry Group: Retail/wholesale - food |

Shares Outstanding: 23,600,000 |

|

Price: $40.70 12/31/2007 |

Day's Volume: 105,100 12/31/2007 |

Shares in Float: 15,300,000 |

|

52 Week High: $42.96 8/8/2007 |

50-Day Average Volume: 273,100 |

Up/Down Volume Ratio: 0.7 |

|

Pivot Point: $41.20 10/19/2007 high plus $0.10 |

Pivot Point +5% = Max Buy Price: $43.26 |

Web Address: http://www.greenmountaincoffee.com/ |

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports |

View all notes | Alert me of new notes | CANSLIM.net Company Profile

CANSLIM.net Company Profile: Green Mountain Coffee Roasters, Inc., through its subsidiaries, engages in roasting, packaging, and distributing roasted coffee primarily in the northeastern United States. It sells approximately 100 whole bean and ground coffee selections, hot cocoa, teas, and coffees. It sells coffee to retailers, including supermarkets; convenience stores; specialty stores; food service enterprises, including restaurants, hotels, universities, and business offices; and directly to individual consumers. It was founded in 1981 and is headquartered in Waterbury, Vermont. The Composite Rating, which is a combination of all the other readings, stands at a very healthy 92. Meanwhile, the Relative Strength (RS) line is at a new all-time high while the Relative Strength rank is 98 and the company's Earnings Per Share (EPS) rating is 93. Earnings have grown at a very healthy clip over the past three quarters, satisfying the C criteria. Return on Equity of 18% is just above the 17% guideline. GMCR resides in the Retail Wholesale - Food group which is currently ranked 90th of out the 197 Industry Groups, but strength in other high-ranked stocks such as Amcon Distribution (DIT) helps satisfy the L criteria. The number of top-rated funds owning an interest rose from 40 in Dec '06 to 48 in Sept '07, helping reassure investors about the I criteria.

What to Look For and What to Look Out For: GMCR has recently enjoyed a very strong rally from the $30 area. That sprint higher helped send this stock above its current pivot point of $41.20, but volume failed to confirm the breakout. Disciplined investors will watch for a proper technical buy signal and signs of institutional buying demand which requires gains on at least +50% above average volume (to satisfy the I criteria) as a stock rises above its pivot point. Until then, patience is paramount. GMCR is currently fighting to stay above its prior chart highs near $40. A close back under its prior chart highs would prompt concern, especially if there are damaging losses on heavier than average volume. If the stock rolls over and closes below its prior chart highs then the next level of support is its 50 DMA line ($35.29). Always limit losses per the 7-8% sell rule, and never hold a stock if it falls more than that much from your purchase price.

Technical Analysis: The stock is currently building on a 5-month base, pulling back on light volume to consolidate its recent move. It demonstrated bullish action when it broke out above its pivot point on 12/21/07 however volume, a critical component needed to trigger a proper technical buy signal, was light.