Choppy Action Has Not Allowed Sound Base To Form

Wednesday, November 11, 2009 CANSLIM.net

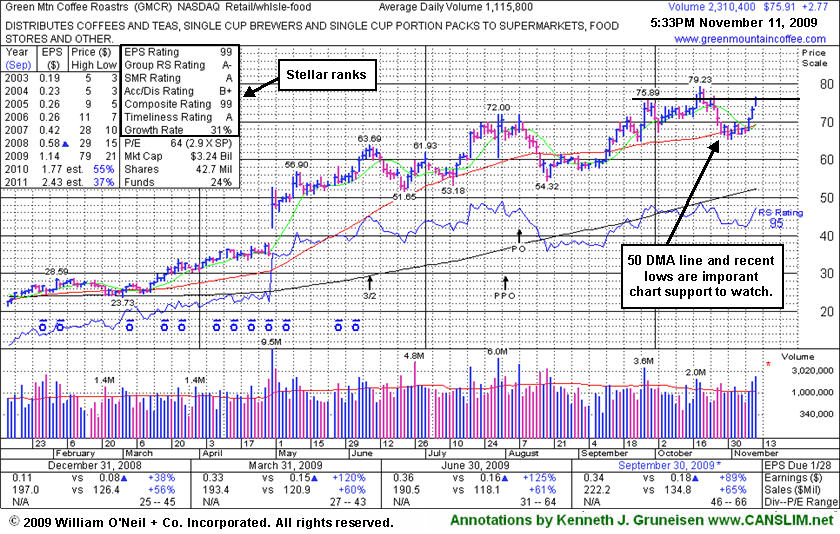

Green Mountain Coffee Roasters (GMCR +$2.77 or +3.79% to $75.91) posted a third consecutive gain today, rising with above average volume for its third highest close ever. That leaves almost no overhead supply remaining to act as resistance, however its choppy action in recent weeks has not allowed for a sound new base to form. It found support near its 50-day moving average line after it negated its recent breakout from a cup-with-high-handle pattern and slumped below its July highs, triggering technical sell signals.

Disciplined investors avoid buying stocks with flawed base patterns, and they always limit losses at any time a stock falls more than 7-8% from their buy price. If any add-on purchases were made after GMCR's later stage breakouts, those positions might have been sold to effectively limit risk, meanwhile, shares of the stock bought at earlier levels might still be justifiable to hold. Any deterioration under recent chart lows would raise concerns, and subsequent losses under its 50 DMA line would trigger technical sell signals as more worrisome signs of weakness.

Do not be confused by the 3-for-2 split that occurred in the interim, as GMCR has traded up as much as +204% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).