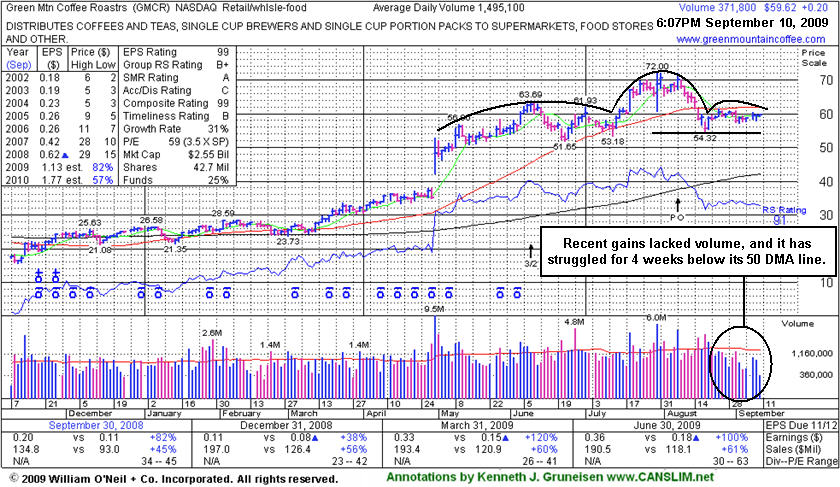

Struggling Below 50 Day Average 4 Weeks With Lack Of Volume Behind Gains

Thursday, September 10, 2009 CANSLIM.net

Green Mountain Coffee Roasters (GMCR +$0.20 or +0.34% to $59.62) has been hovering in a tight trading range for the past 4 weeks under its 50-day moving average (DMA) line with volume drying up. As previously noted, "a violation of its prior chart low ($54.32 on 8/18/09) would complete a bearish 'head-and-shoulders' pattern and may trigger more worrisome technical sell signals." It last appearance in this FSU section on 8/26/09 (read here) came under the headline, "Coffee Stock Cooling Off Since Share Offering Recently Completed", which described some current concerns that have arisen since GMCR traded up more than +168% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

After a stock slumps under its 50 DMA line its outlook becomes increasingly questionable the longer it stays trading under its 50 DMA line. That important short-term average can be a source of near-term technical resistance, so for its outlook to improve, GMCR now needs to produce gains to get back above it. Meanwhile, the next support is at prior chart lows in the $54-53 area, where violations would trigger additional sell signals and raise more serious concerns. As previously noted, "Its gap down and considerable loss on 8/17/09 on heavy volume triggered technical sell signals."