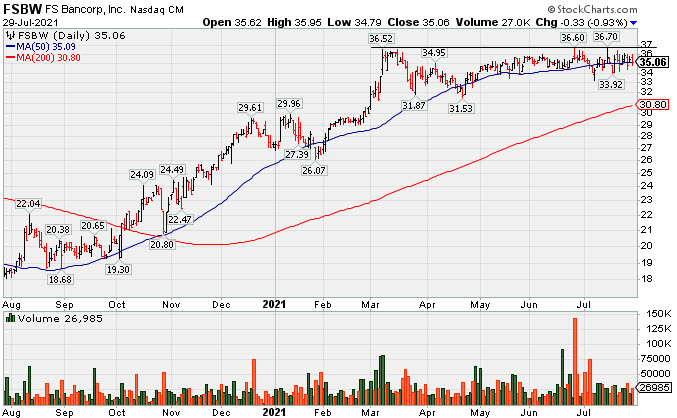

Latest Earnings Report Broke Streak of Strong Increases - Thursday, July 29, 2021

F S Bancorp (FSBW -$0.33 or -0.93% to $35.06) is still consolidating near its 50-day moving average (DMA) line ($35.21). It recently reported Jun '21 quarterly earnings -16% on -11% sales revenues versus the year ago period raising fundamental concerns. That broke a streak of 4 consecutive strong quarterly comparisons above the +25% minimum earnings guideline (C criteria). Its Earnings Per Share Rating fell from 97 to 81 since last shown in this FSU section on 6/24/21 with an annotated graph under the headline "Still Consolidating With Close Striking Distance of All-Time High".

Do not be confused by a 2:1 stock split which impacted share prices as of 7/15/21 (Featured Price, Pivot Point, and Max Buy levels were updated accordingly). This thinly-traded Bank was highlighted in yellow with pivot point cited based on its 3/08/21 high plus 10 cents in the 5/18/21 mid-day report (read here).

Its annual earnings (A criteria) history has been great. It completed a new Public Offering on 9/08/17. The number of top-rated funds owning its shares rose from 168 in Jun '20 to 187 in Mar '21, a reassuring sign concerning the I criteria. Its small supply of only 8.5 million shares outstanding can contribute to greater price volatility in the event of institutional buying or selling. It has a Timeliness Rating of C and Sponsorship Rating of B.

Still Consolidating With Close Striking Distance of All-Time High - Thursday, June 24, 2021

F S Bancorp (FSBW +$0.88 or +1.25% to $71.37) posted a quiet gain today. This thinly-traded Bank is still perched within close striking distance of the pivot point cited based on its 3/08/21 high plus 10 cents. It has been consolidating above its 50-day moving average (DMA) line ($69.25) where it found prompt support during its ongoing ascent. Subsequent gains above the pivot point backed by at least +40% above average volume are needed to trigger a technical buy signal.

FSBW was highlighted in yellow with pivot point cited based on its 3/08/21 high plus 10 cents in the 5/18/21 mid-day report (read here). It was last shown in this FSU section that evening with an annotated graph under the headline "Thinly-Traded Bank Consolidating Above 50-Day Moving Average".

Fundamentals remain strong. FSBW has an Earnings Per Share Rating of 97. It reported Mar '21 quarterly earnings +137% on +16% sales revenues versus the year ago period, its 4th consecutive strong quarterly comparison above the +25% minimum earnings guideline (C criteria), matching the fact-based investment system's winning models. Its annual earnings (A criteria) history has been great. It completed a new Public Offering on 9/08/17.

The number of top-rated funds owning its shares rose from 168 in Jun '20 to 187 in Mar '21, a reassuring sign concerning the I criteria. Its small supply of only 4.2 million shares outstanding can contribute to greater price volatility in the event of institutional buying or selling. It has a Timeliness Rating of A and Sponsorship Rating of B.

Thinly-Traded Bank Consolidating Above 50-Day Moving Average - Tuesday, May 18, 2021

F S Bancorp (FSBW -$1.03 or -1.47% to $69.09) was highlighted in yellow with pivot point cited based on its 3/08/21 high plus 10 cents in the earlier mid-day report (read here). It is consolidating above its 50-day moving average (DMA) line ($68.52) where it found prompt support during its ongoing ascent. Subsequent gains above the pivot point backed by at least +40% above average volume are needed to trigger a technical buy signal.

FSBW has an Earnings Per Share Rating of 97. It reported Mar '21 quarterly earnings +137% on +16% sales revenues versus the year ago period, its 4th consecutive strong quarterly comparison above the +25% minimum earnings guideline (C criteria), matching the fact-based investment system's winning models. Its annual earnings (A criteria) history has been great. This thinly traded Bank completed a new Public Offering on 9/08/17.

The number of top-rated funds owning its shares rose from 168 in Jun '20 to 184 in Mar '21, a reassuring sign concerning the I criteria. Its small supply of only 4.2 million shares outstanding can contribute to greater price volatility in the event of institutional buying or selling. It has a Timeliness Rating of A and Sponsorship Rating of B.