Positive Reversal After Slumping to New Lows - Wednesday, September 6, 2017

Near 50-Day Moving Average Line, Yet Not Far Off High - Monday, August 7, 2017

Medical Products Firm Perched Near All-Time High - Monday, June 26, 2017

Some Overhead Supply Remains For High Ranked Medical Firm - Wednesday, May 17, 2017

Perched Near Pivot Point After Eight Consecutive Gains - Thursday, July 07, 2011

Positive Reversal After Slumping to New Lows - Wednesday, September 6, 2017

Edwards Lifesciences Cp (EW +$0.36 or +0.32% to $112.23) managed a "positive reversal" after slumping to new 16-week lows today, closing with a gain backed by above average volume. It is only -7.8% off its all-time high, but its Relative Strength Rating has slumped to 70, below the 80+ minimum guideline for buy candidates. A rebound above its downward sloping 50 DMA line ($115.64) is needed for its outlook to improve. Fundamentals remain strong.

More damaging losses would raise greater concerns. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a new leg up.

Recently it reported Jun '17 quarterly earnings +42% on +11% sales revenues, continuing its strong earnings track record. Three of the past 4 quarterly comparisons had earnings above the +25% minimum guideline (C criteria) and its annual earnings growth (A criteria) is a good match with the fact-based investment system's fundamental guidelines.

It was last shown in this FSU section on 8/07/17 with an annotated graph under the headline, " Near 50-Day Moving Average Line, Yet Not Far Off High". It was highlighted in yellow in the 5/16/17 mid-day report with pivot point cited based on its high after a cup-with-handle base (read here).

The Medical - Products firm has seen the number of top-rated funds owning its shares rise from 1489 in Jun '16 to 1,514 in Jun '17, a slightly reassuring sign of institutional demand (I criteria). Its current Up/Down Volume Ratio of 0.9 is an unbiased indication its shares have been under slight distributional pressure over the past 50 days. It has a B Timeliness Rating and a B Sponsorship rating.

Near 50-Day Moving Average Line, Yet Not Far Off High - Monday, August 7, 2017

Edwards Lifesciences Cp (EW +$0.29 or +0.25%to $116.48) is still sputtering below its 50 DMA line ($116.92). Relative Strength Rating has slumped to 75, below the 80+ minimum guideline for buy candidates. More damaging losses would raise greater concerns. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a new leg up.

Recently it reported Jun '17 quarterly earnings +42% on +11% sales revenues, continuing its strong earnings track record. Three of the past 4 quarterly comparisons had earnings above the +25% minimum guideline (C criteria) and its annual earnings growth (A criteria) is a good match with the fact-based investment system's fundamental guidelines.

It was last shown in this FSU section on 6/26/17 with an annotated graph under the headline, "Medical Products Firm Perched Near All-Time High". It was highlighted in yellow in the 5/16/17 mid-day report with pivot point cited based on its high after a cup-with-handle base (read here).

The Medical - Products firm has seen the number of top-rated funds owning its shares rise from 1489 in Jun '16 to 1,516 in Jun '17, a slightly reassuring sign of institutional demand (I criteria). Its current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days. It has a B Timeliness Rating and a B Sponsorship rating.

Medical Products Firm Perched Near All-Time High - Monday, June 26, 2017

Edwards Lifesciences Cp (EW -$1.83 or -1.52% to $118.32) is perched within close striking distance of its all-time high. Additional confirming gains into new high territory with above average volume would be a reassuring sign that it may be capable of a sustained and meaningful advance in price. It was last shown in this FSU section on 5/17/17 with an annotated graph under the headline, "Some Overhead Supply Remains For High Ranked Medical Firm". It was highlighted in yellow in the 5/16/17 mid-day report with pivot point cited based on its high after a cup-with-handle base (read here).

EW reported earnings +32% on +27% sales revenues for the Mar '17 quarter. Three of the past 4 quarterly comparisons had earnings above the +25% minimum guideline (C criteria) and its annual earnings growth (A criteria) is a good match with the fact-based investment system's fundamental guidelines.

The Medical - Products firm has seen the number of top-rated funds owning its shares rise from 1489 in Jun '16 to 1,549 in Mar '17, a sign of institutional buying demand (I criteria). Its current Up/Down Volume Ratio of 2.7 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness Rating and a B Sponsorship rating.

Some Overhead Supply Remains For High Ranked Medical Firm - Wednesday, May 17, 2017

Edwards Lifesciences Cp (EW -$1.81 or -1.59% to $111.84) pulled back today with lighter than average volume. It was highlighted in yellow in the 5/16/17 mid-day report with pivot point cited based on its high after a cup-with-handle base (read here). A gain backed by +76% above average volume triggered a technical buy signal on Tuesday, but it ended near the bottom of its intra-day range, a sign that it was encountering some distributional pressure. Additional confirming gains with above average volume would be a reassuring sign. Meanwhile, it is -8.1% off its all-time high and still faces some resistance due to overhead supply up tho the $121 level.

EW reported earnings +32% on +27% sales revenues for the Mar '17 quarter. Three of the past 4 quarterly comparisons had earnings above the +25% minimum guideline (C criteria) and its annual earnings growth (A criteria) is a good match with the fact-based investment system's fundamental guidelines.

The Medical - Products firm has seen the number of top-rated funds owning its shares rise from 1496 in Jun '16 to 1,558 in Mar '17, a sign of institutional buying demand (I criteria). Its current Up/Down Volume Ratio of 2.3 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness Rating and a B Sponsorship rating.

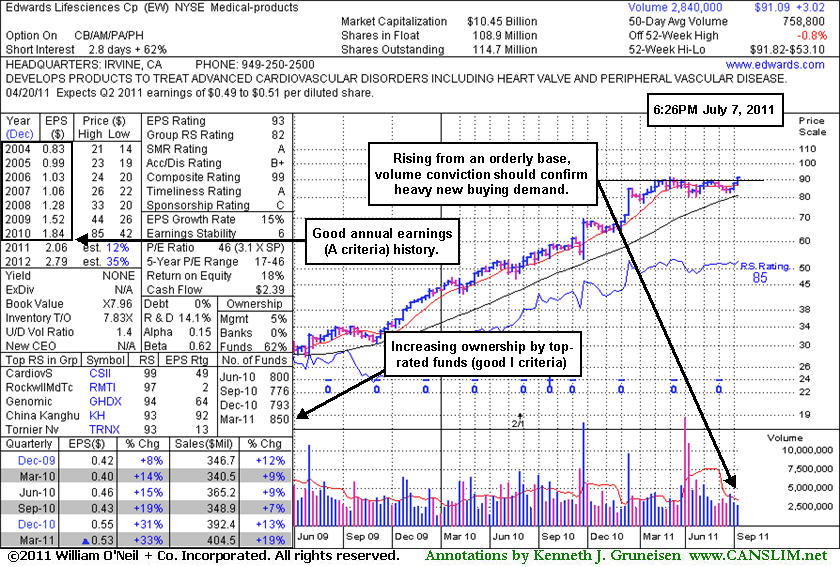

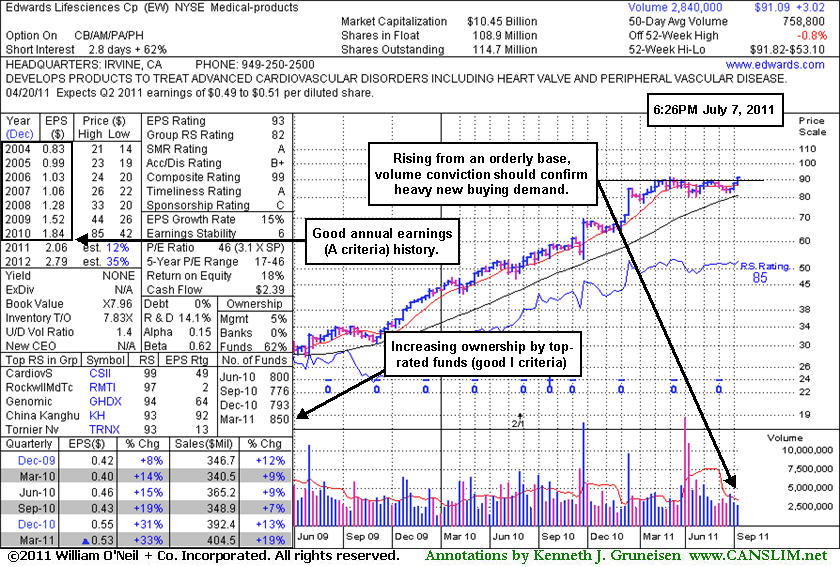

Perched Near Pivot Point After Eight Consecutive Gains - Thursday, July 07, 2011

Edwards Lifesciences Cp (EW +$0.24 or +0.26% to $91.09) is a Medical - Products firm challenging its 52-week and all-time highs while posting its 8th consecutive small gain today backed by +28% above average volume. It was featured in yellow in the 7/06/11 mid-day report (read here) with an annotated daily graph while wedging above its pivot point of $90.48 based on its 5/19/11 high plus 10 cents. Disciplined investors would note that a volume driven gain and strong close above its pivot point may trigger a technical buy signal, but it is still too early to say whether that critical proof of new heavy buying demand will show up and confirm a proper buy signal. Volume should be a minimum of +40-50% above average behind a breakout, ideally much heavier, such as several times an average daily volume total.

Recent quarterly comparisons showed accelerating sales revenues and earnings increases, and it has maintained a slow steady annual earnings (A criteria) history. The weekly graph below shows that the number of top-rated funds owning its shares rose from 793 in Dec '10 to 850 Mar '11, a sign of institutional buying demand (the I criteria).