You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - MONDAY, NOVEMBER 28TH, 2011

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+291.23 |

11,523.01 |

+2.59% |

|

Volume |

958,637,520 |

+117% |

|

Volume |

1,564,313,880 |

+127% |

|

NASDAQ |

+85.83 |

2,527.34 |

+3.52% |

|

Advancers |

2,563 |

81% |

|

Advancers |

2,128 |

80% |

|

S&P 500 |

+33.88 |

1,192.55 |

+2.92% |

|

Decliners |

533 |

17% |

|

Decliners |

453 |

17% |

|

Russell 2000 |

+31.74 |

697.90 |

+4.76% |

|

52 Wk Highs |

81 |

|

|

52 Wk Highs |

16 |

|

|

S&P 600 |

+17.37 |

388.68 |

+4.68% |

|

52 Wk Lows |

52 |

|

|

52 Wk Lows |

104 |

|

|

|

Major Averages Rally to Halt Losing Streak

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Dow Jones Industrial Average closed 291 points higher at 11,522. The S&P 500 Index snapped a seven-day losing streak, finishing up 33 points at 1,192. The Nasdaq Composite Index ended at 2,527, up 85 points. Advancers beat decliners by about 5-1 on the NYSE and on the Nasdaq. Volume totals expanded as expected on the NYSE and on the Nasdaq exchange following shortened Friday session. New 52-week highs outnumbered new 52-week lows on the NYSE while new lows still outnumbered new highs on the Nasdaq exchange. There were 10 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, up from the prior session total of 1 stock. There were gains for all 15 of the high-ranked companies currently included on the Featured Stocks Page.

Stocks rebounded from the worst Thanksgiving week since 1932. Stocks were helped by record "Black Friday" sales and as European leaders increased efforts to curb contagion. Over the weekend, retail sales increased +16.4% from a year ago with $52.4 billion in sales. Consumer discretionary stocks got a boost as Macy's (M +4.72%) and J.C. Penny Co Inc (JCP +1.62%), and Best Buy Co Inc (BBY +3.36%) rose. The holiday shopping season continued with Cyber Monday, which pushed Amazon.com Inc (AMZN +6.44%).

In Europe, German and French leaders drafted a framework to commit euro zone member states to greater fiscal discipline without waiting to change EU treaties. In addition, there were rumors that the IMF is preparing a 600-billion euro loan for Italy in case the sovereign-debt crisis worsens. Stocks held gains after some housing data. A Commerce Department report showed fewer new homes were purchased in October than forecast as sales increased +1.3% to a 307,000 annual pace.

Energy and raw-material producers led the rally as crude oil touched above $100 a barrel for the first time in more than a week.

Our monthly newsletter CANSLIM.net News will be published soon with an informative review of current market conditions, leading groups, and best buy candidates. Via the Premium Member Homepage links to all prior reports and webcasts are always available.

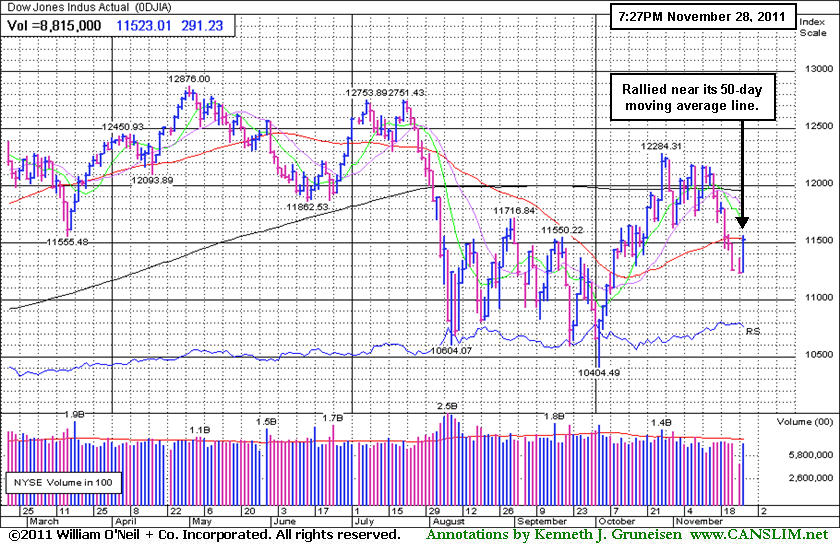

PICTURED: The Dow Jones Industrial Average rallied near its 50-day moving average line. The Nasdaq Composite and S&P 500 Index remain well below their respective 50 DMA lines. The S&P 600 Small Cap rallied above its 50 DMA line.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Gains Included Widespread Industry Participation

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Broker/Dealer Index ($XBD +3.83%) and Bank Index ($BKX +2.72%) ratcheted higher and the Retail Index ($RLX +3.10%) also provided a positive influence on the major averages on Monday. The tech sector saw unanimous gains from the Semiconductor Index ($SOX +3.21%), Biotechnology Index ($BTK +4.00%), Internet Index ($IIX +4.22%), Networking Index ($NWX +4.70%). Defensive groups including the Gold & Silver Index ($XAU +3.10%) and Healthcare Index ($HMO +4.41%) also rallied. Energy-related shares heated up with higher crude prices while the Oil Services Index ($OSX +3.71%) and Integrated Oil Index ($XOI +3.83%) surged higher.

Charts courtesy www.stockcharts.com

PICTURED: The Networking Index ($NWX +4.70%) posted a solid gain that halted a 7-day streak of losses toward the 2011 low.

| Oil Services |

$OSX |

217.10 |

+7.77 |

+3.71% |

-11.43% |

| Healthcare |

$HMO |

2,193.77 |

+92.58 |

+4.41% |

+29.66% |

| Integrated Oil |

$XOI |

1,157.02 |

+42.72 |

+3.83% |

-4.63% |

| Semiconductor |

$SOX |

355.17 |

+11.03 |

+3.21% |

-13.76% |

| Networking |

$NWX |

217.49 |

+9.77 |

+4.70% |

-22.48% |

| Internet |

$IIX |

278.30 |

+11.27 |

+4.22% |

-9.56% |

| Broker/Dealer |

$XBD |

79.31 |

+2.93 |

+3.83% |

-34.73% |

| Retail |

$RLX |

515.87 |

+15.50 |

+3.10% |

+1.47% |

| Gold & Silver |

$XAU |

193.40 |

+5.82 |

+3.10% |

-14.64% |

| Bank |

$BKX |

35.85 |

+0.95 |

+2.72% |

-31.33% |

| Biotech |

$BTK |

1,041.67 |

+40.07 |

+4.00% |

-19.72% |

|

|

|

|

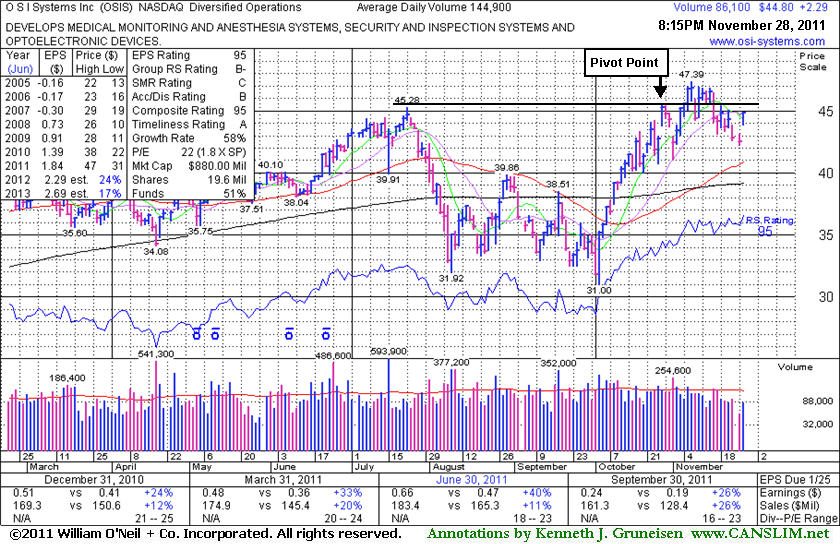

Gap Up Today has Leader Poised Near Pivot Previously Cited

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

O S I Systems Inc (OSIS +$2.29 or +5.39% to $44.80) gapped up today, rallying with higher (but still below average) volume back toward its previously cited pivot point. A new pivot point has not been cited however its color code was changed to yellow while consolidating well above its 50-day moving average (DMA) line. Subsequent volume-driven gains above its pivot point and recent chart highs may trigger a convincing technical buy signal.

There were no confirming gains backed by volume, and it has instead endured mild distributional pressure. Its last appearance in this FSU section was on 11/01/11 with an annotated daily graph under the headline, "Pullback My Be Handle Following Cup Shaped Base." It had gapped down, pulling back after wedging to a new 52-week high without great volume conviction.

It may be forming a longer and higher handle following the previously noted cup shaped base. It is normally considered ideal for volume to dry up during the period when a handle forms, and that is what it has done. Annual earnings (A criteria) growth has been strong and quarterly earnings increases have been above the +25% guideline satisfying the C criteria. Ownership by top-rated funds has not shown any great increases in the past 6 months. That may serve as a reminder for disciplined investors to watch for proof of fresh buying demand from the institutional crowd to confirm a proper technical buy signal. As always, limit losses if any stock ever falls more than -7% from the purchase price.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ADS

-

NYSE

Alliance Data Sys Corp

COMPUTER SOFTWARE and SERVICES - Information and Delivery Service

|

$96.40

|

+3.32

3.57% |

$96.90

|

839,213

88.35% of 50 DAV

50 DAV is 949,900

|

$107.18

-10.06%

|

10/21/2011

|

$97.94

|

PP = $101.15

|

|

MB = $106.21

|

Most Recent Note - 11/28/2011 8:40:34 PM

Most Recent Note - 11/28/2011 8:40:34 PM

G - Gapped up today for a solid gain on near average volume halting a streak of 9 consecutive losses. The next important chart support is at its 200 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/17/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ALXN

-

NASDAQ

Alexion Pharmaceuticals

DRUGS - Drug Manufacturers - Other

|

$67.47

|

+3.60

5.64% |

$67.53

|

951,832

62.57% of 50 DAV

50 DAV is 1,521,300

|

$70.42

-4.19%

|

9/15/2011

|

$63.20

|

PP = $60.81

|

|

MB = $63.85

|

Most Recent Note - 11/28/2011 7:59:09 PM

Most Recent Note - 11/28/2011 7:59:09 PM

Y - Rallied above its 50 DMA line today, helping its outlook, and its color code is changed to yellow again. Any subsequent violation of its recent low ($62.02 on 11/21/11) would raise more serious concerns and trigger a more worrisome technical sell signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/14/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CELG

-

NASDAQ

Celgene Corp

DRUGS - Drug Manufacturers - Major

|

$62.05

|

+1.81

3.00% |

$62.10

|

2,539,124

66.09% of 50 DAV

50 DAV is 3,841,700

|

$68.25

-9.08%

|

9/16/2011

|

$61.21

|

PP = $62.59

|

|

MB = $65.72

|

Most Recent Note - 11/28/2011 8:01:04 PM

Most Recent Note - 11/28/2011 8:01:04 PM

G - Finished near the session high today with a solid gain on near average volume helping it rally from a slump near its 200 DMA line. A rebound above its 50 DMA line is needed for its outlook to improve.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/7/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FEIC

-

NASDAQ

F E I Co

ELECTRONICS - Diversified Electronics

|

$37.81

|

+1.49

4.10% |

$38.03

|

175,062

40.07% of 50 DAV

50 DAV is 436,900

|

$42.25

-10.51%

|

10/28/2011

|

$40.31

|

PP = $40.88

|

|

MB = $42.92

|

Most Recent Note - 11/28/2011 8:04:30 PM

Most Recent Note - 11/28/2011 8:04:30 PM

G - Gain today on light volume halted a 7 session losing streak. It faces some resistance due to overhead supply up through the $42 area.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/25/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

GNC

-

NYSE

G N C Holdings Inc

RETAIL - Drug Stores

|

$27.59

|

+0.24

0.88% |

$28.50

|

1,001,468

77.98% of 50 DAV

50 DAV is 1,284,300

|

$27.99

-1.43%

|

10/26/2011

|

$24.60

|

PP = $24.80

|

|

MB = $26.04

|

Most Recent Note - 11/28/2011 8:06:50 PM

Most Recent Note - 11/28/2011 8:06:50 PM

G - Gain today on light volume for a new all-time high. Prior chart highs in the $25-26 area define initial support to watch on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/21/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

HMSY

-

NASDAQ

H M S Holdings Corp

COMPUTER SOFTWARE and SERVICES - Healthcare Information Service

|

$28.90

|

+1.08

3.88% |

$29.29

|

672,600

99.12% of 50 DAV

50 DAV is 678,600

|

$31.99

-9.66%

|

10/27/2011

|

$26.44

|

PP = $28.37

|

|

MB = $29.79

|

Most Recent Note - 11/28/2011 8:35:04 PM

Most Recent Note - 11/28/2011 8:35:04 PM

Y - Gapped up today for a solid gain on average volume, closing back above its previously cited pivot point helping its outlook improve. Prior highs in the $27-28 area acted as support during the recent pullback.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/4/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ISRG

-

NASDAQ

Intuitive Surgical Inc

HEALTH SERVICES - Medical Appliances and Equipment

|

$424.96

|

+11.70

2.83% |

$427.50

|

366,453

88.79% of 50 DAV

50 DAV is 412,700

|

$449.06

-5.37%

|

10/19/2011

|

$424.69

|

PP = $415.29

|

|

MB = $436.05

|

Most Recent Note - 11/28/2011 8:38:36 PM

Most Recent Note - 11/28/2011 8:38:36 PM

Y - Gapped up today for a solid gain on higher (near average) volume to halt a 7 session losing streak. Consolidating above its 50 DMA line and above the old high which was the basis for the last pivot point cited.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/15/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MG

-

NYSE

Mistras Group Inc

DIVERSIFIED SERVICES - Bulding and Faci;ity Management Services

|

$22.11

|

+1.38

6.66% |

$22.27

|

92,471

44.65% of 50 DAV

50 DAV is 207,100

|

$23.51

-5.95%

|

10/28/2011

|

$22.49

|

PP = $23.61

|

|

MB = $24.79

|

Most Recent Note - 11/28/2011 7:22:22 PM

Most Recent Note - 11/28/2011 7:22:22 PM

Y - Considerable gap up and gain today with below average volume. Its 50 DMA line and prior highs acted as important chart support near $21 during the recent consolidation. Subsequent violation of the recent low would raise concerns and trigger a technical sell signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/11/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MKTX

-

NASDAQ

Marketaxess Holdings Inc

FINANCIAL SERVICES - Investment Brokerage - Nationa

|

$27.88

|

+1.51

5.73% |

$27.94

|

152,417

62.96% of 50 DAV

50 DAV is 242,100

|

$31.45

-11.35%

|

10/28/2011

|

$29.79

|

PP = $31.05

|

|

MB = $32.60

|

Most Recent Note - 11/28/2011 7:46:21 PM

Most Recent Note - 11/28/2011 7:46:21 PM

G - A considerable gain today with below average volume helped it rebound above its 50 DMA line helping its technical stance improve. Prior lows and its 200 DMA line in the $24-25 area define important support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/23/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

OSIS

-

NASDAQ

O S I Systems Inc

ELECTRONICS - Semiconductor Equipment and Mate

|

$44.80

|

+2.29

5.39% |

$44.81

|

87,954

59.27% of 50 DAV

50 DAV is 148,400

|

$47.39

-5.47%

|

11/1/2011

|

$42.07

|

PP = $45.57

|

|

MB = $47.85

|

Most Recent Note - 11/28/2011 8:31:12 PM

Most Recent Note - 11/28/2011 8:31:12 PM

Y - Gapped up today, rallying with higher (but still below average) volume back toward its pivot point. Color code is changed to yellow while consolidating well above its 50 DMA line. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/28/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

RAX

-

NYSE

Rackspace Hosting Inc

INTERNET - Internet Software and; Services

|

$41.62

|

+2.35

5.98% |

$41.80

|

1,633,897

102.72% of 50 DAV

50 DAV is 1,590,600

|

$46.50

-10.48%

|

11/8/2011

|

$44.28

|

PP = $46.27

|

|

MB = $48.58

|

Most Recent Note - 11/28/2011 7:55:33 PM

Most Recent Note - 11/28/2011 7:55:33 PM

G - Solid gain today on average volume, rallying from support at its 50 and 200 DMA lines. Subsequent violations would trigger damaging technical sell signals, meanwhile it faces near-term resistance up through the $45 area.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/10/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SWI

-

NYSE

Solarwinds Inc

COMPUTER SOFTWARE and SERVICES - Application Software

|

$30.83

|

+0.77

2.56% |

$31.48

|

1,031,140

87.97% of 50 DAV

50 DAV is 1,172,200

|

$31.69

-2.71%

|

10/27/2011

|

$27.78

|

PP = $25.62

|

|

MB = $26.90

|

Most Recent Note - 11/28/2011 7:57:25 PM

Most Recent Note - 11/28/2011 7:57:25 PM

G - Small gap up today on near average volume. Recently holding its ground in a tight trading range near its all-time high. Prior highs in the $25-26 area define initial chart support to watch on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/22/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

TDG

-

NYSE

Transdigm Group Inc

AEROSPACE/DEFENSE - Aerospace/Defense Products and; Services

|

$92.98

|

+1.81

1.99% |

$94.07

|

470,657

113.96% of 50 DAV

50 DAV is 413,000

|

$102.73

-9.49%

|

11/9/2011

|

$98.45

|

PP = $95.14

|

|

MB = $99.90

|

Most Recent Note - 11/28/2011 8:42:14 PM

Most Recent Note - 11/28/2011 8:42:14 PM

Y - Posted a solid gain today with above average volume. On 11/17/11 it marked its top with a negative reversal for a loss on heavy volume. Its 50 DMA line defines near-term support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/9/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

UA

-

NYSE

Under Armour Inc Cl A

CONSUMER NON-DURABLES - Textile - Apparel Clothing

|

$79.61

|

+4.92

6.59% |

$79.70

|

1,012,887

76.25% of 50 DAV

50 DAV is 1,328,400

|

$87.40

-8.91%

|

10/25/2011

|

$82.43

|

PP = $80.80

|

|

MB = $84.84

|

Most Recent Note - 11/28/2011 7:49:16 PM

Most Recent Note - 11/28/2011 7:49:16 PM

G - Gain today with near average volume helped it rally above its 50 DMA line helping its technical stance improve. Its 200 DMA line defines the next important support level.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/3/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

V

-

NYSE

Visa Inc Cl A

DIVERSIFIED SERVICES - Business/Management Services

|

$93.47

|

+4.45

5.00% |

$93.75

|

3,698,281

69.71% of 50 DAV

50 DAV is 5,305,100

|

$95.87

-2.50%

|

10/24/2011

|

$94.21

|

PP = $94.85

|

|

MB = $99.59

|

Most Recent Note - 11/28/2011 7:53:33 PM

Most Recent Note - 11/28/2011 7:53:33 PM

Y - Gap up gain today with below average volume helped it rally above its 50 DMA line, improving its technical stance, and its color code its changed to yellow.

>>> The latest Featured Stock Update with an annotated graph appeared on 11/18/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|