You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, FEBRUARY 23RD, 2011

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-107.01 |

12,105.78 |

-0.88% |

|

Volume |

1,330,375,770 |

+1% |

|

Volume |

2,427,242,630 |

+10% |

|

NASDAQ |

-33.43 |

2,722.99 |

-1.21% |

|

Advancers |

1,054 |

33% |

|

Advancers |

638 |

23% |

|

S&P 500 |

-8.04 |

1,307.40 |

-0.61% |

|

Decliners |

1,988 |

63% |

|

Decliners |

2,014 |

73% |

|

Russell 2000 |

-13.31 |

799.65 |

-1.64% |

|

52 Wk Highs |

60 |

|

|

52 Wk Highs |

44 |

|

|

S&P 600 |

-8.52 |

422.01 |

-1.98% |

|

52 Wk Lows |

27 |

|

|

52 Wk Lows |

54 |

|

|

|

Major Averages Sink Again Amid More Distributional Pressure

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Dow Jones Industrial Average closed down 107 points at 12,105, marking the first back-to-back triple-digit losses for the Blue Chip index in eight months. Declining issues beat advancers 2-1 on the NYSE and by 3-1 on the Nasdaq. Higher volume totals were reported on both major US exchanges as stocks fell, a sign of more distributional pressure (institutional selling). New 52-week highs outnumbered new 52-week lows on the NYSE, but on the Nasdaq exchange new 52-week lows outnumbered new 52-week highs for the first time since November 23rd, 2010. There was a total of 18 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, down from a total of 26 on the prior session. On the Featured Stocks Page there were losses from 22 of the 23 high-ranked market leaders.

Oil prices on the New York Mercantile Exchange hit $100 per barrel, the first time back in triple digits since October 2, 2008. Wall Street seemed more concerned over the prospects of civil war in Libya than news in the US that existing home sales for January rose to an eight-month high while the median selling price dropped to the lowest level in nine years.

Energy stocks benefited from the higher prices while airlines' shares tumbled. Chevron Corp (CVX +2%) rose while United Continental Holdings (UAL -6.8%) dove in response to headwinds created by higher fuel costs. Hewlett-Packard (HPQ -9.6%) was responsible for 36 points of the Dow's decline and added to the negative bias in the tech sector as the bellwether computer firm projected that revenue will be lower than expected. DirecTV (DTV +1.8%) bucked the market's negative bias with a small gain after the company said it attracted more subscribers in the fourth quarter.

The damaging losses this week, coupled with waning leadership, put the latest rally for the major averages (M criteria) under pressure. Typically, 3 out of 4 stocks move in the same direction as the major averages. Investors should be mindful to protect hard-earned profits, limit losses, and stand ready to raise portfolio cash levels if more damaging losses occur. The Nasdaq Composite Index recently traded within -1% of its 2007 high. The S&P 600 Small Cap Index has recently traded less than -1% away from its all-time high. The Dow Jones Industrial Average (-12.7% at last week's close) and the S&P 500 Index (-14.8% at last week's close) remain further away from a complete recovery to new all-time highs.

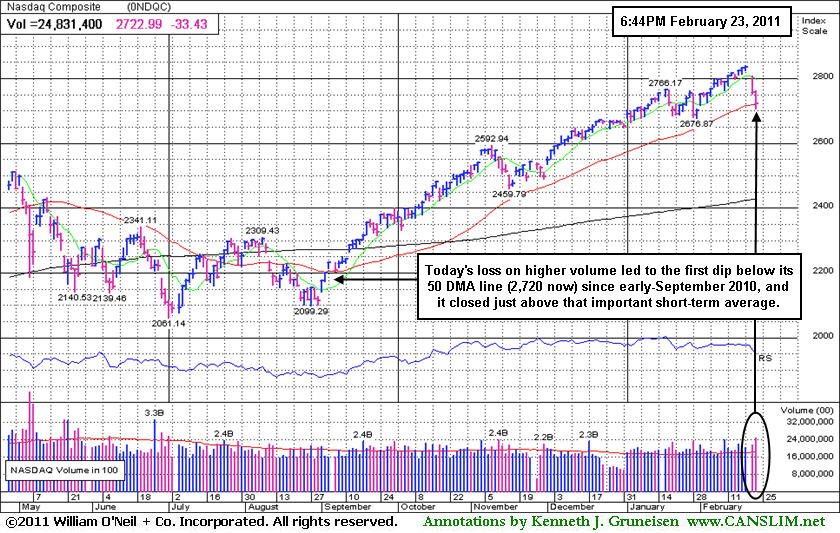

PICTURED: The Nasdaq Composite Index's loss on Wednesday with higher volume led to the first dip below its 50-day moving average (DMA) line (2,720 now) since early-September 2010, yet it closed just above that important short-term average with the help of a late-afternoon rebound.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Commodity-Linked Groups Posted Standout Gains

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The tech sector led Wednesday's declines as the Semiconductor Index ($SOX -1.89%), Internet Index ($IIX -1.81%), Networking Index ($NWX -1.75%), and Biotechnology Index ($BTK -0.79%) faced profit-taking pressure. Weakness in the Retail Index ($RLX -1.82%) and Healthcare Index ($HMO -1.75%) added to the major averages' negative bias. The Broker/Dealer Index ($XBD -0.98%) and Bank Index ($BKX -0.32%) also were also a negative influence as they each suffered small losses. Meanwhile, commodity-linked groups were standout winners as the Oil Services Index ($OSX +0.81%), Integrated Oil Index ($XOI +1.86%), and the Gold & Silver Index ($XAU +1.94%) posted solid gains.

Charts courtesy www.stockcharts.com

PICTURED: The Gold & Silver Index ($XAU +1.94%) closed above recent resistance at its 50-day moving average (DMA) line with a solid gain today.

| Oil Services |

$OSX |

282.74 |

+2.26 |

+0.81% |

+15.35% |

| Healthcare |

$HMO |

1,987.93 |

-35.39 |

-1.75% |

+17.49% |

| Integrated Oil |

$XOI |

1,352.88 |

+24.67 |

+1.86% |

+11.52% |

| Semiconductor |

$SOX |

444.27 |

-8.54 |

-1.89% |

+7.88% |

| Networking |

$NWX |

314.72 |

-5.62 |

-1.75% |

+12.18% |

| Internet |

$IIX |

315.62 |

-5.81 |

-1.81% |

+2.57% |

| Broker/Dealer |

$XBD |

124.08 |

-1.22 |

-0.98% |

+2.11% |

| Retail |

$RLX |

506.27 |

-9.40 |

-1.82% |

-0.42% |

| Gold & Silver |

$XAU |

213.30 |

+4.05 |

+1.94% |

-5.86% |

| Bank |

$BKX |

53.10 |

-0.17 |

-0.32% |

+1.70% |

| Biotech |

$BTK |

1,261.13 |

-10.00 |

-0.79% |

-2.81% |

|

|

|

|

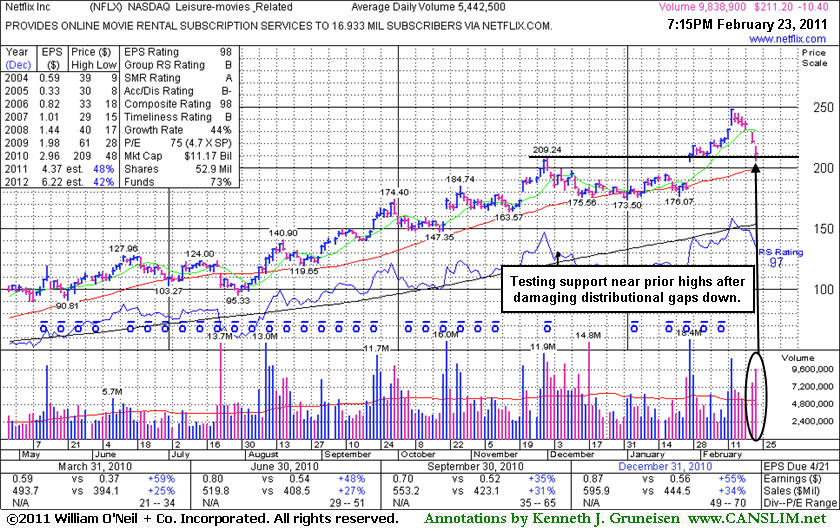

Damaging Losses Test An Old Chart Resistance Level

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Netflix Inc (NFLX -$10.40 or -4.69% to $211.20) gapped down for a second consecutive session, and its damaging loss on heavier volume today extended its losing streak to 6 consecutive trading days. It is -14.7% off its high and concerns have risen after damaging distributional pressure has impacted the stock and the broader market. NFLX is testing prior resistance near its old high ($209), a level that has previously been noted as defining support to watch above its 50-day moving average (DMA) line. Following its last appearance in this FSU section on 1/10/11 with detailed analysis and an annotated graph under the headline "Late Stage Breakout Faltered, But Leader Still Proving Resilient" it continued to find support near its 50-day moving average (DMA) line. Then it gapped up on 1/27/11 with very heavy volume (18.4 million shares) triggering a new technical buy signal. By 2/04/11 its color code was changed to green after it got extended from prior highs.

Even after its recent slump its Accumulation/Distribution Rating is a B- now, improved from a D+ at the time of its last FSU section appearance. Chart readers may expect to see it find support near its prior highs and above its 50 DMA line, but more damaging losses would hurt its outlook and may lead to a longer and deeper consolidation. Keep in mind that 3 out of 4 stocks tend to go in the direction of the major averages, so the broader market's action (M criteria) is likely to carry a lot of weight as to how this high-ranked leader fares in the near-term.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

BIDU

-

NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$115.90

|

-4.38

-3.64% |

$121.48

|

11,785,348

157.56% of 50 DAV

50 DAV is 7,480,100

|

$131.63

-11.95%

|

2/1/2011

|

$117.74

|

PP = $112.08

|

|

MB = $117.68

|

Most Recent Note - 2/23/2011 2:32:06 PM

Most Recent Note - 2/23/2011 2:32:06 PM

G - Down today amid widespread market weakness. Pulling back from last week's all-time high with higher than average volume behind a second consecutive damaging loss. Trading near prior highs in the $112-115 area previously noted as defining initial chart support to watch above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/2/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CMG

-

NYSE

Chipotle Mexican Grill

LEISURE - Restaurants

|

$244.19

|

-7.71

-3.06% |

$251.88

|

1,648,623

159.83% of 50 DAV

50 DAV is 1,031,500

|

$275.00

-11.20%

|

2/11/2011

|

$271.15

|

PP = $262.87

|

|

MB = $276.01

|

Most Recent Note - 2/23/2011 2:21:40 PM

Most Recent Note - 2/23/2011 2:21:40 PM

G - Down today on higher volume, its color code is changed to green as distributional pressure sends it more than -7% below its pivot point, raising concerns. Recent highs and its 50 DMA line in the $235-237 area define technical chart support levels to watch where more damaging losses would raise greater concerns. Recently reported strong earnings and technically rallied "straight up from the bottom" from an 11-week cup shaped base without a handle.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/11/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CRUS

-

NASDAQ

Cirrus Logic Inc

ELECTRONICS - Semiconductor - Specialized

|

$22.22

|

-1.12

-4.80% |

$23.30

|

5,321,792

162.71% of 50 DAV

50 DAV is 3,270,700

|

$25.48

-12.79%

|

1/28/2011

|

$20.69

|

PP = $19.17

|

|

MB = $20.13

|

Most Recent Note - 2/23/2011 1:38:56 PM

Most Recent Note - 2/23/2011 1:38:56 PM

G - Down considerably for a second consecutive session today with increasing volume indicating distributional pressure amid widespread market weakness. Subsequent deterioration below initial support at a significant prior high close ($20.54 on 7/26/10) would raise concerns. Additional support may be expected near its 50 DMA line and other more recent chart highs in the $19 area.

>>> The latest Featured Stock Update with an annotated graph appeared on 1/28/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CTSH

-

NASDAQ

Cognizant Tech Sol Cl A

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$73.91

|

-1.64

-2.17% |

$75.23

|

3,261,585

146.95% of 50 DAV

50 DAV is 2,219,500

|

$77.74

-4.93%

|

2/7/2011

|

$75.09

|

PP = $76.46

|

|

MB = $80.28

|

Most Recent Note - 2/23/2011 1:46:17 PM

Most Recent Note - 2/23/2011 1:46:17 PM

G - Weakness today has it slumping below its 50 DMA line, raising concerns. Color code is changed to green while deteriorating further below its pivot point amid widespread market weakness.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/8/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

DECK

-

NASDAQ

Deckers Outdoor Corp

CONSUMER NON-DURABLES - Textile - Apparel Footwear

|

$87.20

|

-1.80

-2.02% |

$90.45

|

2,574,699

166.76% of 50 DAV

50 DAV is 1,544,000

|

$92.69

-5.92%

|

2/3/2011

|

$79.61

|

PP = $82.67

|

|

MB = $86.80

|

Most Recent Note - 2/23/2011 2:15:09 PM

Most Recent Note - 2/23/2011 2:15:09 PM

Y - Down today amid widespread market weakness, pulling back from all-time high hit on the prior session. Technically, it managed a powerful positive reversal on 2/17/11 and clinched a late buy signal based on the previously noted "double bottom" base pattern. The recent consolidation was too short to be considered a proper "handle" on a cup-with-handle pattern, however one may also consider it to be rising from a 9-week flat base (no new pivot point is being cited). The stock is free of all resistance due to overhead supply.

>>> The latest Featured Stock Update with an annotated graph appeared on 1/26/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

EZCH

-

NASDAQ

Ezchip Semiconductor Ltd

ELECTRONICS - Semiconductor - Specialized

|

$28.86

|

+0.09

0.31% |

$29.32

|

504,973

132.26% of 50 DAV

50 DAV is 381,800

|

$33.48

-13.80%

|

12/2/2010

|

$27.53

|

PP = $26.00

|

|

MB = $27.30

|

Most Recent Note - 2/23/2011 5:28:33 PM

Most Recent Note - 2/23/2011 5:28:33 PM

G - Held its ground today after a gap down on 2/23/11 for a loss on higher volume, raising concerns while diving under its 50 DMA line amid widespread market weakness. A prompt rebound above its short-term average would help its outlook, meanwhile it faces overhead supply now up through the $33 area which may hinder its ability to rally.

>>> The latest Featured Stock Update with an annotated graph appeared on 1/21/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

EZPW

-

NASDAQ

Ezcorp Inc Cl A

SPECIALTY RETAIL - Specialty Retail, Other

|

$27.39

|

-0.46

-1.65% |

$28.04

|

549,387

141.74% of 50 DAV

50 DAV is 387,600

|

$29.94

-8.52%

|

2/18/2011

|

$27.94

|

PP = $30.04

|

|

MB = $31.54

|

Most Recent Note - 2/23/2011 3:12:07 PM

Most Recent Note - 2/23/2011 3:12:07 PM

Y - Slumping under its 50 DMA line today yet showing resilience to still stay within the tight trading range of recent weeks. Color code was changed to yellow with new pivot point cited based on its 1/17/11 high plus ten cents after a short flat base. Subsequent gains with heavy volume with a rally above its pivot point may trigger a new (or add-on) technical buy signal. Recent low ($25.56 on 1/25/11) defines an important support level now.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/3/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FOSL

-

NASDAQ

Fossil Inc

CONSUMER DURABLES - Recreational Goods, Other

|

$74.71

|

-2.86

-3.69% |

$77.65

|

1,021,204

131.60% of 50 DAV

50 DAV is 776,000

|

$83.68

-10.72%

|

2/1/2011

|

$73.30

|

PP = $74.44

|

|

MB = $78.16

|

Most Recent Note - 2/23/2011 2:37:54 PM

Most Recent Note - 2/23/2011 2:37:54 PM

G - Testing support today as a considerable loss without great volume conviction has it now trading near its 50 DMA line and prior resistance in the $74 area previously noted as defining initial chart support. Slumping after its gap down on 2/15/11 with heavy volume following 8 consecutive gains into new high territory.

>>> The latest Featured Stock Update with an annotated graph appeared on 1/12/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

GSIT

-

NASDAQ

G S I Technology Inc

ELECTRONICS - Semiconductor - Broad Line

|

$8.94

|

-0.33

-3.56% |

$9.44

|

390,311

159.64% of 50 DAV

50 DAV is 244,500

|

$10.20

-12.35%

|

2/18/2011

|

$10.08

|

PP = $10.25

|

|

MB = $10.76

|

Most Recent Note - 2/23/2011 2:41:51 PM

Most Recent Note - 2/23/2011 2:41:51 PM

G - Down again today with above average volume, raising serious concerns and trading near 4-week lows while testing support at its 50 DMA line. Gapped down on 2/22/11 amid widespread market weakness and its color code was changed to green after erasing the prior session's gain. Closed the 2/18/11 session in the middle of its intra-day range with a gain backed by more than 4 times average volume, and disciplined investors should note that it did not trigger a proper technical buy signal. See the latest FSU analysis for details and an annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/18/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

HMSY

-

NASDAQ

H M S Holdings Corp

COMPUTER SOFTWARE and SERVICES - Healthcare Information Service

|

$73.39

|

-3.22

-4.20% |

$75.89

|

418,830

266.60% of 50 DAV

50 DAV is 157,100

|

$77.43

-5.22%

|

11/19/2010

|

$61.89

|

PP = $63.01

|

|

MB = $66.16

|

Most Recent Note - 2/23/2011 12:16:05 PM

Most Recent Note - 2/23/2011 12:16:05 PM

G - Gapped down today, pulling back from its 52-week high hit on the prior session. After 15 consecutive gains with ever-increasing volume it is extended from any sound base pattern. Support to watch is defined by prior chart highs and its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/16/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

JOBS

-

NASDAQ

Fifty One Job Inc Ads

DIVERSIFIED SERVICES - Staffing and; Outsourcing Service

|

$56.04

|

-0.91

-1.60% |

$57.39

|

166,737

125.93% of 50 DAV

50 DAV is 132,400

|

$61.99

-9.60%

|

2/7/2011

|

$59.23

|

PP = $61.38

|

|

MB = $64.45

|

Most Recent Note - 2/23/2011 5:34:00 PM

Most Recent Note - 2/23/2011 5:34:00 PM

G - Down today for a second consecutive loss with slightly above average volume, testing support at its 50 DMA line amid widespread market weakness. Now -9.6% off its all-time high reached last week when gains lacked the volume conviction to produce a powerful breakout, its color code is changed to green. Its recent low ($52.58 on 1/28/11) defines another important support level where a violation would raise serious concerns and a trigger technical sell signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/7/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

LULU

-

NASDAQ

Lululemon Athletica

MANUFACTURING - Textile Manufacturing

|

$77.27

|

-1.85

-2.34% |

$78.89

|

3,045,138

143.98% of 50 DAV

50 DAV is 2,115,000

|

$85.28

-9.39%

|

1/26/2011

|

$68.11

|

PP = $74.70

|

|

MB = $78.44

|

Most Recent Note - 2/23/2011 2:25:06 PM

Most Recent Note - 2/23/2011 2:25:06 PM

Y - Color code is changed to yellow while pulling back below its "max buy" level with a loss today on higher volume amid widespread market weakness. Prior highs near $74 define chart support to watch now along with its 50 DMA line, where subsequent violations would trigger technical sell signals.

>>> The latest Featured Stock Update with an annotated graph appeared on 1/14/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MWIV

-

NASDAQ

M W I Veterinary Supply

HEALTH SERVICES - Medical Instruments and; Supplies

|

$66.01

|

-1.23

-1.83% |

$67.79

|

119,621

173.87% of 50 DAV

50 DAV is 68,800

|

$72.27

-8.66%

|

11/4/2010

|

$61.79

|

PP = $59.60

|

|

MB = $62.58

|

Most Recent Note - 2/23/2011 3:16:48 PM

Most Recent Note - 2/23/2011 3:16:48 PM

G - Down today for its 3rd loss with above average volume in 4 sessions since reaching its all-time high. It has not built a sound new base pattern. Prior highs in the $67 area define initial chart support to watch. Sales revenues acceleration (bigger percentage increases sequentially, +34%, +41%, +45% and +55% in the Mar, Jun, Sep, and Dec '10 quarterly comparisons versus the year earlier) is a very reassuring sign.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/2/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

NFLX

-

NASDAQ

Netflix Inc

SPECIALTY RETAIL - Music and Video Stores

|

$211.20

|

-10.40

-4.69% |

$217.90

|

9,845,289

180.90% of 50 DAV

50 DAV is 5,442,500

|

$247.55

-14.68%

|

1/10/2011

|

$187.88

|

PP = $209.34

|

|

MB = $219.81

|

Most Recent Note - 2/23/2011 2:47:50 PM

Most Recent Note - 2/23/2011 2:47:50 PM

G - Gapped down for a second consecutive session, its damaging loss extends it losing streak to 6 consecutive trading days. It is -14.3% off its high and enduring distributional pressure amid widespread market weakness, now testing prior resistance near its old high ($209) previously noted as defining support to watch above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 1/10/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

NTAP

-

NASDAQ

Netapp Inc

COMPUTER HARDWARE - Data Storage Devices

|

$50.64

|

-1.20

-2.31% |

$51.52

|

10,522,703

204.77% of 50 DAV

50 DAV is 5,138,900

|

$61.02

-17.01%

|

1/6/2011

|

$57.49

|

PP = $58.06

|

|

MB = $60.96

|

Most Recent Note - 2/23/2011 5:22:24 PM

Most Recent Note - 2/23/2011 5:22:24 PM

Down today for a 4th consecutive loss with above average volume, finishing -17% off its 52-week high. Damaging losses were recently noted as it triggered technical sell signals and it will be dropped from the Featured Stocks list tonight. An earlier low (on 11/1710) and its 200 DMA line define the next chart support levels to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/4/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

OPEN

-

NASDAQ

Opentable Inc

INTERNET - Internet Software and Services

|

$84.11

|

-2.09

-2.42% |

$86.20

|

1,411,816

147.90% of 50 DAV

50 DAV is 954,600

|

$95.97

-12.36%

|

1/5/2011

|

$74.05

|

PP = $76.79

|

|

MB = $80.63

|

Most Recent Note - 2/23/2011 5:24:41 PM

Most Recent Note - 2/23/2011 5:24:41 PM

G - Down today with 3rd consecutive damaging loss on above average volume amid widespread market weakness. Prior highs near $82 define support to watch above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/15/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ORCL

-

NASDAQ

Oracle Corp

COMPUTER SOFTWARE and SERVICES - Application Software

|

$32.18

|

-0.35

-1.08% |

$32.66

|

22,149,126

84.83% of 50 DAV

50 DAV is 26,111,400

|

$33.71

-4.54%

|

1/20/2011

|

$32.31

|

PP = $32.37

|

|

MB = $33.99

|

Most Recent Note - 2/23/2011 4:36:48 PM

Most Recent Note - 2/23/2011 4:36:48 PM

Y - Down today on below average volume, testing support at its 50 DMA line and closing the session slightly below its pivot point. It finished just -4.5% off last week's new 52-week high and volume totals in recent weeks have been light.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/22/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PAY

-

NYSE

Verifone Systems Inc

COMPUTER HARDWARE - Transaction Automation Systems

|

$44.04

|

-1.00

-2.22% |

$45.83

|

2,580,454

174.11% of 50 DAV

50 DAV is 1,482,100

|

$49.91

-11.76%

|

1/27/2011

|

$41.77

|

PP = $44.97

|

|

MB = $47.22

|

Most Recent Note - 2/23/2011 4:42:53 PM

Most Recent Note - 2/23/2011 4:42:53 PM

Y - Down again today with above average volume for 3rd consecutive loss, slumping below its pivot point and raising concerns while closing below its old high close ($44.26 on 1/13/11) completely negating the 2/14/11 technical buy signal. Support to watch is its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 1/27/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PCLN

-

NASDAQ

Priceline.Com Inc

INTERNET - Internet Software and Services

|

$425.99

|

-7.79

-1.80% |

$438.88

|

2,550,994

269.18% of 50 DAV

50 DAV is 947,700

|

$464.47

-8.28%

|

1/3/2011

|

$399.55

|

PP = $428.20

|

|

MB = $449.61

|

Most Recent Note - 2/23/2011 4:56:19 PM

Most Recent Note - 2/23/2011 4:56:19 PM

Y - Down today with above average volume, raising concerns while closing in the middle of its intra-day range but below its 50 DMA line. Amid widespread market weakness it also slumped under its pivot point with its 4th consecutive loss on ever-increasing volume. More serious concerns and technical sell signals would be triggered by subsequent damaging losses below today's low ($116.00) coinciding with its 1/20/11 chart low.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/14/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

RAX

-

NYSE

Rackspace Hosting Inc

INTERNET - Internet Software and; Services

|

$35.87

|

-1.00

-2.71% |

$37.06

|

2,442,125

130.16% of 50 DAV

50 DAV is 1,876,200

|

$40.62

-11.69%

|

1/10/2011

|

$22.84

|

PP = $32.76

|

|

MB = $34.40

|

Most Recent Note - 2/23/2011 5:00:27 PM

Most Recent Note - 2/23/2011 5:00:27 PM

G - Down today with above average volume, finishing -11.7% off its all-time high. Amid widespread market weakness it has slumped back to prior highs near $35 previously noted as defining support to watch above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/9/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

TIBX

-

NASDAQ

Tibco Software Inc

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$23.29

|

-0.89

-3.68% |

$24.18

|

3,166,350

115.60% of 50 DAV

50 DAV is 2,739,100

|

$25.94

-10.22%

|

2/1/2011

|

$24.35

|

PP = $22.18

|

|

MB = $23.29

|

Most Recent Note - 2/23/2011 4:24:36 PM

Most Recent Note - 2/23/2011 4:24:36 PM

G - Down on average volume today following a gap down on the prior session amid widespread market weakness, pulling back on higher volume after recently wedging up to new 52-week highs with gains on lighter volume. Prior highs in the $22 area define support along with its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/10/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

UA

-

NYSE

Under Armour Inc Cl A

CONSUMER NON-DURABLES - Textile - Apparel Clothing

|

$64.25

|

-1.90

-2.87% |

$66.46

|

1,009,265

128.52% of 50 DAV

50 DAV is 785,300

|

$70.43

-8.77%

|

1/27/2011

|

$58.31

|

PP = $56.99

|

|

MB = $59.84

|

Most Recent Note - 2/23/2011 2:27:17 PM

Most Recent Note - 2/23/2011 2:27:17 PM

G - Down today without great volume conviction, slumping -8.1% off its 52-week high now. Following a recent spurt of gains with above average volume, prior resistance in the $60 area defines initial support to watch above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/1/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$41.03

|

-1.52

-3.57% |

$43.24

|

757,422

141.10% of 50 DAV

50 DAV is 536,800

|

$44.06

-6.88%

|

1/6/2011

|

$36.12

|

PP = $37.34

|

|

MB = $39.21

|

Most Recent Note - 2/23/2011 2:29:16 PM

Most Recent Note - 2/23/2011 2:29:16 PM

G - Pulling back from all-time highs without great volume conviction today. It has repeatedly been noted - "Extended from a sound base pattern, and prior highs in the $37-38 area define chart support to watch above its 50 DMA line."

>>> The latest Featured Stock Update with an annotated graph appeared on 2/17/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|