You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Tuesday, February 18, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - MONDAY, DECEMBER 24TH, 2018

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-653.17 |

21,792.20 |

-2.91% |

|

Volume |

657,558,610 |

-80% |

|

Volume |

1,626,521,810 |

-64% |

|

NASDAQ |

-140.07 |

6,192.92 |

-2.21% |

|

Advancers |

630 |

21% |

|

Advancers |

831 |

27% |

|

S&P 500 |

-65.52 |

2,351.10 |

-2.71% |

|

Decliners |

2,354 |

79% |

|

Decliners |

2,247 |

73% |

|

Russell 2000 |

-25.16 |

1,266.92 |

-1.95% |

|

52 Wk Highs |

2 |

|

|

52 Wk Highs |

8 |

|

|

S&P 600 |

-15.75 |

793.86 |

-1.95% |

|

52 Wk Lows |

1,256 |

|

|

52 Wk Lows |

1,108 |

|

|

|

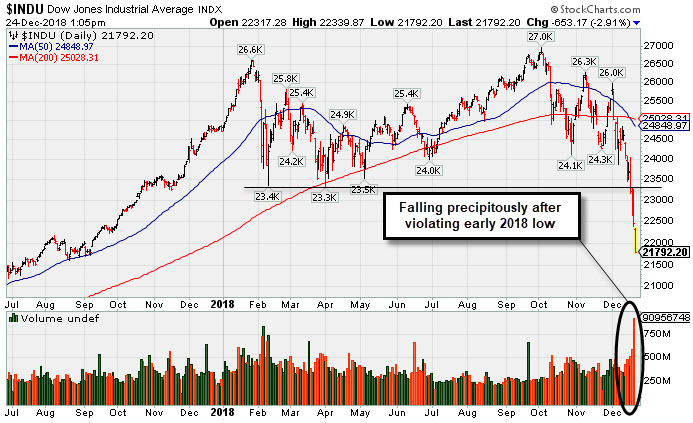

Major Averages Continue Their Steep Descent

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Stocks finished firmly lower Monday. The Dow tumbled 653 points to 21,792, notching its worst Christmas Eve performance on record. The S&P 500 lost 65 points to 2,351, putting the index within 0.3% of bear market territory. The Nasdaq Composite slid 140 points to 6,192. The volume totals on the holiday-shortened session were lighter than the prior session totals on the NYSE and on the Nasdaq exchange. Decliners led advancers by almost a 4-1 margin on the NYSE and near a 3-1 margin on the Nasdaq exchange. Leadership has evaporated completely as three days in a row there have been zero high-ranked companies from the Leaders List that made a new 52-week high and were listed on the BreakOuts Page. New 52-week lows totals solidly outnumbered new 52-week highs totals which were in the single digits on both the NYSE and on the Nasdaq exchange. As noted in prior commentaries, the major indices (M criteria) are in a correction. Disciplined investors reduce exposure to protect capital in bad markets and wait for a new rally and solid follow-through day to eventually shift the market direction (M criteria) back to a bullish stance. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The Dow Jones Industrial Average has fallen precipitously after violating the early 2018 low. It has slumped -19.14% off its record high hit 10/03/18, quickly approaching the "Bear Market" threshold.

The major averages declined for a fourth consecutive session amid political uncertainty. Comments from President Trump attributing the recent market downturn to the Federal Reserve, prompted renewed concern surrounding reports over the weekend the President may be looking to replace Fed Chair Jerome Powell. The government shutdown, which started Friday evening, also weighed on investor sentiment as the Trump administration warned it could last into January. On the data front, the lone economic report from the Chicago Fed showed national economic activity eased slightly in November compared to October.

All 11 S&P 500 sectors ended the session down more than 2.0%. Energy was a notable decliner as WTI crude lost 3.3% to $44.07/barrel. In corporate news, Financials remained under pressure despite comments from Treasury Secretary Steven Mnuchin that top executives at the six largest U.S. banks confirmed of ample liquidity for regular market operations. Meanwhile, Tesla sank 7.6% to $295.39 after cutting the price of its Model 3 in China.

Perceived “safe-haven” assets rallied with Treasuries strengthening with the yield on the 10-year note down four basis points to 2.75%. COMEX gold hit a 6-month high, gaining 1.1% to $1,267.50/ounce amid a weaker dollar. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Retail, Financial, Tech, and Energy Groups Fell

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX -1.66%), Broker/Dealer Index ($XBD -1.08%), and the Bank Index ($BKX -2.11%) created a drag on the major indices. The tech sector had a negative bias as the Semiconductor Index ($SOX -2.90%), Biotech Index ($BTK -1.30%) and Networking Index ($NWX -2.25%) ended unanimously lower. Energy-linked groups had a negative bias as the Oil Services Index ($OSX -2.35%), Integrated Oil Index ($XOI -4.17%), meanwhile the Gold & Silver Index ($XAU +2.74%) was a standout gainer.

Charts courtesy of www.stockcharts.com

PICTURED: The Networking Index ($NWX -2.25%) has slumped severely after violating the October low.

| Oil Services |

$OSX |

75.70 |

-1.82 |

-2.35% |

-49.38% |

| Integrated Oil |

$XOI |

1,084.70 |

-47.32 |

-4.18% |

-18.78% |

| Semiconductor |

$SOX |

1,069.39 |

-31.90 |

-2.90% |

-14.66% |

| Networking |

$NWX |

452.37 |

-10.43 |

-2.25% |

-7.78% |

| Broker/Dealer |

$XBD |

224.20 |

-2.47 |

-1.09% |

-15.47% |

| Retail |

$RLX |

1,785.71 |

-30.09 |

-1.66% |

+3.00% |

| Gold & Silver |

$XAU |

70.55 |

+1.88 |

+2.74% |

-17.26% |

| Bank |

$BKX |

80.78 |

-1.74 |

-2.11% |

-24.30% |

| Biotech |

$BTK |

3,890.37 |

-50.59 |

-1.28% |

-7.86% |

|

|

|

|

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

MLR

-

NYSE

Miller Industries Inc

AUTOMOTIVE - Auto Parts

|

$26.01

|

-0.49

-1.85% |

$26.51

|

16,202

46.29% of 50 DAV

50 DAV is 35,000

|

$29.40

-11.53%

|

11/30/2018

|

$28.35

|

PP = $29.50

|

|

MB = $30.98

|

Most Recent Note - 12/21/2018 12:50:33 PM

G - Sputtering near its closely coinciding 50-day and 200-day moving average (DMA) lines. Resistance remains due to overhead supply up to the $29 level. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Failed to Produce Buy Signal and Deterioration Raised Concern - 12/20/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CME

-

NASDAQ

C M E Group Inc

DIVERSIFIED SERVICES - Business/Management Services

|

$176.62

|

-6.03

-3.30% |

$183.00

|

1,172,261

49.74% of 50 DAV

50 DAV is 2,357,000

|

$197.08

-10.38%

|

10/4/2018

|

$179.29

|

PP = $177.45

|

|

MB = $186.32

|

Most Recent Note - 12/24/2018 1:39:48 PM

Most Recent Note - 12/24/2018 1:39:48 PM

Slumped badly today. It will be dropped from the Featured Stocks list tonight. A volume-driven loss on the prior session violated its 50 DMA line and recent low ($183.43 on 12/06/18) triggering technical sell signals. Recently reported earnings +22% on +2% sales revenues for the Sep '18 quarter, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns.

>>> FEATURED STOCK ARTICLE : Consolidating Above 50-Day Moving Average - 12/12/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

UBNT

-

NASDAQ

Ubiquiti Networks

TELECOMMUNICATIONS - Diversified Communication Serv

|

$93.01

|

-1.73

-1.83% |

$95.44

|

235,856

48.93% of 50 DAV

50 DAV is 482,000

|

$115.44

-19.43%

|

11/9/2018

|

$108.20

|

PP = $101.43

|

|

MB = $106.50

|

Most Recent Note - 12/21/2018 5:27:03 PM

G - Slumped further below its 50 DMA line ($100.08) with today's 7th consecutive loss. A rebound above the 50 DMA line is needed for its outlook to improve.

>>> FEATURED STOCK ARTICLE : Volume Totals Cooling While Still Hovering Above "Max Buy" Level - 12/11/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PLNT

-

NYSE

Planet Fitness Inc Cl A

Leisure-Services

|

$49.05

|

-1.59

-3.14% |

$50.42

|

1,344,178

111.55% of 50 DAV

50 DAV is 1,205,000

|

$58.50

-16.15%

|

11/7/2018

|

$57.10

|

PP = $55.45

|

|

MB = $58.22

|

Most Recent Note - 12/24/2018 11:18:59 AM

Most Recent Note - 12/24/2018 11:18:59 AM

G - Slumped further below its 50 DMA line ($51.52) with today's early loss testing the recent low ($48.02 on 11/20/18). Its 200 DMA line ($46.56) defines the next important support where more damaging losses would raise concerns and trigger technical sell signals.

>>> FEATURED STOCK ARTICLE : Fitness Firm Remains Near High Despite Unhealthy Environment - 12/14/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

INVA

-

NASDAQ

Innoviva Inc

Medical-Biomed/Biotech

|

$15.89

|

-0.11

-0.69% |

$16.14

|

288,384

24.61% of 50 DAV

50 DAV is 1,172,000

|

$18.60

-14.57%

|

11/23/2018

|

$17.74

|

PP = $18.09

|

|

MB = $18.99

|

Most Recent Note - 12/21/2018 5:05:46 PM

G - Color code is changed to green after slumping below its 50 DMA line ($16.31) during a streak of 7 consecutive losses. A rebound above the 50 DMA line is needed for its outlook to improve.

>>> FEATURED STOCK ARTICLE : Perched Near High With Volume Totals Cooling - 12/13/2018 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|