You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Thursday, April 17, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - THURSDAY, DECEMBER 8TH, 2016

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+65.19 |

19,614.81 |

+0.33% |

|

Volume |

962,569,870 |

-6% |

|

Volume |

2,062,673,080 |

+7% |

|

NASDAQ |

+23.60 |

5,417.36 |

+0.44% |

|

Advancers |

1,869 |

63% |

|

Advancers |

2,164 |

68% |

|

S&P 500 |

+4.84 |

2,246.19 |

+0.22% |

|

Decliners |

1,119 |

37% |

|

Decliners |

1,002 |

32% |

|

Russell 2000 |

+21.86 |

1,386.37 |

+1.60% |

|

52 Wk Highs |

490 |

|

|

52 Wk Highs |

561 |

|

|

S&P 600 |

+13.85 |

855.36 |

+1.65% |

|

52 Wk Lows |

19 |

|

|

52 Wk Lows |

27 |

|

|

|

Major Averages Rally With Expanding Leaderrship

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Stocks finished higher on Thursday. The Dow was up 65 points to 19614. The S&P 500 added 4 points to 2246 and the Nasdaq Composite gained 23 points to 5417. Volume totals were mixed, lighter than the prior session total on the NYSE and higher on the Nasdaq exchange. Breadth was positive as advancers led decliners by more than a 3-2 margin on the NYSE and more than 2-1 on the Nasdaq exchange. There were 196 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, versus 135 on the prior session. New 52-week highs expanded and solidly outnumbered new 52-week lows on both the NYSE and the Nasdaq exchange.

PICTURED: The Nasdaq Composite Index has rallied with increasing volume for a new record high.

The major averages (M criteria) are in a confirmed uptrend. New buying efforts should only be made in candidates with superior fundamental and technical characteristics. The Featured Stocks Page lists noteworthy high-ranked leaders.

The major averages advanced on Thursday, notching fresh record highs, following a key monetary policy announcement from the European Central Bank. The ECB will extend its monthly bond-buying program until December 2017, reducing asset-purchases from $86 billion to $64.6 billion a month. In a press conference, ECB President Mario Draghi stated there’s no question of tapering off the stimulus program and reiterated the $64.6 billion could be increased if necessary. On the domestic front, initial jobless claims came in at 258,000, above the expected 255,000.

Eight of 11 sectors in the S&P 500 finished positive on the session. Financials caught a boost after the ECB decision with Bank of America (BAC +1.68%). Technology shares outperformed with Juniper Networks (JNPR +3.28%) rising. In the consumer space, Lululemon (LULU +15%) as the yoga-wear maker reported better-than-expected quarterly profit. Shares of Costco (COST +2.43%) after same-store sales rose 1% in the quarter. Express Scripts (ESRX -6.72%) was a notable decliner falling 6.7% to $70.75 amid negative analyst commentary.

Treasuries declined with the benchmark 10-year note down 16/32 to yield 2.39%. In commodities, NYMEX WTI crude added 2.2% to $50.85/barrel. In FOREX, the Dollar Index advanced 0.9%. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial and Tech Groups Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

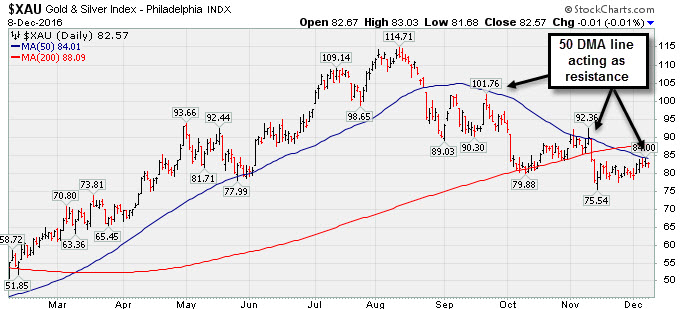

The Bank Index ($BKX +1.28%) and Broker/Dealer Index ($XBD +1.44%) each posted solid gains, further boosting the major averages on Thursday. The tech sector had a positive bias as the Semiconductor Index ($SOX +0.82%), Networking Index ($NWX +2.35%), and the Biotechnology Index ($BTK +0.88%) rose. The Retail Index ($RLX -0.14%) ended slightly lower. The Oil Services Index ($OSX +2.44%) outpaced the Integrated Oil Index ($XOI +0.57%) while the Gold & Silver Index ($XAU -0.01%) was unchanged. Charts courtesy www.stockcharts.com

PICTURED: The Gold & Silver Index ($XAU -0.01%) has been meeting resistance at its 50-day moving average (DMA) line during its multi-month descent.

| Oil Services |

$OSX |

187.93 |

+4.48 |

+2.44% |

+19.15% |

| Integrated Oil |

$XOI |

1,260.43 |

+7.18 |

+0.57% |

+17.50% |

| Semiconductor |

$SOX |

895.70 |

+7.25 |

+0.82% |

+35.00% |

| Networking |

$NWX |

454.17 |

+10.45 |

+2.35% |

+20.81% |

| Broker/Dealer |

$XBD |

212.74 |

+3.02 |

+1.44% |

+19.46% |

| Retail |

$RLX |

1,394.79 |

-1.96 |

-0.14% |

+8.67% |

| Gold & Silver |

$XAU |

82.57 |

+0.00 |

+0.00% |

+82.27% |

| Bank |

$BKX |

92.96 |

+1.17 |

+1.27% |

+27.20% |

| Biotech |

$BTK |

3,139.56 |

+27.36 |

+0.88% |

-17.68% |

|

|

|

|

Challenging its High With Big Volume-Driven Gain

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Lumentum Holdings Inc (LITE +$3.90 or +9.85% $43.50) was highlighted in yellow with pivot point cited based on its 10/07/16 high plus 10 cents in the earlier mid-day report (read here). Little resistance remains while rebounding toward prior highs after a choppy consolidation above and below its 50-day moving average (DMA) line. Subsequent gains with at least +40% above average volume for new highs are needed to trigger a proper technical buy signal.

This high-ranked leader from the Telecom - Fiber Optics group was previously noted in the 10/28/16 mid-day report - "Reported Sep '16 earnings +96% on +21% sales revenues helping its quarterly sales and earnings history better match with the fact-based investment system's fundamental guidelines." Its annual earnings (A criteria) history has been strong, helping it earn the highest possible Earnings Per Share (EPS) rank of 99, well above the +80 minimum guideline.

The number of top-rated funds owning its shares rose from 266 in Dec '15 to 374 in Sep '16, a reassuring sign concerning the I criteria. It has a Timeliness Rating of A and a Sponsorship Rating of C.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

CSFL

-

NASDAQ

Centerstate Banks Inc

Banks-Southeast

|

$25.25

|

+0.46

1.86% |

$25.48

|

446,685

175.86% of 50 DAV

50 DAV is 254,000

|

$24.88

1.49%

|

10/10/2016

|

$18.20

|

PP = $18.37

|

|

MB = $19.29

|

Most Recent Note - 12/7/2016 12:10:07 PM

G - Powering to new all-time highs with a streak of volume-driven gains, getting very extended from any sound base. Its 50 DMA line and prior highs define near-term support in the $19 area.

>>> FEATURED STOCK ARTICLE : Very Extended From Base Following Additional Gains on Volume - 12/2/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

IESC

-

NASDAQ

I E S Holdings Inc

Bldg-Maintenance and Svc

|

$20.70

|

-0.45

-2.13% |

$21.40

|

76,376

85.82% of 50 DAV

50 DAV is 89,000

|

$21.30

-2.82%

|

11/23/2016

|

$19.35

|

PP = $18.26

|

|

MB = $19.17

|

Most Recent Note - 12/7/2016 4:29:03 PM

G - Hit another new high with today's big gain backed by light volume, getting more extended from its prior base. Prior highs in the $18 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Strength Returned for Previously Featured Leader - 11/23/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

BERY

-

NYSE

Berry Plastics Group Inc

CONSUMER NON-DURABLES - Packaging and Containers

|

$50.25

|

+0.44

0.88% |

$50.52

|

1,547,987

95.03% of 50 DAV

50 DAV is 1,629,000

|

$50.88

-1.24%

|

11/30/2016

|

$50.26

|

PP = $46.47

|

|

MB = $48.79

|

Most Recent Note - 12/6/2016 5:30:45 PM

G - Posted a gain with below above average volume, closing above its "max buy" level and its color code is changed to green. There was a "breakaway gap" on 11/29/16, powering to new 52-week highs with considerable volume-driven gains. Prior highs in the $46 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Pulling Back After "Breakaway Gap" With Heavy Volume - 12/1/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

EVR

-

NYSE

Evercore Partners Inc

FINANCIAL SERVICES - Investment Banking

|

$71.50

|

+0.80

1.13% |

$71.97

|

324,544

72.60% of 50 DAV

50 DAV is 447,000

|

$71.25

0.35%

|

11/14/2016

|

$63.30

|

PP = $60.73

|

|

MB = $63.77

|

Most Recent Note - 12/5/2016 5:21:37 PM

G - Powered further into new all-time high territory with today's gain backed by +57% above average volume. It is very extended from its prior base. Disciplined investors avoid chasing extended stocks. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Hit Another New High Today With Volume-Driven Gain - 12/5/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NTES

-

NASDAQ

Netease Inc Adr

INTERNET - Internet Information Providers

|

$225.21

|

+2.05

0.92% |

$227.39

|

926,756

79.89% of 50 DAV

50 DAV is 1,160,000

|

$272.58

-17.38%

|

6/29/2016

|

$182.42

|

PP = $186.55

|

|

MB = $195.88

|

Most Recent Note - 12/6/2016 5:21:56 PM

G - Halted its slide with recent gains lacking great volume conviction. The longer it lingers below its downward sloping 50 DMA line the worse its outlook gets. A rebound above the 50 DMA line ($245) is needed to help its outlook improve. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Concerns Remain While Lingering Below 50-Day Moving Average - 12/6/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

HTHT

-

NASDAQ

China Lodging Group Ads

LEISURE - Lodging

|

$52.01

|

+0.28

0.54% |

$52.10

|

134,343

83.96% of 50 DAV

50 DAV is 160,000

|

$53.88

-3.46%

|

9/29/2016

|

$46.12

|

PP = $47.82

|

|

MB = $50.21

|

Most Recent Note - 12/6/2016 5:27:57 PM

G - There was a "negative reversal" today for a loss with heavy volume after touching another new 52-week high. It is extended from its prior base and was repeatedly noted with caution in prior reports - "Reported earnings +10% on +6% sales revenues for the Sep '16 quarter, below the +25% minimum earnings guideline (C criteria), raising concerns."

>>> FEATURED STOCK ARTICLE : Perched Near Highs After Finding Support Above 50-Day Average - 11/18/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

DW

-

NYSE

Drew Industries Inc

MATERIALS and CONSTRUCTION - General Building Materials

|

$109.10

|

+0.25

0.23% |

$110.05

|

288,187

118.60% of 50 DAV

50 DAV is 243,000

|

$109.75

-0.59%

|

11/29/2016

|

$106.29

|

PP = $101.00

|

|

MB = $106.05

|

Most Recent Note - 12/7/2016 4:32:59 PM

G - Color code is changed to green after a gain with average volume today for a close above its "max buy" level. Prior highs in the $101-103 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Pullback Following Volume-Driven Gain For New Highs - 11/30/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LMAT

-

NASDAQ

Lemaitre Vascular Inc

Medical-Products

|

$23.85

|

+0.61

2.62% |

$23.87

|

123,027

84.27% of 50 DAV

50 DAV is 146,000

|

$24.99

-4.56%

|

10/27/2016

|

$21.03

|

PP = $22.60

|

|

MB = $23.73

|

Most Recent Note - 12/5/2016 5:18:07 PM

Y - Posted a gain today with below average volume and it remains below its "max buy" level. Prior highs in the $22 area acted as support along with its 50 DMA line following its technical breakout.

>>> FEATURED STOCK ARTICLE : Perched Near Highs Following Recent Technical Breakout - 11/25/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PATK

-

NASDAQ

Patrick Industries Inc

WHOLESALE - Building Materials Wholesale

|

$74.65

|

+1.10

1.50% |

$74.75

|

134,234

119.85% of 50 DAV

50 DAV is 112,000

|

$74.00

0.88%

|

11/29/2016

|

$72.45

|

PP = $69.63

|

|

MB = $73.11

|

Most Recent Note - 12/7/2016 4:31:25 PM

G - Hit another new high while it rose above its "max buy" level with today's gain on near average volume and its color code is changed to green. Prior highs in the $69 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Volume-Backed Breakout Triggered New Technical Buy Signal - 11/29/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ANET

-

NYSE

Arista Networks Inc

TELECOMMUNICATIONS - Communication Equipment

|

$95.76

|

-2.11

-2.16% |

$98.79

|

664,088

95.01% of 50 DAV

50 DAV is 699,000

|

$98.22

-2.50%

|

11/21/2016

|

$93.80

|

PP = $88.66

|

|

MB = $93.09

|

Most Recent Note - 12/7/2016 4:28:02 PM

G - Hit new all-time highs with today's volume-driven gain, rallying well above its "max buy" level. Disciplined investors avoid chasing stocks extended more than +5% above their pivot point. Prior highs in the $88 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Heavy Volume Behind Breakout Gain - 11/21/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

SFBS

-

NASDAQ

Servisfirst Bancshares

BANKING - Regional - Southeast Banks

|

$74.68

|

+1.25

1.70% |

$75.37

|

217,468

197.70% of 50 DAV

50 DAV is 110,000

|

$75.84

-1.53%

|

7/19/2016

|

$53.28

|

PP = $52.82

|

|

MB = $55.46

|

Most Recent Note - 12/8/2016 12:51:26 PM

Most Recent Note - 12/8/2016 12:51:26 PM

G - Recently churning above average volume while perched at all-time highs. Very extended from its prior base. Its 50 DMA line ($59) defines important support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Very Extended From Prior Base Following Post-Election Gains - 11/22/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

OLLI

-

NASDAQ

Ollie's Bargain Outlet

Retail-DiscountandVariety

|

$31.25

|

-0.60

-1.88% |

$31.83

|

2,677,582

338.08% of 50 DAV

50 DAV is 792,000

|

$32.75

-4.58%

|

10/4/2016

|

$27.36

|

PP = $28.70

|

|

MB = $30.14

|

Most Recent Note - 12/8/2016 12:40:22 PM

Most Recent Note - 12/8/2016 12:40:22 PM

G - Reported earnings +55% on +16% sales revenues for the Oct '16 quarter, continuing its strong earnings track record. Color code is changed to green after quickly rebounding above its "max buy" level following a gap down today. Prior highs in the $28 area define important support to watch coinciding with its 50 DMA line.

>>> FEATURED STOCK ARTICLE : Pulling Back After Getting Extended More Than +5% Above Prior Highs - 11/28/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LITE

-

NASDAQ

Lumentum Holdings Inc

TELECOMMUNICATIONS - Cables / Satalite Equipment

|

$43.50

|

+3.90

9.85% |

$44.00

|

2,125,954

219.17% of 50 DAV

50 DAV is 970,000

|

$45.25

-3.87%

|

12/8/2016

|

$42.80

|

PP = $45.35

|

|

MB = $47.62

|

Most Recent Note - 12/8/2016 5:59:57 PM

Most Recent Note - 12/8/2016 5:59:57 PM

Y - Finished strong after highlighted in yellow with pivot point cited based on its 10/07/16 high plus 10 cents. Little resistance remains while rebounding toward prior highs after a choppy consolidation above and below its 50 DMA line. Volume-driven gains for new highs may trigger a technical buy signal. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Challenging its High With Big Volume-Driven Gain - 12/8/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|