You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 7, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, AUGUST 28TH, 2015

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-11.76 |

16,643.01 |

-0.07% |

|

Volume |

1,004,458,290 |

-18% |

|

Volume |

1,788,113,880 |

-18% |

|

NASDAQ |

+15.61 |

4,828.32 |

+0.32% |

|

Advancers |

2,041 |

66% |

|

Advancers |

1,916 |

66% |

|

S&P 500 |

+1.21 |

1,988.87 |

+0.06% |

|

Decliners |

1,070 |

34% |

|

Decliners |

998 |

34% |

|

Russell 2000 |

+9.31 |

1,162.91 |

+0.81% |

|

52 Wk Highs |

6 |

|

|

52 Wk Highs |

25 |

|

|

S&P 600 |

+4.32 |

674.84 |

+0.64% |

|

52 Wk Lows |

21 |

|

|

52 Wk Lows |

28 |

|

|

|

Indices Held Ground After Solid Bounce From Lows

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

For the week, the Dow advanced 1.1%, the S&P 500 climbed 0.9%, and the NASDAQ rose 2.6%. Stocks finished mixed on Friday. The Dow fell 11 points to 16643. The S&P 500 gained 1 point to 1988. The NASDAQ eked out a 15 point advance to 4828. Friday's volume totals were reported lighter than the prior session on the NYSE and on the Nasdaq exchange. Breadth was positive as advancers led decliners by a 2-1 margin on the NYSE and on the Nasdaq exchange. There were 8 stocks that made it onto the BreakOuts Page, up from 5 high-ranked companies from the Leaders List that made a new 52-week high on the prior session. There was only 1 gainer from the 5 high-ranked companies currently on the Featured Stocks Page, a list that was trimmed during recent weakness. The total number of new 52-week lows still outnumbered new 52-week highs on both exchanges. PICTURED: The S&P 500 Index chart shows the severity of the recently noted correction while the benchmark index's 50-day and 200-day moving average (DMA) lines have converged. Friday's session marked Day 3 of a new rally attempt. Provided that the Day 1 session lows are not violated, investors may start looking for a valid follow-through day to possibly signal a new "confirmed rally" at some point between Day 4 and Day 7, or afterward.

Keep in mind, for a market environment to be considered technically "healthy" at least 2 of the 3 major indices should be trading above their respective 200-day moving average (DMA) lines. The market correction (M criteria) grew worrisome as all of the major indices dove below their respective 200-day moving average (DMA) lines. A lot of recovery work must be done to get the indices back into "healthy" shape, and that improvement could require some considerable time and patience.

Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price. This is precisely how the fact-based investment system prompts investors to reduce exposure in weak markets, preserving cash until another confirmed rally marked by solid leadership. The major averages pared earlier losses, as investors focused on economic data and Fed speak. Personal income in July rose 0.4%, but personal spending only gained 0.3%. Meanwhile, consumer sentiment in August fell to a three-month low. Amid the Fed’s Jackson Hole Symposium, regional Presidents Bullard and Mester both reassured investors of a 2015 rate increase. Five of 10 S&P 500 sectors finished in positive territory. Energy and materials were up the most in sympathy with commodity prices. Exxon Mobil (XOM +0.3%) inched higher and Freeport McMoRan (FCX +1.9%) extended its 28%+ move higher yesterday. Following announcements of inclusion in the S&P 500, Activision (ATVI +6.4%) jumped and United Continental (UAL +6.6%) rose. In earnings, Smith & Wesson (SWHC +11.3%) rallied on positive results, but disappointing reports left Autodesk (ADSK -7.3%) lower. In M&A, Mylan (MYL -2.8%) fell after shareholders approved its bid for Perrigo (PRGO - 2%), which lost. Treasuries were mixed on the heels of the Fed comments. The 10-year note was unchanged, yielding 2.18%. Commodities were mostly higher, despite dollar strength. WTI crude followed up its 10%+ gain yesterday, by adding 6.6% to $45.38/barrel. COMEX gold jumped 0.9% to $1133.50/ounce. The number of stocks currently listed to the Featured Stocks Page has waned based on deteriorating market conditions. The most current notes with headline links help members have access to more detailed letter-by-letter analysis including price/volume graphs annotated by our experts. See the Premium Member Homepage for archives to all prior pay reports.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Tech and Commodity-Linked Groups Led Gainers

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX -0.11%) ended slightly lower on Friday and financial shares were little changed as the Broker/Dealer Index ($XBD +0.23%) edged higher and the Bank Index ($BKX -0.17%) inched lower. The tech sector had a positive bias as the Biotechnology Index ($BTK +0.94%), Semiconductor Index ($SOX +0.68%), and the Networking Index ($NWX +0.56%) posted gains. The Gold & Silver Index ($XAU +4.24%) was a standout gainer. Strength in energy-linked shares boosted the Oil Services Index ($OSX +3.38%) and the Integrated Oil Index ($XOI +1.66%).

PICTURED: The Biotechnology Index ($BTK +0.94%) rebounded back above its 200-day moving average (DMA) line. It recently slumped below the 200 DMA line and undercut prior lows. The 50 DMA line has been downward sloping, a sign the group has actually been struggling for quite a while. The tech group may continue to dig its heels in near the 200 DMA line. However, more damaging losses could signal a worsening of the already noted market "correction" for the major averages (M criteria), The fact-based investment system discourages speculating on out of favor groups and weak stocks. During especially weak market environments investors should preserve cash by reducing exposure.

| Oil Services |

$OSX |

180.34 |

+5.90 |

+3.38% |

-14.48% |

| Integrated Oil |

$XOI |

1,132.22 |

+18.45 |

+1.66% |

-16.02% |

| Semiconductor |

$SOX |

613.91 |

+4.15 |

+0.68% |

-10.62% |

| Networking |

$NWX |

374.61 |

+2.09 |

+0.56% |

+4.66% |

| Broker/Dealer |

$XBD |

176.73 |

+0.40 |

+0.23% |

-4.28% |

| Retail |

$RLX |

1,201.96 |

-1.32 |

-0.11% |

+16.39% |

| Gold & Silver |

$XAU |

48.82 |

+1.98 |

+4.23% |

-29.02% |

| Bank |

$BKX |

72.76 |

-0.12 |

-0.16% |

-2.02% |

| Biotech |

$BTK |

3,908.00 |

+36.32 |

+0.94% |

+13.63% |

|

|

|

|

Four Years Ago New Lows Totals Were Nearly as Extreme

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

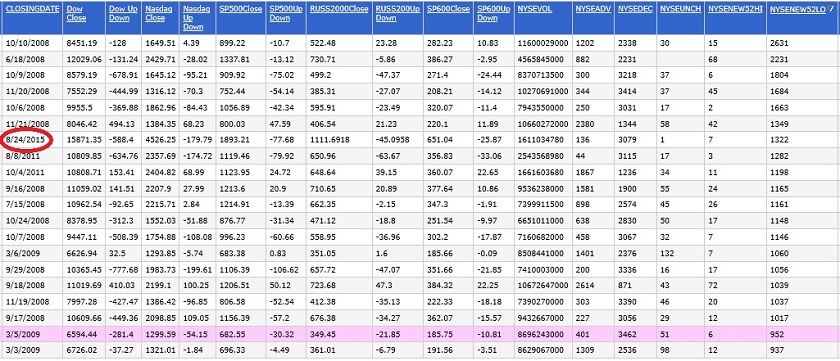

Market conditions (the M criteria) are challenging at times. There are few stocks included on the Featured Stocks list and none of the companies need additional review in detail with annotated graphs. At times like these we have an opportunity to look back and review. Previously featured stocks which were dropped can serve as educational examples of the investment system's tactics. It is also a reminder that high-ranked leaders eventually fall out of favor. If you wish to request for a specific stock to receive more detailed coverage in this section please use the inquiry form to submit your request. Thank you! We analyzed our archives, looking into the past to see when the most stocks were hitting new 52-week lows. Monday's session was the highest number of NYSE stocks hitting new 52-week lows since November 21, 2008, but not the worst day ever in terms of thee total number of stocks hitting new lows. During a market correction 4 years ago, there were totals were nearly as high in August and October of 2011.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

BOFI

-

NASDAQ

B O F I Holding Inc

BANKING - Savings andamp; Loans

|

$117.62

|

-3.88

-3.19% |

$120.71

|

370,755

140.97% of 50 DAV

50 DAV is 263,000

|

$134.79

-12.74%

|

6/10/2015

|

$101.47

|

PP = $97.78

|

|

MB = $102.67

|

Most Recent Note - 8/27/2015 6:37:01 PM

G - Recent market weakness (M criteria) has raised concerns. Halted its slide at its 50 DMA line with today's gain after 7 consecutive losses. It has not formed a sound base following a considerable +32% rally in less than 2 months after first featured in yellow in the 6/10/15 mid-day report.

>>> FEATURED STOCK ARTICLE : Hovering Near Highs Very Extended From Sound Base - 8/20/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

AHS

-

NYSE

A M N Healthcare Svcs

DIVERSIFIED SERVICES - Staffing and Outsourcing Service

|

$33.90

|

-0.72

-2.08% |

$34.53

|

853,572

111.72% of 50 DAV

50 DAV is 764,000

|

$37.25

-8.99%

|

8/5/2015

|

$34.50

|

PP = $32.53

|

|

MB = $34.16

|

Most Recent Note - 8/25/2015 8:25:01 PM

G - Found support today following damaging losses testing prior highs and its 50 DMA line. More damaging losses would raise greater concerns. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Testing Support Amid Broad Market Weakness - 8/25/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$159.00

|

-1.24

-0.77% |

$169.29

|

2,919,641

345.52% of 50 DAV

50 DAV is 845,000

|

$176.77

-10.05%

|

5/29/2015

|

$155.03

|

PP = $159.95

|

|

MB = $167.95

|

Most Recent Note - 8/28/2015 1:10:37 PM

Most Recent Note - 8/28/2015 1:10:37 PM

G - Erased much of its early gains today after briefly rebounding above the 50 DMA line ($163.58). A rebound above the 50 DMA line is needed for its outlook to improve. Found prompt support after undercutting its 200 DMA line on 8/24/15 amid broad market (M criteria) weakness.

>>> FEATURED STOCK ARTICLE : Recent Gains Have Still Lacked Substantial Volume Conviction - 8/13/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LXFT

-

NYSE

Luxoft Holding Inc Cl A

Comp Sftwr-Spec Enterprs

|

$61.71

|

-0.17

-0.27% |

$62.00

|

157,659

54.74% of 50 DAV

50 DAV is 288,000

|

$68.16

-9.46%

|

5/26/2015

|

$51.90

|

PP = $57.40

|

|

MB = $60.27

|

Most Recent Note - 8/27/2015 6:30:38 PM

G - Prompt rebound above the 50 DMA line helped its outlook improve following recent shakeout and broad market weakness (M criteria). See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : After Shakeout a Prompt Rebound Above 50-Day Moving Average - 8/27/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

INGN

-

NASDAQ

Inogen Inc

HEALTH SERVICES - Medical Instruments and Supplies

|

$49.78

|

+2.37

5.00% |

$50.66

|

371,888

134.26% of 50 DAV

50 DAV is 277,000

|

$51.86

-4.01%

|

8/12/2015

|

$49.01

|

PP = $45.85

|

|

MB = $48.14

|

Most Recent Note - 8/28/2015 12:43:32 PM

Most Recent Note - 8/28/2015 12:43:32 PM

G - Color code is changed to green after rising back above its "max buy" level with today's 3rd consecutive gain. Found prompt support near its 50 DMA line amid recent market weakness (M criteria) which remains an overriding concern arguing against new buying efforts.

>>> FEATURED STOCK ARTICLE : Finished Strong With Volume-Driven Breakout Gain - 8/12/2015 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|