You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 21, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, APRIL 7TH, 2020

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-26.13 |

22,653.86 |

-0.12% |

|

Volume |

1,480,501,383 |

+3% |

|

Volume |

4,047,393,200 |

+6% |

|

NASDAQ |

-25.98 |

7,887.26 |

-0.33% |

|

Advancers |

2,100 |

72% |

|

Advancers |

1,810 |

56% |

|

S&P 500 |

-4.27 |

2,659.41 |

-0.16% |

|

Decliners |

815 |

28% |

|

Decliners |

1,410 |

44% |

|

Russell 2000 |

+0.39 |

1,139.17 |

+0.03% |

|

52 Wk Highs |

7 |

|

|

52 Wk Highs |

9 |

|

|

S&P 600 |

+3.00 |

677.65 |

+0.44% |

|

52 Wk Lows |

16 |

|

|

52 Wk Lows |

38 |

|

|

Disciplined investors shall notice a new confirmed uptrend marked by a solid follow-through day. For any clarification or additional help applying the fact-based investment system, we invite members to call, or contact us via the inquiry form.

|

|

Major Indices Reversed Gains and Ended Session Lower

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

All three major U.S. benchmarks lost steam into the close, with the S&P 500 edging down 0.2% after rallying as much as 3.5% in earlier trading. The Dow slipped 26 points, while the Nasdaq Composite fell 0.3%. Breadth was positive as advancers led decliners by a 5-2 margin on the NYSE and 8-7 on the Nasdaq exchange. The reported volume totals were higher than the prior session total on the NYSE and higher on the Nasdaq exchange. Leadership remained thins as 3 high-ranked companies from the Leaders List hit new 52-week highs and were listed on the BreakOuts Page, versus 4 on the prior session. New 52-week lows outnumbered the new 52-week highs totals on both the NYSE and on the Nasdaq exchange. The major indices (M criteria) are in a new confirmed uptrend. Any sustainable rally requires a healthy crop of new leaders. Charts used courtesy of www.stockcharts.com

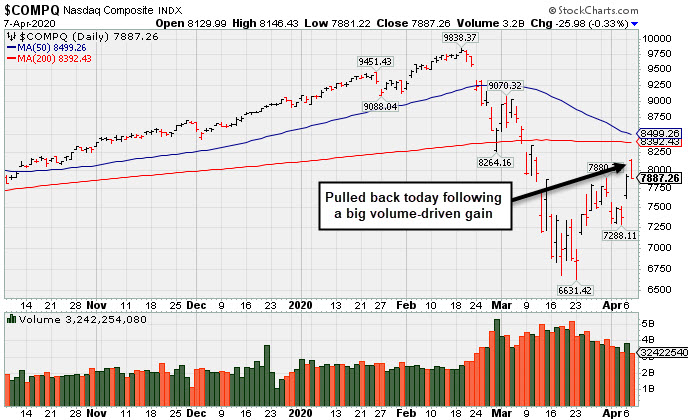

PICTURED: The Nasdaq Composite Index pulled back on Tuesday following a solid gain with higher volume on Monday. Disciplined investors know that a follow-through day of big confirming gains on Monday, April 6th from the major indices on higher volume coupled with an increase in the number of stocks hitting new highs signaled a valid new market uptrend (M criteria).

Stocks finished lower on Tuesday, as market participants scrutinized COVID-19 updates. New York recorded its largest one-day death toll, but the governor noted that new infections and hospitalizations related to the outbreak remained below highs from last week for the third consecutive day. Overseas, data from Europe also suggested that new cases may have peaked.

Despite the late-day equity sell-off, demand for perceived safe haven assets waned, with the yield on the 10-year Treasury note up five basis points to 0.72%. COMEX gold finished lower, while a gauge of the U.S. dollar slid nearly 1%.

Six of 11 S&P 500 sectors closed in positive territory, with Utilities, Consumer Staples, and Technology shares all ending more than 1% lower. Energy shares led advancers despite WTI crude ending lower for the second straight session on skepticism concerning the likelihood and efficacy of coordinated supply curbs. Exxon Mobil (XOM +1.90%) rose following an announcement that the company would cut 2020 capital spending by 30%. Elsewhere, strength in retailers helped fuel Consumer Discretionary gains. In other corporate news, Kraft Heinz (KHC +2.7%) rose following its positive first-quarter pre-announcement.A

On the data front, a report from the NFIB showed small business optimism eased in March. Separately, U.S. job openings increased by more than expected in February, though still declined from the prior month. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Bank, Retail, and Networking Indexes Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX +2.07%) and the Retail Index ($RLX +0.89%) posted gains while the Broker/Dealer Index ($XBD -1.05%). The tech sector was mixed as the Semiconductor Index ($SOX -0.47%) and the Biotech Index ($BTK -1.19%) both fell and the Networking Index ($NWX +0.81%) rose. Commodity-linked shares were also mixed rose as the Oil Services Index ($OSX +1.09%) and Integrated Oil Index ($XOI +0.91%) both rose, but the Gold & Silver Index ($XAU -0.40%) ended lower. PICTURED: The Integrated Oil Index ($XOI +0.91%) is rebounding from its March 2020 low toward its 50-day moving average (DMA) line.

| Oil Services |

$OSX |

25.84 |

+0.28 |

+1.10% |

-66.99% |

| Integrated Oil |

$XOI |

673.56 |

+6.06 |

+0.91% |

-46.99% |

| Semiconductor |

$SOX |

1,585.38 |

-7.50 |

-0.47% |

-14.29% |

| Networking |

$NWX |

484.74 |

+3.88 |

+0.81% |

-16.91% |

| Broker/Dealer |

$XBD |

222.60 |

-2.37 |

-1.05% |

-23.34% |

| Retail |

$RLX |

2,264.85 |

+19.95 |

+0.89% |

-7.53% |

| Gold & Silver |

$XAU |

88.96 |

-0.36 |

-0.40% |

-16.80% |

| Bank |

$BKX |

67.03 |

+1.35 |

+2.06% |

-40.87% |

| Biotech |

$BTK |

4,591.73 |

-55.27 |

-1.19% |

-9.39% |

|

|

|

|

No Featured Stocks

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

During extremely bearish markets the number of stocks covered in this area has sometimes been reduced to zero. We suggest making no excuses for weak stocks in weak markets. Feel free to contact us if you have a need for any additional information. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|