You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Sunday, April 20, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - MONDAY, APRIL 6TH, 2020

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+1,627.46 |

22,679.99 |

+7.73% |

|

Volume |

1,430,537,323 |

-0% |

|

Volume |

3,835,233,100 |

+18% |

|

NASDAQ |

+540.16 |

7,913.24 |

+7.33% |

|

Advancers |

2,625 |

91% |

|

Advancers |

2,735 |

84% |

|

S&P 500 |

+175.03 |

2,663.68 |

+7.03% |

|

Decliners |

270 |

9% |

|

Decliners |

539 |

16% |

|

Russell 2000 |

+86.73 |

1,138.78 |

+8.24% |

|

52 Wk Highs |

6 |

|

|

52 Wk Highs |

12 |

|

|

S&P 600 |

+52.30 |

674.65 |

+8.40% |

|

52 Wk Lows |

20 |

|

|

52 Wk Lows |

49 |

|

|

Disciplined investors shall notice a new confirmed uptrend marked by a solid follow-through day. For any clarification or additional help applying the fact-based investment system, we invite members to call, or contact us via the inquiry form.

|

|

Major Indices Post Big Gains With a Little More Leadership

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

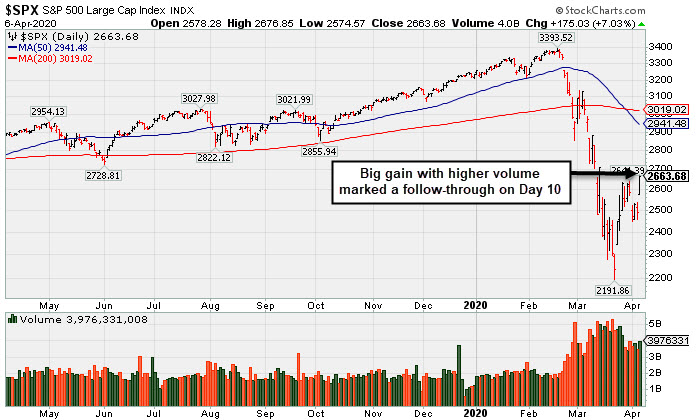

The Dow climbed 1,627 points, while the S&P 500 advanced 7%. The Nasdaq Composite was up 7.3%. Breadth was positive as advancers led decliners by almost a 10-1 margin on the NYSE and more than 5-1 on the Nasdaq exchange. The reported volume totals were near the prior session total on the NYSE and higher on the Nasdaq exchange. Leadership improved as 4 high-ranked companies from the Leaders List hit new 52-week highs and were listed on the BreakOuts Page, versus zero on the prior session. New 52-week lows outnumbered the new 52-week highs totals on both the NYSE and on the Nasdaq exchange. The major indices (M criteria) are in a new confirmed uptrend. Any sustainable rally requires a healthy crop of new leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The S&P 500 Index posted a solid gain with higher volume on Day 10. Disciplined investors know that a follow-through day of big confirming gains from the major indices on higher volume coupled with an increase in the number of stocks hitting new highs signals a valid new market uptrend (M criteria).

Stocks finished higher on Monday amid optimistic COVID-19 reports around the globe. Signs of easing coronavirus cases in many pockets of the world helped lift investor sentiment. Data from Germany, Spain, and Italy over the weekend showed the pandemic slowing somewhat, while New York reported its first decline in deaths on Sunday. In Washington, the White House suggested the coming week would be America’s “toughest” in terms of dealing with the outbreak, but also highlighted signs of stabilization.

All 11 S&P 500 sectors closed in positive territory with Technology shares surging 8.8%. Utilities also led advancers, while the Consumer Discretionary group was another outperformer, with beleaguered retailers and travel stocks some of the standouts. In corporate news, Boeing (BA +19.47%) rose after announcing plans to extend the suspension of its Washington state production operations and halt payment to roughly 30,000 employees this week.

Treasuries declined, with the yield on the 10-year note up six basis points to 0.67%. In commodities, WTI crude fell 8% to $26.08/barrel, on the heels of its best week on record during which it rallied nearly 32%. News that OPEC and its allies postponed today’s virtual meeting until Thursday weighed on oil prices, leaving market participants awaiting clarity on possible production cuts.

This follows a downbeat week on Wall Street which saw the Dow drop 2.7% and the S&P 500 shed 2.1%, representing the fifth weekly loss in the last seven for each benchmark. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Retail, Tech, and Commodity-Linked Groups Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX +9.13%) and Broker/Dealer Index ($XBD +8.10%) both outpaced the Retail Index ($RLX +6.61%). The tech sector was unanimously positive as the Semiconductor Index ($SOX +10.38%), Networking Index ($NWX +7.78%), and the Biotech Index ($BTK +5.35%) each rose. Commodity-linked shares rose as the Oil Services Index ($OSX +6.22%), Integrated Oil Index ($XOI +5.00%), and the Gold & Silver Index ($XAU +5.88%) each posted solid gains. PICTURED: The Networking Index ($NWX +7.78%) rebounded near its 50-day moving average (DMA) line.

| Oil Services |

$OSX |

25.56 |

+1.50 |

+6.23% |

-67.35% |

| Integrated Oil |

$XOI |

667.51 |

+31.79 |

+5.00% |

-47.46% |

| Semiconductor |

$SOX |

1,592.88 |

+149.84 |

+10.38% |

-13.88% |

| Networking |

$NWX |

480.86 |

+34.71 |

+7.78% |

-17.58% |

| Broker/Dealer |

$XBD |

224.97 |

+16.86 |

+8.10% |

-22.53% |

| Retail |

$RLX |

2,244.90 |

+139.15 |

+6.61% |

-8.34% |

| Gold & Silver |

$XAU |

89.32 |

+4.96 |

+5.88% |

-16.46% |

| Bank |

$BKX |

65.68 |

+5.49 |

+9.12% |

-42.06% |

| Biotech |

$BTK |

4,647.01 |

+236.13 |

+5.35% |

-8.30% |

|

|

|

|

No Featured Stocks

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

During extremely bearish markets the number of stocks covered in this area has sometimes been reduced to zero. We suggest making no excuses for weak stocks in weak markets. Feel free to contact us if you have a need for any additional information. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|