You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Saturday, March 29, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, MARCH 30TH, 2011

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+71.60 |

12,350.61 |

+0.58% |

|

Volume |

919,086,260 |

+14% |

|

Volume |

1,757,983,340 |

+12% |

|

NASDAQ |

+19.90 |

2,776.79 |

+0.72% |

|

Advancers |

2,160 |

69% |

|

Advancers |

1,834 |

67% |

|

S&P 500 |

+8.82 |

1,328.26 |

+0.67% |

|

Decliners |

866 |

28% |

|

Decliners |

793 |

29% |

|

Russell 2000 |

+10.88 |

840.37 |

+1.31% |

|

52 Wk Highs |

263 |

|

|

52 Wk Highs |

192 |

|

|

S&P 600 |

+5.60 |

444.26 |

+1.28% |

|

52 Wk Lows |

12 |

|

|

52 Wk Lows |

23 |

|

|

The CANSLIM.net Q1 2011 Webcast airs tonight at 8PM EST (click here) and it will be available "on demand" afterward. It will include a summary of current market conditions, leading industry groups, and recent buy candidates while reviewing prior reports. All UPGRADED MEMBERS are currently entitled to access these webcasts at no additional cost. You will find the link to the Webcast highlighted near the top of the Premium Membership Homepage. The link to the Q4 2010 webcast will be added to the list of other webcasts archived lower on the page. A separate email announcement will also direct you to where you may access this informative webcast.

|

|

Market Leadership Expands With New Confirmed Uptrend

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

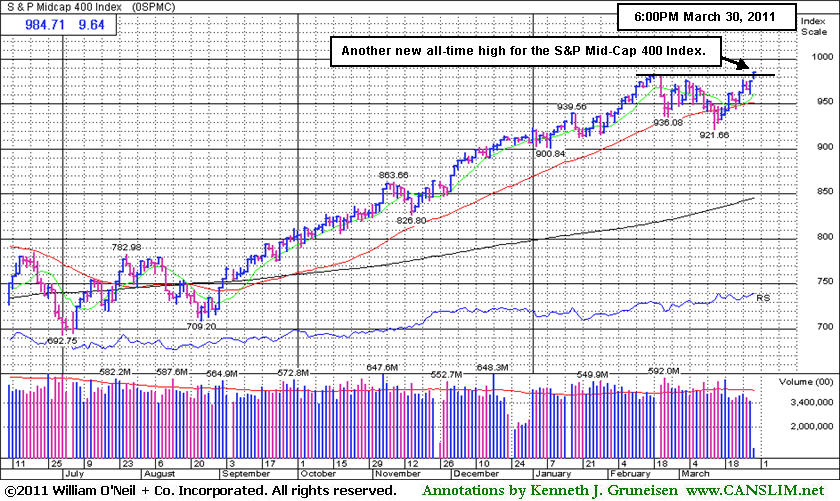

The market is considered to be back in a "confirmed uptrend" and the S&P Mid-Cap 400 Index rallied to a new all-time high while the S&P Small-Cap 600 Index hit a new recovery high and traded within one point of its all-time high on Wednesday. Volume totals on the NYSE and the Nasdaq exchange were higher, a sign of institutional accumulation that is reassuring. Advancing issues beat decliners by 5-2 on both the NYSE and the Nasdaq exchange. New 52-week highs outnumbered new 52-week lows on the Nasdaq exchange and on the NYSE. There were 119 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, more than doubling the total of 55 on the prior session. On the Featured Stocks Page there were gains from all of the 20 high-ranked market leaders currently listed.

The session's broad advance helped the S&P 500 Index extend its best first quarter rally in 13 years. The Dow Jones Industrial Average capped its best 10-day performance since November 2009 and finished at its second best close of the year. End-of-quarter window dressing by portfolio managers was probably a factor, but investors also welcomed good news in the labor market. ADP said private payrolls grew 200-thousand this month. The data were close to expectations, increasing hopes that the government report on Friday will also show improvement. A survey of chief executives showed optimism rising to pre-recession levels.

Merger news was well-received. Cephalon Inc (CEPH +28.4%) spiked higher after Valeant Pharmaceuticals Int'l (VRX +12.82%) made a $5.7 billion bid for the company. Energy stocks including Exxon Mobil Corp (XOM +1.5%) advanced as President Obama called for new incentives for offshore drilling. Visa Inc (V +2.8%) rose on prospects that curbs on debit-card fees will be delayed or modified.

Regular readers of this commentary know that we said, "The bullish action in the past week or more did not meet the strict definition of a follow-through day (FTD)", however, last Thursday's gain of +1.4% from the Nasdaq Composite Index has been recognized, albeit days later, by the newspaper as a follow-though day. CANSLIM.net commentaries have cited recent signs of new leadership (increase in new 52-week highs) that have suggested that the market has a healthy crop of strong leaders underpinning the latest rally effort. Additionally, we observed that the Dow Jones Industrial Average, S&P 500 Index, and the tech-heavy Nasdaq Composite Index, collectively, rallied back above their respective 50-day moving average (DMA) lines helping their technical stance improve. Barring any more damaging distribution days in the near term, investors may be wise to keep a close eye on a watchlist of high-ranked leaders and have a bias toward making new buys whenever all key criteria are met and powerful technical breakouts occur. The usual discipline applies, and losses should always be limited if a stock falls -7% or more from your purchase price.

NOTICE: The CANSLIM.net Q1 2011 Webcast airs tonight at 8PM EST (click here) and it will be available "on demand" afterward. It will include a summary of current market conditions, leading industry groups, and recent buy candidates while reviewing prior reports. All UPGRADED MEMBERS are currently entitled to access these webcasts at no additional cost. You will find the link to the Webcast highlighted near the top of the Premium Membership Homepage. The link to the Q4 2010 webcast will be added to the list of other webcasts archived lower on the page. A separate email announcement will also direct you to where you may access this informative webcast.

PICTURED: The S&P Mid-Cap 400 Index rallied to a new all-time high. It was first noted in the January 14, 2011, for being the first index to have fully recovered all that was lost in the 2007-09 Bear Market.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Biotechnology Index's Breakout Sparked by M&A News

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Defensive groups were among Wednesday's best gainers as the Gold & Silver Index ($XAU +1.74%) and Healthcare Index ($HMO +1.82%) powered higher. Energy-related shares were mixed as the Oil Services Index ($OSX -0.51%) edged lower and the Integrated Oil Index ($XOI +0.64%) posted a small gain. The Retail Index ($RLX +1.36%) posted a solid gain and the influential Bank Index ($BKX +0.66%) and Broker/Dealer Index ($XBD +0.89%) posted reassuring gains. The Networking Index ($NWX +0.70%) and Internet Index ($IIX +0.90%) rose while the Semiconductor Index ($SOX +0.08%) ended flat.

Charts courtesy www.stockcharts.com

PICTURED: The Biotechnology Index ($BTK +2.88%) was a standout gainer, gapping up for a new high. The merger and acquisition (M&A) news mentioned in the commentary above was a catalyst.

| Oil Services |

$OSX |

295.41 |

-1.50 |

-0.51% |

+20.52% |

| Healthcare |

$HMO |

2,172.45 |

+38.81 |

+1.82% |

+28.40% |

| Integrated Oil |

$XOI |

1,380.91 |

+8.78 |

+0.64% |

+13.83% |

| Semiconductor |

$SOX |

441.38 |

+0.34 |

+0.08% |

+7.18% |

| Networking |

$NWX |

330.34 |

+2.31 |

+0.70% |

+17.74% |

| Internet |

$IIX |

317.87 |

+2.84 |

+0.90% |

+3.29% |

| Broker/Dealer |

$XBD |

120.31 |

+1.06 |

+0.89% |

-0.99% |

| Retail |

$RLX |

519.71 |

+6.99 |

+1.36% |

+2.23% |

| Gold & Silver |

$XAU |

215.16 |

+3.69 |

+1.74% |

-5.04% |

| Bank |

$BKX |

52.13 |

+0.34 |

+0.66% |

-0.15% |

| Biotech |

$BTK |

1,363.89 |

+38.24 |

+2.88% |

+5.11% |

|

|

|

|

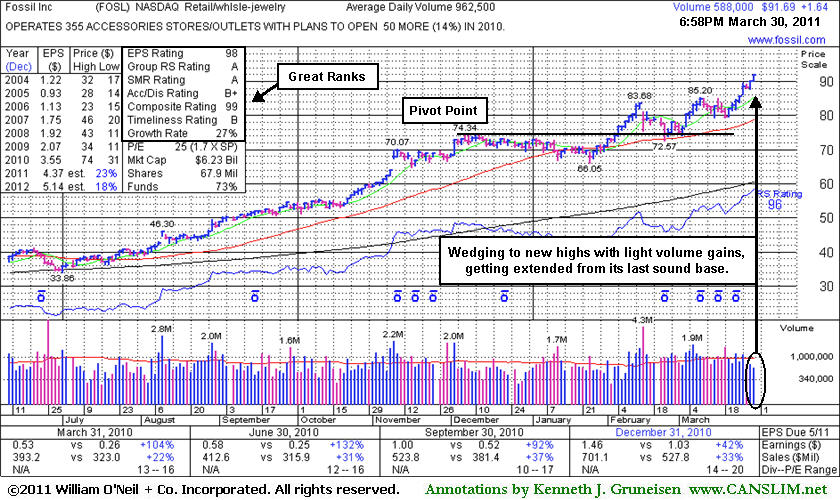

Wedging Higher Getting Extended From Prior Base

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Fossil Inc (FOSL +$1.64 or +1.82% to $91.69 has been wedging higher without great volume conviction, getting more extended from its prior base. It was last shown in this FSU section on 2/24/11 with an annotated graph under the headline "Prior Highs And 50-Day Average Define Important Support", after its damaging gap down on 2/15/11 and additional losses pressured it near prior resistance in the $74 area. It found support near the old resistance level but did not form a sound new base. patience may allow for a new base to form, but disciplined investors avoid chasing extended stocks.

the number of top-rated funds owning its shares rose from 512 in Mar '10 to 550 in Dec '10 a reassuring sign concerning the I criteria of the investment system. Sales revenues and earnings increases showed impressive acceleration in the 5 latest quarters (Dec '09, Mar, Jun, Sep, Dec '10) following a streak of 4 negative comparisons versus the year ago period. Much earlier, FOSL appeared in this section near $44 on 8/11/10 under the headline, "Breakaway Gap On More Than Triple Average Volume". It was featured in yellow in the 8/10/10 mid-day report (read here) and has subsequently traded as much as +101.9% higher.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

BIDU

-

NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$136.38

|

+0.38

0.28% |

$138.53

|

7,554,674

108.30% of 50 DAV

50 DAV is 6,975,600

|

$136.49

-0.08%

|

3/17/2011

|

$121.97

|

PP = $131.73

|

|

MB = $138.32

|

Most Recent Note - 3/29/2011 5:49:04 PM

Y - Up today with lighter than average volume for its best-ever close. Its gain with 2 times average volume on 3/23/11 triggered a technical buy signal after a riskier "late stage" set-up. The M criteria remains a concern until a follow-through day confirms the new rally and justifies new buying efforts under the system's strict guidelines. Prior high near $131 defines initial chart support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/9/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CMG

-

NYSE

Chipotle Mexican Grill

LEISURE - Restaurants

|

$272.20

|

+6.08

2.28% |

$272.95

|

1,198,931

112.16% of 50 DAV

50 DAV is 1,068,900

|

$275.00

-1.02%

|

2/11/2011

|

$271.15

|

PP = $262.87

|

|

MB = $276.01

|

Most Recent Note - 3/29/2011 5:31:43 PM

G - Closed near the session high with a 5th consecutive gain, rising from support at its 50 DMA line for its third highest close with gains this week backed by light or near average volume. Its recent low ($234.48 on 3/02/11) defines another important nearby level for chart readers to watch closely. Subsequent violations and damaging losses would raise greater concerns and trigger technical sell signals.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/14/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CTCT

-

NASDAQ

Constant Contact Inc

MEDIA - Advertising Services

|

$34.54

|

+0.45

1.32% |

$34.98

|

530,256

130.51% of 50 DAV

50 DAV is 406,300

|

$36.13

-4.40%

|

3/22/2011

|

$33.59

|

PP = $32.49

|

|

MB = $34.11

|

Most Recent Note - 3/30/2011 11:41:04 AM

Most Recent Note - 3/30/2011 11:41:04 AM

G - Rising again today, its color code is changed to green while getting extended from its prior base. Prior highs in the $32 area define support to watch above its 50 DMA line. Approximately 40% of successful winners pull back and test support at their prior resistance level before continuing higher. Disciplined investors always limit losses if a stock falls more than -7% from their purchase price.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/22/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CTSH

-

NASDAQ

Cognizant Tech Sol Cl A

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$81.65

|

+0.72

0.89% |

$81.78

|

1,508,075

63.63% of 50 DAV

50 DAV is 2,370,100

|

$81.17

0.59%

|

2/7/2011

|

$75.09

|

PP = $76.46

|

|

MB = $80.28

|

Most Recent Note - 3/29/2011 5:54:35 PM

G - Held its ground and finished at a best-ever close today. Recent gains helped it hit a new 52-week high (N criteria) , with no resistance remaining due to overhead supply. Color code is changed to green after gains above its "max buy" level without heavy enough volume to trigger a proper technical buy signal. Disciplined investors also know that a follow-through day (FTD) is needed to confirm the market direction (M criteria) is again favorable for new buying efforts.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/17/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

DECK

-

NASDAQ

Deckers Outdoor Corp

CONSUMER NON-DURABLES - Textile - Apparel Footwear

|

$87.39

|

+2.25

2.64% |

$87.48

|

981,088

68.37% of 50 DAV

50 DAV is 1,435,000

|

$94.70

-7.72%

|

2/3/2011

|

$79.61

|

PP = $82.67

|

|

MB = $86.80

|

Most Recent Note - 3/30/2011 5:52:30 PM

Most Recent Note - 3/30/2011 5:52:30 PM

G - Today's 6th consecutive gain with light volume has it continuing to rebound toward prior highs. Color code is changed to green after rallying back above the previously cited "max buy" level after an earlier double bottom pattern noted. Its recent low ($77.71 on 3/21/11) defines the next important chart support level.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/3/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

EZPW

-

NASDAQ

Ezcorp Inc Cl A

SPECIALTY RETAIL - Specialty Retail, Other

|

$31.50

|

+0.40

1.29% |

$31.74

|

330,953

87.25% of 50 DAV

50 DAV is 379,300

|

$31.80

-0.94%

|

2/18/2011

|

$27.94

|

PP = $30.04

|

|

MB = $31.54

|

Most Recent Note - 3/30/2011 7:22:13 PM

Most Recent Note - 3/30/2011 7:22:13 PM

Y - Volume was below average behind its gain today while approaching its "max buy" level. Market conditions (M criteria) have recognizably improved in terms of leadership (new 52-week highs) in recent weeks without a strictly defined follow-through day.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/10/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FOSL

-

NASDAQ

Fossil Inc

CONSUMER DURABLES - Recreational Goods, Other

|

$91.69

|

+1.64

1.82% |

$91.94

|

588,566

61.15% of 50 DAV

50 DAV is 962,500

|

$90.18

1.67%

|

2/1/2011

|

$73.30

|

PP = $74.44

|

|

MB = $78.16

|

Most Recent Note - 3/30/2011 7:19:41 PM

Most Recent Note - 3/30/2011 7:19:41 PM

G - Wedging up today with lighter than average volume for another new all-time high, getting more extended from any sound base. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/30/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

HMSY

-

NASDAQ

H M S Holdings Corp

COMPUTER SOFTWARE and SERVICES - Healthcare Information Service

|

$82.46

|

+0.05

0.06% |

$83.77

|

124,780

75.30% of 50 DAV

50 DAV is 165,700

|

$83.98

-1.81%

|

11/19/2010

|

$61.89

|

PP = $63.01

|

|

MB = $66.16

|

Most Recent Note - 3/29/2011 5:47:18 PM

G - Gain today with slightly above average volume for its best close ever. It is extended from any sound base pattern. See the latest FSU analysis for additional details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/25/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

HS

-

NYSE

Healthspring Inc

HEALTH SERVICES - Health Care Plans

|

$37.23

|

+0.31

0.84% |

$37.27

|

762,115

102.08% of 50 DAV

50 DAV is 746,600

|

$39.19

-5.00%

|

3/22/2011

|

$38.29

|

PP = $38.85

|

|

MB = $40.79

|

Most Recent Note - 3/28/2011 7:17:04 PM

G - Held its ground today. Gapped down on 3/25/11 after pricing a new Public Offering of 7.5 million shares, holding its ground near recent lows and well above its 50 DMA line. It failed to convincingly rally for a close above its pivot point after touching a new 52-week high on 3/22/11, and its color code was changed to green after slumping more than -7% below its pivot point.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/23/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

INFA

-

NASDAQ

Informatica Corp

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$51.25

|

+0.46

0.91% |

$51.59

|

1,120,245

114.81% of 50 DAV

50 DAV is 975,700

|

$51.97

-1.39%

|

3/24/2011

|

$50.04

|

PP = $49.86

|

|

MB = $52.35

|

Most Recent Note - 3/30/2011 7:23:28 PM

Most Recent Note - 3/30/2011 7:23:28 PM

Y - Up today with slightly above average volume. Prior highs in the $49 area define initial support to watch. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/28/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

LULU

-

NASDAQ

Lululemon Athletica

MANUFACTURING - Textile Manufacturing

|

$89.84

|

+0.67

0.75% |

$90.97

|

3,038,843

137.65% of 50 DAV

50 DAV is 2,207,600

|

$89.25

0.66%

|

3/28/2011

|

$68.11

|

PP = $85.38

|

|

MB = $89.65

|

Most Recent Note - 3/30/2011 11:54:03 AM

Most Recent Note - 3/30/2011 11:54:03 AM

G - Hit another new all-time high today and traded above its "max buy" level, and its color code is changed to green. Considerable volume-driven gains above its pivot point triggered a new (or add-on) technical buy signal this week while breaking out above prior resistance following a noted new base-on-base pattern. Its board of directors approved a 2-for-1 stock split (pending). Traded up at least +87% from when first featured less than 6 months earlier in the 10/08/10 mid-day report (read here) and in that evening's Featured Stock Update section with an annotated graph (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 2/25/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MG

-

NYSE

Mistras Group Inc

DIVERSIFIED SERVICES - Bulding and Faci;ity Management Services

|

$17.20

|

+0.06

0.35% |

$17.29

|

153,980

149.21% of 50 DAV

50 DAV is 103,200

|

$17.23

-0.17%

|

3/15/2011

|

$15.48

|

PP = $15.90

|

|

MB = $16.70

|

Most Recent Note - 3/29/2011 1:10:42 PM

G - It has been stubbornly holding its ground, extended from a sound base pattern. Prior highs and its 50 DMA line define important support to watch on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/15/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MWIV

-

NASDAQ

M W I Veterinary Supply

HEALTH SERVICES - Medical Instruments and; Supplies

|

$78.09

|

+0.46

0.59% |

$78.42

|

37,921

40.26% of 50 DAV

50 DAV is 94,200

|

$78.48

-0.50%

|

11/4/2010

|

$61.79

|

PP = $59.60

|

|

MB = $62.58

|

Most Recent Note - 3/28/2011 3:38:05 PM

G - Gain today has it poised for its second highest close ever. Consolidating in a tight range for the past 3 weeks, extended from any sound base pattern.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/8/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

OPEN

-

NASDAQ

Opentable Inc

INTERNET - Internet Software and Services

|

$106.92

|

+4.00

3.89% |

$107.47

|

1,472,686

127.01% of 50 DAV

50 DAV is 1,159,500

|

$106.15

0.73%

|

3/17/2011

|

$90.71

|

PP = $96.07

|

|

MB = $100.87

|

Most Recent Note - 3/30/2011 12:10:09 PM

Most Recent Note - 3/30/2011 12:10:09 PM

G - Gapped up today, hitting a new all-time high, getting more extended from its recently noted new base. Its prior high near $96 defines initial support to watch following its latest technical breakout.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/24/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PAY

-

NYSE

Verifone Systems Inc

COMPUTER HARDWARE - Transaction Automation Systems

|

$56.84

|

+0.34

0.60% |

$58.88

|

2,751,215

145.49% of 50 DAV

50 DAV is 1,891,000

|

$56.64

0.35%

|

1/27/2011

|

$41.77

|

PP = $44.97

|

|

MB = $47.22

|

Most Recent Note - 3/29/2011 5:36:13 PM

G - Up again today with below average volume, quietly rising for another new all-time high and closing near the session high. Repeatedly noted - "No resistance remains due to overhead supply, but it is extended from a sound base pattern. Its 50 DMA line defines chart support to watch."

>>> The latest Featured Stock Update with an annotated graph appeared on 3/2/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

PCLN

-

NASDAQ

Priceline.Com Inc

INTERNET - Internet Software and Services

|

$504.00

|

+12.31

2.50% |

$506.69

|

1,237,836

105.33% of 50 DAV

50 DAV is 1,175,200

|

$493.44

2.14%

|

1/3/2011

|

$399.55

|

PP = $428.20

|

|

MB = $449.61

|

Most Recent Note - 3/30/2011 5:56:54 PM

Most Recent Note - 3/30/2011 5:56:54 PM

G - Rose to a new 52-week high today with near average volume behind its gain, getting extended from any sound base pattern. Its 50 DMA line has defined support throughout its advance.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/21/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

RAX

-

NYSE

Rackspace Hosting Inc

INTERNET - Internet Software and; Services

|

$43.01

|

+3.30

8.31% |

$43.32

|

3,649,741

202.15% of 50 DAV

50 DAV is 1,805,500

|

$40.62

5.88%

|

3/16/2011

|

$36.28

|

PP = $40.72

|

|

MB = $42.76

|

Most Recent Note - 3/30/2011 5:26:12 PM

Most Recent Note - 3/30/2011 5:26:12 PM

G - Spiked above its "max buy" level with a considerable gain today backed by 2 times average volume for a new all-time high, triggering a technical buy signal. Its color code is changed to green after quickly getting extended from its orderly 7-week flat base. Market conditions (M criteria) have recognizably improved in terms of leadership (new 52-week highs) in recent weeks without a strictly defined follow-through day.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/16/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

TIBX

-

NASDAQ

Tibco Software Inc

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$26.74

|

+0.47

1.79% |

$27.00

|

7,209,736

292.80% of 50 DAV

50 DAV is 2,462,300

|

$26.99

-0.93%

|

3/18/2011

|

$23.88

|

PP = $26.04

|

|

MB = $27.34

|

Most Recent Note - 3/30/2011 1:21:38 PM

Most Recent Note - 3/30/2011 1:21:38 PM

Y - Its gain on the prior session with above average volume could be considered a technical buy signal. However, the churning above average volume at its 52-week high this week while not making meaningful price progress suggests that it has been enduring distributional pressure since rising clear of all resistance due to overhead supply.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/18/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

UA

-

NYSE

Under Armour Inc Cl A

CONSUMER NON-DURABLES - Textile - Apparel Clothing

|

$69.03

|

+0.71

1.04% |

$70.56

|

809,456

98.69% of 50 DAV

50 DAV is 820,200

|

$70.69

-2.35%

|

1/27/2011

|

$58.31

|

PP = $56.99

|

|

MB = $59.84

|

Most Recent Note - 3/29/2011 5:23:20 PM

G - Posted a considerable gain with above average volume, rallying from its 50 DMA line and recent lows defining important chart support. It may be forming a base-on-base pattern, but more damaging losses would hurt its outlook.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/7/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$48.71

|

+0.92

1.93% |

$48.80

|

291,190

47.02% of 50 DAV

50 DAV is 619,300

|

$48.67

0.08%

|

1/6/2011

|

$36.12

|

PP = $37.34

|

|

MB = $39.21

|

Most Recent Note - 3/29/2011 7:21:00 PM

G - Quietly touched a new all-time high on the prior session and pulled back today. It has been stubbornly holding its ground after a spurt of volume-driven gains. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/29/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|