You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Saturday, February 15, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, NOVEMBER 8TH, 2016

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+73.14 |

18,332.74 |

+0.40% |

|

Volume |

869,440,200 |

-2% |

|

Volume |

1,589,167,270 |

-9% |

|

NASDAQ |

+27.32 |

5,193.49 |

+0.53% |

|

Advancers |

1,665 |

57% |

|

Advancers |

1,554 |

55% |

|

S&P 500 |

+8.04 |

2,139.56 |

+0.38% |

|

Decliners |

1,253 |

43% |

|

Decliners |

1,267 |

45% |

|

Russell 2000 |

+2.89 |

1,195.14 |

+0.24% |

|

52 Wk Highs |

91 |

|

|

52 Wk Highs |

61 |

|

|

S&P 600 |

+1.78 |

726.04 |

+0.25% |

|

52 Wk Lows |

56 |

|

|

52 Wk Lows |

84 |

|

|

|

Indices Rebound Further With Less Volume While Awaiting Election Results

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Stocks finished higher on Tuesday. The Dow was up 72 points to 18332. The S&P 500 added 8 points to 2139 and the Nasdaq Composite gained 27 points to 5193. The S&P 500 Index rallied after finding impressive support at its 200 DMA line. However, volume totals behind the gains were again reported lighter than the prior session totals on the NYSE and lower on the Nasdaq exchange, leaving questions concerning the intensity of buying conviction from institutional investors. Breadth was slightly positive as advancers led decliners by 4-3 on the NYSE and 5-4 on the Nasdaq exchange. Leadership improved as there were 32 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, up from 28 on the prior session. New 52-week highs outnumbered new 52-week lows on the NYSE, but new lows still outnumbered new 52-week highs on the Nasdaq exchange.

PICTURED: The S&P 500 Index rallied near its 50-day moving average (DMA) line which may act as resistance as it did in recent months. Recent lows define important support to watch along with its 200 DMA line. Subsequent violations would raise more serious concerns. Damage remains on the charts of the major averages (M criteria) while the benchmark S&P 500 Index and the Nasdaq Composite Index both remain below their respective 50 DMA lines. Therefore, subsequent losses having the look of a more serious "correction" may prompt disciplined investors to keep reducing exposure to stocks. As more recognized strength and leadership returns, new buying efforts should only be made in candidates with superior fundamental and technical characteristics. The Featured Stocks Page lists noteworthy high-ranked leaders.

The major averages pared early losses and finished positive on the session as investors await results of Tuesday’s U.S. presidential election. Interest rate expectations continued to increase amid the election news. According to Bloomberg data, futures are currently pricing an 88% probability of a rate hike by December versus 76% odds last week. On the data front, a Job Openings and Labor Turnover Survey update revealed job openings increased to 5.49 million in September.

Ten of 11 sectors in the S&P 500 ended in positive territory. In earnings, Priceline Group (PCLN +6.61%) gapped up for new highs as the company’s revenue beat Street expectations. ACADIA Pharmaceuticals (ACAD+16.75%) rose amid solid prescription growth in the quarter. Tech shares advanced with Microchip (MCHP +2.78%) after being the subject of positive analyst commentary. In Health Care, Valeant Pharmaceuticals (VRX -21.69%) fell as the drugmaker widely missed quarterly profit estimates. Shares of CVS Health (CVS -11.8%) fell after the company cut its full-year forecast. In the consumer space, Hertz Rental Car (HTZ -22.50%) dropped amid lower-than-expected rental volume.

Treasuries declined along the curve with the benchmark 10-year note down 12/32 to yield 1.86%. In commodities, NYMEX WTI crude slipped 0.1% to $44.86/barrel. COMEX gold lost 0.2% to $1276.400/ounce. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Tech, Retail, and Broker/Dealer Indexes Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

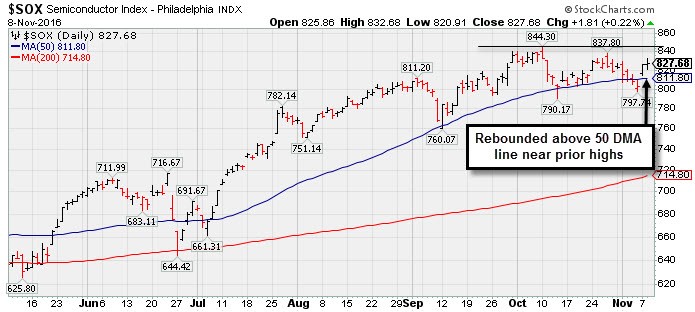

The Retail Index ($RLX +0.47%) and the Broker/Dealer Index ($XBD +0.22%) tallied small gains on Tuesday while the Bank Index ($BKX -0.36%) edged lower. The Biotechnology Index ($BTK +1.22%), Networking Index ($NWX +0.84%), and the Semiconductor Index ($SOX +0.22%) rose. The Oil Services Index ($OSX -0.34%) and the Integrated Oil Index ($XOI -0.22%) both edged lower while the Gold & Silver Index ($XAU +0.54%) gained ground. Charts courtesy www.stockcharts.com

PICTURED: The Semiconductor Index ($SOX +0.22%) rebounded near record highs after finding prompt support near its 50-day moving average (DMA) line.

| Oil Services |

$OSX |

151.03 |

-0.52 |

-0.34% |

-4.25% |

| Integrated Oil |

$XOI |

1,148.24 |

-2.48 |

-0.22% |

+7.04% |

| Semiconductor |

$SOX |

827.68 |

+1.81 |

+0.22% |

+24.75% |

| Networking |

$NWX |

411.72 |

+3.43 |

+0.84% |

+9.52% |

| Broker/Dealer |

$XBD |

171.85 |

+0.38 |

+0.22% |

-3.50% |

| Retail |

$RLX |

1,325.42 |

+6.25 |

+0.47% |

+3.27% |

| Gold & Silver |

$XAU |

87.19 |

+0.47 |

+0.54% |

+92.47% |

| Bank |

$BKX |

75.14 |

-0.27 |

-0.36% |

+2.82% |

| Biotech |

$BTK |

3,041.76 |

+36.63 |

+1.22% |

-20.25% |

|

|

|

|

Seriously Applying the Fact-Based System Now

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Asset Management Services Using the Fact-Based Investment System You can have professional help in limiting your losses and maximizing your gains in all market environments. For help with how your portfolio is managed click here and indicate "Find a Broker". Account minimum $250,000. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

TDG

-

NYSE

Transdigm Group Inc

AEROSPACE/DEFENSE - Aerospace/Defense Products and; Services

|

$272.75

|

+2.30

0.85% |

$274.29

|

253,064

63.42% of 50 DAV

50 DAV is 399,000

|

$294.38

-7.35%

|

10/25/2016

|

$268.12

|

PP = $269.41

|

|

MB = $282.88

|

Most Recent Note - 11/7/2016 5:47:43 PM

Y - Posted a gain today with +39% above average volume conviction. Previously noted - "Gains above a stock's pivot point must be backed by at least +40% above average volume to trigger a proper new (or add-on) technical buy signal. Rebounded above its 50 DMA line with volume-driven gains after issuing a Special Dividend effective 10/20/16."

>>> FEATURED STOCK ARTICLE : Rebound Above 50-Day Moving Average Line Needed - 10/19/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CSFL

-

NASDAQ

Centerstate Banks Inc

Banks-Southeast

|

$18.59

|

-0.08

-0.43% |

$18.75

|

258,312

153.76% of 50 DAV

50 DAV is 168,000

|

$19.08

-2.57%

|

10/10/2016

|

$18.20

|

PP = $18.37

|

|

MB = $19.29

|

Most Recent Note - 11/8/2016 12:30:54 PM

Most Recent Note - 11/8/2016 12:30:54 PM

Y - Gapped up on the prior session and its 50 DMA line and prior highs define near-term support in the $18 area. Subsequent losses leading to violations would trigger technical sell signals.

>>> FEATURED STOCK ARTICLE : Challenged 52-Week High With Another Volume-Driven Gain - 10/10/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NTES

-

NASDAQ

Netease Inc Adr

INTERNET - Internet Information Providers

|

$248.96

|

-2.22

-0.88% |

$251.90

|

876,201

74.19% of 50 DAV

50 DAV is 1,181,000

|

$272.58

-8.67%

|

6/29/2016

|

$182.42

|

PP = $186.55

|

|

MB = $195.88

|

Most Recent Note - 11/7/2016 5:50:03 PM

G - Gapped up today for a solid gain on average volume. Its 50 DMA line and recent lows define important support to watch. It is extended from any sound base.

>>> FEATURED STOCK ARTICLE : Very Extended From Base Following Additional Gains - 10/21/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

HTHT

-

NASDAQ

China Lodging Group Ads

LEISURE - Lodging

|

$46.35

|

+0.94

2.07% |

$46.65

|

228,679

156.63% of 50 DAV

50 DAV is 146,000

|

$47.72

-2.87%

|

9/29/2016

|

$46.12

|

PP = $47.82

|

|

MB = $50.21

|

Most Recent Note - 11/8/2016 12:35:06 PM

Most Recent Note - 11/8/2016 12:35:06 PM

Y - Considerable volume-driven gains helped it rebound above its 50 DMA line ($45.07) to nearly challenge its 52-week high. Gains with more than +40% above average volume while rising above the pivot point may trigger a new (or add on) technical buy signal. Halted its slide in the $41 area. Subsequent losses leading to deterioration below recent lows would raise greater concerns.

>>> FEATURED STOCK ARTICLE : Still Building on New Base Pattern - 10/25/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LMAT

-

NASDAQ

Lemaitre Vascular Inc

Medical-Products

|

$21.77

|

-0.12

-0.55% |

$21.85

|

144,864

88.33% of 50 DAV

50 DAV is 164,000

|

$22.50

-3.24%

|

10/27/2016

|

$21.03

|

PP = $22.60

|

|

MB = $23.73

|

Most Recent Note - 11/7/2016 6:00:56 PM

Y - Today's big volume-driven gain led to a best-ever close. The pivot point cited was based on its 9/20/16 high plus 10 cents. Subsequent volume-driven gains for new highs may trigger a technical buy signal following a base-on-base pattern. Little resistance remains due to overhead supply.

>>> FEATURED STOCK ARTICLE : Challenged 52-Week High With Gap Up and Volume-Driven Gain - 10/27/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

SFBS

-

NASDAQ

Servisfirst Bancshares

BANKING - Regional - Southeast Banks

|

$54.16

|

+0.19

0.35% |

$54.59

|

76,282

123.04% of 50 DAV

50 DAV is 62,000

|

$54.42

-0.48%

|

7/19/2016

|

$53.28

|

PP = $52.82

|

|

MB = $55.46

|

Most Recent Note - 11/7/2016 5:45:53 PM

Y - Posted a gain with above average volume today for its second-best close ever. Found support near its 50 DMA line in recent weeks. More damaging losses would raise concerns. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Relative Strength Improved as Bullish Action Has Continued - 11/7/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

OLLI

-

NASDAQ

Ollie's Bargain Outlet

Retail-DiscountandVariety

|

$26.80

|

+0.25

0.94% |

$27.10

|

285,612

26.23% of 50 DAV

50 DAV is 1,089,000

|

$28.72

-6.69%

|

10/4/2016

|

$27.36

|

PP = $28.70

|

|

MB = $30.14

|

Most Recent Note - 11/7/2016 5:52:46 PM

Y - Color code is changed to yellow after it rebounded above its 50 DMA line ($26.43) helping its outlook improve. Still faces near-term resistance up through the $27-28 level. Members were repeatedly reminded - "Volume-driven gains above the pivot point are still needed to trigger a convincing technical buy signal."

>>> FEATURED STOCK ARTICLE : Gapped Up on News Being Added to S&P 600 Small Cap Index - 10/4/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|