You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Sunday, April 27, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, NOVEMBER 5TH, 2019

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+30.52 |

27,492.63 |

+0.11% |

|

Volume |

988,807,820 |

+4% |

|

Volume |

2,262,427,180 |

+6% |

|

NASDAQ |

+1.48 |

8,434.68 |

+0.02% |

|

Advancers |

1,321 |

46% |

|

Advancers |

1,636 |

53% |

|

S&P 500 |

-3.65 |

3,074.62 |

-0.12% |

|

Decliners |

1,551 |

54% |

|

Decliners |

1,465 |

47% |

|

Russell 2000 |

+2.21 |

1,599.61 |

+0.14% |

|

52 Wk Highs |

185 |

|

|

52 Wk Highs |

222 |

|

|

S&P 600 |

+1.37 |

990.18 |

+0.14% |

|

52 Wk Lows |

27 |

|

|

52 Wk Lows |

37 |

|

|

|

Session Leaves Major Indices Perched at Record Highs

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

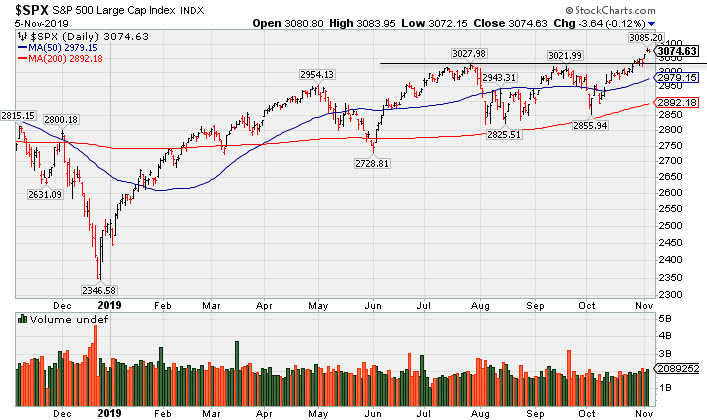

The Dow rose 30 points, extending Monday’s gain in which the blue chip index notched its first all-time high since July. The S&P 500 edged down 0.1%, while the Nasdaq Composite added less than 0.1%. Advancers led decliners by a narrow margin on the Nasdaq exchange while decliners had a narrow lead over advancers on the NYSE. There were 98 high-ranked companies from the Leaders List that hit a new 52-week high and were listed on the BreakOuts Page, versus the total of 1I04 on the prior session. New 52-week highs totals easily outnumbered new 52-week lows totals on the NYSE and on the Nasdaq exchange. The major indices (M criteria) are in a "confirmed uptrend" after enduring distributional pressure in recent weeks. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The S&P 500 Index is perched near its new record high.

Stocks fluctuated on Tuesday, as investors monitored economic data releases, corporate earnings results, and trade developments. Treasuries extended their recent slump, with the yield on the 10-year note up five basis points to 1.85%, near the highest level since September. On the data front, a gauge of service sector activity improved in October, rebounding from a three-year low. Separately, the U.S. trade deficit narrowed in September, while the Jobs Openings and Labor Turnover Survey (JOLTS) revealed job openings dipped to 7.02 million in September.

Trade news also garnered investor attention, as expectations remained elevated for a partial “phase one” trade deal to be signed later this month. Overnight reports suggested Washington is contemplating rescinding plans to impose additional tariffs on Chinese goods in December, and would consider removing duties that were imposed in September. Amid the trade optimism, WTI crude added 1.1% to $57.15/barrel. COMEX gold fell 1.7% to $1,485.80/ounce amid a stronger dollar.

Six of 11 S&P 500 sectors finished in positive territory. In earnings, Regeneron Pharmaceuticals (REGN +6.93%) rose after topping consensus earnings and sales estimates. Marriott International (MAR +2.71%) rose despite a bottom line miss and a reduction to its full-year outlook. Adobe (ADBE +4.25%) rose after offering profit guidance ahead of expectations. In other corporate news, Walgreens Boots Alliance (WBA +2.62%) rose amid reports the pharmacy chain is considering going private.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Bank and Networking Indexes Led Group Gainers

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX +0.83%) posted a solid gain while the Broker/Dealer Index ($XBD +0.05%) and the Retail Index ($RLX -0.05%) both finished flat. The tech sector was mixed as the Networking Index ($NWX +0.85%) outpaced the Semiconductor Index ($SOX +0.19%) | | | |