You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Sunday, April 27, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, NOVEMBER 1ST, 2019

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+301.13 |

27,347.36 |

+1.11% |

|

Volume |

854,921,930 |

-26% |

|

Volume |

2,054,795,639 |

-9% |

|

NASDAQ |

+94.04 |

8,386.40 |

+1.13% |

|

Advancers |

2,122 |

73% |

|

Advancers |

2,386 |

77% |

|

S&P 500 |

+29.35 |

3,066.91 |

+0.97% |

|

Decliners |

771 |

27% |

|

Decliners |

727 |

23% |

|

Russell 2000 |

+26.88 |

1,589.33 |

+1.72% |

|

52 Wk Highs |

181 |

|

|

52 Wk Highs |

189 |

|

|

S&P 600 |

+15.07 |

980.42 |

+1.56% |

|

52 Wk Lows |

24 |

|

|

52 Wk Lows |

47 |

|

|

|

Major Indices Posted Solid Gains With Impressive Leadership

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

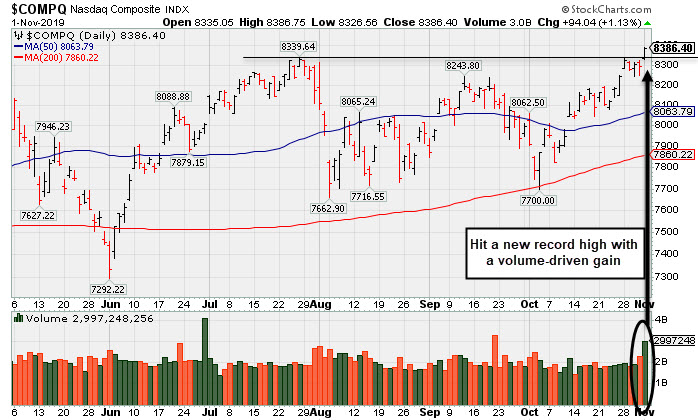

The S&P 500 rallied 1% to another record closing high to cap a fourth-straight weekly gain. The Dow climbed 301 points, while the Nasdaq Composite advanced 1.1%, also ending the day at an all-time high. For the week, the S&P 500 rose 1.5%, while the Dow and Nasdaq Composite were each up 1.4% and 1.7%, respectively. Advancers led decliners by almost a 3-1 margin on the NYSE and more than 3-1 on the Nasdaq exchange. There were 81 high-ranked companies from the Leaders List that hit a new 52-week high and were listed on the BreakOuts Page, versus the total of 53 on the prior session. New 52-week highs totals expanded and easily outnumbered shrinking new 52-week lows totals on the NYSE and on the Nasdaq exchange. The major indices (M criteria) are in a "confirmed uptrend" after enduring distributional pressure in recent weeks. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The Nasdaq Composite Index hit a new record high with a solid volume-driven gain.

Stocks finished firmly higher Friday, as investors digested better-than-expected economic data and the latest trade headlines. On the data front, the Labor Department’s non-farm payrolls report showed 128,000 jobs were added in October, exceeding analyst expectations of an 85,000 uptick. The unemployment rate rose to 3.6% from a 50-year low of 3.5%. Separately, the Institute for Supply Management’s gauge showed manufacturing activity improved slightly in October, though remained in contractionary territory for the third-consecutive month. Treasuries declined, with the yield on the 10-year note up four basis points to 1.72%. In commodities, WTI crude added 3.7% to $56.20/barrel, paring its weekly decline to 1%.

Risk sentiment was also supported on reassurance from President Trump, who said that Washington and Beijing would determine a new meeting site to sign a “Phase One” trade agreement later this month. Separately, Chinese officials stated a “consensus on principles” was reached with the U.S. during discussions this week.

Nine of 11 S&P 500 sectors closed in positive territory, with Real Estate and Utilities the laggards. Energy shares paced gains with Exxon Mobil (XOM +3.00%) rising following its positive quarterly results. In M&A news, Fitbit (FIT +15.53%) rose after Google parent Alphabet (GOOGL +1.07%) agreed to purchase the smartwatch maker.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Energy Groups Outpaced Financial, Retail, Semiconductor, and Biotech

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX +1.93%) and the Broker/Dealer Index ($XBD +1.61%) both posted solid gains and outpaced the Retail Index ($RLX +0.85%). The tech sector was mixed as the Semiconductor Index ($SOX +2.34%) and the Biotech Index ($BTK +2.36%) each posted solid gains but the , N | | | |