You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Saturday, April 5, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - THURSDAY, OCTOBER 22ND, 2020

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+152.84 |

28,363.66 |

+0.54% |

|

Volume |

844,436,440 |

-1% |

|

Volume |

3,387,095,100 |

-1% |

|

NASDAQ |

+21.50 |

11,506.20 |

+0.19% |

|

Advancers |

2,077 |

69% |

|

Advancers |

2,169 |

64% |

|

S&P 500 |

-28.79 |

3,467.31 |

-0.82% |

|

Decliners |

921 |

31% |

|

Decliners |

1,242 |

36% |

|

Russell 2000 |

+26.48 |

1,630.25 |

+1.65% |

|

52 Wk Highs |

49 |

|

|

52 Wk Highs |

72 |

|

|

S&P 600 |

+13.85 |

928.92 |

+1.51% |

|

52 Wk Lows |

26 |

|

|

52 Wk Lows |

40 |

|

|

|

Major Indices Rose With Lighter Volume and Less Leadership

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

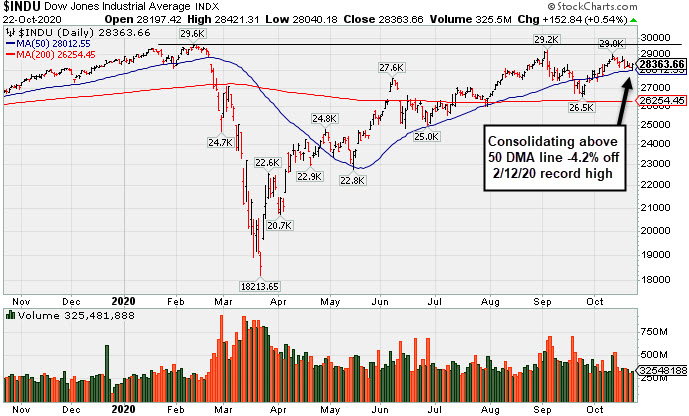

The Dow added 152 points, while the S&P 500 gained 0.5%. The Nasdaq Composite advanced 0.2%. The reported volume totals were slightly lighter than the prior session on the NYSE and on the Nasdaq exchange. Breadth was positive as advancers led decliners by a 2-1 margin on the NYSE and nearly a 2-1 margin on the Nasdaq exchange. There were 27 high-ranked companies from the Leaders List that hit new 52-week highs and were listed on the BreakOuts Page, versus the total of 31 on the prior session. New 52-week highs totals outnumbered new 52-week lows totals on the NYSE and on the Nasdaq exchange. The major indices are in a confirmed uptrend (M criteria). New buying efforts may be justified in leading stocks on a case-by-case basis.  PICTURED: The Dow Jones Industrial Average is consolidating above its 50-day moving average (DMA) line and -4.2% off its record high.

Stocks ended higher in choppy trading Thursday, as investors digested upbeat economic data and a slew of corporate earnings reports. Fiscal stimulus also remained in focus, as talks between the White House and Democrats resumed today. House Speaker Nancy Pelosi boosted investor sentiment after suggesting a stimulus deal is “just about there.”

Eight of 11 S&P 500 sectors finished the day in positive territory with the Energy group adding more than 4.0%. In earnings, Coca-Cola (KO +1.38%) rose after beating analyst estimates on both the top and bottom line. AT&T (T +5.84%) rose after noting that subscribers for its HBO and HBO Max streaming services topped its own estimates. Tesla (TSLA +0.75%) edged higher after reporting its fifth consecutive quarter of profits and reaffirming its projected delivery outlook. In the gaming space, Las Vegas Sands (LVS +8.42%) rose amid a “positive recovery trajectory” overseas with domestic results contributing to better than expected numbers. In other corporate news, Gilead Sciences (GILD +0.76%) edged higher with the FDA approving its coronavirus antiviral drug Remdesivir.

On the data front, initial jobless claims declined to 787,000 in the most recent week, below expectations of 870,000 and last week’s downwardly revised 842,000 figure. An update on September existing home sales surged to its highest level in 14 years as record low mortgage rates continue to attract buyers. Treasuries weakened, with the yield on the 10-year note rising five basis points to 0.86%. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Energy, Financial, and Biotech Indexes Led Group Gainers

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Financials helped underpin the major indices as the Bank Index ($BKX +3.73%) outpaced the Broker/Dealer Index ($XBD +1.11%), meanwhile, the Retail Index ($RLX -0.37%) edged lower. The Biotech Index ($BTK +1.47%) outpaced the Networking Index ($NWX +0.77%) while the Semiconductor Index ($SOX +0.13%) inched higher. The energy-linked groups were standout gainers as the Oil Services Index ($OSX +2.82%) and Integrated Oil Index ($XOI +3.20%) rose, meanwhile, the Gold & Silver Index ($XAU -1.13%) was a clear laggard as it ended the session lower. PICTURED: The Networking Index ($NWX +0.77%) is consolidating near its 50-day moving average (DMA) line.

| Oil Services |

$OSX |

29.56 |

+0.81 |

+2.82% |

-62.24% |

| Integrated Oil |

$XOI |

600.77 |

+18.64 |

+3.20% |

-52.72% |

| Semiconductor |

$SOX |

2,370.32 |

+3.06 |

+0.13% |

+28.15% |

| Networking |

$NWX |

565.68 |

+4.31 |

+0.77% |

-3.04% |

| Broker/Dealer |

$XBD |

305.93 |

+3.37 |

+1.11% |

+5.36% |

| Retail |

$RLX |

3,454.48 |

-12.83 |

-0.37% |

+41.04% |

| Gold & Silver |

$XAU |

146.41 |

-1.67 |

-1.13% |

+36.93% |

| Bank |

$BKX |

80.37 |

+2.89 |

+3.73% |

-29.11% |

| Biotech |

$BTK |

5,378.31 |

+77.88 |

+1.47% |

+6.13% |

|

|

|

|

Slump Below 50-Day Moving Average Again Raises Concerns

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Adobe Inc (ADBE -$12.36 or -2.49% to $483.60) slumped to close below its 50-day moving average (DMA) line ($487) with today's loss on higher (near average) volume raising some concerns and its color code was changed to green. Only a prompt rebound above the 50 DMA line would help its outlook improve. The prior low ($452 on 9/18/20) defines the next important support level to watch.

ADBE now faces some near-term resistance due to overhead supply up to the $536 level. Fundamentals remain strong. It was last shown in this FSU section on 10/08/20 with an annotated graph under the headline, "Showed Resilience Near 50-Day Moving Average" after highlighted in yellow in the 9/10/20 mid-day report (read here). It was noted that after finding support at its 10 week-moving average (WMA). A valid secondary buy point exists up to 5% above the latest high. Disciplined investors always limit losses by selling any stock that falls more than 7-8% from their purchase price.

This well-known Computer Software - Desktop firm reported Aug '20 quarterly earnings +25% on +14% sales revenues versus the year ago period, which marked its 4th consecutive quarterly earnings increase above the +25% minimum guideline (C criteria). Annual earnings history (A criteria) has been strong and steady.

It has a large supply of 479.7 million shares outstanding (S criteria) which makes it a less likely sprinter. However, the number of top-rated funds owning its shares rose from 3,285 in Sep '19 to 3,985 in Sep '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.1 is an unbiased indication its shares have been under slight accumulation over the past 50 days. It has an A Timeliness Rating and a B Sponsorship rating, however, its Accumulation/Distribution rating is currently a D+. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ADBE

-

NASDAQ

ADBE

-

NASDAQ

Adobe Inc

COMPUTER SOFTWARE and SERVICES - Application Software

|

$483.60

|

-12.36

-2.49% |

$496.86

|

2,611,374

84.65% of 50 DAV

50 DAV is 3,085,000

|

$536.88

-9.92%

|

9/10/2020

|

$488.46

|

PP = $536.88

|

|

MB = $563.72

|

Most Recent Note - 10/22/2020 5:31:18 PM

Most Recent Note - 10/22/2020 5:31:18 PM

G - Color code is changed to green after slumping below its 50 DMA line ($487.83) with today's loss. Only a prompt rebound above the 50 DMA line would help its outlook improve. Fundamentals remain strong. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Slump Below 50-Day Moving Average Again Raises Concerns - 10/22/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CRL

-

NYSE

CRL

-

NYSE

Charles River Labs Intl

DRUGS - Biotechnology

|

$233.93

|

+4.84

2.11% |

$234.80

|

316,484

103.09% of 50 DAV

50 DAV is 307,000

|

$250.29

-6.54%

|

7/15/2020

|

$192.66

|

PP = $189.95

|

|

MB = $199.45

|

Most Recent Note - 10/22/2020 5:39:00 PM

Most Recent Note - 10/22/2020 5:39:00 PM

G - Consolidating above prior highs and above its 50 DMA line ($223) which define near-term support to watch. Due to report Sep '20 quarterly results on 10/29/20. Volume and volatility often increase near earnings news.

>>> FEATURED STOCK ARTICLE : New Record High for Charles River Labs - 10/9/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

AMD

-

NASDAQ

AMD

-

NASDAQ

Advanced Micro Devices

ELECTRONICS - Semiconductor - Broad Line

|

$79.42

|

+0.22

0.28% |

$80.82

|

36,447,860

71.58% of 50 DAV

50 DAV is 50,921,000

|

$94.28

-15.76%

|

8/31/2020

|

$90.42

|

PP = $87.39

|

|

MB = $91.76

|

Most Recent Note - 10/19/2020 1:50:12 PM

G - Consolidating near its 50 DMA line ($82.08) with volume totals cooling. Reportedly is considering buying Xilinx Inc (XLNX). Damaging deterioration below the 50 DMA line and the recent low ($73.85 on 9/18/20) would raise greater concerns and trigger more worrisome technical sell signals. It has not formed a sound base and faces some near-term resistance due to overhead supply up to the $94 level. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Consolidating Just Above 50-Day Moving Average - 10/14/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

TER

-

NASDAQ

TER

-

NASDAQ

Teradyne Inc

ELECTRONICS - Semiconductor Equipment and Mate

|

$90.94

|

-1.13

-1.23% |

$92.75

|

2,166,222

94.72% of 50 DAV

50 DAV is 2,287,000

|

$93.44

-2.68%

|

10/21/2020

|

$92.22

|

PP = $93.54

|

|

MB = $98.22

|

Most Recent Note - 10/21/2020 5:57:03 PM

Y - Challenged its all-time high with today's 3rd consecutive gain backed by ever-increasing volume. A Subsequent gain above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. Reported earnings +53% on +41% sales revenues for the Sep '20 quarter versus the year ago period, its 4th consecutive quarterly comparison with earnings above the +25% minimum earnings guideline (C criteria). Sequential comparisons show encouraging acceleration in its sales revenues growth rate. Its annual earnings (A criteria) history has been strong. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Challenging All-Time High With Volume-Drive Gain - 10/21/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

TREX

-

NYSE

TREX

-

NYSE

Trex Company Inc

MATERIALS and CONSTRUCTION - General Building Materials

|

$75.34

|

+0.66

0.88% |

$76.14

|

631,576

79.85% of 50 DAV

50 DAV is 791,000

|

$81.23

-7.25%

|

6/26/2020

|

$54.53

|

PP = $66.47

|

|

MB = $69.79

|

Most Recent Note - 10/22/2020 5:36:22 PM

Most Recent Note - 10/22/2020 5:36:22 PM

G - Halted its slide with a small gain today after a streak of 6 consecutive losses with below average volume. Any subsequent losses below the 50 DMA line ($72.95) or recent low ($63.32 on 9/21/20) would raise concerns and trigger technical sell signals. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Recently Wedged Into New High Territory - 10/16/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

NFLX

-

NASDAQ

NFLX

-

NASDAQ

Netflix Inc

SPECIALTY RETAIL - Music and Video Stores

|

$485.23

|

-3.82

-0.78% |

$495.14

|

6,967,256

114.12% of 50 DAV

50 DAV is 6,105,000

|

$575.37

-15.67%

|

10/14/2020

|

$547.45

|

PP = $557.39

|

|

MB = $585.26

|

Most Recent Note - 10/21/2020 12:18:32 PM

G - Reported earnings +18% on +23% sales revenues for the Sep '20 quarter, below the +25% minimum earnings guideline (C criteria). Gapped down today violating its 50 DMA line ($506) triggering a technical sell signal, and its color code was changed to green due to fundamental and technical deterioration. Recent low ($458.60 on 9/18/20) defines the next important near term support where any further deterioration would raise serious concerns and trigger a more worrisome technical sell signal.

>>> FEATURED STOCK ARTICLE : Encountered Distributional Pressure When Poised for Breakout - 10/15/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LGIH

-

NASDAQ

LGIH

-

NASDAQ

L G I Homes Inc

Bldg-Resident/Comml

|

$112.27

|

-6.23

-5.26% |

$119.41

|

426,163

163.28% of 50 DAV

50 DAV is 261,000

|

$132.98

-15.57%

|

10/1/2020

|

$123.17

|

PP = $124.04

|

|

MB = $130.24

|

Most Recent Note - 10/22/2020 5:16:49 PM

Most Recent Note - 10/22/2020 5:16:49 PM

G - Color code is changed to green after today's 2nd consecutive volume-driven loss violated its 50 DMA line ($116.60) triggering a technical sell signal. A prompt rebound above the 50 DMA line is needed for its outlook to improve. Members were cautioned with a recent note - "Recent gains above the new pivot point lacked the +40% above average volume needed to clinch a proper new (or add-on) technical buy signal."

>>> FEATURED STOCK ARTICLE : Hovering Near High But Recent Gains Lacked Great Volume - 10/19/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NOW

-

NYSE

NOW

-

NYSE

Servicenow Inc

Computer Sftwr-Enterprse

|

$505.96

|

-4.32

-0.85% |

$513.55

|

856,090

61.90% of 50 DAV

50 DAV is 1,383,000

|

$533.37

-5.14%

|

8/20/2020

|

$453.34

|

PP = $454.79

|

|

MB = $477.53

|

Most Recent Note - 10/19/2020 1:52:30 PM

G - Posting a 3rd consecutive gain today with below average volume for yet another new all-time high. Found support at its 50 DMA line ($472) but did not form a new base of sufficient length. Fundamentals remain strong. Any losses below the 50 DMA line and prior low ($432.85 on 9/08/20) would raise concerns and trigger technical sell signals.

>>> FEATURED STOCK ARTICLE : Record High With Light Volume Behind 3rd Consecutive Gain - 10/13/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

VEEV

-

NYSE

VEEV

-

NYSE

Veeva Systems Inc Cl A

Computer Sftwr-Medical

|

$290.75

|

-4.08

-1.38% |

$297.85

|

619,785

77.38% of 50 DAV

50 DAV is 801,000

|

$313.99

-7.40%

|

10/6/2020

|

$287.71

|

PP = $298.86

|

|

MB = $313.80

|

Most Recent Note - 10/22/2020 5:34:57 PM

Most Recent Note - 10/22/2020 5:34:57 PM

Y - Slumping back below its pivot point with recent losses on lighter than average volume raising some concerns. The 50 DMA line ($278.58) defines important near-term support where a violation would trigger a technical sell signal. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : First Sound Base Being Built After Considerable Rally - 10/6/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

TEAM

-

NASDAQ

TEAM

-

NASDAQ

Atlassian Corp Plc Cl A

Comp Sftwr-Spec Enterprs

|

$203.08

|

-3.91

-1.89% |

$209.80

|

1,993,914

124.70% of 50 DAV

50 DAV is 1,599,000

|

$216.30

-6.11%

|

10/12/2020

|

$193.77

|

PP = $199.60

|

|

MB = $209.58

|

Most Recent Note - 10/22/2020 12:20:02 PM

Most Recent Note - 10/22/2020 12:20:02 PM

Y - Color code is changed to yellow while pulling back from its 52-week highs and below its "max buy" level. Prior highs in the $199 area define initial support to watch above its 50 DMA line.

>>> FEATURED STOCK ARTICLE : TEAM Perched Within Close Striking Distance of New Highs - 10/12/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|