2/6/2015 12:08:12 PM - Gapped up for a considerable gain and new 52-week high today. Reported earnings -3% on +20% sales for the Dec '14 quarter, a 2nd consecutive quarterly comparison with earnings below the +25% minimum guideline (C criteria) of the fact-based investment system. Deeply undercut its 200 DMA line then rebounded impressively since 8/04/14 when dropped from the Featured Stocks list.

1/28/2015 12:15:18 PM - Hitting a new 52-week high today. Reported earnings +20% on +18% sales for the Sep '14 quarter, below the +25% minimum guideline (C criteria) of the fact-based investment system. Deeply undercut its 200 DMA line then rebounded since noted with caution on 8/04/14 when dropped from the Featured Stocks list.

1/23/2015 12:23:19 PM - Reported earnings +20% on +18% sales for the Sep '14 quarter, below the +25% minimum guideline (C criteria) of the fact-based investment system. Consolidating near its 52-week high, extended from any sound base. Deeply undercut its 200 DMA line then rebounded since noted with caution on 8/04/14 when dropped from the Featured Stocks list.

1/5/2015 12:27:35 PM - Perched near its 52-week high, extended from any sound base. Deeply undercut its 200 DMA line then rebounded since last noted with caution on 8/04/14 when dropped from the Featured Stocks list. Reported earnings +20% on +18% sales for the Sep '14 quarter, below the +25% minimum guideline (C criteria) of the fact-based investment system.

8/4/2014 5:31:14 PM - Holding its ground near its 200 DMA line which may act as support. Faces resistance due to overhead supply and its RS rating has slumped below 80+ guideline. See the latest FSU analysis for more details and new annotated graphs.

7/30/2014 3:51:42 PM - G - Gapped down today for a damaging loss on heavy volume, violating its 50 DMA line and triggering a technical sell signal. Color code is changed to green while trading near its 200 DMA line which may act as support. Reported earnings +42% on +20% sales revenues for the Jun '14 quarter.

7/29/2014 12:18:37 PM - Y - Challenging its 52-week high with today's 6th consecutive gain after finding prompt support at its 50 DMA line. Little resistance remains due to overhead supply up through the $167 level.

7/28/2014 12:06:13 PM - Y - Small gap up today for a 5th consecutive gain after finding prompt support at its 50 DMA line. Little resistance remains due to overhead supply up through the $167 level.

7/22/2014 12:54:24 PM - Y - Rallying with higher volume after finding prompt support at its 50 DMA line, and its color code is changed to yellow. Faces some resistance due to overhead supply up through the $167 level.

7/21/2014 6:17:22 PM - G - Quietly sputtered below its 50 DMA line and its color code is changed to green. Only a prompt rebound would help its outlook improve. Weak action completely negated the recent technical breakout.

7/14/2014 6:20:36 PM - Y - Gain today came on lighter volume. Friday's close below the prior high close ($156.35 on 3/21/14) raised greater concerns and completely negated the recent technical breakout. See latest FSU analysis for more details and new annotated graphs.

7/8/2014 12:40:06 PM - Y - Pulling back today amid widespread weakness. Deterioration leading to a close below the prior high close ($156.35 on 3/21/14) would raise greater concerns and completely negate the recent technical breakout.

7/2/2014 12:18:20 PM - Y - Gapped down today while retreating from its 52-week high. Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price.

6/27/2014 5:03:14 PM - Y - Churned above average volume today while hovering near its 52-week high. A considerable volume-driven gain above its pivot point on 6/23/14 triggered a technical buy signal. No resistance remains due to overhead supply. Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price.

6/23/2014 12:15:56 PM - Y - Hitting a new 52-week high with today's volume-driven gain above its pivot point. No resistance remains due to overhead supply, and a strong finish may clinch a convincing technical buy signal. Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price.

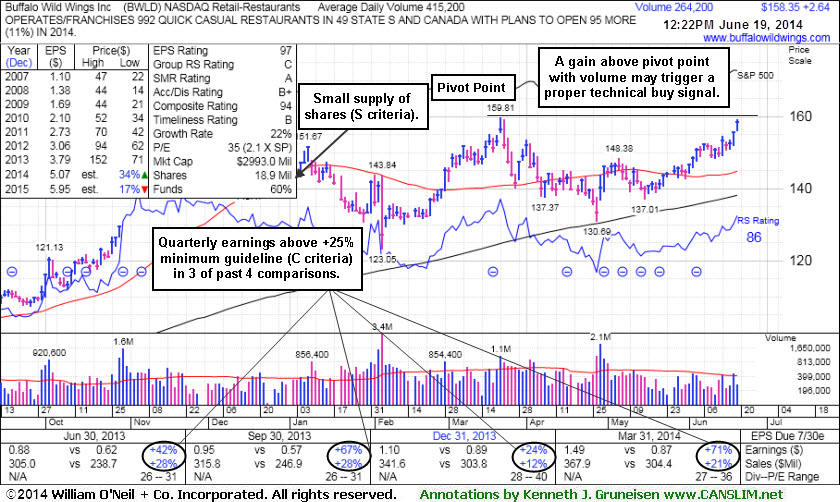

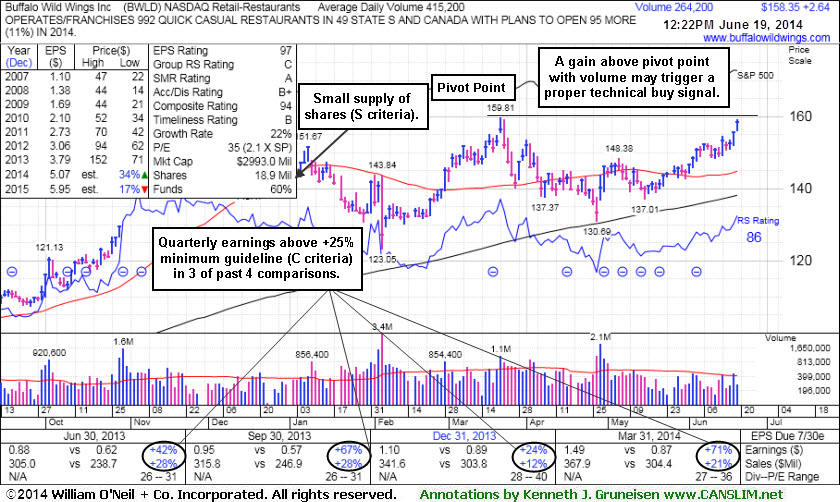

6/19/2014 6:44:24 PM - Y - Highlighted in yellow with pivot point cited based on its 3/21/14 high plus 10 cents in the earlier mid-day report (read here). Challenged its 52-week high with today's 3rd consecutive gain while working on the right side of a 13-week base. Subsequent volume-driven gains above the pivot point are still needed to trigger a proper technical buy signal. Reported earnings +71% on +21% sales revenues for the Mar '14 quarter, an improvement after a slightly sub par quarter. See the latest FSU analysis for more details and new annotated graphs.

6/19/2014 12:38:16 PM - Y - Color code is changed to yellow with pivot point cited based on its 3/21/14 high plus 10 cents. Challenging its 52-week high with today's 3rd consecutive gain while working on the right side of a 13-week base. Subsequent volume-driven gains above the pivot point are still needed to trigger a proper technical buy signal. Reported earnings +71% on +21% sales revenues for the Mar '14 quarter, an improvement after a slightly sub par quarter. Found support at its 200 DMA line then rebounded since last noted with caution in the 4/03/14 mid-day report - "Reported earnings +24% on +12% sales revenues for the Dec '13 quarter."

4/3/2014 12:26:17 PM - Consolidating above its 50 DMA line which acted as support during its consolidation since noted with caution in the 3/24/14 mid-day report - "Reported earnings +24% on +12% sales revenues for the Dec '13 quarter, and fundamental concerns remain."

4/2/2014 12:46:02 PM - Consolidating above its 50 DMA line which acted as support during its consolidation since last noted with caution in the 3/24/14 mid-day report - "Reported earnings +24% on +12% sales revenues for the Dec '13 quarter, and fundamental concerns remain."

3/24/2014 12:07:02 PM - Retreating from the new 52-week and all-time highs hit on the prior session. The 3/21/14 mid-day report cautioned members - "Reported earnings +24% on +12% sales revenues for the Dec '13 quarter, and fundamental concerns remain."

3/21/2014 12:03:58 PM - Hitting new 52-week and all-time highs after gapping up today. Reported earnings +24% on +12% sales revenues for the Dec '13 quarter, and fundamental concerns remain.

2/4/2014 12:46:59 PM - Rebounding near its 50 DMA line which may act as resistance. Repeatedly noted with caution in prior mid-day reports - "Reported earnings +67% on +28% sales revenues for the Sep '13 quarter but fundamental concerns remain."

1/31/2014 12:08:43 PM - Slumped well below its 50 DMA line with volume-driven losses since last noted with caution in the 1/09/14 mid-day report - "Reported earnings +67% on +28% sales revenues for the Sep '13 quarter but fundamental concerns remain."

1/9/2014 12:13:11 PM - Gapped down today, retreating from its 52-week high and testing support near its 50 DMA line again. Reported earnings +67% on +28% sales revenues for the Sep '13 quarter but fundamental concerns remain. Found support above its 50 DMA line during its orderly consolidation since last noted with caution in the 11/15/13 mid-day report - "Reported earnings +42% on +28% sales revenues for the quarter ended June 30, 2013 versus the year ago period. Quarterly earnings increases were below the +25% minimum guideline (C criteria) in 5 prior quarterly comparisons versus the year ago periods. Annual earnings (A criteria) history has been strong."

11/15/2013 12:36:02 PM - Hitting another new 52-week high today. Reported earnings +67% on +28% sales revenues for the Sep '13 quarter but fundamental concerns remain. Held its ground stubbornly and rallied since noted with caution in the 10/02/13 mid-day report - "Reported earnings +42% on +28% sales revenues for the quarter ended June 30, 2013 versus the year ago period. Quarterly earnings increases were below the +25% minimum guideline (C criteria) in 5 prior quarterly comparisons versus the year ago periods. Annual earnings (A criteria) history has been strong."

10/31/2013 12:17:24 PM - Following a considerable gap up gain for another new 52-week high backed by above average volume on the prior session, on track today for a 5th consecutive gain into new high territory. Reported earnings +67% on +28% sales revenues for the Sep '13 quarter but fundamental concerns remain. Held its ground stubbornly and rallied since noted with caution in the 10/02/13 mid-day report - "Reported earnings +42% on +28% sales revenues for the quarter ended June 30, 2013 versus the year ago period. Quarterly earnings increases were below the +25% minimum guideline (C criteria) in 5 prior quarterly comparisons versus the year ago periods. Annual earnings (A criteria) history has been strong."

10/30/2013 12:44:35 PM - Considerable gap up gain for another new 52-week high with today's 4th consecutive gain backed by above average volume. Reported earnings +67% on +28% sales revenues for the Sep '13 quarter but fundamental concerns remain. Held its ground stubbornly and rallied since noted with caution in the 10/02/13 mid-day report - "Reported earnings +42% on +28% sales revenues for the quarter ended June 30, 2013 versus the year ago period. Quarterly earnings increases were below the +25% minimum guideline (C criteria) in 5 prior quarterly comparisons versus the year ago periods. Annual earnings (A criteria) history has been strong."

10/29/2013 12:29:57 PM - Hitting another new 52-week high with today's 3rd consecutive gain backed by above average volume. Held its ground stubbornly and rallied since last noted with caution in the 10/02/13 mid-day report - "Reported earnings +42% on +28% sales revenues for the quarter ended June 30, 2013 versus the year ago period. Quarterly earnings increases were below the +25% minimum guideline (C criteria) in 5 prior quarterly comparisons versus the year ago periods. Annual earnings (A criteria) history has been strong."

10/2/2013 12:26:58 PM - Hitting another new 52-week high with today's 3rd consecutive gain backed by heavy volume. Reported earnings +42% on +28% sales revenues for the quarter ended June 30, 2013 versus the year ago period. Quarterly earnings increases were below the +25% minimum guideline (C criteria) in 5 prior quarterly comparisons versus the year ago periods. Annual earnings (A criteria) history has been strong.

10/1/2013 12:12:01 PM - Hitting a new 52-week high with today's 2nd consecutive gain backed by heavy volume. Reported earnings +42% on +28% sales revenues for the quarter ended June 30, 2013 versus the year ago period. Quarterly earnings increases were below the +25% minimum guideline (C criteria) in 5 prior quarterly comparisons versus the year ago periods. Annual earnings (A criteria) history has been strong.

4/30/2013 12:06:32 PM - Gapped down today, retreating from its 52-week high with a considerable loss on heavy volume. Reported earnings -11% on +21% sales revenues for the quarter ended March 31, 2013 versus the year ago period. Since last noted in the 10/18/12 mid-day report it went through another consolidation below its 200 DMA line and then rebounded in recent months. Strong annual earnings history (A criteria), however earnings increases have been below the +25% minimum guideline (C criteria) in 5 latest quarterly comparisons versus the year ago periods.

10/18/2012 12:25:11 PM - Since last noted in the 3/26/12 mid-day report at its 52-week high it went through a deep consolidation below its 200 DMA line and then rebounded in recent months. The company has a strong annual earnings history (A criteria), however earnings increases have been below the +25% minimum guideline (C criteria) in the Mar and Jun '12 quarterly comparisons versus the year ago periods.

3/26/2012 12:14:06 PM - Considerable gain for a new high after gapping up today. It had been wedging higher in recent weeks without great volume conviction but did not form a sound base pattern. Stubbornly held its ground following a considerable "breakaway gap" for a new all-time high when noted in the 2/08/12 mid-day report - "Tested support at its 200 DMA line recently and rallied back to new highs with volume conviction. Reported earnings +33% on +34% sales revenues for the quarter ended December 31, 2011 versus the year ago period. The C criteria is better satisfied with 3 of the past 4 quarterly comparisons now above the +25% guideline, making it a better match with the fact-based system's guidelines. The company has a strong annual earnings history (A criteria). Breakaway gaps are one noted exception to the rule that investors should avoid chasing stocks more than +5% above prior chart highs, however risk increases that an ordinary pullback may prompt selling rules. Patient investors may watch for secondary buy points to possibly develop and be noted."

2/10/2012 12:02:43 PM - Up again today following a considerable "breakaway gap" for a new all-time high on Wednesday. The 2/08/12 mid-day report noted - "Tested support at its 200 DMA line recently and rallied back to new highs with volume conviction. Reported earnings +33% on +34% sales revenues for the quarter ended December 31, 2011 versus the year ago period. The C criteria is better satisfied with 3 of the past 4 quarterly comparisons now above the +25% guideline, making it a better match with the fact-based system's guidelines. The company has a strong annual earnings history (A criteria). Breakaway gaps are one noted exception to the rule that investors should avoid chasing stocks more than +5% above prior chart highs, however risk increases that an ordinary pullback may prompt selling rules. Patient investors may watch for secondary buy points to possibly develop and be noted."

2/9/2012 11:59:28 AM - Up again today following a considerable "breakaway gap" for a new all-time high on the prior session. The 2/08/12 mid-day report noted - "Tested support at its 200 DMA line recently and rallied back to new highs with volume conviction. Reported earnings +33% on +34% sales revenues for the quarter ended December 31, 2011 versus the year ago period. The C criteria is better satisfied with 3 of the past 4 quarterly comparisons now above the +25% guideline, making it a better match with the fact-based system's guidelines. The company has a strong annual earnings history (A criteria). Breakaway gaps are one noted exception to the rule that investors should avoid chasing stocks more than +5% above prior chart highs, however risk increases that an ordinary pullback may prompt selling rules. Patient investors may watch for secondary buy points to possibly develop and be noted."

2/8/2012 12:28:16 PM - Considerable "breakaway gap" today for a new all-time high. Tested support at its 200 DMA line recently and rallied back to new highs with volume conviction. Reported earnings +33% on +34% sales revenues for the quarter ended December 31, 2011 versus the year ago period. The C criteria is better satisfied with 3 of the past 4 quarterly comparisons now above the +25% guideline, making it a better match with the fact-based system's guidelines. The company has a strong annual earnings history (A criteria). Breakaway gaps are one noted exception to the rule that investors should avoid chasing stocks more than +5% above prior chart highs, however risk increases that an ordinary pullback may prompt selling rules. Patient investors may watch for secondary buy points to possibly develop and be noted.

2/6/2012 12:23:29 PM - Small gap down today after rallying to new 52-week and all-time highs with a streak of 4 consecutive gains. Tested support at its 200 DMA line recently and rallied back. Noted in prior mid-day reports - "Reported earnings +30% on +31% sales revenues for the latest quarter ended September 30, 2011 versus the year ago period. It made a stand above the "neckline" defined by its prior low after mid-day reports noted - 'It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007.'"

2/3/2012 12:18:00 PM - Hitting new 52-week and all-time highs with today's 4th consecutive gain. Tested support at its 200 DMA line last week and rallied back above its 50 DMA line when last noted in the 1/25/12 mid-day report - "Reported earnings +30% on +31% sales revenues for the latest quarter ended September 30, 2011 versus the year ago period. It made a stand above the "neckline" defined by its prior low after mid-day reports noted - 'It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007.'"

1/25/2012 12:08:21 PM - Tested support at its 200 DMA line on the prior session, and rallying above its 50 DMA line today. Reported earnings +30% on +31% sales revenues for the latest quarter ended September 30, 2011 versus the year ago period. It made a stand above the "neckline" defined by its prior low after mid-day reports noted - "It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

1/17/2012 11:50:51 AM - Pulling back today near its 50 DMA line with a 4th consecutive small loss. Reported earnings +30% on +31% sales revenues for the latest quarter ended September 30, 2011 versus the year ago period. It made a stand above the "neckline" defined by its prior low after mid-day reports recently noted - "It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

1/3/2012 12:21:15 PM - Pulling back today from a new 52-week high it quietly touched last week. Reported earnings +30% on +31% sales revenues for the latest quarter ended September 30, 2011 versus the year ago period. It made a stand above the "neckline" defined by its prior low after mid-day reports recently noted - "It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

11/28/2011 12:17:21 PM - Rallying up from support at its 200 DMA line again with today's considerable gain. Reported earnings +30% on +31% sales revenues for the latest quarter ended September 30, 2011 versus the year ago period. It made a stand above the "neckline" defined by its prior low after mid-day reports recently noted - "It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

10/24/2011 12:42:07 PM - Rallying up from support at its 200 DMA line with today's 3rd consecutive gain. Reported earnings +30% on +31% sales revenues for the latest quarter ended September 30, 2011 versus the year ago period. It made a stand above the "neckline" defined by its prior low after mid-day reports recently noted - "It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

10/13/2011 12:18:06 PM - Consolidating near support at its 200 DMA line and above recent chart lows. Prior mid-day reports recently noted - "It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

10/12/2011 12:09:35 PM - Consolidating near support at its 200 DMA line and above recent chart lows. The 9/28/11 mid-day report noted - "It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

9/28/2011 12:20:45 PM - Gapped up today for its 3rd consecutive gain, rising from support near its 200 DMA line. It has the look of an ominous head-and-shoulders pattern formed over the past 5 months. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007.

7/27/2011 12:22:38 PM - Churning heavy volume while consolidating above prior highs and its 50 DMA line defining support in the $64 area. Reported earnings +16% on +26% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Perched near its all-time high after a recent streak of volume-driven gains helped it rise from a base-on-base type pattern. Prior mid-day reports noted - "Technically broke out on 4/14/11 from a base-on-base pattern. No overhead supply exists to act as resistance. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

7/22/2011 12:49:11 PM - Quietly perched at its all-time high. A recent streak of volume-driven gains helped it rise from a base-on-base type pattern. Prior mid-day reports noted - "Technically broke out on 4/14/11 from a base-on-base pattern. No overhead supply exists to act as resistance. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

7/11/2011 12:10:59 PM - Pulling back further today, it touched new all-time highs last week and then reversed into the red. With a streak of volume-driven gains it recently rose from another base-on-base type pattern, and prior mid-day reports noted - "Technically broke out on 4/14/11 from a base-on-base pattern. No overhead supply exists to act as resistance. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

7/8/2011 11:56:52 AM - Touched a new all-time high on the prior session then reversed into the red. With a streak of volume-driven gains it rose from another base-on-base type pattern last week. Prior mid-day reports noted - "Technically broke out on 4/14/11 from a base-on-base pattern. No overhead supply exists to act as resistance. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

7/7/2011 11:58:16 AM - Touched a new all-time high today and then reversed into the red. With a streak of volume-driven gains it rose from another base-on-base type pattern last week. Prior mid-day reports noted - "Technically broke out on 4/14/11 from a base-on-base pattern. No overhead supply exists to act as resistance. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

7/5/2011 12:08:49 PM - Stubbornly holding its ground near all-time highs following a recent streak of volume-driven gains. It rose from another base-on-base type pattern last week. Last noted in the 5/05/11 mid-day report - "Technically broke out on 4/14/11 from a base-on-base pattern. No overhead supply exists to act as resistance. The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons. Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

5/5/2011 9:10:01 AM - Holding its ground near all-time highs with volume totals cooling. Recent mid-day reports noted - "Technically broke out on 4/14/11 from a base-on-base pattern. No overhead supply exists to act as resistance.The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons.

Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

4/28/2011 12:27:22 PM - Hit another new all-time high today. The 4/27/11 mid-day report noted - "Technically broke out on 4/14/11 from a base-on-base pattern. No overhead supply exists to act as resistance.The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons.

Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007."

4/27/2011 12:30:48 PM - Hit a new all-time high today. Technically broke out on 4/14/11 from a base-on-base pattern. No overhead supply exists to act as resistance.The company has a strong annual earnings history (A criteria). The C criteria has not been well satisfied by +25% earnings increases in quarterly comparisons.

Blue triangles beside the quarterly earnings figure in at least the past 8 comparisons indicate pre-tax, non-recurring items were included (where possible, such items are normally removed to provide data better suited for comparison). The restaurant operator survived but failed to impress as it went through several long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007.

4/29/2009 11:34:12 AM - Gapped down rather uneventfully today after reporting its latest quarterly financial results. Recently approaching its Sept '08 chart highs near $45 after a deep "V" shaped consolidation as low as $14.50. Now there is little remaining overhead supply. The company has a strong annual earnings history (the A criteria) while quarterly earnings have been a bit erratic with respect to the C criteria. Its quarterly comparisons show solid sales revenues increases. BWLD quickly produced considerable gains after first featured in yellow in mid-day report on 3/17/07 (read here). The restaurant operator went through 2 long and very deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007.

4/28/2009 11:57:01 AM - Approaching its Sept '08 chart highs near $45 after a deep "V" shaped consolidation as low as $14.50. Now there is little remaining overhead supply. The company has a strong annual earnings history (the A criteria) while quarterly earnings have been a bit erratic with respect to the C criteria. Its quarterly comparisons show solid sales revenues increases. This previously featured restaurant operator went through 2 long and deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007.

4/27/2009 11:14:01 AM - Quietly consolidating after a considerable gain on 4/22/09 with above average volume, approaching prior (Sept '08) chart highs near $45. This previously featured restaurant operator went through 2 long and deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007. Now there is little remaining overhead supply. The company has a strong annual earnings history (the A criteria). Its quarterly comparisons show solid sales revenues with earnings increases near the minimum guidelines.

4/22/2009 11:28:07 AM - Considerable gain today with above average volume has it quickly approaching prior (Sept '08) chart highs near $44-45. This previously featured restaurant operator went through 2 long and deep corrections since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007. Now there is little remaining overhead supply. The company has a strong annual earnings history (the A criteria). Its quarterly comparisons show solid sales revenues with earnings increases near the minimum guidelines.

9/19/2008 12:40:41 PM - Testing prior chart highs near $45. This previously featured restaurant operator went through a long and deep correction since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007. The 2 most recent quarterly comparisons showed better sales revenues and earnings increases, and it has been rallying toward its 52-week and all-time highs. It may encounter resistance in the $42-47 range due to remaining overhead supply.

9/11/2008 1:37:11 PM - This previously featured restaurant operator went through a long and deep correction since it was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007. The 2 most recent quarterly comparisons showed better sales revenues and earnings increases, and it has been rallying toward its 52-week and all-time highs. It may encounter resistance in the $42-47 range due to remaining overhead supply.

9/3/2007 - Monthly Note in Review - Featured at $29.11 (split adjusted) in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with an annotated graph and note that "a break above the pivot point of $59.28 (10 cents above the recent 1/16 high) with the required volume of 50% above the 50 DAV would have it triggering a technical buy signal" (read here). By 3/19/07 it traded above the pivot, yet volume totals were a bit suspect early on. On 3/25/07 it also was featured in the CANSLIM.net Special Report "8 Stocks That Should Now Be On You Watch List" (read here). Two days later it blasted off to new all-time highs on very heavy volume. In the next 3 months it went on to rise +64% above its price when first featured, which included a big bullish gap up on 5/2/07. It split 2-for-1on June 18, 2007 and topped out within a couple of days of the split. By mid-July it was slumping under its 50 DMA line, and CANSLIM.net's 7/25/07 note warned that "price is clearly breaking support" (read here). It gapped down on 8/1/07 for its largest single-day point loss marking its heaviest volume down day, an obvious sell signal. It was dropped from the CANSLIM.net Featured Stocks List on 8/15/2007, and it continues to struggle well under its 50 DMA line.

8/15/2007 6:32:22 PM - G - Closes below its 200 DMA. Has not recoverd since its recent gap down. As previously noted - A close below its 200 DMA and this stock will be removed from the CANSLIM.net Featured Stocks List.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/14/2007 4:10:00 PM - G - Continues trading above its 200 DMA. Has not recoverd since its recent gap down. A close below its 200 DMA and this stock will be removed from the CANSLIM.net Featured Stocks List.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/13/2007 6:44:40 PM - G - Closes with a below average volume decline today after being higher intra-day. Has not recoverd since its recent gap down. A close below its 200 DMA and this stock will be removed from the CANSLIM.net Featured Stocks List.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/10/2007 5:19:17 PM - G - Below average volume declines today. Has not recoverd since its recent gap down. A close below its 200 DMA and this stock will be removed from the CANSLIM.net Featured Stocks List.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/9/2007 - G - Looks to be closing with a gain today on about average volume yet has not recoverd since its recent gap down. A close below its 200 DMA and this stock will be removed from the CANSLIM.net Featured Stocks List.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/8/2007 - G - Trading today on about average volume and looks to be closing near unchanged after yesterday morning's gap open on an upgrade. Still,a close below its 200 DMA and this stock will be removed from the CANSLIM.net Featured Stocks List.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/7/2007 3:48:26 PM - G - Gap open this morning after an upgrade. A close below its 200 DMA and this stock will be removed from the CANSLIM.net Featured Stocks List.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/6/2007 - G - Did dip below the 200 DMA intra-day yet looks to be closing above there. Recent huge gap down after announcing earnings. A close below its 200 DMA and this stock will be removed from the CANSLIM.net Featured Stocks List.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/3/2007 - G - Further declines after a recent huge gap down after announcing earnings. A break below its 200 DMA and it will be removed from the CANSLIM.net Featured Stocks List.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/2/2007 - G - Further declines after yesterday's huge gap down today after announcing earnings. Readers of the CANSLIM.net After market Update saw BWLD noted in the July 26th, 2007 report that evening as follows - ''Continued declines today after yesterday's declines that were clearly breaking support.'' (read here). Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

8/1/2007 - G - Huge gap down today after announcing earnings. Readers of the CANSLIM.net After market Update saw BWLD noted in the July 26th, 2007 report that evening as follows - ''Continued declines today after yesterday's declines that were clearly breaking support.'' (read here). Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 8/1/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/31/2007 - G - Gap open gains today closing above the 50 DMA yet is down 12% in after-market trading. Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/27/2007 4:13:32 PM - G - Dipped intra-day yet closed with a gain as trading continues below the 50 DMA.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/26/2007 - G - Continued declines today after yesterday's declines that were clearly breaking support. Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/25/2007 3:58:09 PM - G - New recent lows today on above average volume is a concern as price is clearly breaking support. Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/24/2007 - G - Continues trading near the 50 DMA ($42.25) yet volume is light. Decent gains since featured at $29.11.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/23/2007 4:20:40 PM - G - Continues trading just below the 50 DMA ($42.24) yet volume is light. Decent gains since featured at $29.11.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/20/2007 5:45:43 PM - G - Continues trading just below the 50 DMA ($42.20) yet volume is light. Decent gains since featured at $29.11.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/19/2007 3:55:21 PM - G - Trading just below the 50 DMA ($42.19) yet volume is light. Decent gains since featured at $29.11.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/18/2007 - G - Trading just below the 50 DMA ($42.14) yet volume is light. Decent gains since featured at $29.11.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/18/2007 - G - Trading just below the 50 DMA ($42.14) yet volume is light. Decent gains since featured at $29.11. Still, a break below there would be a sell signal.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/17/2007 3:33:59 PM - G - Remains near support of the 50 DMA (42.10) with decent gains since featured at $29.11. Still, a break below there would be a sell signal.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/16/2007 4:03:21 PM - G - Remains near support of the 50 DMA (42.03) with decent gains since featured at $29.11. Still, a break below there would be a sell signal.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/13/2007 3:33:38 PM - G - Remains near support of the 50 DMA (41.93) with decent gains since featured at $29.11. Still, a break below there would be a sell signal.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/12/2007 - G - Remains near support of the 50 DMA (41.81) with decent gains since featured at $29.11. Still, a break below there would be a sell signal.Featured at $29.11 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/11/2007 - G - Did dip below its 50 DMA ($41.60) intra-day yet closed above there as volume remains below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a graph annotated by the CANSLIM.net expert staff here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a graph annotated by the CANSLIM.net expert staff here. 2:1 Stock Split was effective on 6/18/2007.

7/10/2007 - G - Continues trading above the 50 DMA ($41.42) as volume has been below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraphs® here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraphs® here. 2:1 Stock Split was effective on 6/18/2007.

7/9/2007 3:23:14 PM - G - Continues trading above the 50 DMA ($41.23) as volume has been below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

7/6/2007 4:50:53 PM - G - Continues trading above the 50 DMA ($41.00) as volume has been below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

7/5/2007 4:41:10 PM - G - Continues trading above the 50 DMA ($40.81) as volume has been below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

7/3/2007 7:05:40 PM - G - Continues trading above the 50 DMA ($40.60) as volume has been below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

7/2/2007 - G - Continues trading above the 50 DMA ($40.42) as volume has been below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/29/2007 4:46:20 PM - G - Continuestrading above the50 DMA ($40.25) as volume has been below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/28/2007 4:11:34 PM - G - Gains continue today from support found at the 50 DMA ($39.89) yet volume was again below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/27/2007 4:29:13 PM - G - Gains today from support found at the 50 DMA ($39.89) yet volume was below average. A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/26/2007 - G - Continued declines today right to support of the 50 DMA ($39.72). A break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/25/2007 - G - Continued declines today after a downgrade on Thursday. Has support near $40 and a break below there would be a sell signal.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 6/25/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/22/2007 4:03:12 PM - G - Continued declines today after a downgrade yesterday. Has support near $40.Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/21/2007 - G - Gap down today after a downgrade. Featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/20/2007 4:08:46 PM - G - Continued gains this morning after yesterday's solid advance today on well above average volume with a new all-time highs close. Adding to gains since featured at $29.87 (split adjusted) in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/20/2007 - G - Continued gains this morning after yesterday's solid advance today on well above average volume with a new all-time highs close. Adding to gains since featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/19/2007 - G - Solid advance today on welll above average volume with a new all-time highs close. Adding to gains since featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/19/2007 - G - Solid advance this morning on welll above average volume. Adding to gains since featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here. 2:1 Stock Split was effective on 6/18/2007.

6/18/2007 - G - Light volume declines today with a 2/1 stock split which PP and Price Featured now reflect.Trading continues as price remains in a consolidation phase since the recent advance. Still trading well above support as ranks remain strong. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here. Scheduled for a 2:1 Stock Split on 6/18/2007.

6/14/2007 - G - Light volume trading continues as price remains in a consolidation phase since the recent advance. Still trading well above support as ranks remain strong. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here. Scheduled for a 2:1 Stock Split on 6/18/2007.

6/14/2007 5:36:06 PM - G - Light volume trading continues as price remainsin a consolidation phase since the recent advance. Still trading well above support as ranks remain strong. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

6/13/2007 3:47:17 PM - G - Makes an advance today the ends a 5 session losing streak. Still trading well above support as ranks remain strong. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

6/12/2007 - G - Continued declines today. Still trading well above support as ranks remain strong. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

6/11/2007 - G - Was advancing first thing this morning yet looks to be closing with a loss although volume is light. Still trading well above support as ranks remain strong. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

6/8/2007 4:21:54 PM - G - Another high volume down day yet closed off of session lows. Still trading well above support as ranks remain strong.

Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

6/7/2007 - G - High volume down day, marking a new recent low close. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

6/5/2007 - G- Price remains near all-time highs as ranks and fundamentals remains solid. Not many willing sellers at this point. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

6/4/2007 8:03:58 PM - G- Gains again today as price is near all-time highs. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/31/2007 4:35:11 PM - G- Slight gain today as price is near all-time highs. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/30/2007 3:59:14 PM - G- Gap down this morning on a downgrade yet not much of a declineas price remainsnear all-time highs. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/29/2007 3:47:17 PM - G- Advances today on below average volume as price is near all-time highs. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/25/2007 - G - Continued declines today on lighter volume as price is near all-time highs. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/24/2007 12:23:04 PM - G - Some declines today on just above average volume as price is near all-time highs. Featured in the CANSLIM.net Special Report - ""8 Stocks That Should be on Your Watchlist"" by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/23/2007 3:44:28 PM - G - Fresh highs today on above average volume, adding to gains since featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/23/2007 - G - Fresh highs today on above average volume, adding to gains since featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/22/2007 - G - Above average volume declines today as price is just off of all-time highs. Featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/22/2007 12:31:20 PM - G - Above average volume declines today, down 2.2%. Featured in the CANSLIM.net Special Report - ""8 Stocks That Should be on Your Watchlist"" by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/21/2007 - G - More gains today on above average volume to new highs, adding to gains since featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/18/2007 12:34:39 PM - G - Gap open this morning after announcing plans to acquire Las Vegas franchised restaurants, adding to gains since featured in the CANSLIM.net Special Report - ""8 Stocks That Should be on Your Watchlist"" by James F. Taulman available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/17/2007 - G - Below average volume advance today. As previously noted -this may be the start of a decline or at least a consolidation period. Recently re-featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman (3/25/2007) available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/16/2007 5:19:33 PM - G - Had some gains intra-day yet cloed near unchanged and off of session lows as volumewas below average. The decrease in the recent overall volume as the stock was making new highs is a concern. As previously noted -this maybe the start of a continued decline or at least a consolidation period. Recently re-featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman (3/25/2007) available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/15/2007 - G - Slight gap open this morning yet is closing with a loss as volume is below average. The decrease in the recent overall volume as the stock was making new highs is a concern. As previously noted -this maybe the start of a continued decline or at least a consolidation period. Recently re-featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman (3/25/2007) available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/14/2007 4:52:08 PM - G - Considerable declines today, down 4.25% as volume was just above average. The decrease in the recent overall volume as the stock was making new highs is a concern. Today's pull-back may be the start of a continued decline or at least a consolidation period. Recently re-featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman (3/25/2007) available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/11/2007 - G - New high close as recent uptrend continues yet today's volume was light. Recently re-featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman (3/25/2007) available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/10/2007 - G - Slight decline today on just below average volume as price is at all-time highs.Recently re-featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman (3/25/2007) available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/9/2007 - G - New highs today yet on just below average volume. Recently re-featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman (3/25/2007) available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/8/2007 - G - Slight declines today on below average volume are no concern after several up days on well above average volume. Recently re-featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlist'' by James F. Taulman (3/25/2007) available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.

5/7/2007 - G - Closes today at an all time high with gains of better than 3% on above average volume adding to gains since featured. Recently re-featured in the CANSLIM.net Special Report - ''8 Stocks That Should be on Your Watchlis'' by James F. Taulman (3/25/2007) available here. First featured in the 03/13/07 CANSLIM.net Mid-Day BreakOuts Report with a DailyGraph here as a setup. Covered in more detail in the 5/04/07 CANSLIM.net After Market Update with a DailyGraph(R) here.