You are not logged in.

This means

you CAN ONLY VIEW reports that were published prior to Wednesday, April 9, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

MIDDAY BREAKOUTS REPORT - THURSDAY, JUNE 19TH, 2014 MIDDAY BREAKOUTS REPORT - THURSDAY, JUNE 19TH, 2014

Previous Mid Day Report Next Mid Day Report >>>

|

|

DOW 16859.11 -47.58 (-0.28%) | NASDAQ 4342.1 -20.74 (-0.48%) | S&P 500 1954.36 -2.62 (-0.13%)

|

Time of Screening :

6/19/2014 12:07:07 PM Report Released :

6/19/2014 1:20:17 PM

Price is:

Above 52W High and Less Than 52W High

but within 10% of the 52 Week High

Volume Is:

At least 57.5% of 50 Day Average at

the time of the screening.

More details about this report...

At around

mid-way through each trading day we run

a screen against our database of

high-ranked stocks, searching for

possible buy candidates that are trading

at or near their 52-week high on above

average volume. The results of that

screen are split into the two sections

you see below. The first, titled

"TODAY's FEATURED STOCKS" shows stocks

that our experts have recently

identified as among the strongest candidates to

consider. Stocks highlighted in yellow

are the most timely and noteworthy, so

particular attention and prompt action

may be appropriate. The second section,

titled "TODAY's BREAKOUT SCREEN" shows

the remainder of stocks meeting today's

screen parameters. Our experts have

reviewed and included notes on these

stocks as well, but found that they may

not match up as favorably.

|

|

Y - Today's strongest

candidates

highlighted

by our staff

of experts.

|

|

G - Previously featured in

this report as yellow and

now may no longer be buyable

under the guidelines.

|

|

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(50 DAV) |

52 Wk Hi

% From Hi |

Date

Featured |

Price

Featured |

Pivot Point |

|

Max Buy |

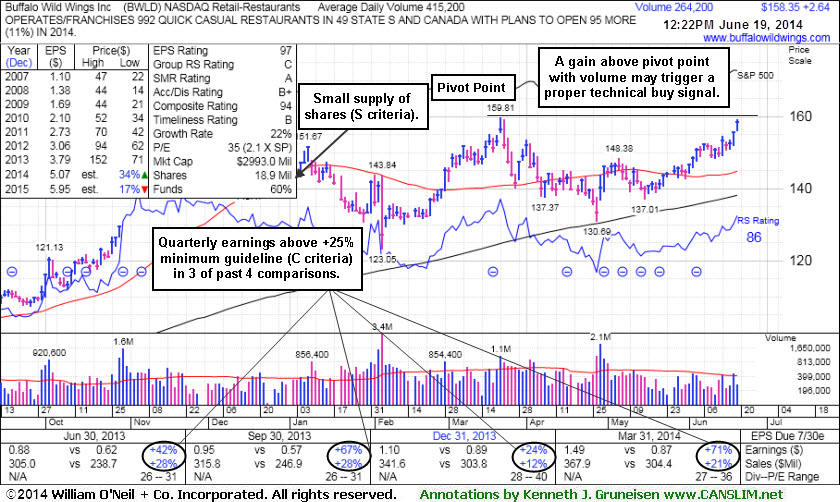

BWLD

- NASDAQ

Buffalo Wild Wings Inc

|

$158.52

|

+2.81

1.80%

|

$159.17

|

252,741

60.90% of 50 DAV

50 DAV is 415,000

|

$159.81

-0.81%

|

6/19/2014 |

$158.52

|

PP = $159.91

MB = $167.91 |

Most Recent Note - 6/19/2014 12:38:16 PM

Y - Color code is changed to yellow with pivot point cited based on its 3/21/14 high plus 10 cents. Challenging its 52-week high with today's 3rd consecutive gain while working on the right side of a 13-week base. Subsequent volume-driven gains above the pivot point are still needed to trigger a proper technical buy signal. Reported earnings +71% on +21% sales revenues for the Mar '14 quarter, an improvement after a slightly sub par quarter. Found support at its 200 DMA line then rebounded since last noted with caution in the 4/03/14 mid-day report - "Reported earnings +24% on +12% sales revenues for the Dec '13 quarter."

>>> The latest Featured Stock Update with an annotated graph appeared on 8/1/2007. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

EQM

- NYSE

E Q T Midstream Partners

|

$94.60

|

+2.97

3.24%

|

$94.79

|

320,904

105.56% of 50 DAV

50 DAV is 304,000

|

$97.22

-2.69%

|

12/12/2013 |

$53.17

|

PP = $56.51

MB = $59.34 |

Most Recent Note - 6/19/2014 12:47:15 PM

G - Perched near its 52-week high today. Prior reports repeatedly cautioned members - "It is very extended from any sound base. Fundamental concerns remain after 2 consecutive sub par quarters below the +25% minimum earnings guideline."

>>> The latest Featured Stock Update with an annotated graph appeared on 6/4/2014. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

TRN

- NYSE

Trinity Industries Inc

|

$84.90

|

-0.11

-0.13%

|

$86.69

|

1,270,051

80.28% of 50 DAV

50 DAV is 1,582,000

|

$87.89

-3.41%

|

4/30/2014 |

$75.57

|

PP = $76.05

MB = $79.85 |

Most Recent Note - 6/19/2014 1:18:10 PM

G - Perched within close striking distance of its 52-week high, extended from its prior base. Recent lows in the $79 area and its 50 DMA line coincide defining important near-term support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/16/2014. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

|

|

Symbol - Exchange - Industry Group

Company Name |

Last |

Chg |

Day

High |

52 WK Hi |

% From Hi |

Volume

% DAV |

DAV |

ACMP

- NYSE - ENERGY - Oil & Gas Pipelines

Access Midstream Ptnrs

|

$61.51 |

+1.04

1.72%

|

$61.69

|

$66.71

|

-7.79% |

1,099,900

207.14%

|

531,000

|

Most Recent Note for ACMP - 6/19/2014 12:10:49 PM

Found support at its 50 DMA line after retreating abruptly from its new 52-week high following news it will be completely acquired by Williams Co (WMB). Prior mid-day reports repeatedly cautioned members - "Reported earnings +7% on +17% sales revenues for the Mar '14 quarter, below the +25% minimum earnings guideline (C criteria). The earnings history for this MLP is not a match with the fact-based investment system's guidelines."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

ASX

- NYSE - ELECTRONICS - Semiconductor Equipment & Mate

Advancd Semicdtr Eng Adr

|

$6.58 |

-0.07

-1.05%

|

$6.66

|

$6.65

|

-1.05% |

424,399

61.60%

|

689,000

|

Most Recent Note for ASX - 6/19/2014 12:12:17 PM

Perched at its 52-week high following 3 consecutive gains marked by above average volume. Reported earnings +40% on +11% sales revenues for the Mar '14 quarter, but fundamental concerns remain. Noted with caution in prior mid-day reports - "Fundamentals are not a match with the fact-based investment system (C and A criteria). Low-priced stocks are discouraged unless all key criteria are solidly satisfied."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

CMI

- NYSE - MANUFACTURING - Diversified Machinery

Cummins Inc

|

$156.15 |

-0.66

-0.42%

|

$156.91

|

$161.03

|

-3.03% |

1,087,639

100.24%

|

1,085,000

|

Most Recent Note for CMI - 6/19/2014 12:43:58 PM

Reported earnings +27% on +12% sales revenues for the Mar '14 quarter. Fundamental concerns remain, as prior quarterly earnings increases were below the +25% minimum guideline (C criteria). Last noted with caution in the 3/20/12 mid-day report - "Downward turn in FY '09 earnings (A criteria) makes it fall below the fundamental guidelines of the fact-based investment system."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

CO

- NYSE - DIVERSIFIED SERVICES - Technical Services

China Cord Blood Corp

|

$4.75 |

+0.05

1.06%

|

$4.84

|

$4.85

|

-2.06% |

45,299

59.60%

|

76,000

|

Most Recent Note for CO - 6/19/2014 12:46:33 PM

Reported earnings +40% on +14% sales revenues for the Mar '14, but fundamental concerns remain with respect to the fact-based investment system's C and A criteria. Low-priced stocks are discouraged from consideration unless all key criteria are solidly satisfied.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

ESTE

- AMEX - Oil&Gas-U S Expl&Prod

Earthstone Energy Inc

|

$34.09 |

+0.10

0.29%

|

$34.75

|

$35.00

|

-2.61% |

7,239

60.33%

|

12,000

|

Most Recent Note for ESTE - 6/19/2014 12:49:05 PM

Technically it broke out on 5/16/14 after noted in the 5/09/14 mid-day report with caution. Perched at its 52-week high today following a spurt of 12 gains in the span of 14 sessions. Reported +51% earnings on +41% sales revenues for the Mar '14 quarter, the 4th consecutive quarterly comparison satisfying the C criteria. It is very extended from any sound base after having rallied above previously noted resistance at multi-year highs in the $25-26 area. There is a very small supply of only 1.25 million shares (S criteria) in the float and only 4 top-rated funds (I criteria) own its shares.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

GLOG

- NYSE - Transportation-Ship

GasLog Ltd

|

$29.59 |

+1.75

6.29%

|

$29.89

|

$28.89

|

2.42% |

2,112,969

147.45%

|

1,433,000

|

Most Recent Note for GLOG - 6/19/2014 12:50:22 PM

Rebounded above its 50 DMA line during its streak of 8 consecutive gains and it is hitting a new 52-week high today. Prior mid-day reports repeatedly cautioned members - "Completed a new Public Offering on 4/11/14. Showed strong sales and earnings increases in the 4 latest quarterly comparisons through Mar '14 but its annual earnings (A criteria) history has been erratic and not a match with the fact-based investment system's guidelines."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

IHG

- NYSE - LEISURE - Lodging

Intercontinental Hotels

|

$39.11 |

+0.24

0.62%

|

$39.17

|

$39.80

|

-1.73% |

464,965

252.70%

|

184,000

|

Most Recent Note for IHG - 6/19/2014 12:51:56 PM

Holding its ground stubbornly near its 52-week high following a spurt of volume-driven gains since a considerable gap up on 5/02/14. Reported earnings +18% on +0% sales revenues for the quarter ended Dec 31, 2013 versus the year ago period. Prior mid-day reports repeatedly noted - "Its prior earnings history (A criteria) is below guidelines of the fact-based system."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

MCRS

- NASDAQ - COMPUTER SOFTWARE & SERVICES - Technical & System Software

Micros Systems Inc

|

$65.60 |

-0.27

-0.41%

|

$65.94

|

$70.24

|

-6.61% |

589,879

59.11%

|

998,000

|

Most Recent Note for MCRS - 6/19/2014 12:54:48 PM

Perched near its 52-week high today following a considerable volume-driven gain on 6/17/14. The prior mid-day report cautioned members - "Reported earnings +16% on +11% sales revenues for the quarter ended March 31, 2014 versus the year ago period. Prior comparisons have not been a match with the fact-based system's guidelines."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

MEAS

- NASDAQ - MANUFACTURING - Industrial Electrical Equipmen

Measurement Specialties

|

$86.20 |

+8.20

10.51%

|

$86.44

|

$79.00

|

9.11% |

2,672,731

4,689.00%

|

57,000

|

Most Recent Note for MEAS - 6/19/2014 12:58:48 PM

Gapped up and hit a new 52-week high today following news it will be acquired by TE Connectivity under the terms of a definitive agreement valued at approximately $1.7 billion. During an impressive streak of gains with no resistance due to overhead supply it was noted repeatedly with caution in prior mid-day reports - "Earnings rose +6% on +18% sales revenues for the Mar '14 quarter and fundamental concerns remain. Continuing its streak of sub par earnings comparisons. Its annual earnings (A criteria) history is below guidelines of the fact-based system. Fundamentals deteriorated after it was dropped from the Featured Stocks list on 12/14/2007. It subsequently fell from $23.15 to as low as $2.30. Its impressive rebound makes it an interesting turnaround story."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

NVDA

- NASDAQ - ELECTRONICS - Semiconductor - Specialized

Nvidia Corp

|

$19.04 |

-0.55

-2.81%

|

$19.33

|

$19.73

|

-3.50% |

7,373,263

112.91%

|

6,530,000

|

Most Recent Note for NVDA - 6/19/2014 1:00:09 PM

Gapped down today, retreating from its 52-week high. Last noted with caution in the 5/09/14 mid-day report - "Reported earnings +61% on +16% sales revenues for the Apr '14 quarter, but fundamental concerns remain. Prior quarterly and annual earnings (C and A criteria) history has not been a match with the fact-based investment system's guidelines."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

OILT

- NYSE - ENERGY - Oil & Gas Pipelines

Oiltanking Partners Lp

|

$95.10 |

+2.28

2.46%

|

$96.90

|

$98.21

|

-3.17% |

28,986

72.47%

|

40,000

|

Most Recent Note for OILT - 6/19/2014 1:01:26 PM

Hovering near its 52-week high today, enduring recent distributional pressure. Found support when consolidating above its 50 DMA line. It formed a short 4-week "square box" base however it is a late stage and riskier base pattern. Prior mid-day reports repeatedly cautioned members - "Announced a new CEO on 3/04/14. Completed a new Public Offering on 11/19/13 and found support near its 50 DMA line. Reported earnings +31% on +49% sales revenues for the Mar '14 quarter, its 4th consecutive quarter above the +25% minimum earnings guideline (C criteria)."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

PAGP

- NYSE - Oil&Gas-Transprt/Pipelne

Plains GP Hldgs LP Cl A

|

$28.97 |

-0.01

-0.02%

|

$29.20

|

$29.88

|

-3.06% |

473,467

72.29%

|

655,000

|

Most Recent Note for PAGP - 6/19/2014 1:04:26 PM

Perched near its 52-week high, consolidating above its 50 DMA line. Last noted with caution in the 5/08/14 mid-day report - "Earnings history is not a match with the fact-based investment system's guidelines (C and A criteria)."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

RH

- NYSE - RETAIL - Home Furnishing Stores

Restoration Hardware Hld

|

$88.15 |

+2.16

2.51%

|

$89.08

|

$87.95

|

0.23% |

1,416,867

131.68%

|

1,076,000

|

Most Recent Note for RH - 6/19/2014 1:05:37 PM

Hitting yet another new 52-week high after gapping up today, adding to an impressive spurt of volume-driven gains including a considerable "breakaway gap" on 6/12/14. Reported earnings +200% on +22% sales revenues for the Apr '14 quarter, and prior quarterly earnings were above the +25% minimum guideline (C criteria). Following reorganization, trading began on 11/02/12, and its annual earnings (A criteria) growth has been very strong since. Completed a Secondary Offering 7/12/13 and named a new CEO 1/31/14. The Retail - Home Furnishing group has a Group Relative Strength Rating of D with very little leadership (L criteria) in the industry group.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

SE

- NYSE - RETAIL - Grocery Stores

Spectra Energy Corp

|

$42.20 |

+0.70

1.69%

|

$42.26

|

$42.00

|

0.48% |

1,942,417

82.03%

|

2,368,000

|

Most Recent Note for SE - 6/19/2014 1:07:39 PM

Hitting a new 52-week high today, extended from any sound base pattern. Quarterly and annual earnings (C and A criteria) history is not a match with the fact-based investment system's guidelines.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

STZ

- NYSE - FOOD & BEVERAGE - Beverages - Wineries & Distill

Constellation Brands A

|

$86.53 |

+0.57

0.66%

|

$87.59

|

$85.99

|

0.63% |

789,472

60.68%

|

1,301,000

|

Most Recent Note for STZ - 6/19/2014 1:10:13 PM

Hitting a new 52-week high with today's 4th consecutive gain. Rebounded from below its 50 DMA line and price/volume action has been mostly bullish since last noted with caution in the 4/11/14 mid-day report - "Reported +72% earnings on +86% sales revenues for the quarter ended Feb 28, 2014, its 3rd consecutive quarterly comparison with an earnings increase above the +25% minimum guideline (C criteria). Downturn in FY '13 earnings is a flaw concerning the A criteria."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

SWHC

- NASDAQ - CONSUMER DURABLES - Sporting Goods

Smith & Wesson Hldg Corp

|

$17.03 |

+0.20

1.16%

|

$17.25

|

$17.28

|

-1.48% |

769,752

62.28%

|

1,236,000

|

Most Recent Note for SWHC - 6/19/2014 1:11:50 PM

Consolidating near its 52-week high today and staying well above its 50 DMA line in recent months. Reported earnings +35% on +7% sales for the Jan '14 quarter. Made gradual progress since last noted with caution in the 5/20/14 mid-day report - "Sequential quarterly comparisons have shown worrisome deceleration in its sales revenues and earnings increases. Downturn in FY '11 earnings is a flaw concerning the A criteria. Went through a deep consolidation below its 50 DMA line then rebounded since noted in the 8/07/13 mid-day report with caution."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

TARO

- NYSE - DRUGS - Drug Manufacturers - Other

Taro Pharmaceutical Inds

|

$110.95 |

+1.08

0.98%

|

$112.52

|

$122.51

|

-9.44% |

49,659

97.37%

|

51,000

|

Most Recent Note for TARO - 6/19/2014 1:16:05 PM

Consolidating above its 50 DMA line and perched -9.4% off its 52-week high, enduring distributional pressure in recent weeks and still facing some resistance due to overhead supply. Patient and disciplined investors may watch for a proper base to possibly develop and be noted in the weeks ahead. Reported earnings +86% on +13% sales revenues for the Mar '14 quarter, a 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 46 as of Mar '14, a reassuring sign concerning the I criteria.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

We are not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to FactBasedInvesting.com c/o Premium

Member Services 665 S.E. 10 Street, Suite 201

Deerfield Beach, FL 33441-5634 or by calling 954-785-1121.

We appreciate any feedback

members may wish to send via the inquiry form

here.

|

|

|